Poland Kombucha Market Summary

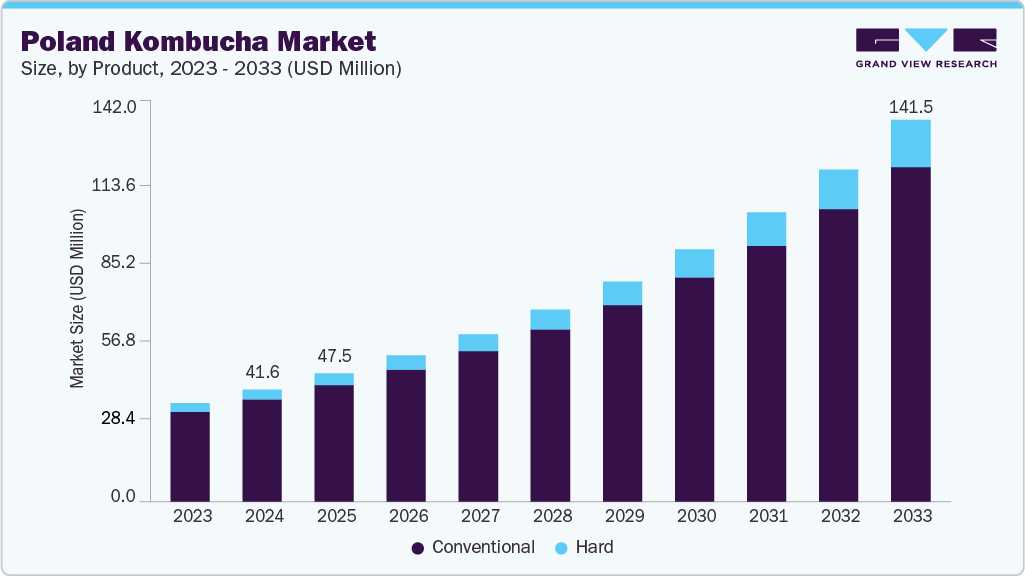

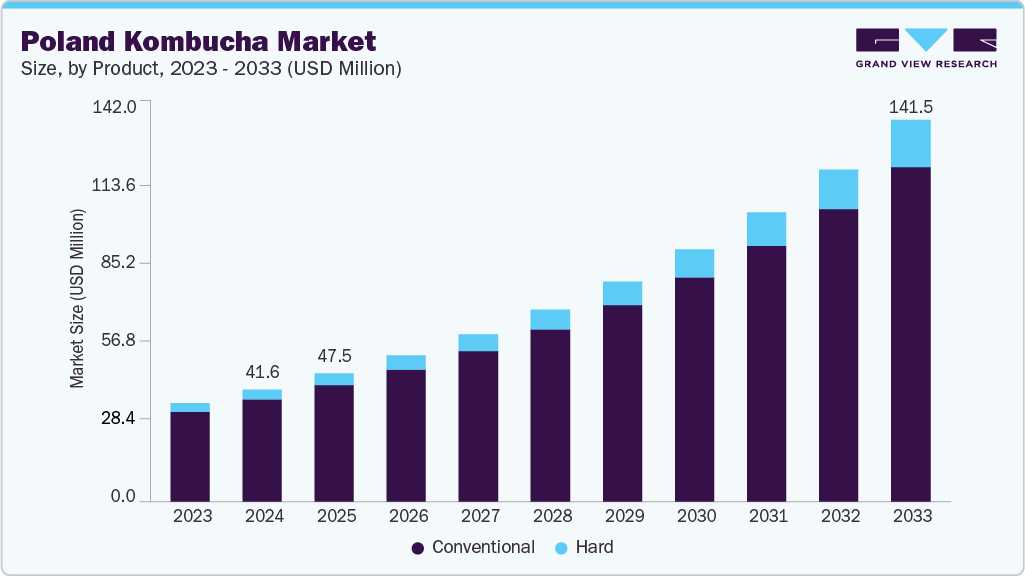

The Poland kombucha market size was estimated at USD 41.6 million in 2024 and is projected to reach USD 141.5 million by 2033, growing at a CAGR of 14.6% from 2025 to 2033. This development is driven by increasing consumer prioritization of health and well-being, particularly in the demand for functional and natural beverages.

