- Home

- »

- Renewable Chemicals

- »

-

Plastic To Fuel Market Size & Share, Industry Report, 2033GVR Report cover

![Plastic To Fuel Market Size, Share & Trends Report]()

Plastic To Fuel Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Pyrolysis, Depolymerization, Gasification), By Plastic Type, By Source (Municipal Solid Waste, Commercial & Industrial Waste), By End Fuel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-487-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic To Fuel Market Summary

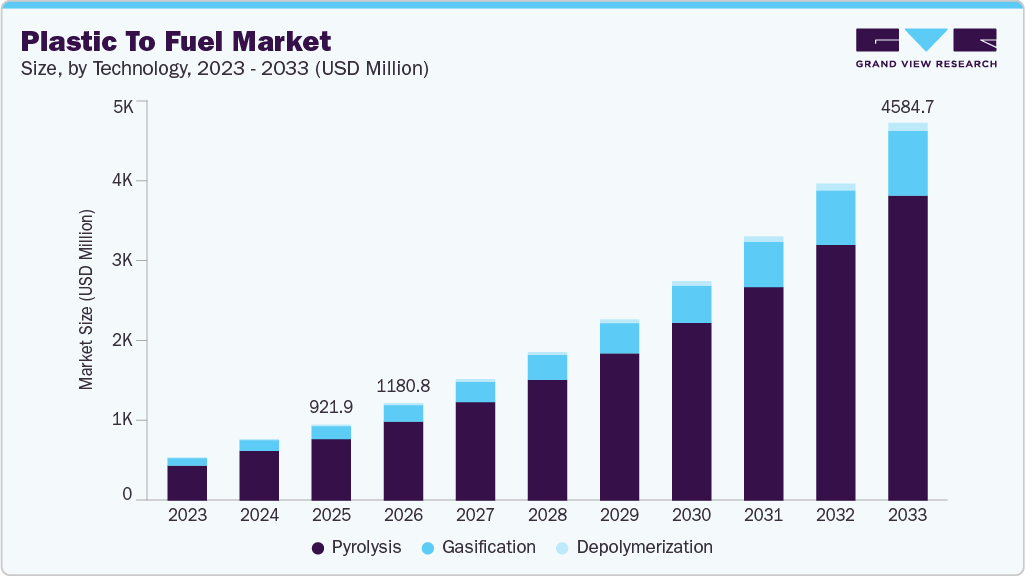

The global plastic to fuel market size was valued at USD 921.8 million in 2025 and is projected to reach USD 4,584.7 million by 2033, growing at a CAGR of 21.4% from 2026 to 2033. Growing interest in alternative fuels, rising landfill constraints, and investments in sustainable waste-to-energy infrastructure are collectively strengthening demand across the global plastic-to-fuel market.

