- Home

- »

- Plastics, Polymers & Resins

- »

-

Polymer Foam Market Size & Share, Industry Report, 2033GVR Report cover

![Polymer Foam Market Size, Share & Trends Report]()

Polymer Foam Market (2026 - 2033) Size, Share & Trends Analysis Report By Source, By Type (PC, PC/ABS, PET, PS, PP, ABS), By Application (Packaging, Building & Construction, Furniture & Bedding, Automotive, Rail, Wind, Marine), By Region, And Segment Forecasts

- Report ID: 978-1-68038-932-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polymer Foam Market Summary

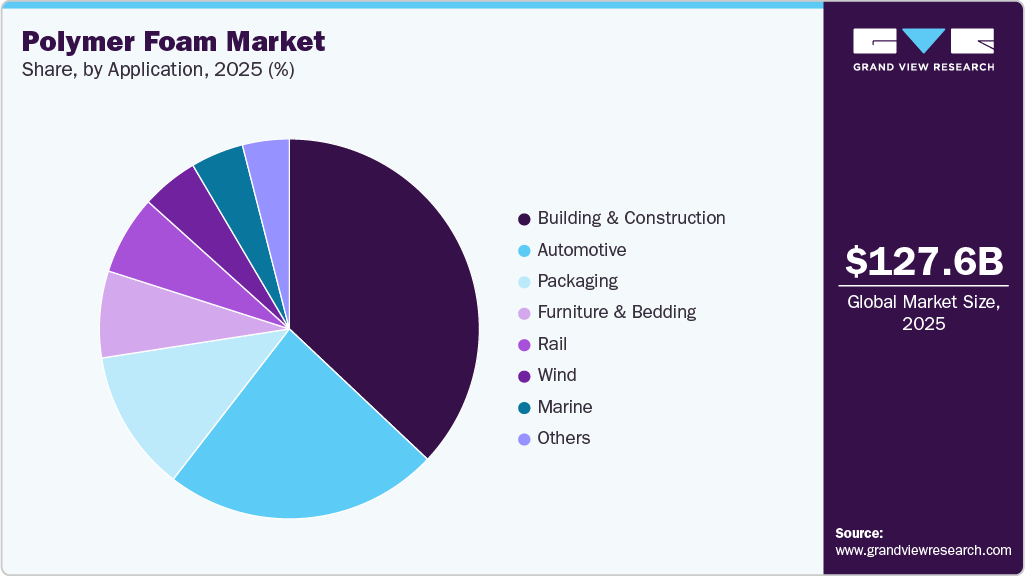

The global polymer foam market size was estimated at USD 127.59 billion in 2025 and is projected to reach USD 193.44 billion by 2033, growing at a CAGR of 5.5% from 2026 to 2033. The rapid growth of cold-chain logistics and protective packaging is expected to drive the market over the forecast period.