Key Market Trends & Insights

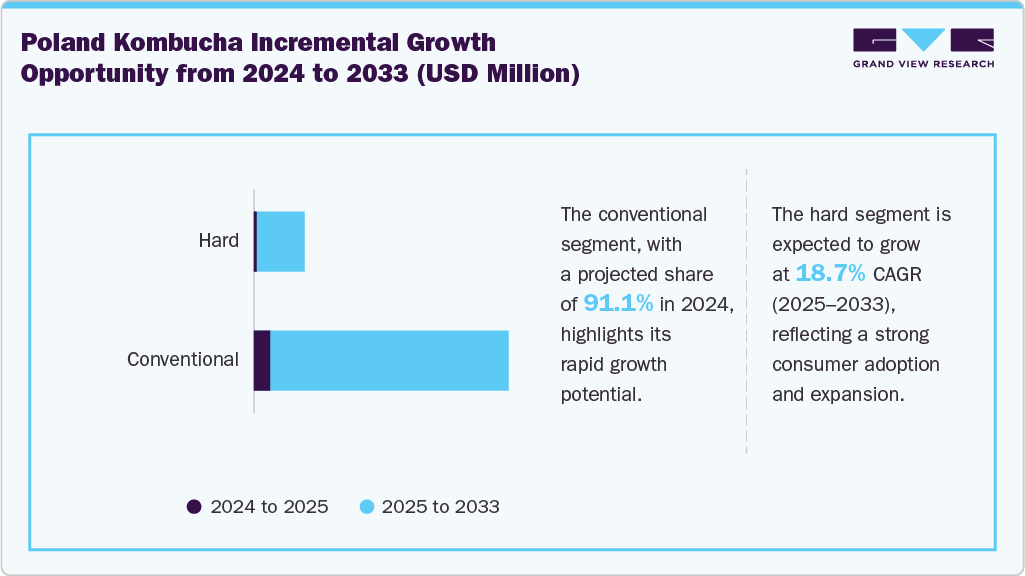

- By product, the conventional segment held the highest market share of 91.1% in 2024.

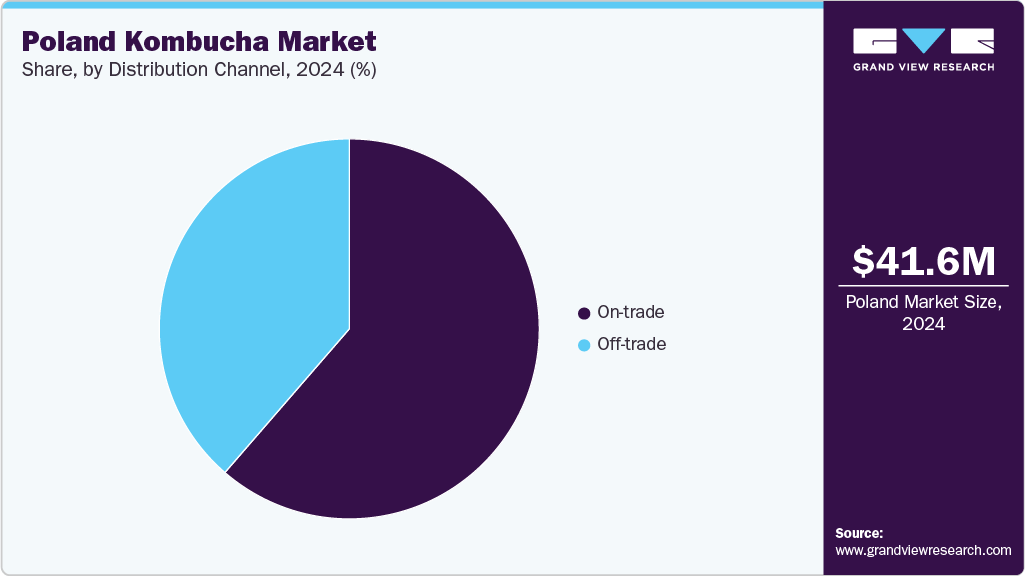

- By distribution channel, the on-trade segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 41.6 Million

