- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyethylene Furanoate Market Size, Share Report 2020-2027GVR Report cover

![Polyethylene Furanoate Market Size, Share & Trends Report]()

Polyethylene Furanoate Market Size, Share & Trends Analysis Report By Application (Bottles, Fibers, Films), By Region (North America, Europe, APAC, Central & South America, MEA), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-2-68038-310-2

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Bulk Chemicals

Report Overview

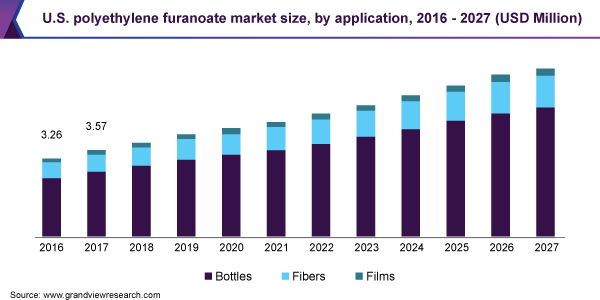

The global polyethylene furanoate market size was valued at USD 27.1 million in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 6.6% from 2020 to 2027. Increasing demand for bio-based recyclable solutions in the packaging industry, coupled with growing awareness among the consumers, is expected to boost the growth of the polyethylene furanoate (PEF) market over the forecast period. Increasing concerns regarding toxic issues pertaining to petrochemicals, along with depleting crude oil reserves, have been driving the development of bio-based polymers. Government regulations on restricting petro-based plastics consumption in certain applications, such as food packaging and medical devices, are expected to further incentivize PEF production.

PEF offers superior properties when compared to Polyethylene Terephthalate (PET) such as excellent gas and moisture barrier, higher glass transition temperature, low melting point, higher tensile strength, light weight, and excellent thermal stability. PEF has the potential to replace PET both in terms of properties and manufacturing costs when produced on a large scale.

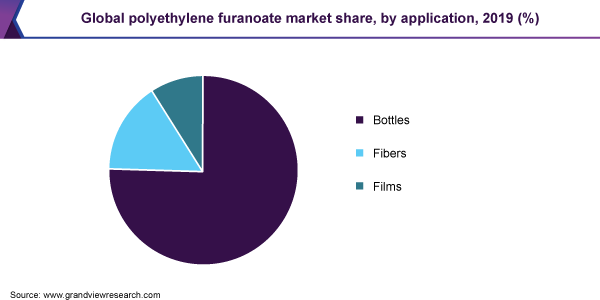

PEF is used primarily in three forms, namely bottles, films, and fibers. It is used to produce rigid and flexible packaging solutions for industries, such as food and beverages, pharmaceutical, and consumer goods. It is also used in the manufacturing of clothing apparel, carpets, diapers, fabrics, filters, and industrial fibers.

Additionally, the outbreak of coronavirus pandemic has severely affected the consumer buying behavior and their preference while choosing the products and services. Consumers are now more conscious about the environmental impact, recyclability, and decomposition time in landfills of the products. This is likely to compel the customers to buy products made from bio-based and recyclable plastics over conventional plastics.

Application Insights

The bottles application segment led the market and accounted for more than 75.0% share of the global revenue in 2019. This significant share is attributed to rising demand from packaging applications, such as food and beverage packaging, personal care packaging, films and sheets, and household care products packaging.

Rising awareness among the consumers regarding sustainable packaging, coupled with rising landfill regulation across the globe, especially in the European region, is compelling the manufacturers to use bio-based and recyclable plastics for packaging. Additionally, ban on single-use plastics in many countries, such as the U.K., New Zealand, Taiwan, Zimbabwe, and various states of the U.S., such as Hawaii, New York, and California, is significantly driving the demand for PEF in the bottles application segment.

Flexible packaging is expected to be one of the key contributors to the growth of the PEF market over the forecast period. It offers sustainable and environment-friendly packaging solutions for a broad range of food and non-food industries. It helps in reducing the amount of material used for packaging and creates much less waste than conventional flexible packaging. This packaging uses natural resources in production and requires lower transit resources, which makes an exceptional sustainable choice for various eco-friendly businesses.