Key Market Trends & Insights

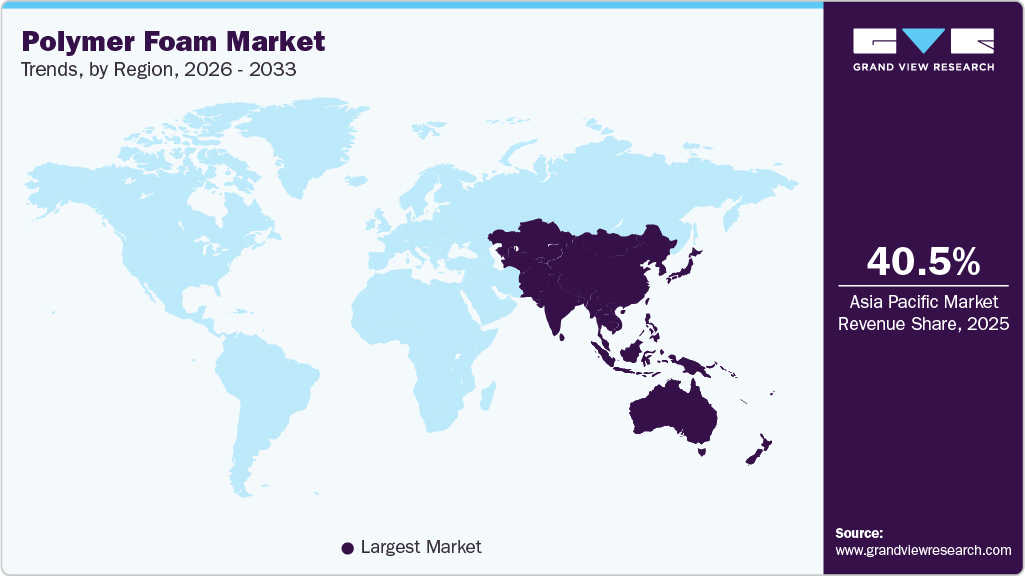

- Asia Pacific dominated the global polymer foam industry with the largest revenue share of 40.54% in 2025.

- The polymer foam market in China accounted for the largest market revenue share in the Asia Pacific in 2025.

- By type, the melamine foam segment is expected to grow at the fastet CAGR of 6.9% from 2026 to 2033.

- By application, the wind segment is expected to expand at the fastest CAGR of 6.6% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 127.59 Billion

- 2033 Projected Market Size: USD 193.44 Billion

- CAGR (2026-2033): 5.5%

- Asia Pacific: Largest market in 2025

Polymer foams are widely used to maintain temperature stability and prevent product damage in the food, pharmaceutical, and electronics industries during storage and transportation, supporting consistent demand growth.Polymer foams are moving from commodity fillers to engineered performance materials. Demand is concentrated in thermal insulation, lightweight automotive components, and protective packaging. Manufacturers are investing in formulation control and process technologies to deliver targeted density, thermal resistance, and mechanical performance. Polyurethane remains the largest segment by value due to its versatility in flexible and rigid forms.

Growth is strongest where regulatory energy-efficiency targets and lightweighting mandates intersect, notably in building retrofits and vehicle electrification programs. Type differentiation now rests on life-cycle attributes rather than price alone. This structural change is driving the development of higher-value products and strategic consolidation across the supply chain.

Drivers, Opportunities & Restraints

A primary market driver is expanding regulatory pressure for energy efficiency in buildings and industrial systems. Codes and incentive programs across North America, Europe, and parts of Asia require improved thermal performance in new construction and retrofits. This increases demand for rigid and semi-rigid foams used in roof, wall, and HVAC insulation.

At the same time, automotive OEMs pursuing electrification prioritize lightweight structural components and battery encapsulation that improve range and thermal management. Those twin application forces raise average selling prices and justify capital investment in higher-performance chemistries and low-global-warming-potential blowing agents. The result is sustained volume growth and premiumization in key regional markets.

The polymer foam value chain presents a clear opportunity for scalable circular solutions. Investment in mechanical densification, chemical depolymerization, and solvent-based recovery can convert low-density foam waste into feedstock for new products. At the same time, formulation opportunities exist for bio-based polyols and non-halogenated flame retardants that address lifecycle emissions and end-of-life restrictions.

Brands and specification engineers are receptive to validated circular content when it does not degrade performance. Capturing this opportunity requires co-investment across manufacturers, waste collectors, and OEMs to create repeatable collection streams and certification protocols. First movers that combine performance parity with lower lifecycle impact will command pricing premiums and longer-term offtake agreements.

The polymer foam industry faces important restraints from raw material price volatility and increasingly strict environmental regulations. Key feedstocks are petroleum-derived and sensitive to crude oil and aromatics pricing. Rapid price swings compress manufacturer margins and complicate long-duration contracts with OEMs. Regulators are also tightening controls on blowing agents, volatile organic compound emissions, and certain flame retardants. Compliance often forces costly reformulation, capital upgrades, or phased product withdrawals in regulated jurisdictions.

