- Home

- »

- Homecare & Decor

- »

-

Plastic Furniture Market Size, Share & Trends Report, 2030GVR Report cover

![Plastic Furniture Market Size, Share & Trends Report]()

Plastic Furniture Market Size, Share & Trends Analysis Report By Application (Residential, Commercial), By Distribution Channel (Online, Offline), By Type (Kitchen, Living Room), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-367-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Plastic Furniture Market Size & Trends

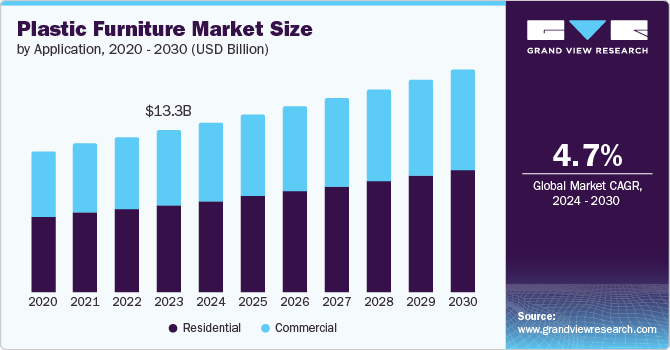

The global plastic furniture market size was valued at USD 13.33 billion in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. Expansion in the market can be attributed to its affordability, durability, lightweight, low maintenance, eco-friendliness, and design versatility. The trend towards modular homes, particularly in nuclear families, and rapid urbanization have driven demand in residential settings, contributing to the market's growth.

Urbanization and rising disposable incomes are leading to increased demand for affordable and stylish furniture options, particularly in developing countries where urban populations are expanding rapidly. This trend is fueled by the desire for modern and comfortable living spaces, which plastic furniture is well-equipped to meet.

Another significant factor driving the growth of the plastic furniture market is its durability and low maintenance requirements. Compared to traditional materials like wood and metal, plastic furniture is known for its resistance to corrosion and ease of cleaning, making it an attractive option for both residential and commercial applications. Moreover, the market offers a diverse range of products, catering to different consumer preferences and needs, which drives demand across various segments.

The market is also being driven by sustainability trends, with consumers increasingly seeking eco-friendly and sustainable products. The rise of recycled plastic furniture made from waste materials is gaining traction, as consumers look to minimize their environmental impact. Furthermore, the surge in online sales platforms has expanded the reach of plastic furniture manufacturers, allowing them to tap into a broader consumer base. Overall, these factors are contributing to a robust growth trajectory for the plastic furniture market, with projections indicating significant expansion in the coming years.

Application Insights

The residential application segment dominated the market with a revenue share of 53.1% in 2023,driven by increasing demand for items such as dining tables, chairs, storage cabinets, and kitchen accessories. Factors contributing to this growth include the need for children's furniture among low-to-moderate income earners, the trend towards playrooms, and the desire for soft, safe, and durable products. Moreover, the shift towards larger living spaces and urbanization is also driving demand for outdoor furniture options.

The commercial application segment is expected to register significant growth with a CAGR of 4.2% over the forecast period. The growing economy is driving demand for plastic furnishings in commercial settings, including workplaces, restaurants, and hospitality establishments. The market is expected to be propelled by the need for durable and versatile products for large-scale events and contract-based projects. In the hospitality industry, plastic furniture is sought after for its durability, easy maintenance, and adaptability in outdoor spaces, while educational institutions utilize it for comfortable seating in classrooms, libraries, and cafeteria areas.

Distribution Channel Insights

The offline distribution channel segment dominated the global plastic furniture market with a revenue share of 84.2% in 2023. One of the primary factors of the segment growth is people like buying furniture in stores, they want to see how it looks and fits before they buy. In addition, consumers want to touch and try furniture before they spend money. sitting in a chair or feeling a table's quality in person gives peace of mind. online shopping can't match that. Moreover, smart staff give advice, answer questions, and help with worries, consumers value this when they purchase big items like furniture.

