- Home

- »

- Advanced Interior Materials

- »

-

Plate And Frame Heat Exchangers Market Size Report, 2030GVR Report cover

![Plate And Frame Heat Exchangers Market Size, Share & Trends Report]()

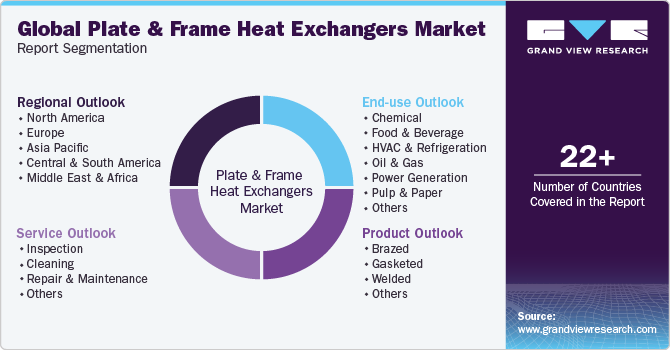

Plate And Frame Heat Exchangers Market Size, Share & Trends Analysis Report By Product (Brazed, Gasketed, Welded), By End-use (Chemical, Power Generation), By Service, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-720-9

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

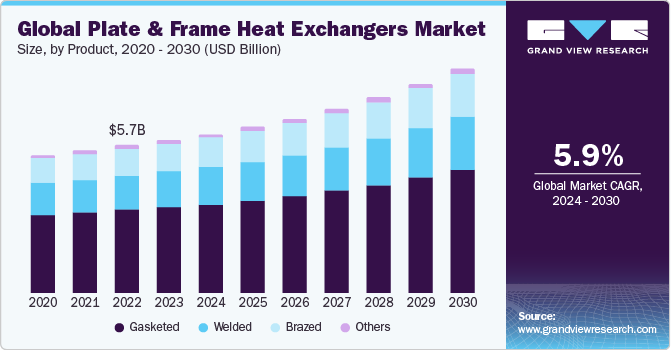

The global plate and frame heat exchangers market size was estimated at USD 5.89 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030. The increasing emphasis on energy efficiency in various industries is fostering a growing demand for these heat exchangers, known for their effectiveness in heat transfer processes. Versatility across industrial applications, stringent environmental regulations driving the adoption of sustainable solutions, ongoing technological advancements enhancing efficiency, and a global focus on renewable energy are all contributing to market growth.

In addition, factors such as urbanization, infrastructure development, cost-effectiveness, and the compact design of plate and frame heat exchangers are influencing their preference in applications where space constraints and operational costs play pivotal roles. The growing awareness of the benefits of heat recovery, coupled with the global shift toward sustainable practices, further underscores the significance of plate and frame heat exchangers in meeting the evolving needs of diverse industries.

The ongoing emphasis on energy efficiency in diverse industries in the U.S. has led to increased adoption of plate & frame heat exchangers that can effectively transfer heat between fluids. Plate and frame heat exchangers are favored for their ability to provide efficient thermal performance, making them a sought-after solution for applications across sectors such as HVAC, chemical processing, and food & beverage.

The push towards sustainable and environmentally friendly practices in the U.S. has significantly contributed to the rising demand for plate and frame heat exchangers. These heat exchangers play a crucial role in helping industries meet stringent environmental regulations by optimizing energy consumption and reducing greenhouse gas emissions. These factors above are expected to propel the demand for plate & frame heat exchangers over the forecast period.

The robust industrial landscape globally spanning manufacturing, oil & gas, and other sectors has fueled the demand for efficient heat exchange solutions. Plate and frame heat exchangers find extensive use in these industries due to their versatility, compact design, and cost-effectiveness. The ability to handle various fluids and to adapt to different operational requirements makes them well-suited for the diverse applications present in the global market.

Furthermore, the increasing focus on renewable energy sources has created additional opportunities for plate & frame heat exchangers. Their use in renewable energy applications, such as solar and geothermal power generation, aligns with the broader national goals of reducing dependence on traditional energy sources and promoting sustainability. The demand for plate & frame heat exchangers is also influenced by factors such as technological advancements in heat exchanger design and materials. Ongoing research and development efforts are leading to innovations that enhance the efficiency and performance of these heat exchangers, further driving their adoption.

