- Home

- »

- Renewable Chemicals

- »

-

Glycerol Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Glycerol Market Size, Share & Trends Report]()

Glycerol Market (2023 - 2030) Size, Share & Trends Analysis Report By Source (Biodiesel, Fatty Alcohol, Fatty Acids, Soaps), By Product (Crude, Refined), By Application (Food & Beverage, Pharmaceutical), By Region, And Segment Forecasts

- Report ID: 978-1-68038-190-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Glycerol Market Summary

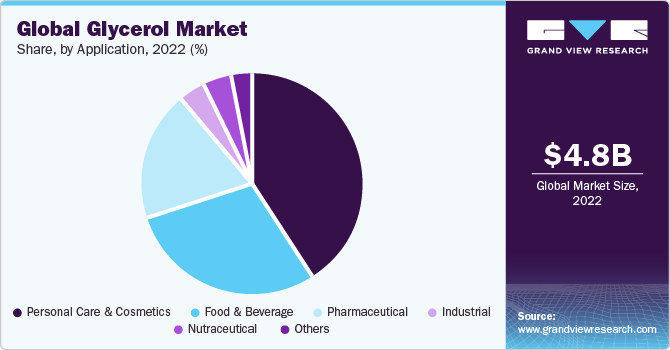

The global glycerol market size was estimated at USD 4.87 billion in 2022 and is projected to reach USD 5.67 billion by 2030, growing at a CAGR of 1.9% from 2023 to 2030. This is attributed to its increasing demand from food, pharmaceutical, and nutraceutical industries.

Key Market Trends & Insights

- Asia Pacific dominated the glycerol market and accounted for the largest revenue share of 36.40% in 2022.

- Europe was the second-largest regional market in 2022 and accounted for 29.23% of the revenue share.

- Based on product, the refined segment dominated the market for glycerol and accounted for the largest revenue share of 75.27% in 2022.

- Based on source, the biodiesel dominated the market and accounted for the largest revenue share of 59.5% in 2022.

- Based on application, the personal care and cosmetics segment dominated the market for glycerol and accounted for the largest revenue share of 40.93% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 4.87 Billion

- 2030 Projected Market Size: USD 5.67 Billion

- CAGR (2023-2030): 1.9%

- Asia Pacific: Largest market in 2022

The product is widely used in several food products including processed meat, condensed milk, and bakery products. There is a rise in consumer preference for glycerol as it is non-toxic and has excellent nutritive values attached to it. It can be derived naturally as well as from petrochemical feedstock. The demand for the product is likely to increase globally in the coming years as it is easy to store and does not harm the environment. Moreover, it is widely used for improving hydration levels and performance levels in athletes, skin conditions, and helps relieve constipation as well. These factors are likely to positively affect the growth of the market for glycerol over the forecast period.

Glycerol is available in two forms in the market - crude form and refined form. The crude form is obtained from the production of biodiesel, which is in its raw form and then sold to large refineries for further processing. It acts as an outstanding source of calories for non-ruminants such as swine, hens, and broilers. The refined form of the product is hygroscope in nature and is used in different applications such as pharmaceuticals, polyether polyols, food and beverages, and alkyd resins.

Glycerol is formed via hydrolysis reaction, saponification, and transesterification during biodiesel production. The substance that is produced has various impurities in it such as remaining wastewater, soaps, salts, esters, and catalysts. It is converted/purified into valuable products during the manufacturing process of biodiesel. Glycerol is manufactured by the hydrolysis of fats and natural oils from animals and plants. The synthesis of the product in yeasts and other organisms takes place through the dephosphorylation of glycerol 3 phosphates.

The prices of raw materials play a crucial role in the market for glycerol. Other costs that come into play apart from those of raw materials include pre-operational costs, capital investments, and working capital. Also, pre-operating costs include installation, setup, capitalized interests, project engineering and management, and commissioning costs. Increasing prices of fossil fuels have led to a rise in the prices of biodiesel, thus triggering the prices at a global level.

