- Home

- »

- Consumer F&B

- »

-

Whey Protein Market Size And Share, Industry Report, 2033GVR Report cover

![Whey Protein Market Size, Share & Trends Report]()

Whey Protein Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Whey Protein Isolates (WPI), Whey Protein Concentrates (WPC), Whey Protein Hydrolysates (WPH)), By Application (Sports Nutrition, Dietary Supplements), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-286-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Whey Protein Market Summary

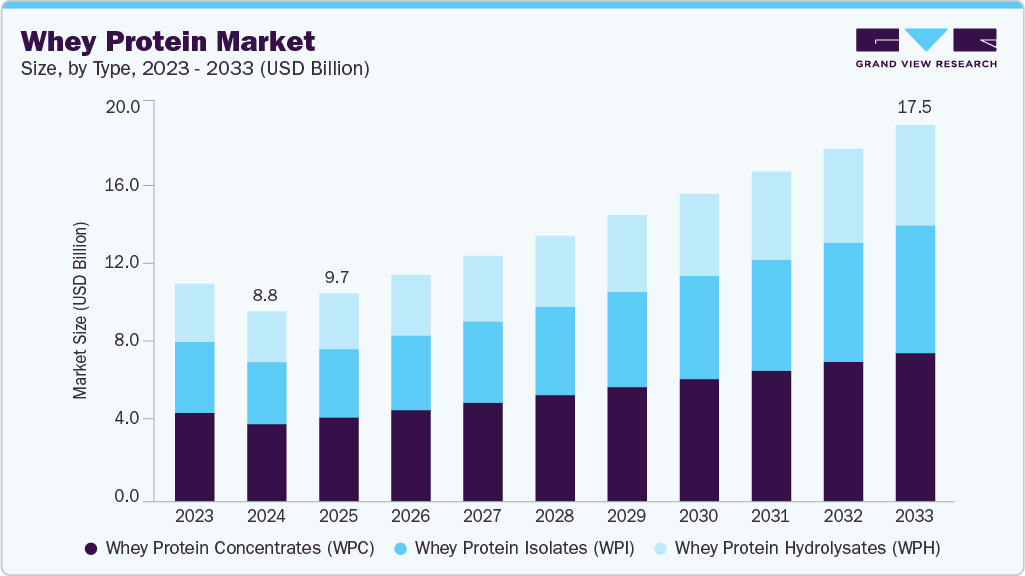

The global whey protein market size was valued at USD 8,846.2 million in 2024 and is projected to reach USD 17,527.3 million in 2033, growing at a CAGR of 7.7% from 2025 to 2033. The global market is witnessing robust growth, driven by rising health awareness, increasing fitness trends, and a growing focus on protein-rich diets among consumers of all age groups.

Key Market Trends & Insights

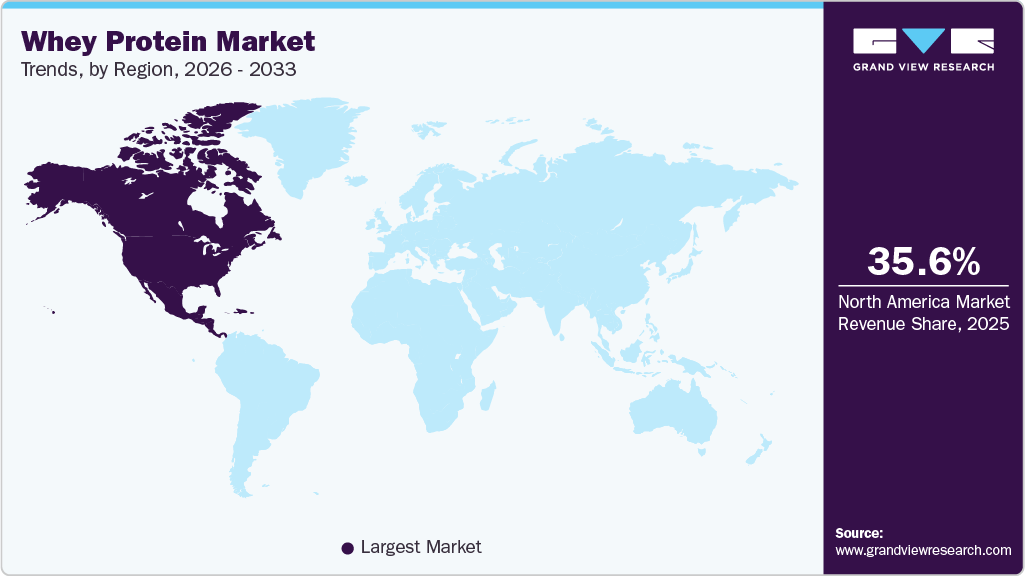

- North America dominated the global whey protein market in 2024 with a revenue share of 36.2%.

