- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyacrylamide Market Size, Share & Growth Report, 2030GVR Report cover

![Polyacrylamide Market Size, Share & Trends Report]()

Polyacrylamide Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Cationic, Anionic), By Application (Water Treatment, Oil & Gas), By Region (Asia Pacific, North America), And Segment Forecasts

- Report ID: 978-1-68038-944-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyacrylamide Market Summary

The global polyacrylamide market size was estimated at USD 5.5 billion in 2022 and is projected to reach USD 9.1 billion by 2030, growing at a CAGR of 6.5% from 2023 to 2030. The growing demand for the product across various application industries including wastewater treatment, oil recovery, paper-making, and food & beverage is expected to propel the industry growth.

Key Market Trends & Insights

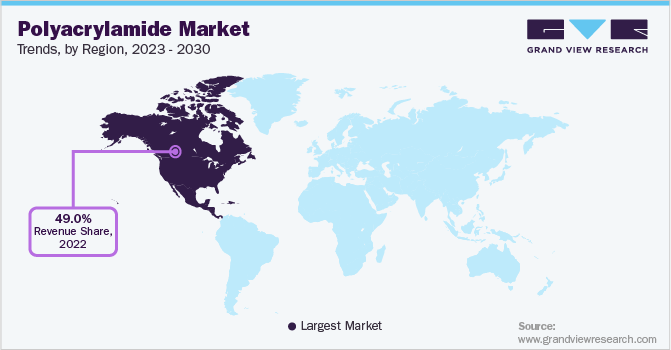

- In terms of region, North America was the largest revenue generating market in 2022.

- Country-wise, China is expected to register significant growth from 2023 to 2030.

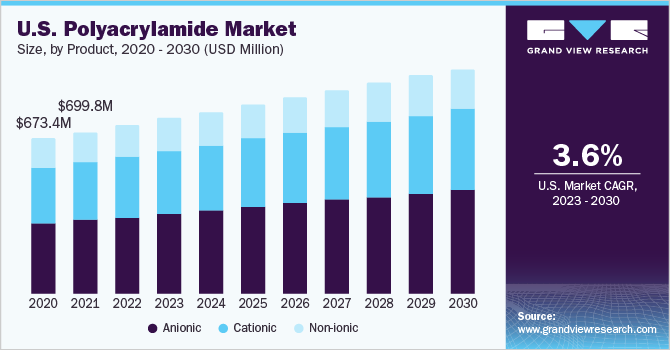

- In terms of product, anionic and cationic polyacrylamide polymers were the dominant product segments, accounting for more than 78.0% of the overall demand in 2022.

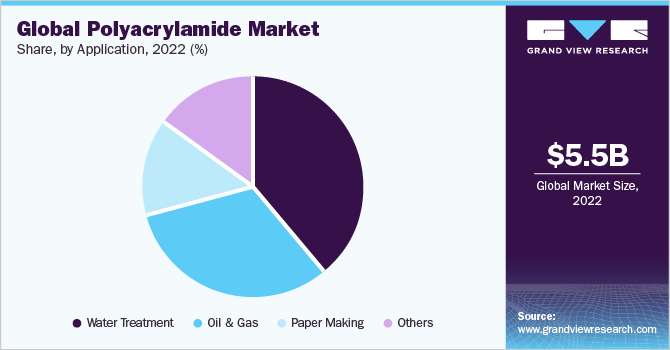

- In terms of application, polyacrylamide demand in water treatment applications dominated the market with a revenue share of more than 38.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 5.5 Billion

- 2030 Projected Market Size: USD 9.1 Billion

- CAGR (2023-2030): 6.5%

- North America: Largest market in 2022

Abundant raw material availability, low labor, and land cost coupled with high consumption in the Asia Pacific region are likely to compel manufacturers to set up their production plants in this region. However, the presence of numerous Chinese manufacturers, which offer their products at relatively lower prices is expected to be a key threat for the new entrants.

