- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Poland Dietary Supplements Market, Industry Report, 2030GVR Report cover

![Poland Dietary Supplements Market Size, Share & Trends Report]()

Poland Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Vitamin, Botanicals, Minerals), By Form (Tablets, Capsules), By Type, By Application, By End-use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-661-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Poland Dietary Supplements Market Trends

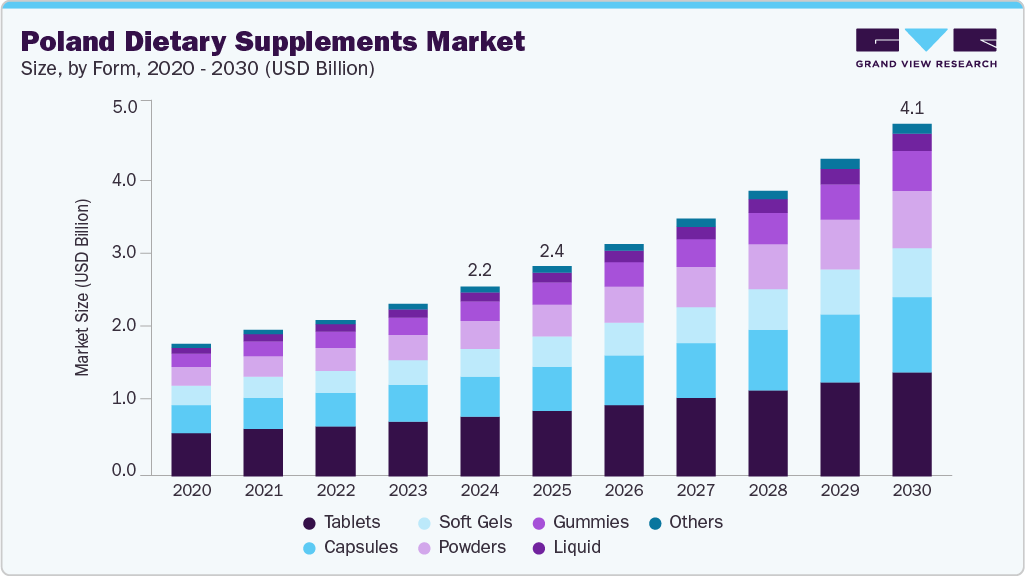

The Poland dietary supplements market size was estimated at USD 2.22 billion in 2024 and is projected to grow at a CAGR of 10.9% from 2025 to 2030. The market growth is attributed to the rising awareness regarding the importance of preventive healthcare and wellness. With a growing emphasis on healthy living, more people are turning to supplements to enhance their immunity, improve energy levels, and address nutritional deficiencies-especially in urban areas where busy lifestyles sometimes lead to poor dietary habits.

An aging population is also significantly impacting Poland's dietary supplements industry. As the proportion of elderly individuals in Poland increases, so does the demand for supplements targeting joint health, bone strength, and cognitive support. This demographic trend encourages product innovation and diversification in age-specific formulas, further fueling market expansion.

The influence of fitness culture and the popularity of sports nutrition has spurred demand for protein powders, amino acids, and performance-enhancing supplements. Younger generations, particularly millennials and Gen Z, increasingly embrace active lifestyles and clean-label products, creating space for plant-based and organic supplement options.

The growth of e-commerce and digital health platforms has made supplements more accessible. Online availability, targeted marketing, and consumer education have enabled manufacturers to reach a broader audience and personalize offerings based on individual health goals, thus accelerating overall market growth.

Consumer Insights

The popularity of food supplements has risen, leading to concerns about the potential risks associated with excessive intake of vitamins and minerals. Polish women are more cautious and informed about dietary supplements. They prefer to seek professional guidance, prioritize product quality, and are influenced by social factors and advertising.

Consumer Demographic

In contrast, men tend to focus on convenience and efficiency. They often rely on mass media and readily available store-bought solutions, typically motivated by functional goals related to strength and performance.