- The whey protein market in the U.S. is growing at a significant CAGR over the forecast period.

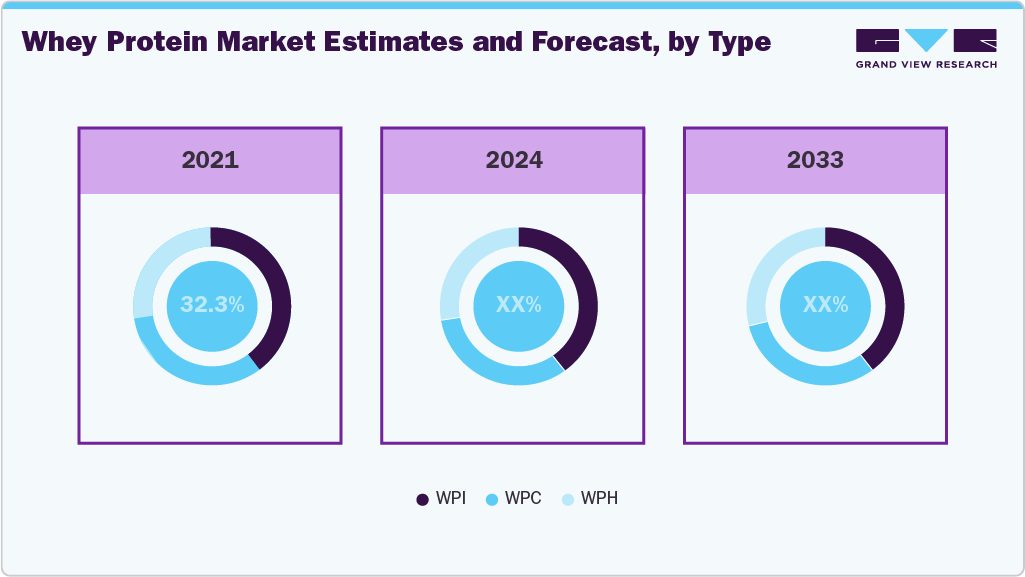

- Based on type, the whey protein concentrates (WPC) segment in the global whey protein market accounted for a share of 40.6% in 2024.

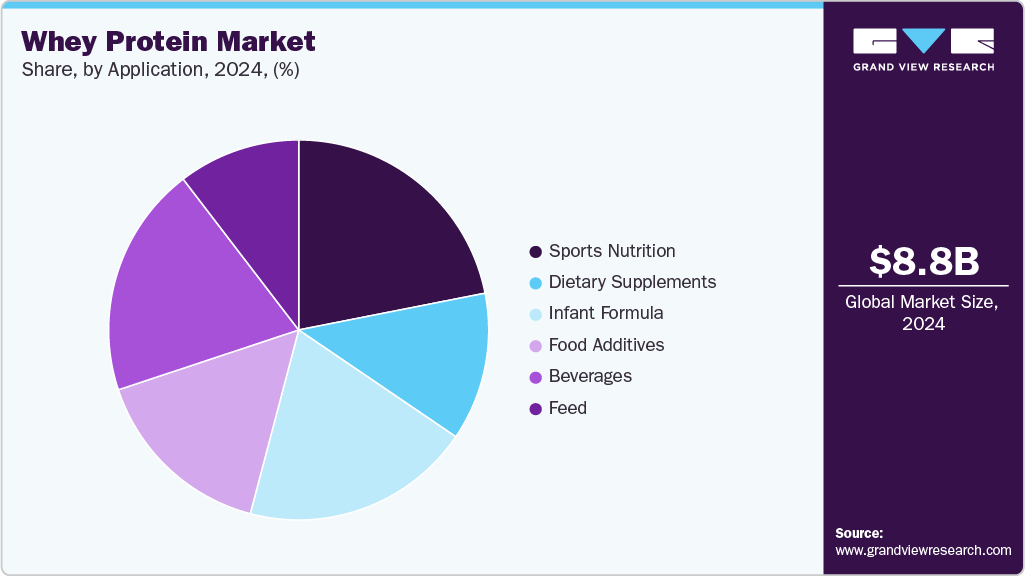

- By application, the sports nutrition segment dominated the market with a revenue share of 21.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8,846.2 Million

