- Home

- »

- Advanced Interior Materials

- »

-

Pneumatic Tools Market Size & Share, Industry Report, 2033GVR Report cover

![Pneumatic Tools Market Size, Share & Trends Report]()

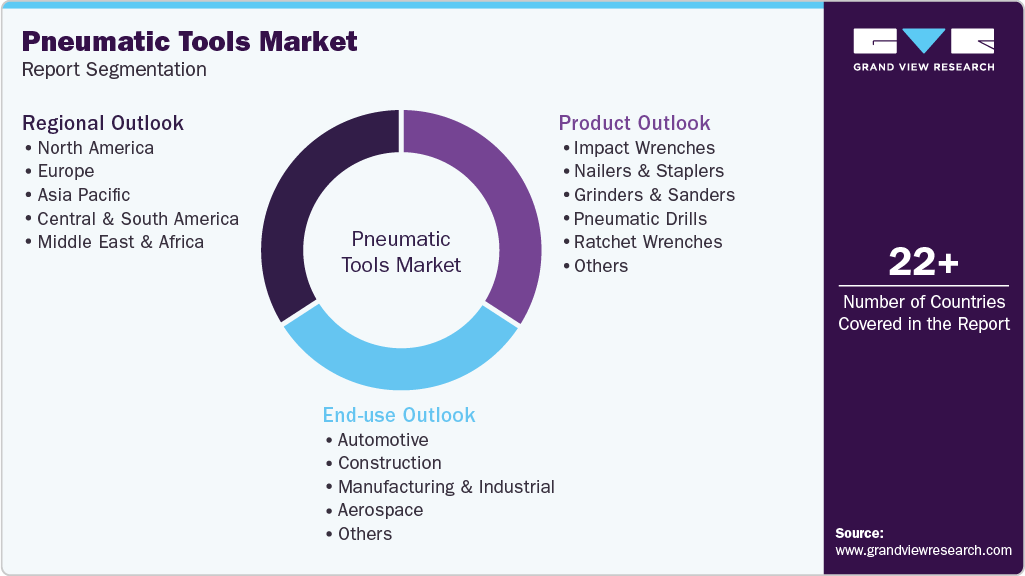

Pneumatic Tools Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Impact Wrenches, Nailers & Staplers, Grinders & Sanders, Pneumatic Drills, Ratchet Wrenches, Others), By End Use (Automotive, Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-773-3

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pneumatic Tools Market Summary

