- Home

- »

- Specialty Polymers

- »

-

Aseptic Packaging Market Size, Share & Growth Report 2030GVR Report cover

![Aseptic Packaging Market Size, Share & Trends Report]()

Aseptic Packaging Market (2025 - 2030) Size, Share & Trends Analysis By Material, By Product (Cartons, Bags & Pouches, Prefilled Syringes, Vials & Ampoules), By Application (Food, Beverage, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-111-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aseptic Packaging Market Summary

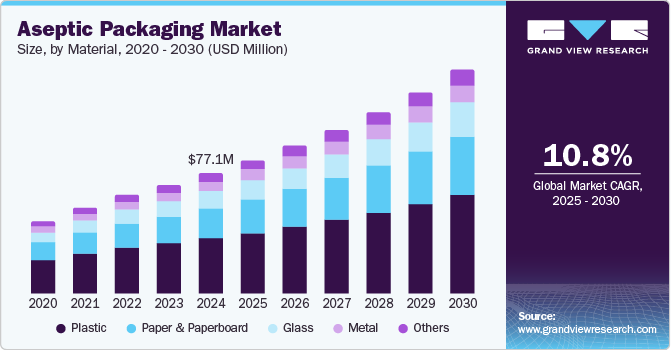

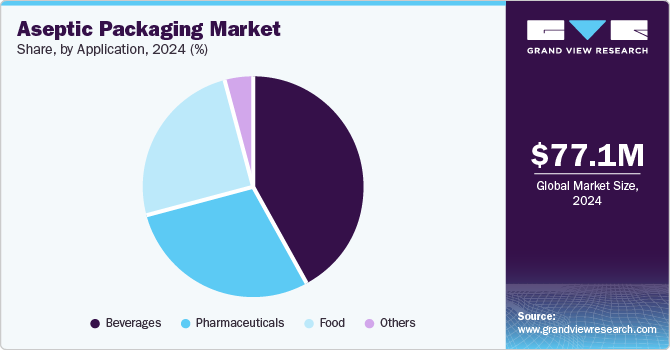

The global aseptic packaging market size was estimated at USD 77.1 million in 2024 and is projected to reach USD 142.8 million by 2030, growing at a CAGR of 10.8% from 2025 to 2030. The increasing demand for longer shelf life and preservation of food and beverages without the need for refrigeration drives this growth.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- The region held a revenue share of 41.1% in 2024.

- In terms of material, the plastic segment accounted for 45.8% of the total revenue generated in the global market in 2024.

- The paper & paperboard segment is expected to grow at a CAGR of 11.8% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 77.1 Million

- 2030 Projected Market Size: USD 142.8 Million

- CAGR (2025-2030): 10.8%

- Asia Pacific: Largest market in 2024

This is particularly important in regions with limited cold chain infrastructure. Secondly, the rising consumer preference for convenient and ready-to-eat products is boosting the need for aseptic packaging solutions. Moreover, advancements in packaging technology, which enhance product safety and quality, contribute to market growth.

Environmental concerns and the push for sustainable packaging options significantly drive the adoption of aseptic packaging. This packaging method is favored for its efficiency in using fewer materials and generating less waste compared to traditional packaging methods, aligning with global sustainability goals. Furthermore, the pharmaceutical industry's robust growth is critical to propelling the aseptic packaging market. The stringent requirements for sterile packaging of drugs and medical devices necessitate advanced packaging solutions that ensure product safety and integrity.

Material Insights

The plastic segment accounted for 45.8% of the total revenue generated in the global aseptic packaging market in 2024. Plastic packaging offers superior durability and flexibility, making it suitable for a wide range of products, from beverages to pharmaceuticals. In addition, advancements in plastic technology have led to the development of lightweight, recyclable, and eco-friendly options, which manufacturers and consumers have received well. The cost-effectiveness of plastic packaging compared to other materials also plays a crucial role in its widespread adoption.