Finally, low material density complicates economically viable recycling and raises disposal costs for downstream users. Together, these factors elevate the total cost of ownership for foam solutions and slow adoption in price-sensitive segments.

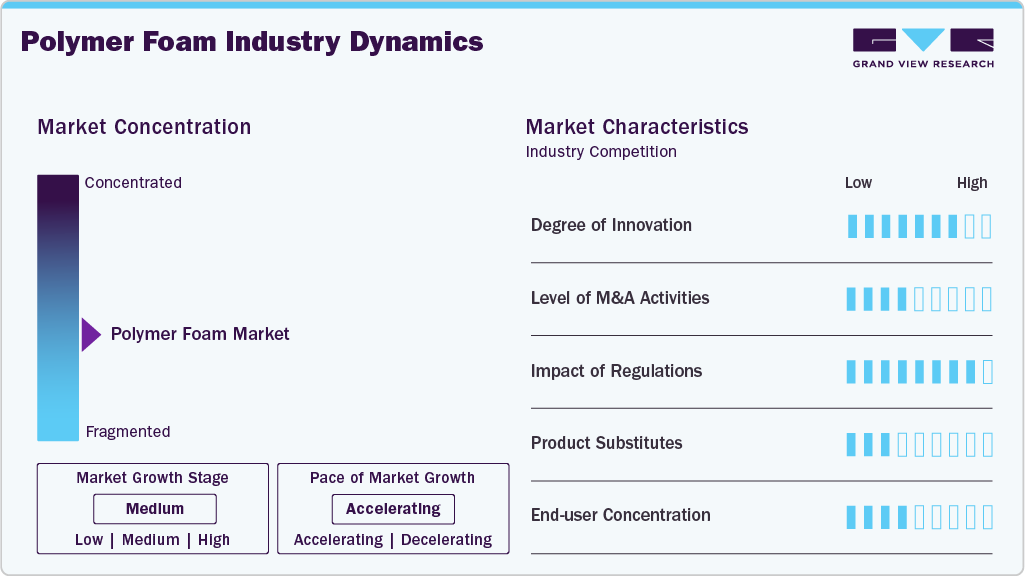

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companies such as Arkema Group, Armacell International S.A., BASF SE, Borealis AG, Fritz Nauer AG, Koepp Schaum GmbH, JSP Corporation, Polymer Technologies, Inc., Recticel NV, Rogers Corporation, SEKISUI ALVEO AG, Synthos S.A., Dow Inc., Trelleborg AB, Zotefoams plc, Woodbridge Foam Corporation, Sealed Air Corporation, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet the evolving demands of the industry.

Innovation in the polymer foam sector is concentrated on circular chemistry and performance-led material design. Chemical depolymerization and solvent-based recovery methods are transitioning from laboratory to pilot scale, enabling near-closed-loop reuse of polyurethane and other foam chemistries and reducing their lifecycle impact. At the same time, bio-based feedstocks and upcycled material formulations are gaining commercial traction for packaging and cold-chain applications. Nanopore and hybrid aerogel composites are also progressing toward commercial insulation applications that match foam performance with improved fire behaviour. These technical advances are reshaping procurement criteria to focus on validated lifecycle metrics and demonstrated recyclability.

Substitution pressure varies by application and geography. In packaging, molded pulp, starch-based foams, mycelium, and compostable formulations are competing directly with EPS in regions that impose restrictions on polystyrene. For building insulation, mineral wool and cellulose remain cost-effective alternatives, while aerogel-based panels target high-performance niches where thickness and fire performance are key considerations. In structural composite cores, balsa and engineered thermoplastic honeycomb offer trade-offs between weight and recyclability compared to traditional foams. Procurement teams now evaluate substitutes on total cost of ownership, regulatory compliance, and end-of-life pathways rather than unit price alone.