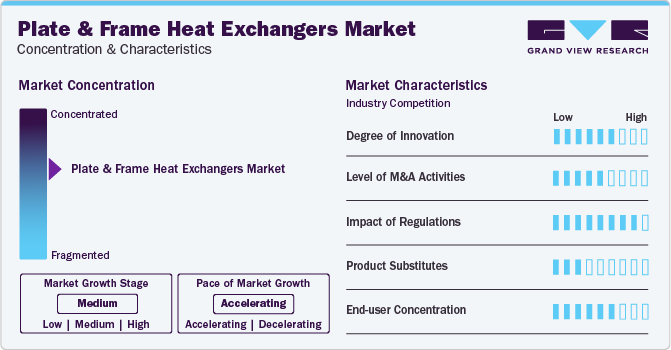

Market Concentration & Characteristics

The market growth stage is medium, and its pace is accelerating. The market for plate & frame heat exchangers is characterized by a high degree of innovation owing to the rapid technological advancements. Moreover, the companies are further adopting various organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

The market exhibits distinctive characteristics driven by a confluence of factors that shape its dynamics. Firstly, the versatility of plate and frame heat exchangers is a defining feature. These heat exchangers find applications across a wide range of industries, including HVAC, chemical processing, food & beverage, and oil & gas. This versatility stems from their ability to handle diverse fluids and accommodate various operational requirements, making them a preferred choice for different processes.

Another key characteristic is the market's responsiveness to the increasing emphasis on energy efficiency. As industries globally and across sectors prioritize energy conservation, plate and frame heat exchangers emerge as integral components for enhancing thermal management. Their efficiency in heat transfer processes contributes to reducing overall energy consumption, aligning with the sustainability goals of modern industries.

Technological advancements represent a significant driver and characteristic of market growth. Ongoing research and development efforts focus on improving the design, materials, and overall performance of these heat exchangers. Innovations in gasket and plate design, as well as materials with enhanced heat transfer properties, contribute to higher efficiency and reliability, driving market growth.

Cost-effectiveness and space efficiency are also notable characteristics influencing the market. The compact design of plate and frame heat exchangers makes them suitable for applications where space constraints are critical. In addition, their cost-effectiveness makes them an attractive choice for industries seeking efficient yet economical heat transfer solutions. Furthermore, the market's adaptability to global trends, such as the shift towards renewable energy, reflects its dynamic nature. Plate and frame heat exchangers play a pivotal role in renewable energy applications, including solar and geothermal power generation, supporting the transition towards cleaner and sustainable energy sources.

Product Insights

The gasketed product segment led the market in 2023 with a global revenue share of 56.4%. Gasketed plate and frame heat exchangers offer several distinct advantages that contribute to their widespread adoption in various industries. Their modular design, featuring multiple thin plates with gaskets between them, facilitates efficient heat transfer in a compact space. This design not only allows for easy customization to meet specific process requirements but also enables convenient maintenance and cleaning. In addition, the gaskets between the plates create tight seals, preventing cross-contamination of fluids and ensuring the integrity of the heat exchange process. This feature is especially crucial in industries with stringent hygiene and quality standards, such as the food and pharmaceutical sectors. The ease of disassembly and reassembly for inspection or maintenance purposes adds to their practicality, reducing downtime and operational disruptions.

Brazed plate & frame heat exchangers find extensive application in various industries due to their compact design, high thermal efficiency, and versatility. Commonly employed in HVAC systems for residential and commercial heating and cooling, these heat exchangers effectively transfer heat between refrigerants and air or water streams. In industrial settings, they play a crucial role in process heating and cooling applications, such as oil and gas processing, chemical manufacturing, and power generation. Their robust construction, which eliminates the need for gaskets, makes them well-suited for applications with high temperatures and pressure fluctuations, ensuring reliable and efficient performance.

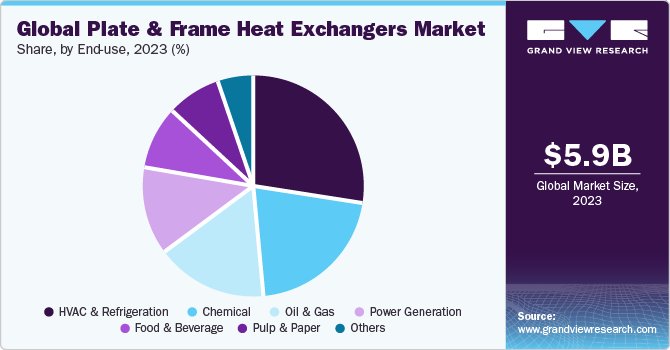

End-use Insights

Chemical end-use held the largest market revenue share in 2023. Plate & frame heat exchangers are widely employed in the chemical industry for efficient heat transfer in various processes. Their compact design and high thermal efficiency make them particularly suitable for applications such as chemical processing, where precise temperature control is essential. These heat exchangers facilitate the exchange of heat between different fluids, allowing for optimal reaction conditions and energy conservation. Their corrosion-resistant materials ensure compatibility with a range of aggressive chemicals commonly encountered in industrial processes.