- 2033 Projected Market Size: USD 17,527.3 Million

- CAGR (2025-2033): 7.7%

- North America: Largest market in 2024

Urban millennials and working professionals are increasingly adopting whey protein as a convenient solution for muscle building, weight management, and overall wellness. The market is further fueled by the expanding sports nutrition segment, rising prevalence of lifestyle-related health issues, and increasing consumer inclination toward functional foods and dietary supplements. Key trends include the rising demand for plant-based and clean-label protein blends, flavored and ready-to-drink whey formulations, and innovative product formats such as bars and snacks. Additionally, the surge in e-commerce, social media influence, and fitness communities is enhancing product awareness and adoption globally, particularly in developed regions.

The consumption of protein-rich diets has significantly increased over the past few years due to rising health awareness among consumers across the world. With increasingly busier lifestyles, consumers are unable to consume a nutritionally rich, complete diet regularly, which prompts them to seek nutrients from packaged food products. Therefore, packaged food manufacturers are fortifying food products with nutritious ingredients, including protein ingredients.

Rising incidences of chronic illnesses due to changing lifestyles and growing fitness trends, particularly among the millennial population, are the key factors driving the adoption of protein-rich diets. Furthermore, child malnutrition is a prevalent issue in African countries, which is primarily caused by protein deficiency. Therefore, higher emphasis on protein-rich diets is being given in African countries, which, in turn, is expected to drive the demand for protein-rich ingredients such as soy, pea, and canola.

The sports nutrition industry involves the consumption of nutrients such as vitamins, proteins, supplements, fats, carbohydrates, minerals, and organic substances. Sports nutritional products consist of sports beverages, sports supplements, and sports foods, which are targeted at the strength and endurance of athletes and bodybuilders to increase their overall performance, enhance stamina, promote muscle growth, and improve health.

Consumer Insights for the Whey Protein Market

The global whey protein market is largely shaped by health-conscious consumers who prioritize fitness, nutrition, and overall wellness. Urban millennials and working professionals are the primary adopters, attracted to whey protein for its convenience, high protein content, and benefits for muscle building, weight management, and recovery post-exercise. Younger consumers, particularly those engaged in active lifestyles, are increasingly exploring flavored whey protein powders, ready-to-drink shakes, and protein-enriched snacks, while older demographics focus more on products that support general health, immunity, and bone strength. The growing awareness of functional foods and nutraceuticals has further encouraged consumers to integrate whey protein into their daily diets.

Consumer demand is also influenced by dietary trends and preferences for clean-label, natural, and plant-based alternatives. The rise of vegan and allergen-free diets has prompted interest in blended formulations combining whey with plant-based proteins like pea or soy. Convenience remains a key factor, with e-commerce platforms and online subscription models enhancing accessibility and trial among consumers. Additionally, social media, fitness influencers, and online communities play a critical role in shaping consumer perceptions, driving experimentation with new flavors, formulations, and usage routines.

Another important driver is the growing influence of the sports nutrition and foodservice segments. Gyms, fitness centers, and health clubs are increasingly offering whey-based protein shakes and supplements to meet the on-the-go nutritional needs of members. Quick-service restaurants, cafes, and health-focused eateries are also incorporating protein-enriched products into menus, catering to demand for functional, performance-oriented nutrition. Overall, the whey protein market reflects a shift toward health-driven, convenience-focused, and experience-oriented consumption, with consumers seeking personalized, high-quality, and innovative protein solutions.