Type Insights

The polystyrene foam segment led the market with the largest revenue share of 30.38% in 2025, and is forecasted to grow at a significant CAGR of 4.7% from 2026 to 2033. Polystyrene foam continues to expand where unit cost and thermal performance are most important. E-commerce and temperature-sensitive shipping create steady demand for lightweight, high-insulation packaging that reduces freight costs and product damage. Manufacturers also supply engineered EPS panels for cavity and external insulation in low-cost construction markets where capital efficiency is a priority. Regulatory actions targeting single-use foodservice items have raised compliance costs but have not materially reduced industrial and building uses that rely on polystyrene for its low-density, predictable thermal performance. Capacity additions remain tied to crude-driven feedstock economics and regional demand for packaging.

The melamine foam segment is anticipated to grow at the fastest CAGR of 6.9% through the forecast period. Melamine foam is being specified more often for acoustic treatment and fire-retardant insulation in commercial interiors and passenger transport. The material offers superior sound absorption at low thickness and inherent flame resistance, eliminating the need for heavy additives, which simplifies certification for rail, metro, and automotive interiors. Demand is rising as specifiers prioritize compact acoustic solutions for open-plan offices and cabin environments where weight and space are constrained. Consumer cleaning applications remain a steady secondary market; however, industrial and transportation specifications now drive higher-margin, volume-based contracts.

Application Insights

The building & construction segment led the market with the largest revenue share of 37.03% in 2025, and is forecasted to grow at a significant CAGR of 4.8% from 2026 to 2033. Stricter building energy codes and fiscal incentives are creating a near-term retrofit and new-build upgrade cycle for high-performance insulation. Policymakers in multiple regions align tax credits and grant programs with codes derived from the IECC and national standards, which raises the threshold for specifying thermal resistance and air sealing. Rigid polymer foams capture a disproportionate share of this incremental demand because they deliver high R-value per inch and durable moisture resistance. Developers and contractors, therefore, prioritize foam products that balance upfront cost with measured lifecycle savings under evolving compliance metrics.

The wind segment is expected to expand at the fastest CAGR of 6.6% through the forecast period. Blade OEMs are shifting toward engineered foam cores to meet structural and sustainability targets for next-generation turbines. Thermoplastic cores, such as PET and PVC foam, offer high stiffness-to-weight ratios, simplifying processing for sandwich construction. Recyclable PET core materials also align with OEMs' efforts to achieve circularity claims for end-of-life blade management. This enables longer blades that improve energy capture while containing nacelle and transport costs. Supplier innovation in foam core grades and validated recycling routes is now a key focus for project developers and tier-one blade manufacturers in procurement.

Regional Insights

The polymer foam market in North America is spurred by code-driven retrofit activity across commercial and industrial buildings aimed at lowering energy use and emissions. Growing demand for higher R-value materials and HVAC insulation sustains sales of rigid and spray foam systems. At the same time, nearshoring of manufacturing and expanded cold-chain logistics for food and pharma lift packaging foam volumes. These combined drivers support steady capacity investment and product premiumization in North America.

U.S. Polymer Foam Market Trends

The polymer foam market in the U.S. held a significant share in North America in 2025. Federal and state-level incentives for energy efficiency, combined with increasingly stringent building codes, are accelerating the adoption of high-performance insulation foams in the country, driving the U.S. polymer foam industry. Concurrently, the expansion of the U.S. EV market drives demand for battery encapsulation and thermal interface foams that meet fire safety standards. Procurement teams now prioritize validated lifecycle performance and supplier traceability when buying foam grades. This dual policy and technology push raise average selling prices and support the growth of specialty foam.