Plate & frame heat exchangers play a pivotal role in the HVAC and refrigeration industry, serving as efficient heat transfer solutions. Widely utilized in both residential and commercial settings, these heat exchangers contribute to the regulation of air and fluid temperatures. In HVAC systems, they efficiently transfer heat between air streams, supporting the heating and cooling processes necessary for indoor climate control. Their compact design and ability to handle varying thermal loads make them ideal for installations with space constraints, and their modular construction allows for scalability. In addition, plate & frame heat exchangers are integral components in refrigeration systems, facilitating the condensation and evaporation of refrigerants to maintain desired temperatures in refrigerated spaces. The reliability, adaptability, and energy efficiency of plate and frame heat exchangers contribute significantly to the effectiveness of HVAC and refrigeration systems, ensuring comfortable indoor environments and efficient cooling processes in various applications.

Service Insights

The repair & maintenance service segment led the market in 2023 with the largest revenue share. With stringent rules and regulations, maintenance of plate & frame heat exchangers in a timely manner is of vital importance. The oil & gas, food & beverages, and chemicals industries carry out high-temperature and high-pressure processes. This leads to the requirement for all systems and equipment in these industries to be maintained as per the regulations. Because of the high-temperature and high-pressure conditions, the overheating of heat exchangers can lead to stress cracks that may result in catastrophic failures and hefty downtime costs. Thus, the timely repair & maintenance of plate & frame heat exchangers is critical for industries.

Inspection of plate & frame heat exchangers encompasses the assessment of their plates, gaskets, frames, and components. The thickness of the plates, welded parts, and gasketed joints are required to be inspected at regular intervals to avoid the leakage of fluids during the heat transfer process and eliminate the chances of cross contamination and wastage of thermal energy. The inspection methods for plate & frame heat exchangers include raw material evaluation, pressure tests, and inter-process inspection.

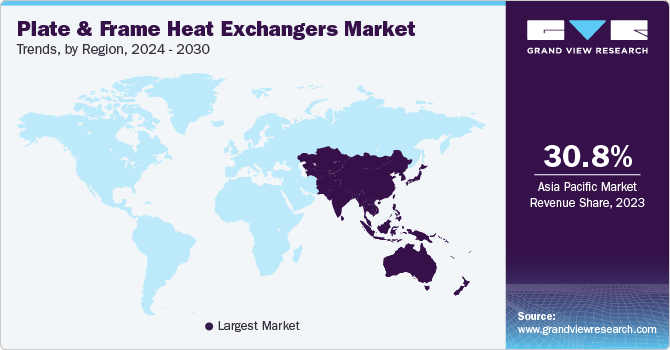

Regional Insights

The plate & frame heat exchangers market in North America boasts robust growth fueled by several key factors. With increasing urbanization, construction activities, and a focus on energy efficiency, the demand for HVAC systems in residential, commercial, and industrial sectors is on the rise.

U.S. Plate And Frame Heat Exchangers Market Trends

The plate & frame heat exchangers market in the U.S. is anticipated to grow at a CAGR of 5.1% from 2024 to 2030. Factors such as industrialization, high electricity demand, and investments in renewable power generation in the country are anticipated to augment the demand for plate & frame heat exchangers. Increasing investments in exploration and production activities by oil & gas companies in the U.S. are anticipated to boost the demand for plate & frame heat exchangers in the oil & gas industry.

The Canada plate & frame heat exchangers market is projected to grow at a CAGR of 6.3% over the forecast period in the North America market. The Increasing investments in construction projects across Canada are anticipated to drive the demand for plate & frame heat exchangers within the country between 2020 and 2030. As per Statistics Canada, investment in building construction surged by 1.7% to reach USD 19.8 billion in November 2023.

Asia Pacific Plate And Frame Heat Exchangers Market Trends

The Asia Pacific plate & frame heat exchangers market accounted for 30.8% of global revenue share in 2023.. The region's focus on energy efficiency, driven by environmental concerns and regulatory measures, further boosts the demand for these heat exchangers. In addition, the burgeoning urbanization, infrastructure development, and the rise in demand for HVAC systems in commercial and residential buildings contribute significantly to the expanding market.