As a result, cost competitiveness is likely to be the key criterion for influencing buyers’ decisions. The industry is dominated by multinationals including SNF Group, CNPC, BASF, and Kemira, which accounted for over 50% of the overall market. These multinationals have a direct and indirect distribution system for the product supply in the domestic as well as international market. In addition, companies are expected to increase their production volumes to tap the rising demand across the globe.

The U.S. market is expected to grow owing to the growth of water treatment, paper-making, and mining industries. The regulations and amendments on wastewater treatment by the U.S. Environmental Protection Agency (EPA) and Safe Drinking Water Act (SDWA), are expected to propel demand for water treatment chemicals, impacting the industry on a positive note. The polyacrylamide prices are directly dependent on the cost of raw materials including acrylic acid and acrylonitrile, which are derived from crude oil.

Increasing crude oil prices are likely to raise raw material pricing in the industry, resulting in upward trends in the polyacrylamide price trends over the next seven years. The major manufacturers, such as SNF and BASF, have brand values and strategic partners, which enable easy marketing of their products. The manufacturers are likely to improve product quality and invest more in R&D to reduce the overall polyacrylamide cost to tap the growing demands.

Product Insights

Anionic and cationic polyacrylamide polymers were the dominant product segments, accounting for more than 78.0% of the overall demand in 2022. Anionic polyacrylamide polymers are used in applications including wastewater treatment, pulp and paper industry, aquaculture, food & beverage, coal mining, food & beverage, and oil & gas industries. The anionic polyacrylamide polymers have a high demand for industrial wastewater treatment and municipal sewage treatment as flocculating agents. The increasing impure water discharge from industries, and growing scarcity of potable water, is expected to drive demand for polyacrylamide in water treatment application over the coming years.

Also, the growing product demand in other application areas, such as coal washing, mineral processing, metallurgy, iron & steel, and electronic industries, will support segment expansion. The demand for cationic polymers was significant in 2022 owing to their high usage as retention and drainage aids in papermaking and flocculants in wastewater treatment. These polymers act as stabilizers for emulsion polymerization in cosmetics. The aforementioned factors are expected to open new avenues for market growth over the coming years.

Application Insights

Polyacrylamide demand in water treatment applications dominated the market with a revenue share of more than 38.0% in 2022. The rising demand for polyacrylamide to treat municipal sewage, industrial wastewater, and drinking water purification plants is expected to propel demand. Furthermore, increasing attention to the water treatment industry by government regulatory bodies across various countries is likely to have a positive impact on market growth. The demand for the product from the oil & gas industry for enhancement of oil recovery is expected to grow over the forecasted period as the product improves the oil recovery efficiency.

Also, it is used in drilling mud and fracturing fluid additives. The use of polyacrylamide can adjust the drilling fluidity, carry shale debris, lubricate the drill bit, and control fluid loss. The aforementioned factors are expected to drive product demand in oil & gas applications. In the paper-making industry, it works as a retention agent and improves paper quality. As a result, the demand in paper-making applications will grow significantly over the forecast period. Furthermore, it acts as the dispersing agent and helps in reducing fiber flocculation to improve the paper formation process.

Large-scale paper manufacturing for various applications including educational material and packaging, coupled with rising product adoption in the pulp & paper manufacturing process, will drive the segment growth. It is considered an important variable in the mining process, as it effectively separates the solid mineral from the water or solution and this improves the drilling efficiency. The product is widely used in the coal manufacturing industry for the coal washing process. Rising mining activities, coal washing, metal plating, and dying are expected to drive segment growth over the forecast period.

Regional Insight

In North America, the demand for the product is dominated by the water treatment application, which accounts for over 49.0% of the overall demand in 2022. Stringent regulatory actions against wastewater disposal coupled with the rising environmental concerns in the region are expected to drive water treatment activities, which are likely to have a positive impact on the industry’s growth. Furthermore, developments of polyacrylamide polymers for producing polyacrylamide gel and powder are expected to create new avenues in bio-sciences and pharmaceuticals in the region. Asia Pacific also accounted for a considerable share in 2022. China accounted for the major share of the market and is expected to grow at a significant CAGR over the forecast period.