Key Market Trends & Insights

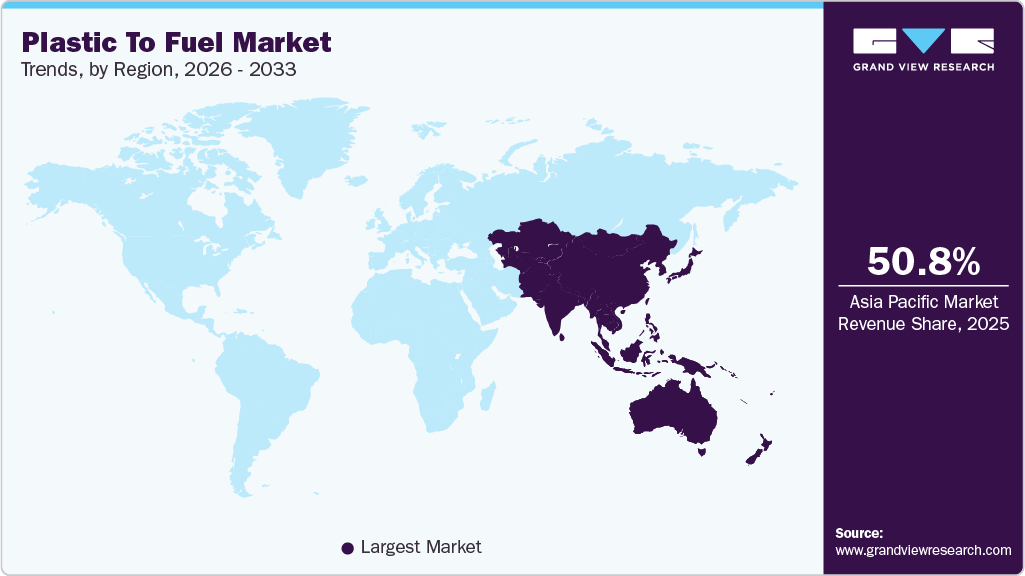

- The Asia Pacific plastic to fuel market held the largest share of 50.75% of the global market in 2025.

- The plastic to fuel market in the U.S. is expected to grow significantly over the forecast period.

- By technology, the pyrolysis held the highest market share of 81.02% in 2025.

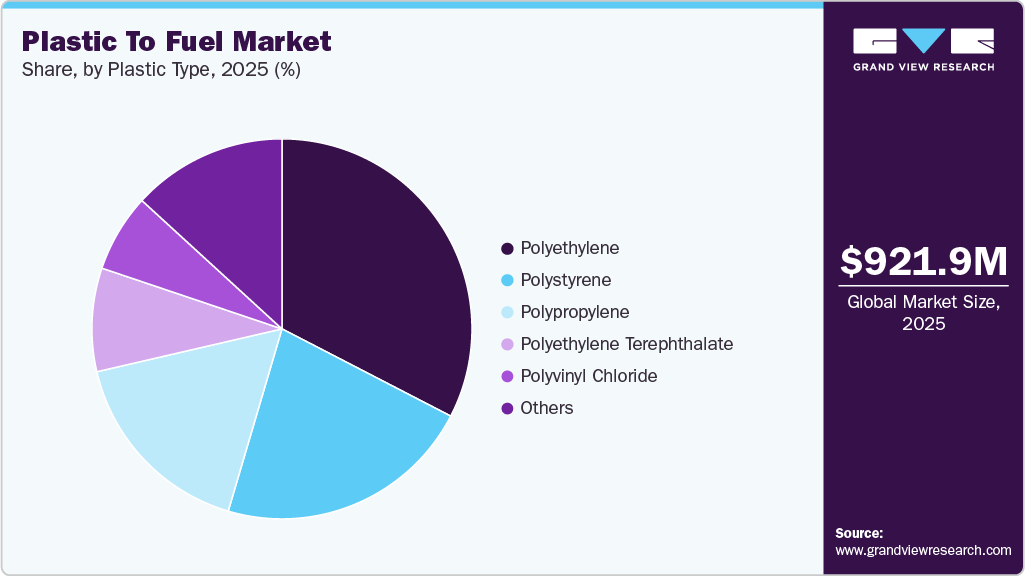

- Based on plastic type, the polyethylene segment held the highest market share in 2025.

- By source, the commercial & industrial waste held the highest market share of 61.49% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 921.8 Million

- 2033 Projected Market Size: USD 4,584.7 Million

- CAGR (2026-2033): 21.4%

- Asia Pacific: Largest market in 2025

A plastic-to-fuel system operates by thermochemically converting waste plastics into liquid fuels, such as diesel, gasoline, and synthetic oil, through processes including pyrolysis and depolymerization, offering an effective solution for reducing plastic waste and recovering energy. Continuous advancements in reactor design, catalyst efficiency, and process optimization, along with improving fuel yields and quality, are significantly enhancing commercial viability. Increasing pressure to address plastic pollution, coupled with supportive government regulations on waste management and circular economy initiatives, is further accelerating the adoption of sustainable practices.