The paper & paperboard segment is expected to grow at a CAGR of 11.8% over the forecast period. This growth is driven by the increasing consumer preference for sustainable and environmentally friendly packaging solutions. Paper and paperboard packaging is perceived as more eco-friendly and biodegradable, aligning with the global push towards reducing plastic waste. Moreover, innovations in paper-based packaging, such as improved barrier properties and enhanced strength, have made it a viable alternative for aseptic packaging. The rising demand for packaged food and beverages also supports the segment growth, where paper and paperboard packaging is extensively used.

Product Insights

Cartons dominated the global Aseptic Packaging market in 2024, primarily due to their versatility and widespread use across various industries. Cartons are highly favored for packaging beverages, dairy products, and liquid foods as they offer excellent protection against contamination and maintain product freshness. Moreover, cartons are lightweight, easy to transport, and easily disposed of or recycled, making them an attractive option for manufacturers and consumers. The ability to print high-quality graphics on cartons also enhances product visibility and appeal on retail shelves.

The prefilled syringes segment is projected to grow at the fastest rate over the forecast period. This growth is driven by the increasing demand for injectable medications and vaccines, especially in the healthcare and pharmaceutical industries. Prefilled syringes offer several advantages, including reduced risk of contamination, improved patient safety, and convenience for healthcare providers. The rise in chronic diseases and the aging population further fuel the demand for prefilled syringes, as they provide a reliable and efficient method for drug delivery.

Application Insights

The beverages segment emerged as the largest contributor to revenue in 2024. This dominance can be attributed to the high demand for packaged beverages, such as juices, milk, and other dairy products, which require effective packaging solutions to maintain freshness and prevent contamination. Aseptic packaging offers several advantages for beverages, including extended shelf life, nutritional value preservation, and flavor integrity. The growing consumer preference for healthier, preservative-free drinks has also driven the demand for aseptic packaging, as it ensures product safety without the need for artificial preservatives. Moreover, the rise in on-the-go consumption and the popularity of single-serve portions have further bolstered the beverages segment, making it a key revenue driver in the market.

On the other hand, the food segment is projected to grow fastest from 2025 to 2030. This growth is fueled by the increasing demand for packaged and ready-to-eat food products, driven by changing lifestyles and the growing urban population. Aseptic packaging is particularly beneficial for food products as it protects against microbial contamination and ensures longer shelf life without refrigeration. The convenience offered by aseptic packaging, combined with the rising awareness of food safety and hygiene, is expected to drive its adoption in the food industry. Moreover, advancements in aseptic packaging technologies, such as improved materials and enhanced barrier properties, make it a more attractive option for food manufacturers, further contributing to the rapid growth of the segment.

Regional Insights

Asia Pacific dominated the global aseptic packaging market, with a revenue share of 41.1% in 2024, driven by rapid industrialization and urbanization. The regional growth is attributed to the increasing demand for packaged food and beverages, particularly in emerging economies such as China and India. The growing middle class and their preference for convenience foods have significantly boosted the market.

China Aseptic Packaging Market Insights & Trend

China aseptic packaging market held a significant share of the Asia Pacific in 2024. This substantial share is due to China’s large population, rising disposable incomes, and the increasing demand for safe and long-lasting packaged food and beverages. The country’s robust manufacturing sector and continuous investments in packaging innovations have also supported market expansion. Moreover, the government’s focus on food safety and quality standards has driven the adoption of aseptic packaging solutions.

North America Aseptic Packaging Market Insights & Trends

North America held a substantial revenue share in the global market in 2024. The region’s market is characterized by a high demand for sterile and safe packaging solutions, particularly in the food and pharmaceutical industries. The growing consumer preference for minimally processed and preservative-free products has fueled the adoption of aseptic packaging. Furthermore, technological advancements and stringent regulatory standards regarding food safety have further driven market growth in North America.