The online distribution channel segment is expected to register the fastest growth with a CAGR of 6.2% in the forecast period. E-commerce platforms give shoppers worldwide easy access to a huge range of plastic furniture. Online stores let people browse products from many brands anytime anywhere. These sites have simple designs detailed info, and customer feedback to help buyers compare and choose items. They also offer home delivery and easy returns. Moreover, websites for plastic furniture make shopping super convenient. Customers can buy from home furniture using clear menus thorough product details, and safe payment methods. This smooth process attracts lots of buyers to online stores driving market growth.

Type Insights

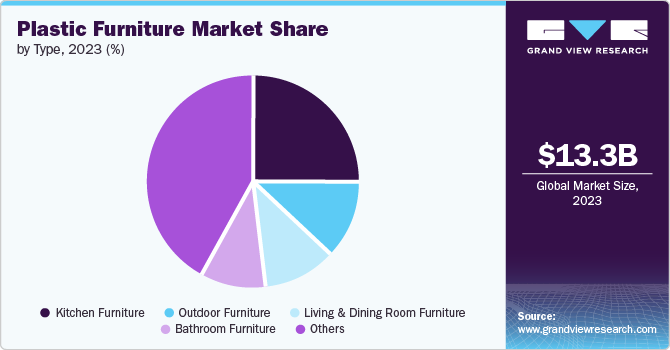

The kitchen furniture segment dominated the global plastic furniture market with a revenue share of 25.2% in 2023. This dominance can be attributed to the high demand for kitchen essentials, versatility and customization, eco-friendly and sustainable options, cost-effectiveness, and low maintenance and durability. In addition, when it comes to plastic kitchen furniture, they are relatively cheaper compared to wooden or metal furniture and hence receives a lot of requests in the market, especially from people who are operating under a limited budget.

The outdoor furniture segment is expected to register the fastest growth with a CAGR of 5.1% in the forecast period. Outdoor furnishings wish to withstand various climate conditions, together with daylight, rain, and humidity. Plastic furniture, particularly those made from polyethylene and polypropylene, are incredibly durable and resistant to UV damage. This sturdiness makes them perfect for outdoor use. Moreover, Plastic outdoor furnishings are straightforward to smooth and preserve compared to other substances like wood that require everyday staining or metal that could rust through the years. This low maintenance factor is attractive to consumers driving market growth.

Regional Insights

North America plastic furniture market held a significant share of the global plastic furniture market in 2023 and is expected to grow rapidly over the forecast period. The region's commercial area, along with offices and company areas, has been increasing rapidly. Manufacturers in North America have been focusing on modern design to make plastic furnishings greater visually attractive and elegant, catering to converting consumer choices.

U.S Plastic Furniture Market Trends

The U.S. plastic furniture market held a significant share of the North America plastic furniture market in 2023. The U.S. has advanced technology and procedures for producing plastic furniture efficiently. This allows for huge-scale production and cost-effective manufacturing, giving U.S. companies a competitive edge in the global market.

Asia Pacific Plastic Furniture Market Trends

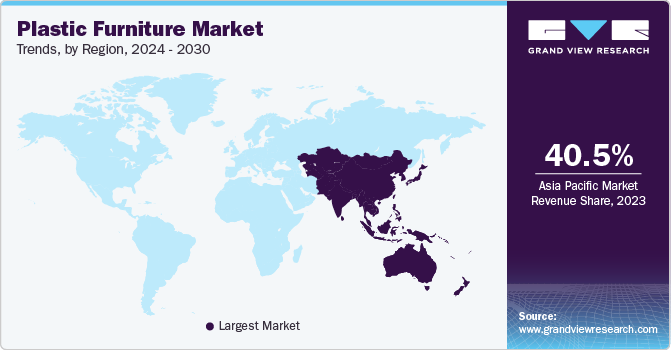

Asia Pacific plastic furniture market dominated the global plastic furniture market with a revenue share of 40.5% in 2023. Rapid urbanization, increase in disposable income, and growing population are the factors driving the market growth. In addition, with most of the Asian population having a budget life they can afford cost-effective plastic furniture resulting in driving market growth.

China plastic furniture market has a significant share of the Asia Pacific plastic furniture market and is expected to grow in the forecast period. China has an advanced developed manufacturing infrastructure, resulting in efficient production of furniture. In addition, China has invested heavily in technology advancement in the manufacturing sector driving the market growth.