The global plastic-to-fuel market is continuing to gain momentum, driven by the increasing need for sustainable waste management solutions and alternative energy sources, particularly in regions facing mounting challenges with plastic waste and landfill constraints. Governments, municipalities, and private players are increasingly investing in plastic-to-fuel facilities to support circular economy goals, reduce environmental pollution, and recover value from non-recyclable plastics. The growing adoption of advanced plastic-to-fuel conversion technologies, particularly pyrolysis-based systems capable of handling mixed and contaminated plastic streams, plays a crucial role in enhancing process efficiency and improving fuel output quality. Continuous advancements in reactor design, catalyst development, emission control systems, and process automation further reinforce market growth and commercial scalability globally.

Drivers, Opportunities & Restraints

The global plastic-to-fuel market continues to progress, driven by the growing demand for sustainable waste management solutions and alternative fuel sources, particularly in regions grappling with escalating plastic waste generation and limited recycling capacity. Governments, municipalities, and industrial players are increasingly investing in plastic-to-fuel infrastructure to support circular economy objectives, reduce landfill dependence, and convert non-recyclable plastics into usable liquid fuels. The ability of plastic-to-fuel technologies to process mixed and contaminated plastic streams, recover energy value, and lower environmental burdens makes them an important component of integrated waste-to-energy strategies. Ongoing improvements in pyrolysis systems, catalyst performance, and thermal conversion efficiency are further accelerating the adoption of this technology across both municipal and industrial applications.

Emerging opportunities are being created by stricter regulations on plastic disposal, rising fuel demand in developing economies, and increasing interest in decentralized waste-to-energy solutions. Advancements in digital process control, emission reduction technologies, and modular plant designs are helping reduce operating risks, improve fuel quality, and enhance project scalability. Growing private-sector participation, public–private partnerships, and investments in sustainable infrastructure are also expanding deployment potential. However, the market continues to face challenges, including high initial capital costs, inconsistent feedstock supply, regulatory uncertainty, and concerns over environmental compliance. Lengthy permitting processes, fluctuating oil prices, and the need for standardized quality benchmarks for output fuels remain key constraints affecting the large-scale commercialization of plastic-to-fuel technologies globally.

Technology Insights

The pyrolysis segment remained the dominant technology category, accounting for approximately 81.02% of global revenue in 2025, and is expected to maintain strong momentum throughout the forecast period. The pyrolysis plastic-to-fuel market continues to expand due to its ability to process mixed and contaminated plastic waste streams while producing high-yield liquid fuels such as diesel-range oils and synthetic crude. Its relatively lower operating temperatures, flexible feedstock compatibility, and scalability for both modular and large-scale plants reinforce widespread adoption. Ongoing advancements in reactor design, catalyst formulations, thermal efficiency, and emission control systems are further supporting the commercial deployment of pyrolysis-based plastic-to-fuel facilities across municipal and industrial waste management ecosystems.

The gasification segment is projected to register the fastest CAGR of over 22% during the assessment period. Its capability to convert plastic waste into syngas suitable for power generation, hydrogen production, and chemical synthesis makes it increasingly attractive for integrated energy and industrial applications. Gasification systems offer higher conversion efficiency and greater versatility in downstream fuel utilization, particularly in regions emphasizing low-emission energy pathways. The growing deployment in industrial clusters, coupled with advancements in high-temperature reactors, gas cleanup systems, and process integration, is accelerating demand for gasification-related equipment and services, thereby supporting broader growth opportunities across the plastic-to-fuel value chain.

Source Insights

The commercial & industrial waste segment accounted for approximately 61.49% of global revenue in 2025, maintaining its position as the dominant source category in the plastic-to-fuel market. The large and consistent generation of plastic waste from manufacturing units, packaging operations, logistics hubs, and commercial facilities ensures reliable feedstock availability, supporting continuous plant utilization and favorable project economics. Higher concentrations of single-polymer plastics, lower contamination levels, and established waste collection contracts further enhance conversion efficiency and fuel yield. Increasing regulatory pressure on industries to divert plastic waste from landfills, along with corporate sustainability commitments and circular economy initiatives, continues to reinforce the adoption of plastic-to-fuel solutions across commercial and industrial waste streams.