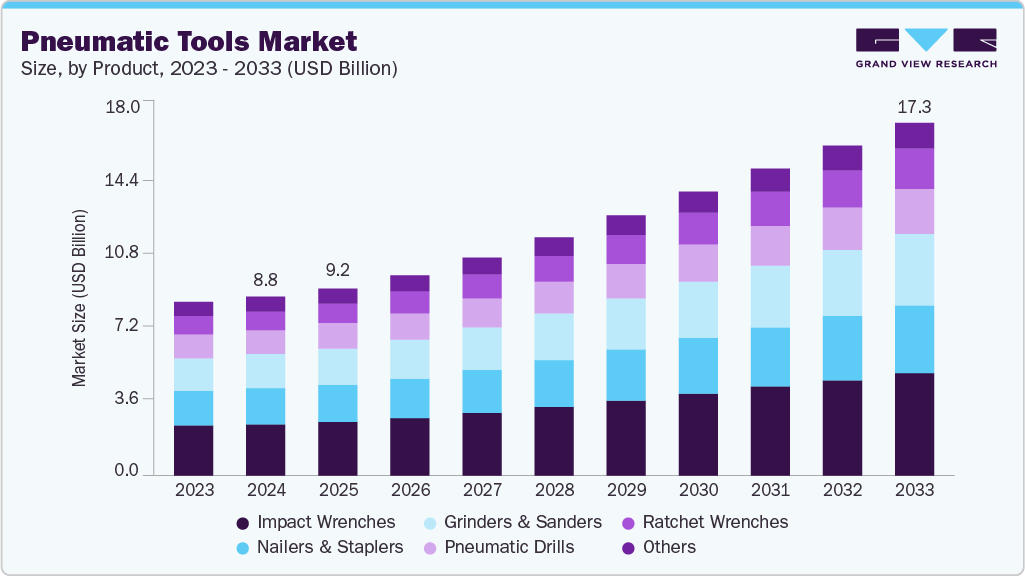

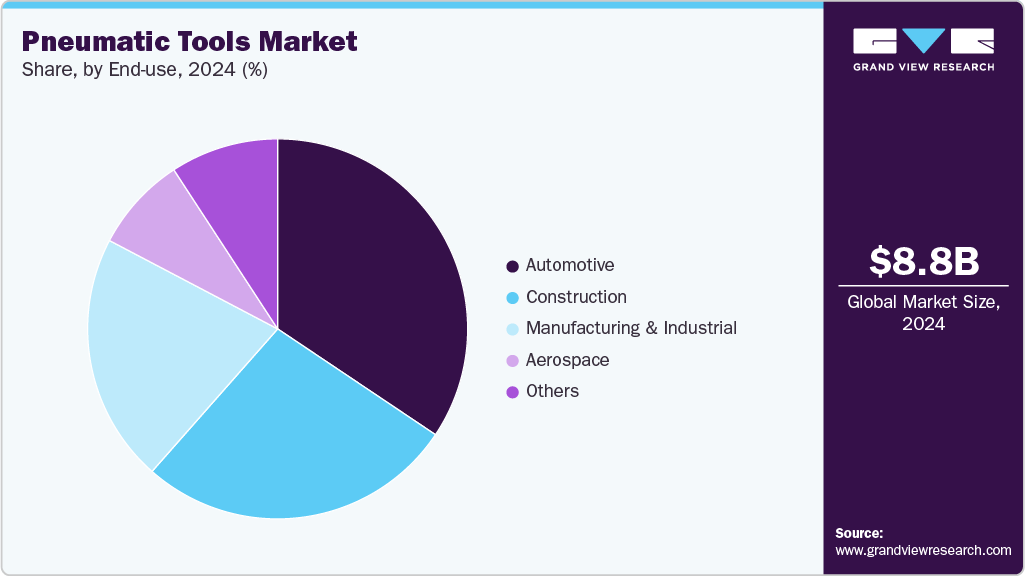

The global pneumatic tools market size was estimated at USD 8.75 billion in 2024 and is projected to reach USD 17.27 billion by 2033, growing at a CAGR of 8.3% from 2025 to 2033. The market is witnessing steady growth due to increasing industrial automation and the need for high-efficiency assembly and fabrication operations.

Key Market Trends & Insights

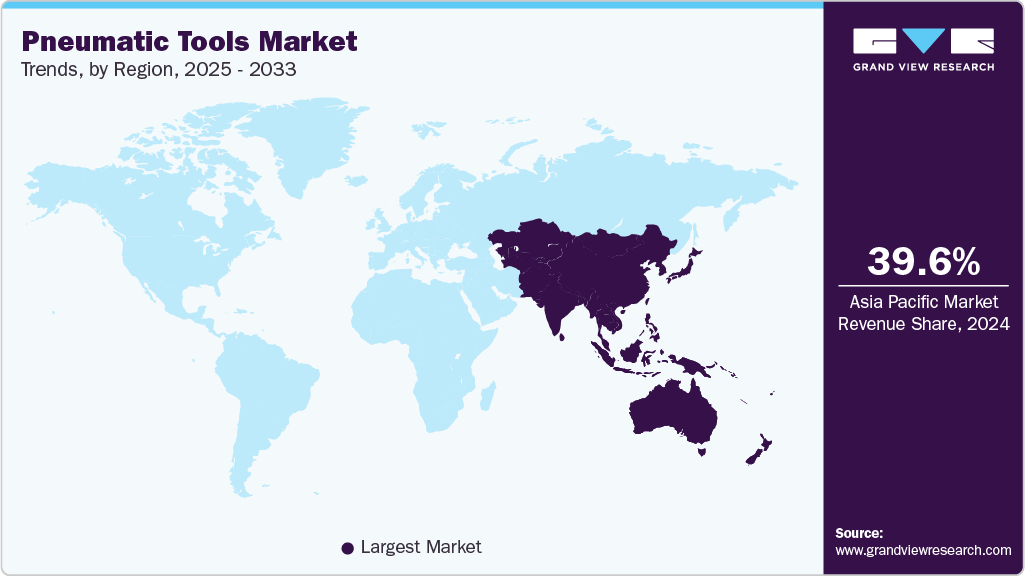

- Asia Pacific dominated the global pneumatic tools industry with the largest revenue share of 39.6% in 2024.

- The U.S. pneumatic tools industry benefits from continuous industrial upgrades, infrastructure redevelopment projects, and high demand for durable, maintenance-free equipment.

- By product, the ratchet wrenches segment is expected to grow at the fastest CAGR of 9.2% over the forecast period.