Asia Pacific Polymer Foam Market Trends

Asia Pacific dominated the global polymer foam market with the largest revenue share of 40.54% in 2025, and is expected to grow at the fastest CAGR of 5.9% over the forecast period. Regional urban growth and large infrastructure pipelines are creating sustained demand for rigid and spray foams in new-build and retrofit insulation. Rising middle-class housing, commercial real estate activity, and expanding cold-chain logistics increase volumes for both commodity and engineered foams. Manufacturers are expanding capacity in China, India, and Southeast Asia to capitalize on local supply advantages and reduce lead times. This dynamic keeps the region the largest and fastest-growing market globally.

The polymer foam market in China accounted for the largest market revenue share in the Asia Pacific in 2025. Large domestic infrastructure and housing programs maintain a high base demand for construction and furniture foams. Simultaneously, China’s export-oriented packaging and component manufacturing sustain high-volume demand for cost-effective polystyrene and polyurethane foams. Government incentives for advanced materials and domestic electric vehicle EV) production further stimulate engineered foam applications. Scale advantages and localized supply chains allow Chinese producers to compete aggressively on price in regional and global markets.

Europe Polymer Foam Market Trends

The polymer foam market in Europe is anticipated to grow at a significant CAGR during the forecast period. Tighter European regulations on fluorinated gases, packaging waste, and circular economy targets are reshaping product specifications. Buyers demand low-global-warming-potential blowing agents, reusable or recyclable core materials, and reduced VOC emissions. Compliance costs push producers to reformulate and invest in recovery technologies. As a result, higher-specification foam grades and certified circular solutions capture incremental share from commodity products, supporting margin expansion for compliant suppliers.

Key Polymer Foam Company Insights

The polymer foam industry is highly competitive, with several key players dominating the landscape. Major companies include Arkema Group, Armacell International S.A., BASF SE, Borealis AG, Fritz Nauer AG, Koepp Schaum GmbH, JSP Corporation, Polymer Technologies, Inc., Recticel NV, Rogers Corporation, SEKISUI ALVEO AG, Synthos S.A., Dow Inc., Trelleborg AB, Zotefoams plc, Woodbridge Foam Corporation, and Sealed Air Corporation. The polymer foam industry is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Polymer Foam Companies:

The following are the leading companies in the polymer foam market. These companies collectively hold the largest market share and dictate industry trends.

- Arkema Group

- Armacell International S.A.

- BASF SE

- Borealis AG

- Fritz Nauer AG

- Koepp Schaum GmbH

- JSP Corporation

- Polymer Technologies, Inc.

- Recticel NV

- Rogers Corporation

- SEKISUI ALVEO AG

- Synthos S.A.

- Dow Inc.

- Trelleborg AB

- Zotefoams plc

- Woodbridge Foam Corporation

- Sealed Air Corporation

Recent Developments

-

In August 2025, Covestro AG agreed to acquire two former Vencorex production sites in Freeport, USA, and Rayong, Thailand. This expansion of isocyanate production capacity strengthens upstream supply for polyurethane foam systems and improves regional service for coatings, adhesives, and foam manufacturers.

-

In September 2024, Armacell acquired all JIOS shares in Armacell JIOS Aerogels Limited, taking full ownership of the aerogel joint venture. The deal accelerates Armacell’s capacity scaling in high-performance insulation and engineered foams, strengthening its position in low-thickness, high-R-value markets.

-

In January 2024, Kingspan completed the acquisition of a 51% stake in STEICO SE. The transaction broadens Kingspan’s low-embodied-carbon insulation portfolio, adding wood-fibre solutions that complement its polymer foam offerings and support shifts in specification toward bio-based alternatives.