The municipal solid waste segment is projected to register the fastest CAGR of over 21.8% during the forecast period. Rapid urbanization, population growth, and rising consumption of plastic-based products are significantly increasing municipal plastic waste volumes, creating strong demand for scalable waste-to-energy solutions. Plastic-to-fuel technologies provide municipalities with an effective means to manage non-recyclable plastics, thereby reducing landfill dependence and environmental pollution. Advancements in pre-sorting systems, feedstock preparation, and contamination-tolerant conversion technologies are improving the viability of municipal solid waste as a fuel source. However, challenges related to waste segregation efficiency, regulatory approvals, and infrastructure investment continue to influence the pace of large-scale adoption across global municipal plastic-to-fuel projects.

End Fuel Insights

The crude oil segment accounted for approximately 60.05% of global revenue in 2025, maintaining its position as the dominant end-fuel category in the plastic-to-fuel market. Plastic-derived crude oil is widely preferred due to its compatibility with existing refinery infrastructure, enabling further upgrading into diesel, gasoline, and other refined products. Its high energy density, ease of storage and transport, and strong demand from petrochemical and refining industries support stable offtake and favorable commercialization prospects. The increasing interest in alternative feedstocks by refineries, coupled with regulatory pressure to reduce reliance on virgin fossil resources, continues to reinforce the adoption of plastic-to-crude oil pathways across global waste-to-energy value chains.

The hydrogen segment is projected to register the fastest CAGR of 23.3% during the forecast period. The growing global emphasis on low-carbon energy systems, hydrogen economy development, and industrial decarbonization is accelerating interest in hydrogen production from plastic waste through advanced gasification and reforming technologies. Plastic-to-hydrogen solutions offer the dual benefit of waste reduction and clean fuel generation, making them attractive for use in refining, chemicals, power generation, and mobility applications. Advancements in syngas upgrading, hydrogen purification, and carbon capture integration are improving process efficiency and environmental performance. However, high capital intensity, technological complexity, and evolving regulatory frameworks remain key factors influencing the large-scale deployment of plastic-to-hydrogen projects globally.

Plastic Type Insights

The polyethylene segment accounted for approximately 32.59% of total revenue in 2025, maintaining its position as the dominant feedstock category in the plastic-to-fuel market. The widespread use of polyethylene across packaging, consumer goods, and industrial applications generates large volumes of waste, making it a readily available and economically attractive input for plastic-to-fuel conversion. Its high hydrocarbon content and favorable thermal degradation characteristics support higher liquid fuel yields, particularly in pyrolysis-based systems. Governments and waste management operators are increasingly prioritizing polyethylene-rich waste streams to improve conversion efficiency and fuel quality, a trend especially visible across the Asia Pacific and Europe, where landfill restrictions and circular economy policies are gaining traction. Despite strong long-term prospects, challenges related to feedstock segregation, contamination, and collection logistics continue to influence operational economics in certain regions.

The polystyrene segment is projected to register the fastest CAGR of over 22.6% during the forecast period. The rising consumption of polystyrene in packaging, insulation, and disposable products, combined with the limited viability of mechanical recycling, is accelerating its diversion toward plastic-to-fuel pathways. Polystyrene’s high aromatic content enables the production of higher-value liquid fuels with superior calorific properties, making it particularly attractive for fuel recovery applications. Advancements in reactor design, catalyst selectivity, and pre-treatment processes are improving conversion efficiency and product consistency. However, regulatory scrutiny, emissions compliance requirements, and variability in waste collection infrastructure remain key factors influencing large-scale commercialization across global plastic-to-fuel projects.