The COVID-19 outbreak across the globe has moderately impacted market growth in the packaging industry. The demand for packaging for healthcare products, retail products, and e-commerce transportation has increased sharply, while the demand for luxury, industrial, and some B2B transport packaging has declined owing to the halt in industrial production and lockdown imposed by various governments across the world.

PEF fibers offer enhanced properties over PET and have the potential to replace PET fibers.They are used in industrial packaging products, such as cement, pesticides, and fertilizers. Additionally, PEF fibers are used in the manufacturing of carpets, clothing fabrics, and others.

Regional Insights

Asia Pacific led the market and accounted for more than 45.0% share of the global revenue in 2019. The shift in the production landscape of biodegradable plastics toward emerging economies, particularly China and India, is expected to positively influence market growth over the forecast period.

The growth of the PEF market in Asia Pacific is projected to be negatively impacted by COVID-19 as there is limited cross-border trade among the economies at present. End-use industries including medical and food and beverages are driving the demand for PEF in the region on account of the rising demand for packed and processed food, coupled with the growing trend of e-commerce shopping.

Europe is the second-largest consumer of polyethylene furanoate owing to various factors, such as the increasing environmental concerns among consumers, stringent environment-friendly laws, and rising R&D investments in bio-based and completely recyclable plastics by private as well as public organizations. In addition, government initiatives such as the decision of the EU to minimize the overall consumption of single-use plastic products by about 90% in the region by the end of 2021 are anticipated to propel the demand for PEF over the forecast period.

Increasing demand for PEF in countries, such as the UAE, Saudi Arabia, and South Africa, owing to the rising demand for completely recyclable bio-based plastics in the end-use industries, such as packaging, consumer goods, and agriculture, is the major factor responsible for the rise in consumption of PEF. Stringent government regulations and the ban on single-use plastics are further expected to drive the market over the forecast period.

Key Companies & Market Share Insights

Companies engaged in the manufacturing of PEF are engaged in developing new and innovative processes and technologies and licensing those technologies to others to gain a competitive advantage in the manufacturing technology and PEF market. For instance, Avantium has developed YXY technology used to produce FDCA, the main component used in the manufacturing of PEF. The company launched a project named “PEFerence” in collaboration with the European Union to develop the supply chain for FDCA and PEF. Prominent players in the global polyethylene furanoate market include:

- Avantium Technologies B.V.

- Danone S.A.

- Toyobo Co., Ltd.

- Alpla

- The Coca-Cola Company

Polyethylene Furanoate Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 28.5 million

Revenue forecast in 2027

USD 44.5 million

Growth Rate

CAGR of 6.6% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in tons, revenue in USD thousand/million, and CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; South Korea; Brazil; Saudi Arabia

Key companies profiled

Avantium Technologies B.V.; Danone S.A.; Toyobo Co., Ltd.; Alpla; The Coca-Cola Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global polyethylene furanoate market report on the basis of application and region:

-

Application Outlook (Volume, Tons; Revenue, USD Thousand, 2016 - 2027)

-

Bottles

-

Fibers

-

Films

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The PEF market size was estimated at USD 27.1 million in 2019 and is expected to reach USD 28.5 million in 2020.

b. The PEF market is expected to grow at a compound annual growth rate of 6.6% from 2020 to 2027 to reach USD 44.4 million by 2027.

b. Asia Pacific dominated the PEF market with a share of 45.1% in 2019. This is attributable to the rising demand for polyethylene furanoate bottles in sustainable packing products in food & beverages, medical, consumer goods, and others.

b. Some of the key players operating in the PEF market include Avantium Technologies B.V., Danone S.A., Toyobo Co., Ltd., Alpla, and The Coca-Cola Company.

b. Key factors driving the PEF market growth include the growing use of renewable & bio-based products and a shift in consumer preferences toward eco-friendly packaging and strict government regulations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."