- 2033 Projected Market Size: USD 141.5 Million

- CAGR (2025-2033): 14.6%

Product innovations, including diverse flavor offerings and improved shelf stability, support this development. Consumers are increasingly prioritizing functional and natural beverages over traditional sugary alternatives. This is evidenced by a broader shift in dietary preferences, with consumers actively seeking products that offer tangible health benefits such as improved digestion, immune support, and natural energy.

Market development is further supported by consistent product innovations, including an expanding array of diverse flavor offerings that cater to local preferences and reduce the perceived tartness often associated with traditional kombucha. Producers are also focusing on improving shelf stability.

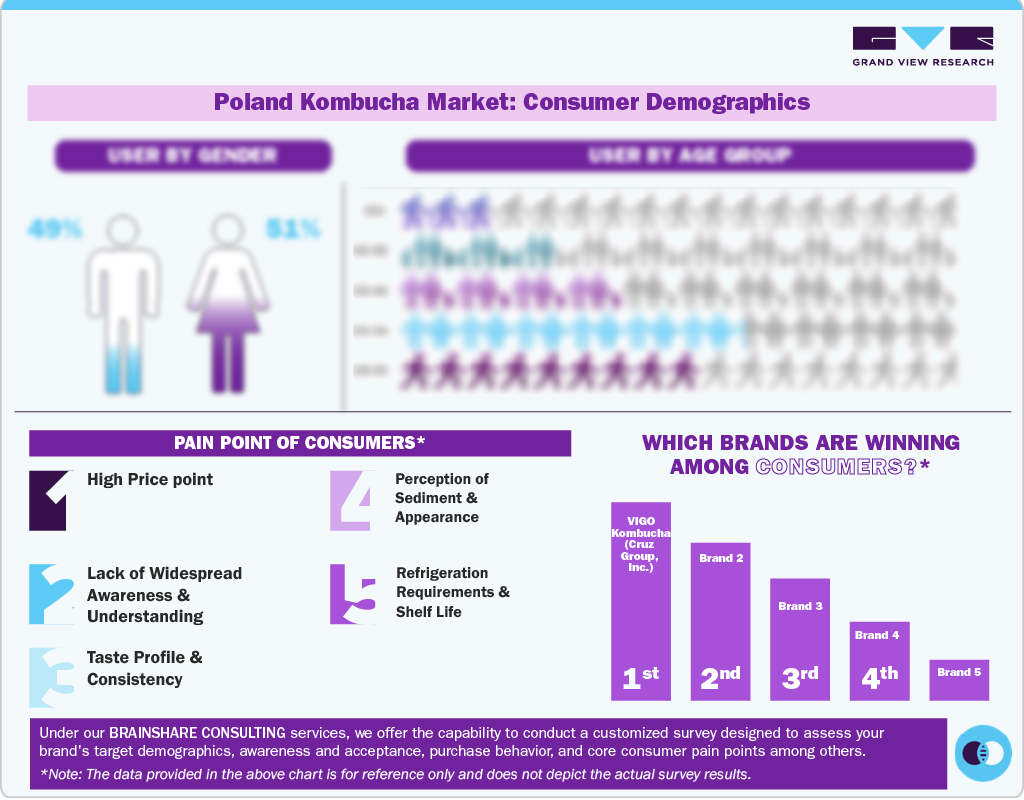

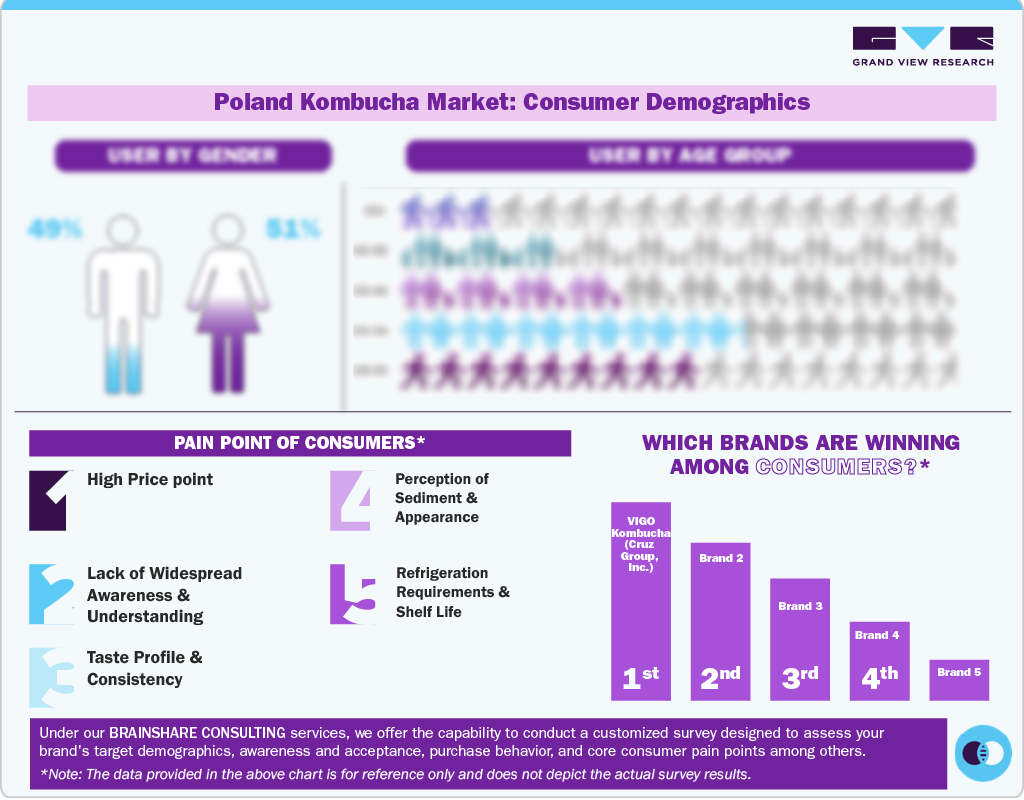

Consumer Insights

Consumers actively seek natural and organic alternatives to traditional sugary drinks, aligning well with kombucha's probiotic benefits for gut health, detoxification properties, and rich antioxidant content. While taste and variety remain key drivers, the perceived health benefits increasingly influence purchasing decisions, especially among the young, urban population. According to the Demographic Survey Department of Poland, the urban population constituted nearly 60% of the total population in 2023. This expanding urban demographic, characterized by higher disposable incomes and a greater propensity for health-conscious choices, presents a substantial growth opportunity for the Polish kombucha industry.

This evolving consumer landscape has led to notable product development and market expansion. Producers, such as Meduzyna Kombucha and VIGO Kombucha, offer diverse flavor profiles, including ginger, cucumber, coriander, rose, mint, honey, and pomegranate, to cater to varied preferences.