Regional Insights

Asia Pacific held 50.75% revenue share of the global plastic-to-fuel market in 2025, driven by rapidly rising plastic waste generation, expanding urban populations, and increasing investments in waste-to-energy infrastructure across major economies in the region. The APAC plastic-to-fuel market continues to benefit from strong policy support for sustainable waste management, landfill diversion targets, and circular economy initiatives aimed at reducing environmental pollution. Rapid industrialization and consumption growth in countries such as India are further reshaping regional demand, with the India plastic-to-fuel market witnessing increasing deployment of pyrolysis and gasification facilities supported by public–private partnerships. These factors collectively reinforce Asia Pacific’s position as the leading hub for large-scale plastic-to-fuel project development and commercialization.

North America Plastic To Fuel Market Trends

Rising concerns over plastic waste accumulation and the growing focus on sustainable waste management are major factors driving the North America plastic-to-fuel market. Municipalities and private operators are increasingly adopting plastic-to-fuel technologies to divert non-recyclable plastics from landfills while recovering energy value. Supportive environmental regulations, corporate sustainability commitments, and increasing investments in waste-to-energy infrastructure continue to strengthen the region’s outlook. Ongoing advancements in conversion efficiency, emissions control, and modular plant designs remain central to plastic-to-fuel adoption across North America.

The U.S. plastic-to-fuel market is expanding due to rising plastic waste volumes, landfill capacity constraints, and increasing interest in alternative fuel production. Growing deployment of pyrolysis and gasification facilities, particularly near industrial clusters and urban centers, is supporting market growth. Federal and state-level initiatives focused on waste reduction, clean energy, and circular economy practices are reinforcing investment activity. The need to manage complex plastic waste streams while producing refinery-compatible fuels continues to position plastic-to-fuel technologies as a strategic waste management solution in the U.S.

Europe Plastic To Fuel Market Trends

The European plastic-to-fuel market is driven by stringent environmental regulations, ambitious recycling targets, and strong circular economy policies. Governments across the region are encouraging advanced recycling and waste-to-energy solutions to reduce landfill dependence and plastic pollution. Investments in chemical recycling, pyrolysis plants, and integrated waste management systems are accelerating adoption. Europe’s strong regulatory framework, technological innovation ecosystem, and presence of leading technology providers further position the region as a key contributor to the advancement of plastic-to-fuel solutions.

Latin America Plastic To Fuel Market Trends

Improving waste management infrastructure and rising urban plastic waste generation are key drivers of the Latin America plastic-to-fuel market. Countries across the region are increasingly exploring plastic-to-fuel technologies to address landfill overuse and environmental challenges while generating alternative fuels. Growing interest in decentralized waste-to-energy facilities and public–private partnerships supports gradual market development. Regulatory reforms, sustainability initiatives, and efforts to attract private investment in waste processing infrastructure continue to contribute to market expansion.

Middle East & Africa Plastic To Fuel Market Trends

The Middle East and Africa (MEA) plastic-to-fuel market is gaining traction due to increasing plastic waste volumes, rapid urbanization, and the need for sustainable waste disposal solutions. Plastic-to-fuel technologies are being evaluated as an effective means to reduce landfill pressure while supporting energy diversification goals. Government-led environmental programs, infrastructure development initiatives, and long-term sustainability strategies are creating favorable conditions for market growth. Expanding waste processing capacity and improving collection and segregation systems remain central to the region’s plastic-to-fuel deployment efforts.

Key Plastic To Fuel Company Insights

Some of the key players operating in the global plastic to fuel market include Plastic Energy, Brightmark, among others.

-

Plastic Energy is one of the global leaders in the plastic-to-fuel and chemical recycling market, widely recognized for its proprietary pyrolysis technology that converts mixed and contaminated plastic waste into recycled feedstock oils (TACOIL). The company has developed and commercialized large-scale industrial facilities in Europe and Asia, working closely with petrochemical majors to integrate plastic-derived oils into existing refinery and cracker infrastructure. Plastic Energy’s technology strategy focuses on high feedstock tolerance, process stability, and circular economy alignment, enabling the recovery of value from plastics that are unsuitable for mechanical recycling. Its strong partnerships with global polymers producers and commitment to regulatory compliance position the company as a key enabler of scalable plastic-to-fuel and plastic-to-chemicals solutions across the globe.