U.S. Aseptic Packaging Market Insights & Trends

The U.S. aseptic packaging market dominated North America in 2024. The country’s leadership is driven by the high demand for aseptic packaging in the food, beverage, and pharmaceutical sectors. The increasing focus on sustainability and the need for products to have an extended shelf life has also played a crucial role in market growth. Furthermore, the presence of major packaging companies and continuous innovations in packaging technology have bolstered the U.S. market.

Europe Aseptic Packaging Market Insights & Trends

Europe's Aseptic Packaging market is expected to grow steadily from 2025 to 2030. The rising demand for sustainable and eco-friendly packaging solutions supports the region’s market growth. European consumers’ increasing awareness of food safety and quality, along with stringent regulatory standards, has driven the adoption of aseptic packaging. In addition, the expansion of the pharmaceutical industry and the growing trend of on-the-go consumption have further contributed to the positive outlook of the market.

Key Aseptic Packaging Company Insights

Some of the key companies in the aseptic packaging market include Robert Bosch GmbH, Reynolds Group Holdings Limited, Becton, Dickinson and Company, IMA S.P.A, Schott AG, Amcor, Greatview Aseptic Packaging Co. Ltd, and others.

-

Amcor offers a wide range of packaging solutions for the food, beverage, and pharmaceutical industries. The company’s aseptic packaging products include cartons, pouches, and bottles.

-

Robert Bosch GmbH specializes in advanced packaging technology solutions. The company offers a range of aseptic filling and packaging machines that cater to the food and beverage industry.

Key Aseptic Packaging Companies:

The following are the leading companies in the aseptic packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- Reynolds Group Holdings Limited

- Becton, Dickinson and Company

- IMA S.P.A

- Schott AG

- Amcor

- Greatview Aseptic Packaging Co. Ltd

- IPI SRL (Coesia Group)

- Tetra Pak International SA

- SIG Combibloc Group

- DS Smith PLC

- Uflex Limited

- Elopak AS

- CDF Corporation

- Smurfit Kappa

- Mondi PLC

- Printpack

- Sealed Air Corporation

Recent Developments

-

In October 2024, UFlex announced plans to expand its aseptic packaging capacity in Egypt through its wholly-owned subsidiary, Flex Asepto (Egypt) SAE. The company has decided to invest in a new facility with an annual production capacity of 12 billion packs. This expansion is expected to strengthen UFlex's position in the Egyptian market and support the growing demand for aseptic packaging solutions in the region.

-

In June 2024, Syntegon announced the acquisition of Telstar. This strategic move was expected to strengthen Syntegon's capabilities in pharmaceutical processing and packaging, particularly in the area of lyophilized vial filling.

-

In April 2024, Baldwin Richardson Foods (BRF) significantly enhanced its aseptic beverage manufacturing capabilities by acquiring Pennsauken Packing Company, a New Jersey-based manufacturing facility. The strategic acquisition was expected to expand BRF's footprint and add a state-of-the-art manufacturing site equipped with best-in-class aseptic processing lines.

Aseptic Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 85.3 million

Revenue forecast in 2030

USD 142.8 million

Growth rate

CAGR of 10.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, Argentina, UAE, Saudi Arabia, South Africa

Key companies profiled

Robert Bosch GmbH, Reynolds Group Holdings Limited, Becton, Dickinson and Company, IMA S.P.A, Schott AG, Amcor, Greatview Aseptic Packaging Co. Ltd, IPI SRL (Coesia Group)Tetra Pak International SA, SIG Combibloc Group, DS Smith PLC, Uflex Limited, Elopak AS, CDF Corporation, Smurfit Kappa, Mondi PLC, Printpack, Sealed Air Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aseptic Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aseptic packaging market report based on material, product, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Metal

-

Glass

-

Paper & Paperboard

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cartons

-

Bottles & Cans

-

Bags & Pouches

-

Prefilled Syringes

-

Vials & Ampoules

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food

-

Processed Food

-

Dairy Food

-

Fruits and Vegetables

-

-

Beverages

-

Ready-to-drink Beverages

-

Dairy Based Beverages

-

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.