Polymer Foam Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 132.57 billion

Revenue forecast in 2033

USD 193.44 billion

Growth rate

CAGR of 5.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, Volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue & volume forecast, competitive landscape, growth factors, and trends

Segment included

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; China; India; Japan; South Korea; Singapore, Indonesia; Brazil

Key companies profiled

Arkema Group; Armacell International S.A.; BASF SE; Borealis AG; Fritz Nauer AG; Koepp Schaum GmbH; JSP Corporation; Polymer Technologies; Inc.; Recticel NV; Rogers Corporation; SEKISUI ALVEO AG; Synthos S.A.; Dow Inc.; Trelleborg AB; Zotefoams plc; Woodbridge Foam Corporation; Sealed Air Corporation

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

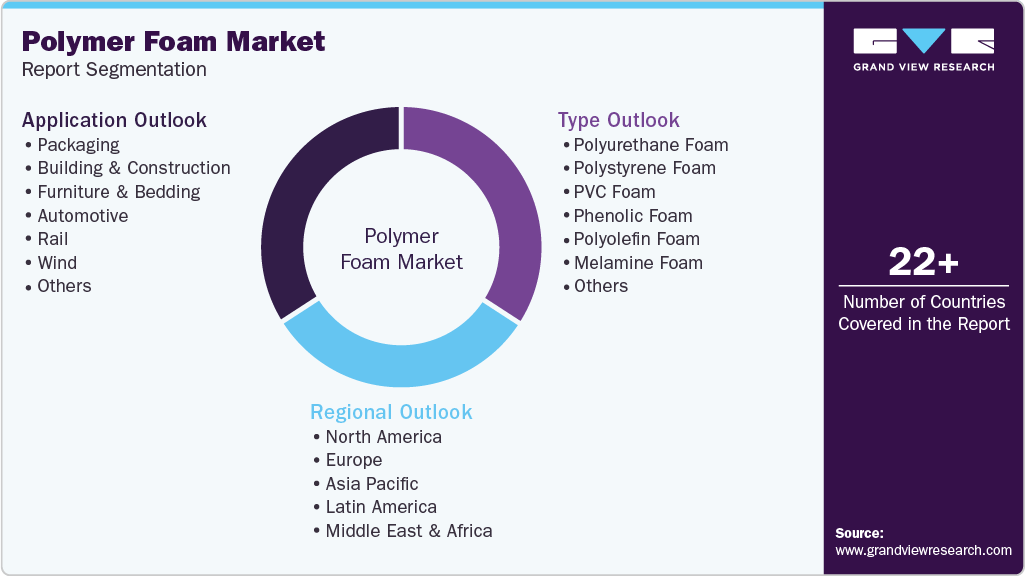

Global Polymer Foam Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global polymer foam market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polyurethane Foam

-

Polystyrene Foam

-

PVC Foam

-

Phenolic Foam

-

Polyolefin Foam

-

Melamine Foam

-

Others

-

-

Applications Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Packaging

-

Building & Construction

-

Furniture & Bedding

-

Automotive

-

Rail

-

Wind

-

Marine

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Indonesia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global polymer foam market size was estimated at USD 127.59 billion in 2025 and is expected to reach USD 132.57 billion in 2026.

b. The global polymer foam market is expected to grow at a compound annual growth rate of 5.5% from 2026 to 2033 to reach USD 193.44 billion by 2033.

b. Building & construction dominated the market across the applications segmentation in terms of revenue, accounting for a market share of 37.03% in 2025, and is forecasted to grow at a 4.8% CAGR from 2026 to 2033.

b. Some key players operating in the polymer foam market include Arkema Group, Armacell International S.A., BASF SE, Borealis AG, Fritz Nauer AG, Koepp Schaum GmbH, JSP Corporation, Polymer Technologies, Inc., Recticel NV, Rogers Corporation, SEKISUI ALVEO AG, Synthos S.A., Dow Inc., Trelleborg AB, Zotefoams plc, Woodbridge Foam Corporation, and Sealed Air Corporation.

b. The rapid growth of cold-chain logistics and protective packaging is expected to drive the market over the forecast period. Polymer foams are widely used to maintain temperature stability and prevent product damage in the food, pharmaceutical, and electronics industries during storage and transportation, supporting consistent demand growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.