-

Brightmark is a prominent player in the plastic-to-fuel market, known for developing and operating advanced pyrolysis facilities that convert non-recyclable plastics into ultra-low sulfur fuels and waxes. The company emphasizes modular plant design, end-to-end waste management integration, and long-term offtake agreements to ensure commercial viability. Brightmark’s projects are closely aligned with municipal and industrial waste streams, supporting landfill diversion and emissions reduction goals. With a strong focus on environmental performance, lifecycle emissions reduction, and public–private partnerships, Brightmark continues to expand its footprint across North America, contributing to the broader adoption of plastic-to-fuel technologies within the global waste-to-energy value chain.

Key Plastic To Fuel Companies:

The following are the leading companies in the plastic to fuel market. These companies collectively hold the largest market share and dictate industry trends.

- Plastic2oil

- Alterra Energy

- Neste

- Nexus Circular

- BRADAM Group, LLC

- Brightmark LLC

- Klean Industries

- Beston (Henan) Machinery Co. Ltd.

- Plastic Energy

- Agilyx Inc.

Recent Developments

-

In January 2025, Agilyx completed the acquisition of a minority stake in GreenDot Global, strengthening its feedstock sourcing and circular plastics platform in Europe.

-

In December 2024, Plastic Energy has advanced the commissioning of its Netherlands advanced recycling facility, developed in collaboration with SABIC, bringing the project closer to full-scale commercial operations in Europe.

Plastic To Fuel Market Report Scope

Report Attribute

Details

Market Definition

The plastic-to-fuel market represents the global revenue generated from technologies and systems that convert waste plastics into usable fuels, including pyrolysis and gasification units, reactors, catalysts, upgrading systems, and associated fuel processing and emission control technologies.

Market size value in 2026

USD 1,180.8 million

Revenue forecast in 2033

USD 4,584.7 million

Growth rate

CAGR of 21.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, plastic type, source, end fuel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; The Netherlands; China; India; Japan; South Korea; Indonesia; Australia; Singapore; Vietnam; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Plastic2oil; Alterra Energy; Neste; Nexus Circular; BRADAM Group, LLC; Brightmark LLC; Klean Industries; Beston (Henan) Machinery Co. Ltd.; Plastic Energy; Agilyx Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic To Fuel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global plastic to fuel market report on the basis of technology, plastic type, source, end fuel, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Pyrolysis

-

Depolymerization

-

Gasification

-

-

Plastic Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Polyethylene

-

Polyethylene Terephthalate

-

Polypropylene

-

Polyvinyl Chloride

-

Polystyrene

-

Others

-

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Municipal Solid Waste

-

Commercial & Industrial Waste

-

-

End Fuel Outlook (Revenue, USD Million, 2021 - 2033)

-

Sulfur

-

Hydrogen

-

Crude Oil

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Australia

-

Singapore

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global plastic to fuel market size was estimated at USD 921.8 million in 2025 and is expected to reach USD 1,180.8 million in 2026.

b. The global plastic to fuel market is expected to grow at a compound annual growth rate of 21.4% from 2026 to 2033 to reach USD 4,584.7 million by 2033.

b. Pyrolysis technology accounted for a revenue share of 81.02% in the global market in 2025. Numerous fuel types can be generated through this technology such as biofuel, solid residue, and synthetic gas which is anticipated to drive this segment.

b. Some key players operating in the plastic to fuel market include Vadaxx Energy, Plastic2Oil, RES Polyflow, Green Envirotec Holdings LLC, Agilyx Corporation, among others.

b. Key factors driving the plastic to fuel market growth include growing need for alternate sources of energy pertaining to the excess dependence on natural resources

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.