Type Insights

Whey protein concentrate (WPC) held the largest share, accounting for 40.6% of the global whey protein industry in 2024, driven by its cost-effectiveness, high protein content, and versatility in various applications such as sports nutrition, dietary supplements, and functional foods. Its popularity is further supported by strong consumer awareness of protein-rich diets and growing demand for muscle recovery and weight management solutions. WPC remains the preferred choice among manufacturers and consumers due to its balanced amino acid profile, ease of formulation in powders, bars, and beverages, and compatibility with flavored and ready-to-drink products. Despite the rising interest in whey protein isolate (WPI) and hydrolysates, WPC continues to dominate, particularly in emerging markets where affordability and accessibility are key purchase considerations.

Whey protein isolates (WPI) are anticipated to grow at a CAGR of 8.1% from 2025 to 2033, driven by increasing consumer demand for high-purity, low-fat, and low-lactose protein formulations. WPI is particularly favored by athletes, fitness enthusiasts, and health-conscious consumers seeking rapid muscle recovery, enhanced performance, and precise protein intake. The growth is further supported by rising adoption in premium sports nutrition products, functional beverages, and meal replacement solutions. Additionally, the expanding awareness of clean-label, allergen-friendly, and lactose-reduced options is encouraging manufacturers to introduce innovative WPI-based products. While whey protein concentrate remains dominant due to affordability, WPI is emerging as a preferred segment in developed regions and among premium consumers focused on quality and efficacy.

Application Insights

Sports nutrition application accounted for a share of over 21.9% of the global revenues in 2024, driven by rising participation in fitness activities, increasing gym memberships, and growing awareness of protein’s role in muscle building and recovery. Athletes, bodybuilders, and active individuals are increasingly opting for whey protein powders, ready-to-drink shakes, and protein bars to meet their performance and nutritional goals. The segment is further supported by product innovations, such as flavored and fortified formulations, that enhance taste, convenience, and functionality. Additionally, the influence of fitness influencers, social media communities, and online retail channels has expanded consumer awareness and adoption of sports nutrition-oriented whey protein products globally.

The beverages segment is anticipated to grow at a CAGR of 7.9% from 2025 to 2033, driven by the rising popularity of ready-to-drink protein shakes, smoothies, and fortified functional beverages. Consumers are increasingly seeking convenient, on-the-go nutrition solutions that support fitness, weight management, and general wellness, which has encouraged manufacturers to innovate with flavored, low-sugar, and clean-label formulations. The growth is further supported by expanding e-commerce platforms, social media influence, and health-focused café and retail offerings. Additionally, beverages incorporating whey protein are gaining traction among urban millennials and working professionals who prioritize convenience, taste, and nutritional value, making this application segment one of the fastest-growing in the global whey protein market.

Regional Insights

The North America whey protein market held a market share of 35.8% of the global revenue in 2024, driven by increasing health consciousness, rising fitness trends, and growing demand for protein-rich diets among millennials and working professionals. The region benefits from well-established sports nutrition and dietary supplement industries, widespread gym and fitness center networks, and strong consumer awareness of functional foods. Additionally, the popularity of ready-to-drink protein beverages, protein bars, and fortified snacks is fueling market adoption. E-commerce platforms and social media influence are further accelerating product awareness and trial, while innovative product launches, including clean-label, low-lactose, and flavored whey protein formulations, are appealing to premium and health-focused consumers. North America remains a key market due to high purchasing power, advanced distribution channels, and a strong inclination toward performance-driven nutrition.

U.S. Whey Protein Market Trends

The whey protein market in the U.S. is expected to grow at a CAGR of 7.3% from 2025 to 2033, driven by high consumer awareness of fitness and wellness trends, growing adoption of protein-rich diets, and widespread availability of sports nutrition products. The U.S. market is characterized by strong demand for ready-to-drink protein beverages, protein powders, and fortified snacks, particularly among millennials and working professionals. Additionally, the presence of well-established dietary supplement and functional food industries, coupled with extensive e-commerce and retail distribution channels, has facilitated easy access and trial. Product innovations, including clean-label, low-lactose, and flavored whey protein formulations, are further enhancing consumer engagement, making the U.S. the largest and most influential market in the North American whey protein landscape.