- By end use, the construction segment is expected to grow at the fastest CAGR of 8.9% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 8.75 Billion

- 2033 Projected Market Size: USD 17.27 Billion

- CAGR (2025-2033): 8.3%

- Asia Pacific: Largest market in 2024

Pneumatic tools are preferred in sectors such as automotive, aerospace, construction, and manufacturing for their durability, consistent torque, and ability to perform heavy-duty tasks. Growing infrastructure projects and expanding production facilities in developing economies are further driving adoption. In addition, industries are focusing on reducing manual labor fatigue and improving workplace safety, making air-powered tools a practical choice.Major factors driving demand include the increasing adoption of lightweight and energy-efficient tools, the growth of the automotive aftermarket, and continuous technological improvements in compressor and air management systems. Pneumatic tools provide operational advantages such as higher speed, reduced maintenance, and longer service life compared to electric tools. Industries seeking sustainable solutions are turning to pneumatic systems due to their lower energy consumption and fewer emissions. Moreover, rapid expansion in manufacturing units and the growing demand for precision in metalworking and fabrication activities are key demand accelerators in the global market.

Technological innovations such as integration of IoT-enabled smart pneumatic systems, noise-reduction mechanisms, and oil-free operation designs are reshaping the market landscape. Manufacturers are investing in portable and compact pneumatic tools to cater to small and medium enterprises. The trend of combining digital monitoring with pneumatic technology is gaining traction, allowing predictive maintenance and performance optimization. Moreover, advancements in composite materials are resulting in lighter yet more powerful tools. Automation in automotive assembly lines and the introduction of hybrid air-electric tools are further setting new benchmarks in productivity and sustainability.

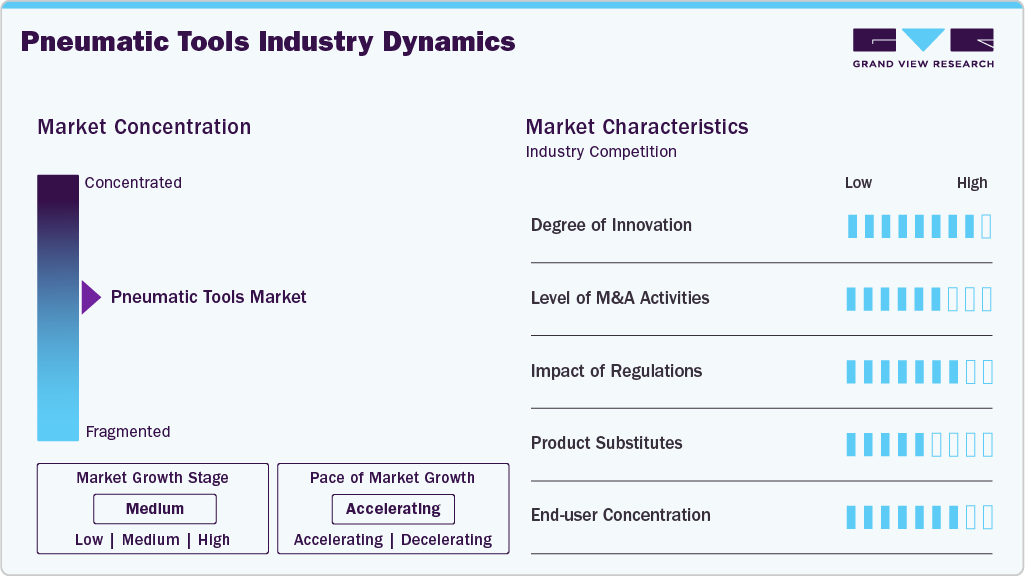

Market Concentration & Characteristics

The pneumatic tools industry is moderately consolidated, with major players such as Ingersoll Rand, Chicago Pneumatic, and Bosch dominating the global landscape. These companies hold a significant share due to extensive product portfolios, strong brand presence, and wide distribution networks. However, numerous regional manufacturers are entering the market, especially in the Asia Pacific, intensifying price competition. Strategic mergers, product differentiation, and aftermarket service offerings have become key focus areas for leading firms to sustain competitiveness and customer loyalty.

Electric and battery-operated tools are emerging as strong substitutes for pneumatic tools due to advancements in lithium-ion battery technology, cordless operation, and lower infrastructure requirements. However, pneumatic tools still maintain an edge in heavy-duty industrial and continuous-use environments due to their higher torque and reliability. The threat of substitution is moderate, as industries with high productivity demands continue to prefer air-powered tools for their consistent performance, longer lifespan, and lower risk of overheating.