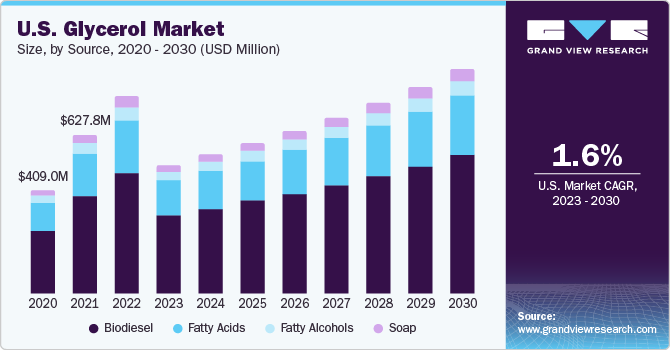

Source Insights

Biodiesel dominated the market and accounted for the largest revenue share of 59.5% in 2022. This is attributed to its usage as a by-product in the production of biodiesel fuels by chemical and enzymatic methods and the production of bioethanol. Biodiesel is one of the most preferred sources of glycerol due to its low cost, as a result of increasing production of biodiesels as replacements for conventional diesel on account of its biodegradable, renewable, and non-toxic properties and lesser emission attributes.

The soap segment accounted for a considerable revenue share in 2022. This is attributed to increasing demand for soaps mainly in personal care application, as it imparts moisture to the skin, which is anticipated to positively impact market growth over the forecast period.

The fatty alcohol segment is expected to grow at the fastest CAGR of 2.7% during the forecast period. This is attributed to its wide usage in the manufacturing of surfactants and detergents. Also, they are used as industrial solvents and as components in the cosmetics, and food and beverage industries. The growing demand for fatty alcohol in the aforementioned industries is likely to trigger product demand and thus, is expected to boost market growth for glycerol over the forecast period.

Product Insights

The refined segment dominated the market for glycerol and accounted for the largest revenue share of 75.27% in 2022. It is also anticipated to grow at the fastest CAGR of 2.1% over the forecast period. Refined glycerin is a colorless, odorless, water-soluble, viscous liquid with a high boiling point. This is attributed to its emulsifying and moisturizing functionalities which make it an effective additive in various personal care and home care formulations. These factors are attributed to boosting the demand for the product in the coming years.

Refined glycerol is generated through laboratory-controlled hydrolysis, transesterification, and saponification processes. It is derived from several kinds of vegetable oils. Further refining of crude glycerol depends on the economics and the availability of production facilities in a particular region.

The crude segment is predicted to witness a significant CAGR during the forecast period. Crude glycerol mostly contains impurities such as free fatty acids and methanol, making it a less preferred product in the market for glycerol. The rising demand for crude glycerol in personal care and nutraceuticals applications is expected to positively impact the market growth over the projected years.

Application Insights

The personal care and cosmetics segment dominated the market for glycerol and accounted for the largest revenue share of 40.93% in 2022. This is attributed to an increase in demand for personal care and pharmaceutical products as a result of improving lifestyle, coupled with increasing health awareness among the population in emerging economies across the Asia Pacific and Latin America. Glycerol is used as a humectant and a means of providing lubrication & improving smoothness. It is found in skincare products, hair care products, shaving cream, water-based personal lubricants and soaps.

The pharmaceutical segment is projected to witness the fastest CAGR of 2.3% during the forecast period. This is attributed to the usage of the product in pharmaceuticals owing to its nutritive value and healing properties. Additionally, it is found in toothpaste, mouthwashes, expectorants, elixirs, cough syrups, and allergen immunotherapy among others. A significant rise in the demand for glycerol for various purposes in pharmaceutical applications is expected to positively impact the demand for the product in the coming years.

Other applications of the product include food preservatives, tobacco, and the production of perfumes and explosives. In perfumes, the substance is used as a fixative to retain the scent of the perfume for longer periods. When added to water and alcohol in perfumes, it helps other ingredients dissolve at a faster rate. Glycerol is turned into nitroglycerin by reaction with nitric acid and sulfuric acid, which is an explosive and hence used in dynamites. It is also used in anti-freeze, lubrication, and printing inks.

Regional Insights

Asia Pacific dominated the glycerol market and accounted for the largest revenue share of 36.40% in 2022. The region is expected to witness the fastest CAGR of 2.3% during the forecast period. This is attributed to changing lifestyle patterns, growing consumption of convenience foods, and the rising number of working women in the region. Prices of glycerol in the Asia Pacific increased multi-fold in the first half of 2021 owing to high demand from end-use industries and constrained production amid a shortage of key feedstock chemicals.

Europe was the second-largest regional market in 2022 and accounted for 29.23% of the revenue share. This is attributed to the large investments by major players in the cosmetics industry, growing consumer expenditure, and the launch of new and innovative products in the personal care segment. Germany, Netherlands, Italy, and France are the leading producers of the product in Europe. European countries have a potential demand for biofuels. Thus, biodiesel production is likely to be high in the coming years, which in turn will have a positive impact on the market.