Product Insights

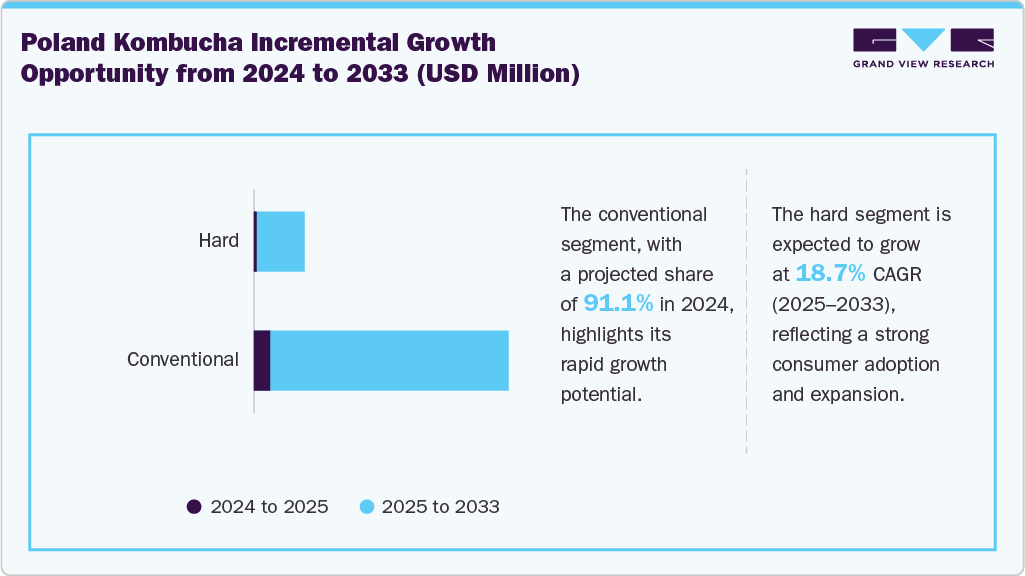

Based on product, the conventional segment dominated the market with a revenue share of 91.1% in 2024. This dominance is underpinned by consumer demand for non‑alcoholic, probiotic‑rich beverages, which are perceived as health‑supportive and refreshing, particularly when available in diverse flavors. Various brands such as KOMBUCHA 221 B.C. and VIGO Kombucha had invested in flavor innovation, introducing variants such as turmeric, ginger, pomegranate, lime, and mixed berries, resulting in an expanded retail presence in the Polish kombucha industry.

The hard segment is expected to experience the fastest CAGR of 18.7% from 2025 to 2033. This emergent segment appeals to younger consumers and those seeking low-sugar, gluten-free, and naturally fermented alcoholic options. The rapid expansion is characterized by innovative product development and strategic market entries from craft brewers, diversifying their offerings and new specialized hard kombucha brands.

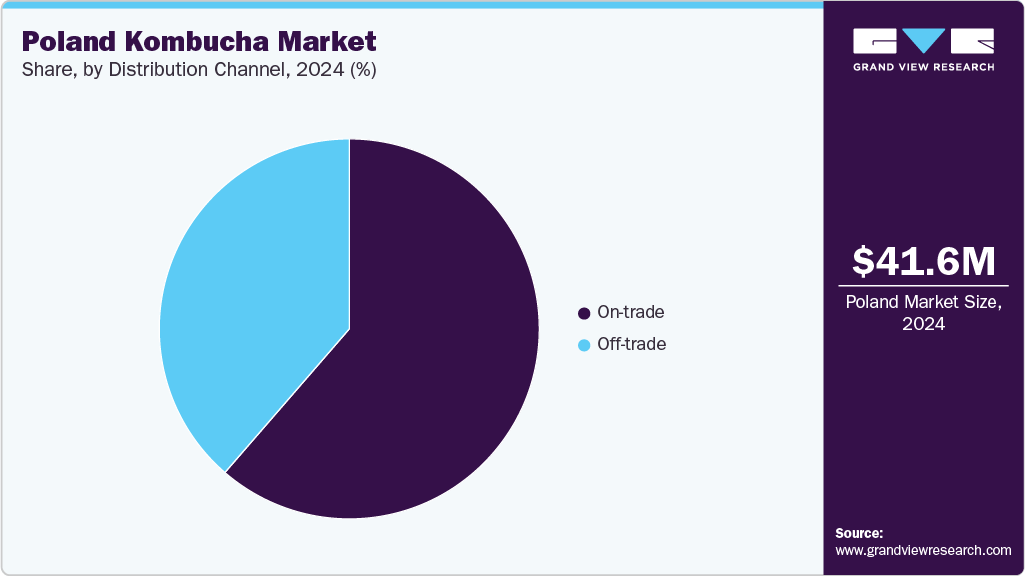

Distribution Channel Insights

The on-trade segment dominated the Poland kombucha industry in 2024. This segment encompasses HoReCa (hotels, restaurants, cafes), bars, and specialized health cafes, where kombucha is often positioned as a premium, healthy beverage alternative. The dominance is driven by the immediate consumption experience and the curated presentation of products, allowing for effective brand storytelling and higher perceived value. In Poland, several upscale cafes and health-conscious restaurant chains have partnered with kombucha producers such as VIGO Kombucha (Cruz Group, Inc.) and Brothers and Sisters Sp. z o.o. to introduce tap‑dispensed kombucha or bottled blends tailored to local tastes, helping to build consumer awareness and trial.