Product Insights

The impact wrenches segment held the largest revenue market share of 28.7% in 2024, due to their ability to deliver high torque efficiently for heavy-duty fastening and loosening tasks. They are widely used in automotive, industrial, and construction applications where speed and reliability are critical. The durability, ease of use, and consistent performance of pneumatic impact wrenches make them the preferred choice over electric alternatives in high-volume operations. Their dominance is further supported by ongoing innovations in lightweight designs and ergonomic handling.

The ratchet wrenches segment is expected to grow at the fastest CAGR of 9.2% over the forecast period, as industries increasingly seek compact, precise, and user-friendly tools for assembly and maintenance tasks. Their ability to access tight spaces and provide controlled torque makes them ideal for automotive, aircraft, and machinery applications. Technological improvements such as cordless integration, vibration reduction, and energy-efficient operation are accelerating adoption. The growth of small and medium enterprises and increased focus on workplace ergonomics also contribute to rising demand.

End Use Insights

The automotive segment held the largest revenue market share of 34.4% in 2024, driven by the need for fast, reliable, and high-precision assembly in manufacturing and repair operations. Pneumatic tools are essential for wheel alignment, engine assembly, and chassis construction due to their high torque output and consistent performance. Growing vehicle production globally, coupled with the rise of electric vehicles requiring specialized assembly tools, continues to strengthen the dominance of automotive applications in the market.

The construction segment is expected to grow at the fastest CAGR of 8.9% over the forecast period, fueled by expanding infrastructure projects, urbanization, and industrial development. Tools like nailers, grinders, and air hammers improve productivity and reduce manual effort in building, renovation, and heavy-duty tasks. Rising demand for energy-efficient and durable equipment, along with increasing adoption of pneumatic systems for precision work, is driving substantial growth in this sector. Construction companies are increasingly integrating pneumatic tools to enhance operational efficiency and safety.

Regional Insights

Asia Pacific pneumatic tools industry dominated the global market and accounted for the largest revenue share of 39.6% in 2024, owing to rapid industrialization, growing automotive production, and a surge in construction activities. China, India, and Japan are the leading contributors due to significant investment in manufacturing and automation infrastructure. Increasing labor costs have also encouraged industries to adopt pneumatic systems for efficiency. The presence of local manufacturers offering affordable products and the availability of skilled labor further support regional growth. Expanding electronics and consumer goods sectors continue to create new opportunities for pneumatic tool suppliers.

China’s pneumatic tools industry is witnessing robust growth due to the expanding automotive manufacturing base and government-backed initiatives to modernize industrial facilities. The shift toward smart manufacturing and robotics integration has accelerated demand for precision pneumatic systems. Domestic brands are investing in R&D to compete with international players by introducing energy-efficient, cost-effective solutions. Rising construction activities and export-oriented industrial output continue to drive the adoption of high-performance pneumatic equipment across various end-use sectors.

North America Pneumatic Tools Market Trends

The North America pneumatic tools industry is experiencing steady growth driven by technological innovation and automation across automotive, aerospace, and oil & gas industries. The U.S. and Canada are witnessing increasing adoption of advanced pneumatic assembly tools integrated with IoT monitoring capabilities. Demand for lightweight, ergonomic tools with noise-reduction features is also high due to strict workplace safety standards. Moreover, the strong presence of key global manufacturers and a growing focus on sustainable manufacturing practices support long-term market expansion.

The U.S. pneumatic tools industry benefits from continuous industrial upgrades, infrastructure redevelopment projects, and high demand for durable, maintenance-free equipment. The resurgence of domestic manufacturing, supported by the Inflation Reduction Act and federal infrastructure funding, is further driving tool adoption. The market also sees growing interest in hybrid pneumatic-electric tools for flexible operation across assembly lines. Strong innovation ecosystems and collaborations between toolmakers and automation firms keep the U.S. at the forefront of pneumatic technology advancement.

Europe Pneumatic Tools Market Trends

Europe’s pneumatic tools industry is characterized by a strong emphasis on worker safety, energy efficiency, and automation compliance. Germany, Italy, and the U.K. lead adoption due to their advanced industrial sectors. EU directives on sustainable manufacturing and carbon footprint reduction are driving the shift toward eco-friendly pneumatic systems. The rise of Industry 4.0 initiatives and demand for precision assembly tools in the automotive and aerospace sectors continues to strengthen market potential across the region.

Germany pneumatic tools industry remains a significant hub for pneumatic tool innovation due to its strong engineering base and manufacturing excellence. The country’s automotive and mechanical engineering industries extensively use pneumatic systems for assembly and production automation. German manufacturers are investing in smart, sensor-integrated pneumatic tools that align with Industry 4.0 standards. Government support for sustainable industrial practices and energy-efficient solutions further enhances the growth prospects of the pneumatic tools industry in the nation.