Europe Whey Protein Market Trends

Europe whey protein market held a share of 31.0% of the global whey protein industry in 2024, driven by increasing health awareness, growing fitness culture, and strong demand for functional foods and dietary supplements across the region. Consumers in countries such as Germany, the UK, and France are increasingly adopting protein-rich diets, with a particular focus on muscle building, weight management, and overall wellness. The market is further supported by the rising popularity of ready-to-drink protein beverages, protein bars, and clean-label whey formulations. Additionally, the expansion of e-commerce platforms, social media influence, and health-focused retail outlets has enhanced product accessibility and trial. Europe’s emphasis on high-quality, organic, and sustainable protein sources is also encouraging innovation, making it one of the key regions contributing to the growth of the global whey protein market.

The whey protein market in the UK is expected to grow at a CAGR of 8.2% from 2025 to 2033. The growing consumer awareness of fitness, health, and protein-enriched diets. Urban millennials and working professionals are increasingly adopting whey protein powders, ready-to-drink shakes, and protein-fortified snacks to support muscle building, weight management, and overall wellness. The market is further supported by the rising popularity of clean-label, low-lactose, and flavored whey formulations, as well as strong penetration of e-commerce platforms and health-focused retail outlets. Additionally, fitness centers, gyms, and sports nutrition communities are promoting the consumption of whey protein, enhancing product visibility and trial. These factors make the UK one of the most influential markets in Europe for whey protein consumption and innovation.

Asia Pacific Whey Protein Market Trends

The Asia Pacific whey protein market is expected to grow at a CAGR of 9.0% from 2025 to 2033, driven by rising health awareness, increasing disposable incomes, and growing adoption of fitness and sports nutrition trends among urban millennials and working professionals. Consumers in countries such as China, India, Japan, and Australia are increasingly integrating whey protein powders, ready-to-drink shakes, and protein-fortified foods into their diets for muscle building, weight management, and overall wellness. The market is further supported by expanding e-commerce platforms, the growing presence of international brands, and the rising influence of social media and fitness communities. Additionally, the increasing focus on clean-label, flavored, and fortified whey protein formulations is encouraging product innovation, making the Asia Pacific one of the fastest-growing regions in the global whey protein market.

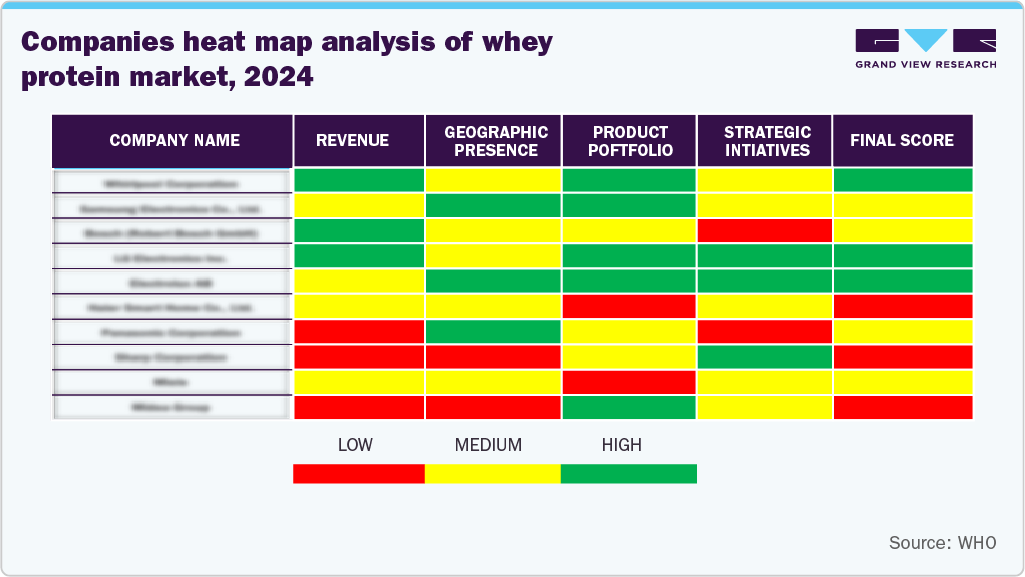

Key Whey Protein Company Insights

Key companies in the whey protein industry primarily focus on innovation, flavor diversity, and health-centric offerings. They are investing in type development, strategic partnerships, and sustainable packaging to cater to evolving consumer preferences, expand their footprint, and strengthen competitiveness across regions.

Key Whey Protein Companies:

The following are the leading companies in the whey protein market. These companies collectively hold the largest market share and dictate industry trends.