The plate & frame heat exchangers market in China is estimated to grow at a significant CAGR over the forecast period. As China continues to lead in construction and urbanization, and as its pharmaceutical sector grows, the demand for plate & frame heat exchangers in the country is expected to rise, reflecting broader trends in infrastructure development and industrial expansion.

The India plate & frame heat exchangers market is projected to grow at a CAGR of 8.1% over the forecast period. The market in India is witnessing significant growth, fueled by an increase in construction activities, industrialization, and a rise in disposable incomes, alongside growing awareness about the products.

Europe Plate And Frame Heat Exchangers Market Trends

The plate & frame heat exchangers market in Europe is witnessing sustained growth due to demand for plate & frame heat exchangers propelled by a combination of factors. The region’s commitment to environmental sustainability and stringent energy efficiency regulations are driving industries to adopt advanced heat transfer solutions. Plate & frame heat exchangers, known for their high thermal efficiency and versatility, are pivotal in meeting these requirements across various sectors, including manufacturing, chemical processing, and power generation.

The Germany plate & frame heat exchangers market is expected to grow significantly at a CAGR of 5.7%. As the pharmaceutical sector in Germany continues to grow due to innovation, research, and development, and increasing demand for medications, the demand for sophisticated manufacturing equipment like plate and frame heat exchangers will also grow.

The plate & frame heat exchangers market in the UK held a significant share of the European market. The market is growing due to increasing investments in offshore drilling, oil & gas, chemical, and construction & infrastructure industries to propel economic growth. In 2022, the UK awarded over 100 licenses to companies for oil & gas exploration in the North Sea. Almost 900 locations were offered for exploration.

Central & South America Plate And Frame Heat Exchangers Market Trends

The plate & frame heat exchangers market in Central & South America is estimated to grow rapidly over the coming years. These trends are influenced by economic, environmental, and technological advancements taking place in Central & South America. The surging emphasis on energy efficiency across various industries in the region has fueled the demand for plate & frame heat exchangers owing to their high thermal efficiency.

The Brazil plate & frame heat exchangers market is expected to grow significantly at a CAGR of 6.7% over the projected period. The food & beverages industry is one of the most significant contributors to the economy of Brazil. The Brazilian Food Processors' Association (ABIA) reported that the food processing industry of the country achieved revenues worth USD 208 billion in 2022, thereby recording a 16.6% rise in this revenue compared to that of the previous year.

Middle East & Africa Plate And Frame Heat Exchangers Market Trends

The plate & frame heat exchangers market in the Middle East & Africa is experiencing rapid development. As the region is a leading producer and exporter of crude oil and natural gas, it has a strong demand for plate & frame heat exchangers due to their extensive use in the region's oil & gas sector. With countries in the Middle East ramping up investments to boost oil & gas output, the need for plate & frame heat exchangers is anticipated to rise during the forecast period.

The Saudi Arabia plate & frame heat exchangers market is expected to grow significantly at a CAGR of 6.4% over the forecast period. Oil-based industries in the country include companies engaged in the production of oil, petrochemicals, industrial gas, and refineries of ammonia, petroleum, and caustic. Thus, the presence of vast oil & gas reserves, as well as a robust infrastructure for processing oil, is anticipated to propel the growth of the petrochemical industry, thereby boosting the demand for plate & frame heat exchangers.

Key Plate And Frame Heat Exchangers Company Insights

Some of the key players operating in the market include Alfa Laval, Danfoss, Kelvion Holding GmbH, Xylem, Inc., and API Heat Transfer, Inc.

-

Alfa Laval's business line is based on three major technologies, namely separation/filtration, heat transfer, and fluid handling. Products offered through heat transfer include numerous types of heat exchangers that are designed for different temperatures and pressure levels. The company offers a diverse range of plate & frame heat exchangers to meet various industrial needs. This versatility allows them to cater to different applications across multiple industries, from food & beverage to energy and petrochemicals.

-

Kelvion Holding GmbH business line is focused on the manufacturing and supply of heat exchangers to HVAC, chemical, oil & gas, power generation, and food & beverage industries. Heat exchangers offered by the company are broadly categorized as compact fin heat exchangers, shell & tube heat exchangers, plate heat exchangers, and single tube heat exchangers. Other products in the company’s product portfolio include transformer cooling systems and cooling towers. Kelvion offers services related to heat exchangers, such as commissioning, inspection, repair, monitoring & testing, consulting & training, and upgrade & replacement. It marks its global presence through 67 locations and partners in North America, Europe, Asia Pacific, the Middle East & Africa, and Central & South America.