Europe Plastic Furniture Market Trends

Europe plastic furniture market was identified as a lucrative region in 2023. Europe is famous for its layout and innovation in various industries, together with furniture. The European furnishings industry has a long history of mixing new technologies with cultural history and style, mainly in the creation of brilliant and aesthetically attractive plastic furnishings. Moreover, European manufacturers have a reputation for producing splendid furniture with thorough attention to detail driving the market growth.

Germany plastic furniture market held a substantial market share in 2023 owing to its innovative use of plastics in furniture production. Germany has an extended record of embracing plastics as a flexible and value-effective material for furnishings manufacturing. In addition, German designers and manufacturers had been early adopters of the use of plastics in furniture design, main to a wide variety of innovative and useful plastic furniture.

Key Plastic Furniture Company Insights

Some of the key companies in the plastic furniture market include Tramontina; Cosmoplast; Supreme Furnitures; Nilkamal Furniture; Wim Plast Limited; and Avon Furniture; among others. Companies are driving growth through innovation, sustainability, and expansion. Product launches feature unique designs, improved durability, and enhanced functionality. Manufacturers adopt sustainable practices, such as recycling plastic waste, while expanding globally through new products and diverse distribution channels to cater to various consumer segments.

-

Tramontina focuses on making people’s lives better through the production of a wide variety of merchandise that caters to numerous desires. The organization emphasizes functionality and style in its services, aiming to encourage people in their day workouts and create significant experiences. Tramontina delivers value via its various product lines, which encompass kitchen utensils, electrical appliances, electric supplies, furnishings (timber and plastic), application motors, and porcelain tableware.

-

Avon Furniture is a prominent manufacturer and supplier of workplace chairs, partitions, modular structures, and sofas designed for cutting-edge workplaces. The organization is known for its superior exceptional products that offer durability at high expenses. The company focuses on retaining wonderful requirements to position itself at the forefront of the industry.

Key Plastic Furniture Companies:

The following are the leading companies in the plastic furniture market. These companies collectively hold the largest market share and dictate industry trends.

- Tramontina

- Cosmoplast

- Supreme Furnitures

- Nilkamal Furniture

- Wim Plast Limited

- Avon Furniture

- Keter Group BV

- VITRA INTERNATIONAL AG

- Patio Furniture Outdoor Living

- Swagath Furniture (A Brand of Uma Plastics Limited)

Recent Developments

- In April 2024, Avon Furniture launched the 2-seater Sunbrella Heritage fabric lounge sofa in Alpine and Muted White colors, a stylish and comfortable outdoor furniture piece designed for relaxation and enjoyment.

- In March 2024, Tramontina announced its entry into the Indian market, with a comprehensive houseware solution range, encompassing cookware, tableware, cutlery, furniture, and more, to be launched in the coming years.

Plastic Furniture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.94 billion

Revenue forecast in 2030

USD 18.35 billion

Growth Rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, distribution channel, type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Tramontina; Cosmoplast; Supreme Furnitures; Nilkamal Furniture; Wim Plast Limited; Avon Furniture; Keter Group BV; VITRA INTERNATIONAL AG; Patio Furniture Outdoor Living; Swagath Furniture (A Brand of Uma Plastics Limited)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

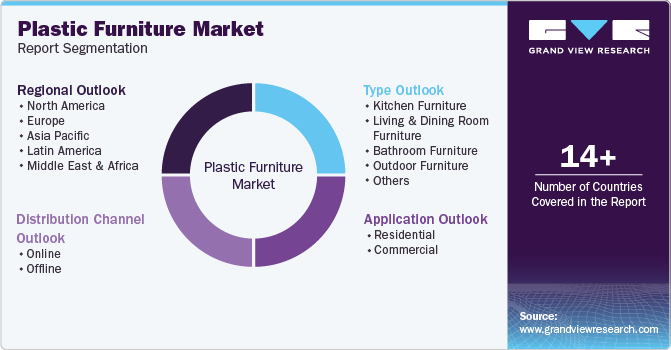

Global Plastic Furniture Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plastic furniture market report based on application, distribution channel, type and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Kitchen Furniture

-

Living and Dining Room Furniture

-

Bathroom Furniture

-

Outdoor Furniture

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."