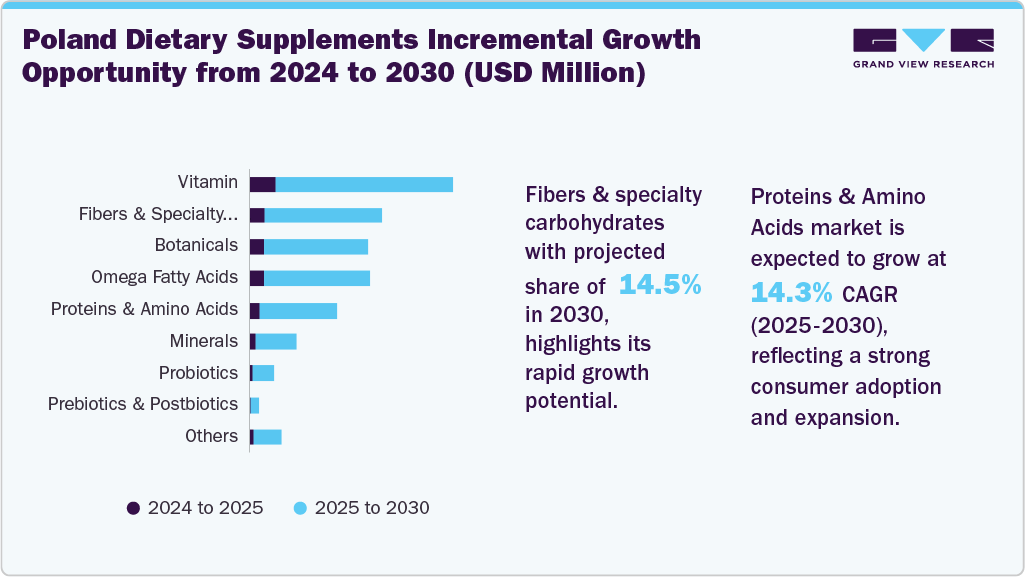

Ingredients Insights

Vitamins dominated the Polish dietary supplements market and accounted for a share of 31.3% in 2024, owing to the demand for essential nutrients to support general health and immunity. Consumers in Poland are increasingly aware of the benefits of vitamins, particularly in preventing deficiencies and promoting long-term wellness. This heightened awareness, coupled with frequent recommendations from healthcare professionals, has propelled vitamin supplements-especially Vitamin D, C, and multivitamins-into widespread daily use.

The proteins and amino acids segment is expected to experience the fastest CAGR from 2025 to 2030. The segment’s growth is attributed to Poland’s growing fitness culture and the rising adoption of active lifestyles, especially among younger consumers. As more people prioritize strength training, weight management, and muscle recovery, demand for products such as whey proteins, BCAAs, and plant-based protein powders has skyrocketed. These supplements are increasingly viewed not just as tools for athletic performance but also as daily nutritional boosters.

Form Insights

Tablets dominated the market and accounted for largest share in 2024, owing to their convenience, portability, and consumer familiarity. Tablets remain the preferred delivery format in Poland’s dietary supplements market due to their ease of use, accurate dosing, and longer shelf life than other forms like powders or liquids. Consumers often perceive tablets as more professional or medically endorsed, which boosts trust, especially among older demographics who may be more comfortable with traditional supplement forms.

The gummies segment is expected to experience the fastest CAGR from 2025 to 2030. Gummies are favored for their pleasant taste, chewable format, and ease of consumption, which makes them especially popular among children, teenagers, and adults who dislike swallowing pills. This format transforms the supplement-taking experience from a chore into something enjoyable, helping to drive consistent usage and higher consumer adherence.