Central & South America Pneumatic Tools Market Trends

Central & South America’s pneumatic tools industry is gaining traction due to the revival of manufacturing and construction sectors in countries such as Brazil and Mexico. Growing industrial automation and the expansion of the automotive supply chain are key factors driving demand. The availability of affordable imported products and increasing awareness of tool efficiency are boosting market penetration. Although economic fluctuations pose challenges, industrial growth initiatives and FDI inflows are supporting the regional market outlook.

Middle East & Africa Pneumatic Tools Market Trends

The Middle East & Africa pneumatic tools industry is witnessing gradual growth driven by infrastructure development and the expansion of the oil & gas and construction industries. Countries such as Saudi Arabia, the UAE, and South Africa are investing in industrial automation and modernization projects, creating demand for durable pneumatic tools. The focus on diversification away from oil-based economies is encouraging investments in manufacturing, logistics, and renewable energy industries-all of which rely heavily on pneumatic systems.

Key Pneumatic Tools Company Insights

Some of the key players operating in the market include Atlas Copco and Bosch.

-

A Swedish industrial powerhouse, Atlas Copco specializes in compressors, vacuum solutions, air and gas treatment systems, and pneumatic tools. The company is known for innovation, energy-efficient products, and a strong global presence in industrial automation and construction sectors.

-

A German multinational, Bosch, produces a wide range of power tools, including pneumatic tools, electric tools, and accessories. It focuses on technological innovation, ergonomics, and durable solutions for industrial, construction, and professional applications.

Nitto Kohki and HiKoki Power Tools are some of the emerging market participants in the pneumatic tools industry.

-

A Japanese manufacturer, Nitto Kohki, is recognized for its high-quality pneumatic tools, couplings, and assembly equipment. The company emphasizes precision engineering and reliability for industrial and manufacturing applications.

-

Formerly known as Hitachi Power Tools, HiKoki is a Japanese brand offering pneumatic and electric tools for construction and industrial use. It is known for robust, high-performance tools and innovative technology integration.

Key Pneumatic Tools Companies:

The following are the leading companies in the pneumatic tools market. These companies collectively hold the largest market share and dictate industry trends.

- Makita

- Fuji Industrial Technique

- Nitto Kohki

- HiKoki Power Tools

- Ingersoll Rand

- Chicago Pneumatic

- Bosch

- Pneumatic Components Ltd

- ATS ELGI

- Atlas Copco

Recent Developments

-

In May 2025, MAKITA released new 18V LXT 21° and 30° framing nailers. These new LXT Framing Nailers deliver the power of pneumatic without the hassles of air hoses.

-

In October 2025, Atlas Copco acquired SUTO iTEC, a specialist in measurement/monitoring for compressed air and gases.

Pneumatic Tools Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.16 billion

Revenue forecast in 2033

USD 17.27 billion

Growth Rate

CAGR of 8.3% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

Global

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Saudi Arabia; UAE; Egypt; Kuwait; Qatar

Key companies profiled

Makita; Fuji Industrial Technique; Nitto Kohki; HiKoki Power Tools; Ingersoll Rand; Chicago Pneumatic; Bosch; Pneumatic Components Ltd; ATS ELGI; Atlas Copco

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pneumatic Tools Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global pneumatic tools market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Impact Wrenches

-

Nailers & Staplers

-

Grinders & Sanders

-

Pneumatic Drills

-

Ratchet Wrenches

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Construction

-

Manufacturing & Industrial

-

Aerospace

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pneumatic tools market size was estimated at USD 8.75 billion in 2024 and is expected to reach USD 9.16 billion in 2025.

b. The global pneumatic tools market is expected to grow at a compound annual growth rate of 8.3% from 2025 to 2033 to reach USD 17.27 billion by 2033.

b. The impact wrenches segment held the highest revenue market share of 28.7% in 2024, due to their ability to deliver high torque efficiently for heavy-duty fastening and loosening tasks.

b. Some of the key players operating in the pneumatic tools market include Makita, Fuji Industrial Technique, Nitto Kohki, HiKoki Power Tools, Ingersoll Rand, Chicago Pneumatic, Bosch, Pneumatic Components Ltd, Atlas Copco, and ATS ELGI.

b. The key factor driving the pneumatic tools market is the increasing demand for high-efficiency, durable, and productivity-enhancing tools across industrial, automotive, and construction sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.