The off-trade segment is anticipated to experience the fastest CAGR of 15.3% from 2025 to 2033. The rapid expansion is propelled by consumers seeking convenient access to healthy beverages for daily consumption and the increasing availability of diverse brands and formats.

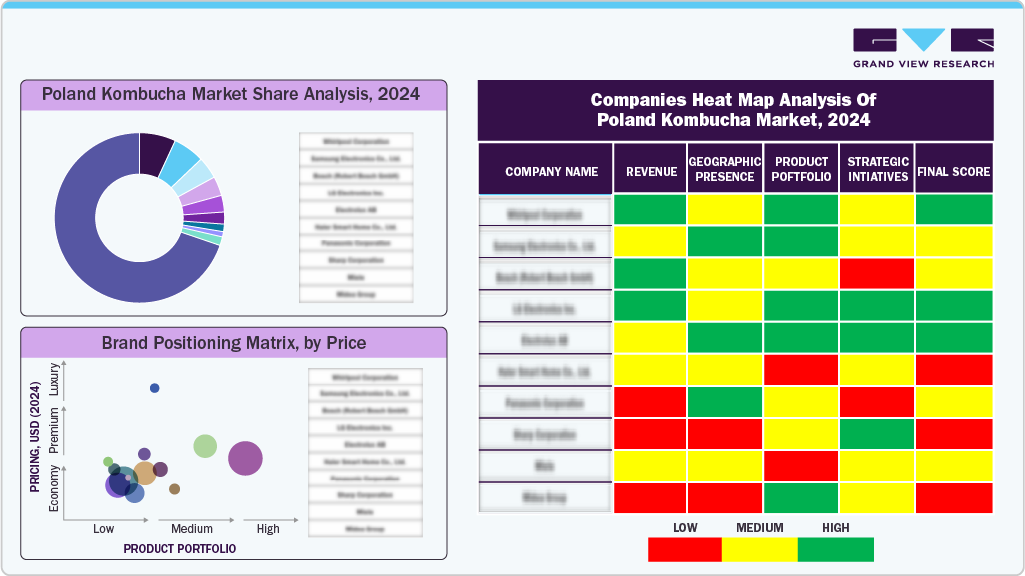

Key Poland Kombucha Company Insights

Some of the key players in the Poland kombucha industry include VIGO Kombucha (Cruz Group, Inc.), Brothers and Sisters Sp. z o.o., KOKO Kombucha, and others.

-

VIGO Kombucha specializes in naturally fermented, pro-health kombucha beverages using organic ingredients, offering a diverse product portfolio including original and various fruit-flavored options such as Schisandra, Rose, and Yerba Mate, catering to health-conscious consumers in Poland and over 50 international markets.

Key Poland Kombucha Companies:

- VIGO Kombucha (Cruz Group, Inc.)

- Brothers and Sisters Sp. z o.o.

- KOKO Kombucha

- KOMBUCHA BY LAURENT

- Meduzyna Kombucha

Poland Kombucha Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 47.5 million

|

|

Revenue forecast in 2033

|

USD 141.5 million

|

|

Growth rate

|

CAGR of 14.6% from 2025 to 2033

|

|

Actual data

|

2021 - 2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million, and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Product, distribution channel

|

|

Key companies profiled

|

VIGO Kombucha (Cruz Group, Inc.); Brothers and Sisters Sp. z o.o.; KOKO Kombucha; KOMBUCHA BY LAURENT; ROY Kombucha; Meduzyna Kombucha

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Poland Kombucha Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Poland kombucha market report based on product, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)