Type Insights

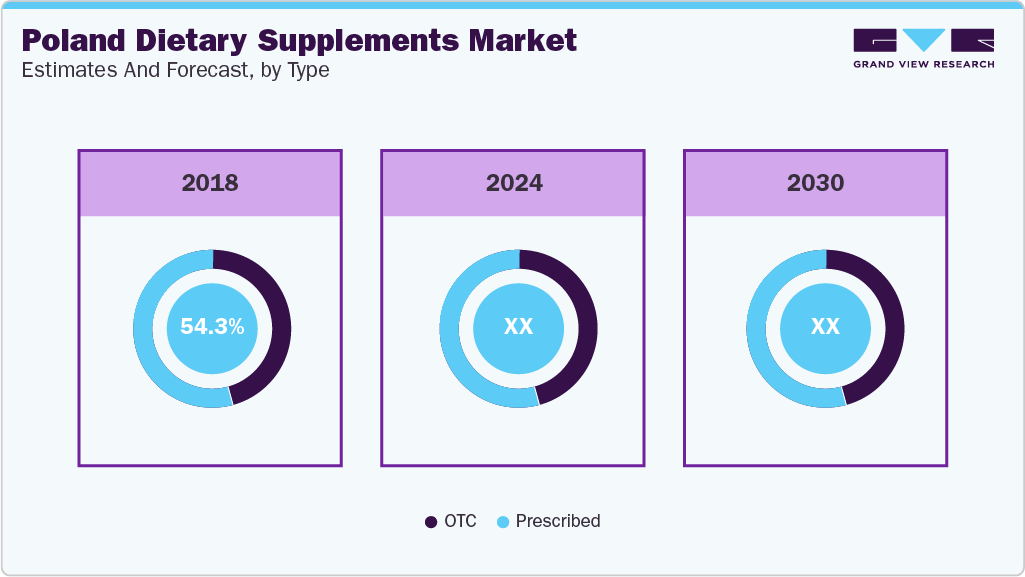

Prescribed supplements dominated the market in 2024, owing to widespread use in managing diagnosed health conditions and recommendations by healthcare professionals. In Poland, there's growing trust in medical guidance when it comes to supplement intake, particularly among aging populations and individuals with chronic illnesses. Prescribed supplements are often tailored to specific deficiencies-such as iron for anemia, calcium and vitamin D for bone health, or folic acid during pregnancy-which further supports their dominance in the market.

The OTC segment is expected to experience the fastest CAGR from 2025 to 2030. OTC supplements benefit from easy accessibility through pharmacies, supermarkets, and online platforms, allowing consumers to make quick and informed choices. The broadening range of OTC supplements-especially those with clean-label claims, plant-based ingredients, and multifunctional benefits-appeals to modern, health-conscious consumers. Moreover, increased ingredient transparency, rising disposable incomes, and tech-savvy health-tracking tools further propel this segment.

Application Insights

The immunity segment dominated the Poland dietary supplements market with a largest revenue share in 2024. This strong performance reflects continued consumer focus on health resilience and illness prevention. The COVID-19 pandemic fundamentally reshaped public health priorities. Polish consumers remain highly vigilant about protecting their immune systems, leading to sustained interest in supplements like vitamin C, vitamin D, zinc, Echinacea, and elderberry.

The prenatal health segment is expected to grow fastest from 2025 to 2030. The rising focus on maternal and fetal well-being. Increased awareness of the importance of prenatal nutrition-especially the role of supplements like folic acid, iron, calcium, and DHA-has led more women to seek targeted products even before conception.

End-use Insights

The adults segment accounted for the largest market share of 62.2% in 2024.Adults increasingly turn to supplements to support immunity, energy levels, stress management, fitness performance, and age-specific needs, making them the most engaged demographic. Workplace pressures, fast-paced living, and dietary inconsistencies often prompt adults to seek convenient health solutions, with multivitamins, omega-3s, and adaptogens being especially popular. Moreover, adults tend to have the purchasing power and autonomy to make proactive health decisions, which translates into higher per-capita supplement consumption.

The geriatric segment is anticipated to grow at the fastest CAGR during the forecast period. The segment’s growth is attributed to the country’s aging population and an increased focus on healthy aging and age-related preventive care. As more individuals enter the 65+-age bracket, there is a rising demand for supplements that support bone density, joint flexibility, heart health, vision, cognitive function, and overall vitality.

