- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyethylene Furanoate Market Size, Industry Report, 2030GVR Report cover

![Polyethylene Furanoate Market Size, Share & Trends Report]()

Polyethylene Furanoate Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Bottles, Fibers, Films), By Region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa, And Segment Forecasts

- Report ID: GVR-2-68038-310-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyethylene Furanoate Market Summary

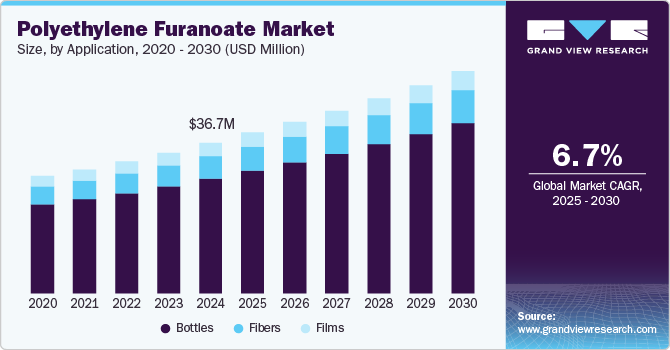

The global Polyethylene Furanoate (PEF) market size was estimated at USD 36.66 million in 2024 and is projected to reach USD 54.15 million by 2030, growing at a CAGR of 6.7% from 2025 to 2030. The increasing awareness about environmental issues is driving the demand for sustainable alternatives to conventional plastics. PEF, a bio-based material derived from renewable resources such as plant-based sugars, offers a promising solution.

Key Market Trends & Insights

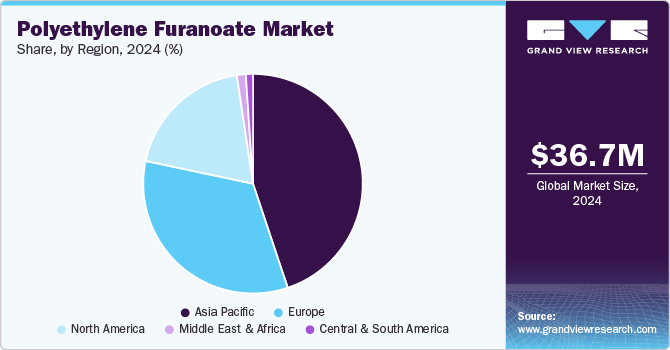

- Asia Pacific dominated the global market with the largest revenue share of 44.9% in 2024.

- The Middle East & Africa polyethylene furanoate market is expected to register the highest CAGR of 7.8% over the forecast period.

- By application, the bottles segment dominated the market in 2024, accounting for the largest revenue share of 76.2%.

- The fibers segment is expected to grow significantly over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 36.66 Million

- 2030 Projected Market Size: USD 54.15 Million

- CAGR (2025-2030):6.7%

- Asia Pacific: Largest market in 2024

In addition, polyethylene furanoate (PEF) recyclability and biodegradability help address the growing concerns of plastic waste, particularly in packaging. This makes PEF a key player in reducing plastic pollution and promoting greener packaging solutions in the polyethylene furanoate industry.

The shift toward sustainable materials drives industries to adopt bio-based alternatives to traditional plastics. PEF is produced using renewable feedstocks, such as plant-based sugars, which help reduce dependence on petroleum-based plastics. This transition is gaining momentum as consumers and industries seek more environmentally friendly products. Furthermore, governments worldwide are introducing regulations that promote renewable materials, providing subsidies, tax benefits, and funding to support the development of bio-based technologies. These incentives are encouraging industries to adopt alternatives such as PEF. As a result, the polyethylene furanoate industry is witnessing significant growth.

Technological advancements in polymerization have made it possible to produce PEF commercially, improving its economic viability. These developments have significantly reduced production costs, allowing PEF to compete with traditional plastics. Moreover, PEF offers superior mechanical and thermal properties to conventional plastic materials, making it suitable for various applications, such as bottles, films, and packaging. Its excellent oxygen barrier properties enhance its potential for food and beverage packaging. These improvements are driving the growth of the polyethylene furanoate industry.

Application Insights

The bottles segment dominated the market and accounted for the largest revenue share of 76.2% in 2024, driven by the growing demand for sustainable packaging solutions. PEF, a bio-based polymer, offers key advantages over traditional polyethylene terephthalate (PET), such as better barrier properties and the potential for biodegradability. With increasing environmental concerns and regulatory pressures, many companies are adopting eco-friendly materials to align with consumer preferences. This shift is boosting the demand for PEF in bottle production, positioning it as a leading material for packaging. These trends are expected to continue, driving further growth in the polyethylene furanoate industry.

The fibers segment is expected to grow significantly over the forecast period. This anticipated growth can be attributed to the increasing demand for sustainable textiles and materials with enhanced performance characteristics. PEF fibers are known for their strength and durability, making them ideal for various textile applications. As environmental concerns rise, manufacturers turn to bio-based fibers such as PEF to meet sustainability goals. This shift toward eco-friendly materials is expected to further support the expansion of the polyethylene furanoate industry.

Regional Insights

North America polyethylene furanoate market held a significant market share in 2024, driven by the rising demand for environmentally friendly materials. Consumer awareness regarding sustainability has prompted major regional companies to seek bio-based alternatives for packaging solutions. The presence of established players committed to using sustainable materials, along with a robust infrastructure for production and distribution, enhances market dynamics. In addition, abundant resources for raw materials such as corn stover facilitate local production of PEF, making it an attractive option for manufacturers aiming to meet eco-conscious consumers in North America.