Brazil and Argentina are the two major producers of glycerol in Central and South America (CSA). The quantity of glycerol sold by Brazil was 328,421 metric tons in 2020. The country ranks 61st in substance exports globally. Argentina is one of the world’s biggest biodiesel producers with an installed capacity of 4.5 million mt/year.

Key Companies & Market Share Insights

The market is highly competitive due to the presence of a large number of multinationals that are engaged in constant research and development activities. Companies such as BASF SE, Procter & Gamble, Cargill, Dow, and Wilmar International dominate the market with a range of products for each application market and their global brand presence. A majority of these companies have integrated their business operations across the value chain to incur maximum profit at the lowest investment.

Global companies are also focusing on capacity expansions, signing partnership agreements with distributors, and various other operational strategies to gain an edge in the competitive market space. For instance, companies such as BASF SE have opened a new food application and development center in Johannesburg, South Africa to help the company focus on value-added customized developments related to glycerol with improved service quality. Some of the prominent players in the global glycerol market include:

-

Cargill, Incorporated

-

BASF SE

-

Procter & Gamble

-

Oleon NV

-

KLK OLEO

-

Dow

-

ADM

-

Wilmar International Ltd.

-

Kao Corporation

-

Emery Oleochemicals

-

COCOCHEM

-

Godrej Industries Limited

-

Monarch Chemicals Ltd

-

Aemetis, Inc.

-

CREMER OLEO GmbH & Co. KG

-

Sakamoto Yakuhin Kogyo Co.Ltd.

-

Fine Chemicals & Scientific Co.

Recent Developments

-

In July 2023, Louis Dreyfus Company announced its expansion of refining capacity in Indonesia. This plan includes the addition of a new glycerine refining capacity in the country.

-

In May 2023, BASF SE announced 1-year completion of converting glycerol to renewable propylene glycol (BioPG) by ORLEN Poludine, a biofuels company in Poland. ORLEN Poludine uses BASF’s technology for this conversion of glycerol to BioPG.

-

In December 2022, Argent Energy announced its plan to construct a new glycerine refinery. The 50,000 tons production capacity refinery is planned to be established in the port of Amsterdam.

-

In July 2021, Eni and BASF SE announced that two companies were coming together for an R&D initiative. This initiative aimed to develop technology for the conversion of glycerin to propanol and reduce the CO2 emission of the transportation sector.

Glycerol Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.18 billion

Revenue forecast in 2030

USD 5.67 billion

Growth rate

CAGR of 1.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million, volume in kilo tons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Netherlands; Russia; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Cargill, Incorporated; BASF SE; Procter & Gamble; Oleon NV; KLK OLEO; Dow; ADM; Wilmar International Ltd.; Kao Corporation; Emery Oleochemicals; COCOCHEM; Godrej Industries Limited; Monarch Chemicals Ltd; Aemetis, Inc.; CREMER OLEO GmbH & Co. KG; Sakamoto Yakuhin Kogyo Co., Ltd.; Fine Chemicals & Scientific Co.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glycerol Market Report SegmentationThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global glycerol market report based on source, product, application, and region:

-

Source Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

-

Biodiesel

-

Fatty Alcohols

-

Fatty Acids

-

Soap

-

-

Product Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

-

Crude

-

Refined

-

-

Application Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

-

Food & Beverage

-

Pharmaceutical

-

Nutraceutical

-

Personal Care & Cosmetics

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global glycerol market size was valued at USD 4.87 billion in 2022 and is expected to reach USD 3.18 billion in 2023.

b. The global glycerol market is expected to grow at a compound annual growth rate of 1.9% from 2023 to 2030 to reach USD 5.67 billion by 2030.

b. Biodiesel dominated the glycerol market with a share of 59.5% in 2022. This is attributable to its usage as a by-product in the production of biodiesel fuels by chemical and enzymatic methods and the production of bioethanol.

b. Some key players operating in the glycerol market include Cargill Incorporated, BASF SE, Procter & Gamble Chemicals, Oleon NV, KLK OLEO, Dow Chemical Company, ADM, and others.

b. Key factors that are driving the glycerol market include increasing product demand from food, pharmaceutical, and nutraceutical industries. The product is widely used in several food products, including processed meat, condensed milk, and bakery products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.