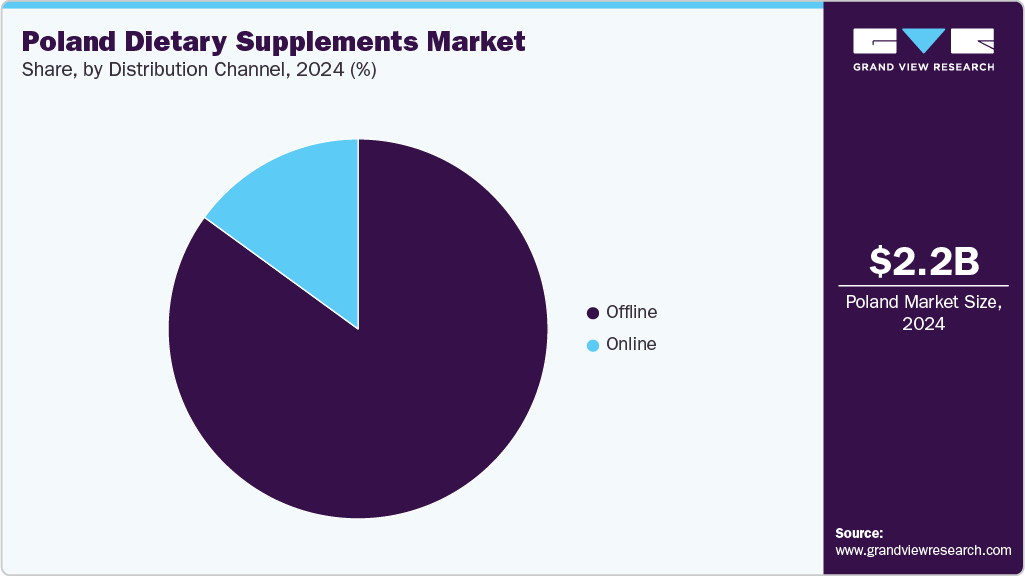

Distribution Channel Insights

The offline distribution segment held the largest revenue share of the market in 2024, owing to its strong presence in pharmacies, health stores, and supermarkets, which remain the most trusted and convenient purchasing channels for many Polish consumers. People often rely on in-store recommendations from pharmacists or health professionals, especially when choosing supplements for specific health needs.

The online distribution segment is projected to experience the fastest CAGR from 2025 to 2030. This surge in the online distribution segment reflects Poland’s increasingly digital consumer landscape and the convenience-driven mindset of modern shoppers. As e-commerce platforms become more sophisticated and user-friendly, consumers are gravitating toward digital channels for their flexibility, ease of comparison, and home delivery services. This shift is especially prominent among younger, tech-savvy demographics and busy professionals who value time-saving options.

Key Poland Dietary Supplements Company Insights

Some of the key companies operating in Poland dietary supplements industry include Aflofarm, Amway Corp, Olimp Laboratories Sp. Z, and others.

-

Amway Corp offers a range of health and wellness products, including its flagship Nutrilite dietary supplements. The company uses a direct-selling model and has adapted to local regulations and consumer preferences. Due to legislative restrictions, some Nutrilite products are not available in Poland.

-

USP Zdrowie is a leading player in Poland’s over-the-counter (OTC) and dietary supplements market. It holds the top position in the Polish OTC segment with a portfolio of over 40 brands, including Ibuprom, Apap, and Gripex.

Key Poland Dietary Supplements Companies:

- Aflofarm

- Amway Corp

- USP Health Sp. z o. o.

- Olimp Laboratories Sp. Z

- GSK plc

- GNC Holdings, LLC

Recent Developments

-

In June 2025, dsm-firmenich expanded its partnership with Brenntag Specialties Pharma to include Poland and the Czech Republic. Brenntag is responsible for distributing over 40 vitamins and carotenoids across seven European countries.

Poland Dietary Supplements Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 4.12 billion

Growth rate

CAGR of 10.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, form, type, application, end-use, distribution channel

Key companies profiled

Aflofarm; Amway Corp; USP Health Sp. z o. o.; Olimp Laboratories Sp. Z; GSK plc; GNC Holdings, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Poland Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Poland dietary supplements market report based on ingredients, form, type, application, end-use, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.