- Arla foods

- Saputo Inc.

- Fonterra Co-operative Group Ltd

- Glanbia plc

- Olam International Ltd

- Carbery Group.

- Agri-Mark, Inc

- Agropur, Inc

- The Milky Whey, Inc

- Fairway Dairy & Ingredients

Recent Developments

-

In October 2025, Glanbia Performance Nutrition launched its Isopure product line in the UK, featuring high-purity whey isolate and collagen-enriched protein blends. The expansion leverages strong retail partnerships with Holland & Barrett, Boots, and Sainsbury’s, aiming to capture the growing consumer base for premium, low-lactose protein supplements in Europe.

-

In July 2025, MyProtein introduced Splash Of- a new line of clear whey isolate beverages offering around 20 grams of protein per serving with under 90 calories. Available in multiple fruit-based flavors, the range caters to consumers seeking a lighter, refreshing alternative to traditional creamy protein shakes. This launch aligns with the growing trend toward clean-label, juice-style protein drinks that appeal to lifestyle and casual fitness users.

-

In May 2025, GNC India launched two functional whey protein products-Pro Performance 100% Whey + Nitro Surge and Pro Performance 100% Whey + Keto Surge. The new formulations target consumers seeking performance enhancement and metabolic benefits, incorporating ingredients such as L-arginine, L-citrulline, and CLA. These launches strengthen GNC’s position in India’s evolving sports nutrition segment and cater to the growing demand for multifunctional protein supplements.

-

In April 2025, New Zealand-based Nutrition from Water (NXW) entered strategic partnerships with Japan’s Nissei Kyokei and several European firms to commercialize Marine Whey™, a sustainable protein derived from aquatic sources. This collaboration marks a significant step in diversifying global protein supply chains and promoting eco-friendly protein innovation in the whey segment.

Whey Protein Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9,679.7 million

Revenue Forecast in 2033

USD 17,527.3 million

Growth rate

CAGR of 7.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in thousand tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Russia; China; India; Japan; Australia, New Zealand; Brazil; Argentina, Colombia, Turkey, Saudi Arabia and Egypt

Key companies profiled

Arla foods; Saputo Inc.; Fonterra Co-operative Group Ltd; Glanbia plc; Olam International Ltd; Carbery Group.; Agri-Mark, Inc; Agropur, Inc; The Milky Whey, Inc; Fairway Dairy & Ingredients

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Whey Protein Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global whey protein market report on the basis of type, application, and region.

-

Type Outlook (Revenue, USD Million; Volume, Thousand Tons; 2021 - 2033)

-

Whey Protein Isolates (WPI)

-

Whey Protein Concentrates (WPC)

-

Whey Protein Hydrolysates (WPH)

-

-

Application Outlook (Revenue, USD Million; Volume, Thousand Tons; 2021 - 2033)

-

Sports Nutrition

-

Dietary Supplements

-

Infant Formula

-

Food Additives

-

Beverages

-

Feed

-

-

Regional Outlook (Revenue, USD Million; Volume, Thousand Tons; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

Turkey

-

Saudi Arabia

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global whey protein market size was estimated at USD 8.85 billion in 2024 and is expected to reach USD 9.68 billion in 2025.

b. The global whey protein market is expected to grow at a compound annual growth rate of 7.7% from 2025 to 2033 to reach USD 17.53 billion by 2033.

b. North America dominated the whey protein market with a share of 32.21% in 2024. This is attributable to the presence of health-conscious consumers who prefer including additional nutrition in their daily meals.

b. Some key players operating in the whey protein market include Hilmar Cheese Company, Inc.; Saputo Inc.; Glanbia plc; Fonterra Co-operative Group Ltd.; Arla Foods; Alpavit; Wheyco GmbH; Milk Specialties; Carbery Group; LACTALIS Ingredients; Olam International; Davisco Foods International, Inc.; Milkaut SA; Leprino Foods Company; Maple Island Inc., Nestle S.A, Nutricia (Danone), Abbott, and Sanofi S.A.

b. Key factors that are driving the whey protein market growth include growing awareness about the benefits such as improvement in body strength, presence of enriched nutrients and proteins, prevention against allergic conditions in infants, and antioxidant defense.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.