The robust base of the pharmaceutical and chemical manufacturing industries in the region has resulted in a high volume of wastewater, which will propel the product demand as water treatment chemical. In addition, the region is one of the top pulp & paper manufacturing markets in the world. Thus, the presence of several pulp & paper manufacturers, such as Shandong Pulp & Paper Co., Ltd., will have a positive impact on the industry growth. The product demand in Germany was significant in 2022 and will grow at a lucrative CAGR from 2023 to 2030. The country is the largest EU water technology exporter in Europe. Also, high investments in water recycling and purification technology are expected to drive product demand in water treatment activities.

Key Companies & Market Share Insights

Manufacturers are expected to invest more in capacity expansion to strengthen their position in the industry and meet the rising consumer demand. For example, in 2015, SNF Holding expanded its production capacity by building a new plant in Louisiana to expand the product business in the domestic as well as international market. Some of the key players in the global polyacrylamide market include:

-

Anhui Jucheng Fine Chemical Co, Ltd. (CJCC)

-

Ashland Inc.

-

BASF SE

-

Kemira

-

SNF Group

-

Black Rose Industries Ltd.

-

Shandong Polymer Bio-Chemicals Co., Ltd.

-

Xitao Polymer Co., Ltd.

-

ZL EOR Chemicals Ltd.

-

Dongying Kechuang Biochemical Industrial Co., Ltd.

Polyacrylamide Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.8 billion

Revenue forecast in 2030

USD 9.1 billion

Growth rate

CAGR of 6.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

Anhui Jucheng Fine Chemical Co, Ltd. (CJCC); Ashland Inc.; BASF SE; Kemira; SNF Group; Black Rose Industries Ltd.; Shandong Polymer Bio-chemicals Co., Ltd.; Xitao Polymer Co., Ltd.; ZL EOR Chemicals Ltd.; Dongying Kechuang Biochemical Industrial Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

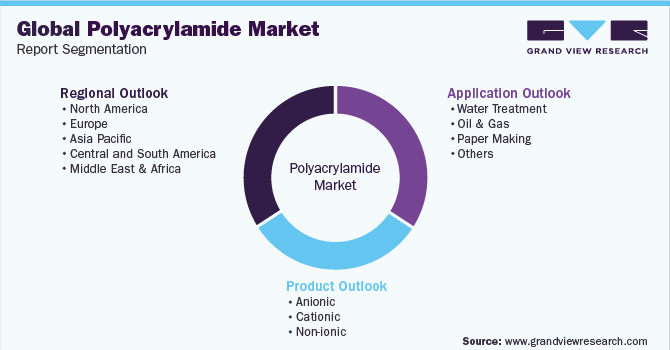

Global Polyacrylamide Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global polyacrylamide market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Anionic

-

Cationic

-

Non-ionic

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Water Treatment

-

Oil & Gas

-

Paper Making

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global polyacrylamide market size was estimated at USD 5.5 billion in 2022 and is expected to reach USD 5.8 billion in 2023.

b. The global polyacrylamide market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 9.1 billion by 2030.

b. Anionic segment dominated the polyacrylamide market with a share of 43.9%. Anionic polyacrylamide polymers are used in applications including wastewater treatment, pulp and paper, aquaculture, coal mining, food and beverage, and oil and gas industries.

b. Some key players operating in the polyacrylamide market include SNF, BASF, CNPC, Ashland, Kemira, Anhui Jucheng Fine Chemical Co, Ltd. (CJCC), Black Rose Industries Ltd., Shandong Polymer Bio-chemicals Co., Ltd., Xitao Polymer Co., Ltd., and Anhui Tianrun.

b. Key factors that are driving the market growth include rising demand for the product from the oil and gas industry for the enhancement of oil recovery.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.