Europe Polyethylene Furanoate Market Trends

Europe polyethylene furanoate market is expected to register a significant CAGR over the forecast period, which can be attributed to stringent environmental regulations and a strong consumer shift toward sustainable products. European consumers increasingly demand eco-friendly packaging solutions, prompting manufacturers to invest in bio-based alternatives such as PEF. Furthermore, ongoing innovations in production processes enhance the feasibility of PEF applications across various sectors, solidifying Europe’s position as a leader in sustainable materials.

Asia Pacific Polyethylene Furanoate Market Trends

Asia Pacific polyethylene furanoate market held the highest revenue share of 44.9% in 2024, driven by rapid industrialization and a growing emphasis on sustainable packaging solutions. Countries in this region are witnessing an increase in consumer awareness regarding environmental issues, which has led to a surge in demand for biodegradable materials such as PEF. In addition, the expansion of e-commerce and processed food sectors further propels the need for innovative packaging solutions that meet functional and environmental requirements.

The China polyethylene furanoate market dominated the Asia Pacific with a significant revenue share in 2024 due to a large consumer base that prefers cost-effective and biodegradable packaging options. The country’s growing focus on sustainability and eco-friendly materials encourages manufacturers to explore alternatives to traditional plastics. In addition, the rapid growth of e-commerce platforms has heightened the need for efficient and sustainable packaging solutions. As companies strive to meet consumer demand for greener products, PEF is increasingly considered a viable choice due to its biodegradability and excellent performance. This trend is expected to continue, reinforcing China’s strong position in the polyethylene furanoate market.

Middle East & Africa Polyethylene Furanoate Market Trends

Middle East & Africa polyethylene furanoate market is expected to register the highest CAGR of 7.8% over the forecast period, which can be attributed to increasing investments in infrastructure and a rising awareness of environmental sustainability among consumers and businesses alike. The region's focus on developing sustainable practices within various industries encourages the adoption of bio-based materials such as PEF, which are perceived as more environmentally friendly than conventional plastics.

Saudi Arabia polyethylene furanoate market dominated the Middle East and Africa, with a significant revenue share in 2024, due to the country's robust industrial sector increasingly recognizing the benefits of incorporating sustainable materials into their operations. As local businesses strive to enhance their sustainability profiles, the demand for innovative packaging solutions such as PEF is expected to rise sharply, positioning Saudi Arabia as a key player in this emerging market segment.

Key Polyethylene Furanoate Company Insights

Key companies in the global polyethylene furanoate market are Avantium N.V.; BASF; Danone; ALPLA, and TOYOBO CO., LTD. These players adopt numerous strategies to improve their competitive edge. Strategic partnerships are formed to leverage complementary strengths, improve product offerings, and expand distribution networks. In addition, mergers and acquisitions enable companies to consolidate resources, enter new markets, and diversify their product lines. Furthermore, new product launches focus on innovation and meeting evolving consumer preferences, allowing companies to capture market share in polyethylene furanoate market.

-

Avantium N.V. offers a range of innovative products focused on PEF, a 100% plant-based and fully recyclable polymer. Its product lineup includes PEF for bottles, packaging, films, and textiles, which provide superior barrier properties to extend shelf life. The company is also building the world’s first commercial plant for producing Furandicarboxylic Acid (FDCA), a key component of PEF.

-

Danone offers various innovative products for the PEF market by focusing on sustainable packaging solutions. It has partnered with several organizations to develop PEF-based product packaging, especially in the food and beverage sector. The company uses PEF for bottles and packaging to enhance sustainability, reduce plastic waste, and improve shelf life.

Key Polyethylene Furanoate Companies:

The following are the leading companies in the polyethylene furanoate market. These companies collectively hold the largest market share and dictate industry trends.

- Avantium N.V.

- BASF

- Danone

- ALPLA

- TOYOBO CO., LTD.

- ADM

- Corbion

- Mitsui Chemicals, Inc.

- DuPont.

- Origin Materials

Recent Developments

-

In October 2024, Avantium N.V. launched the Releaf brand to promote plant-based and recyclable PEF, offering sustainable alternatives for bottles, packaging, and textiles. The brand aims to reduce reliance on fossil plastics and showcases its versatility through an installation at Dutch Design Week, created with design studio Hoogvliet Jongerius. The installation demonstrates both the aesthetic and functional potential of eco-friendly materials. This initiative marks a significant step in integrating sustainability into the packaging and textile industries.

-

In July 2024, BASF launched Haptex 4.0, a fully recyclable polyurethane solution for synthetic leather production. This innovative material allows the recycling of synthetic leather and PET fabric together without needing a layer peel-off process. Haptex 4.0 promotes sustainable manufacturing, aligns with circular economy principles, and meets strict VOC standards, making it suitable for footwear, fashion, automotive interiors, and furniture use.

Polyethylene Furanoate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 39.19 million

Revenue forecast in 2030

USD 54.15 million

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, France, UK, Italy, China, India, Japan, South Korea, Brazil, Saudi Arabia.

Key companies profiled

Avantium N.V.; BASF; Danone; ALPLA; TOYOBO CO., LTD.; ADM; Corbion; Mitsui Chemicals, Inc.; DuPont.; Origin Materials.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyethylene Furanoate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global polyethylene furanoate market report based on application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Fibers

-

Films

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.