Güntner GmbH & Co. KG, Kaori Heat Treatment Co. Ltd, Tranter Inc., Ares Plate Heat Exchanger Ltd., and Funke Wärmeaustauscher Apparantebau GmbH are some of the emerging market participants.

-

Güntner GmbH & Co. KG manufactures refrigeration systems and provides its products to a wide range of industries, including pharmaceutical, automotive, computer, manufacturing, and food, along with numerous public sector institutions. It offers products through four business segments, namely industrial, HVAC, energy & process, and commercial. The company offers a wide range of condensers, air coolers, dry coolers, controls, adiabatic, and plate heat exchangers through its wide distribution network. The company is considered as an emerging player as the company has limited product offerings as compared to other companies.

-

Tranter Inc. has multiple operating units that are engaged in manufacturing, engineering, sales, and services. It offers various types of heat exchangers, including plate & frame, shell & plate, prime surface, mini-welded plate, and welded plate.

Key Plate And Frame Heat Exchangers Companies:

The following are the leading companies in the plate and frame heat exchangers market. These companies collectively hold the largest market share and dictate industry trends.

- Alfa Laval AB

- API Heat Transfer

- Danfoss

- Kelvion Holding GmbH

- Nexson Group

- Barriquand Group

- SPX Flow

- Hisaka Works Limited

- Tranter, Inc.

- WCR, Inc.

- Gooch Thermal Systems, Inc.

- Shineheat Corp.

- Elanco Heat Transfer Systems

- HFM

- Kinam Engineering Pvt. Ltd.

Recent Developments

-

In March 2024, the Nexson Group successfully acquired Thermowave GmbH, a premium German manufacturer of plate heat exchangers. The range of products from Thermowave GmbH spans from conventional heat exchangers designed for HVAC systems to highly specialized equipment tailored for the industrial refrigeration, food & beverage, chemical & processing, and energy sectors. This strategic acquisition is expected to enhance Nexson Group's product range in the market.

-

In September 2023, Kelvion Holding GmbH expanded its production capabilities in Sarstedt, enabling the facility to manufacture an extra 150,000 heat exchangers annually.

-

In March 2023, Alfa Laval introduced the T21 gasketed plate-and-frame heat exchanger (GPHE) with the aim of fostering energy efficiency across various industries.

-

In May 2023, the Business Unit for Brazed and fusion Bonded Heat Exchangers at Alfa Laval revealed plans to enhance the manufacturing of brazed plate heat exchangers in response to growing demand during the ongoing global energy transition.

Plate And Frame Heat Exchangers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.13 billion

Revenue forecast in 2030

USD 8.63 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, service, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Alfa Laval; Danfoss; Kelvion Holding GmbH; Guntner GmbH & Co. KG; Xylem, Inc.; API Heat Transfer, Inc.; Hisaka Works Limited; HRS Heat Exchangers; SPX Flow, Inc.; SWEP International AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plate And Frame Heat Exchangers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plate and frame heat exchangers market report based on product, end-use, service, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Brazed

-

Gasketed

-

Welded

-

Welded Plate & Block

-

Welded Spiral

-

Welded Shell & Plate

-

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Chemical

-

Food & Beverage

-

HVAC & Refrigeration

-

Oil & Gas

-

Power Generation

-

Pulp & Paper

-

Others

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Inspection

-

Cleaning

-

Repair & Maintenance

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global plate and frame heat exchangers market size was estimated at USD 5.89 billion in 2023 and is expected to be USD 6.13 billion in 2024.

b. The global plate and frame heat exchangers market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 8.63 billion by 2030.

b. Europe region dominated the market and accounted for 31.7% share in 2023. A favorable regulatory environment, a surge in housing demand, rapid infrastructure development, and the renovation of buildings for improved energy performance are fueling the construction sector growth.

b. Some of the key players operating in the plate and frame heat exchangers market include Alfa Laval AB, Danfoss, Hisaka Works Limited, Nexson Group, SPX Flow, Gooch Thermal Systems, Inc., Kelvion Holding GmbH, Xylem, Inc., and API Heat Transfer, Inc., among others

b. The market is driven by the increasing demand for efficient heat transfer solutions across industries. These heat exchangers, characterized by their compact design and high thermal efficiency, have found widespread applications in HVAC, chemical processing, food and beverage, and power generation.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."