- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyhydroxyalkanoates Films Market, Industry Report, 2030GVR Report cover

![Polyhydroxyalkanoates Films Market Size, Share & Trends Report]()

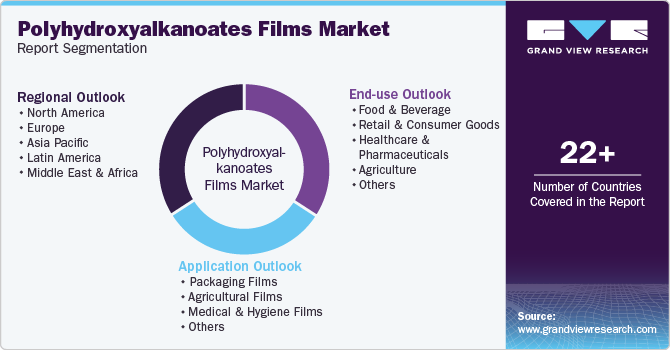

Polyhydroxyalkanoates Films Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Packaging Films, Agricultural Films, Medical & Hygiene Films), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-561-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyhydroxyalkanoates Films Market Trends

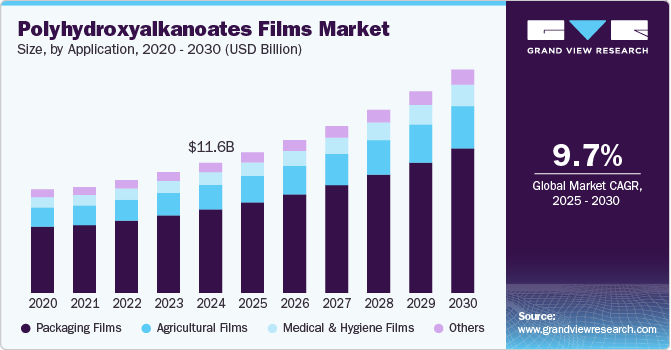

The global polyhydroxyalkanoates films market size was estimated at USD 11.59 billion in 2024 and is expected to grow at a CAGR of 9.7% from 2025 to 2030. The growth of the PHA (polyhydroxyalkanoates) films market is driven by the rising demand for biodegradable and compostable packaging solutions and increasing regulatory pressure to reduce plastic pollution. Additionally, growing consumer preference for sustainable alternatives boosts market adoption. As environmental regulations become more stringent, especially in developed regions such as North America and Europe, traditional petroleum-based plastics are increasingly being replaced with eco-friendly alternatives.

PHA films, derived from renewable resources such as plant oils, sugars, and waste materials, offer a promising solution due to their complete biodegradability and compostability in various environments, including marine settings. These attributes make PHA films particularly attractive for single-use packaging applications where sustainability is a major concern.

Another significant factor contributing to the growth of the PHA (Polyhydroxyalkanoates) films industry is the increasing awareness and support for the circular economy and bioeconomy frameworks. Governments, non-profit organizations, and industries are increasingly collaborating to reduce plastic waste and carbon emissions by adopting biopolymers. Incentives, bans on single-use plastics, and initiatives promoting green packaging have created a favorable regulatory environment for the adoption of PHA films. Additionally, consumer preference is shifting towards eco-conscious brands, encouraging packaging manufacturers and consumer goods companies to integrate biodegradable film solutions like PHA into their supply chains.

The expansion of end use industries, especially in food packaging, agriculture, and healthcare, is also propelling market demand. In the food industry, PHA films are gaining traction as they offer a moisture-resistant and compostable alternative to polyethylene films, suitable for items like fresh produce, snacks, and ready-to-eat meals. In agriculture, PHA-based mulch films help in reducing plastic waste and improving soil health. Moreover, in the medical and hygiene sectors, the non-toxic and biocompatible nature of PHAs opens up avenues for the packaging of disposable medical products and hygiene goods, further boosting market penetration.

Moreover, advancements in production technology and strategic collaborations among biopolymer developers and film manufacturers are playing a key role in market growth. Innovations in fermentation processes, improved yield of PHA from feedstocks, and the development of PHA blends for enhanced film properties are making these materials more commercially viable. Partnerships between material scientists, biotech firms, and packaging companies are accelerating R&D and scaling up production, thereby lowering costs and improving product availability. As production capacity increases and economies of scale are achieved, PHA films are expected to become more competitive with conventional plastics, further driving their adoption across various sectors.

Application Insights

The packaging films segment recorded the largest market revenue share of over 64.0% in 2024. PHA films are increasingly used in packaging applications due to their biodegradable nature and compatibility with food products. These films offer a sustainable alternative to conventional petroleum-based plastics in packaging for food items, consumer goods, and industrial products. Their compostability and ability to maintain barrier properties make them suitable for both flexible and rigid packaging applications.

The agricultural films segment is projected to grow at the fastest CAGR of 9.9% during the forecast period. PHA films are being adopted in agriculture for mulch films, greenhouse covers, and soil-biodegradable films. These films provide soil moisture retention, temperature regulation, and weed suppression while decomposing naturally, eliminating the need for retrieval and disposal. As a result, the segment is poised to witness steady growth during the forecast period.

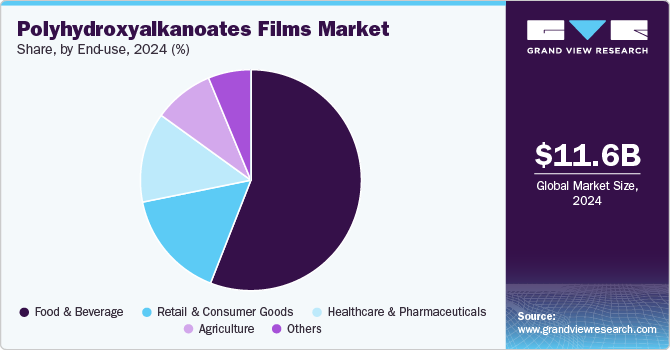

End Use Insights

The food & beverage segment recorded the largest market share of over 55.0% in 2024. PHA films are widely utilized in the food and beverage industry for packaging perishable goods such as fresh produce, dairy, snacks, and ready-to-eat meals. These films are preferred due to their biodegradability, compostability, and ability to maintain food hygiene while reducing plastic waste. Their oxygen and moisture barrier properties can be tailored to match food packaging requirements, extending shelf life and preserving product quality.

The healthcare & pharmaceuticals segment is projected to grow at the fastest CAGR of 10.6% during the forecast period. PHA films are increasingly being explored in the healthcare and pharmaceutical sectors for packaging applications such as blister packs, sachets, pouches for medical devices, pills, and hygiene products. Their biocompatibility and non-toxic degradation make them suitable for applications requiring sterile and safe packaging.

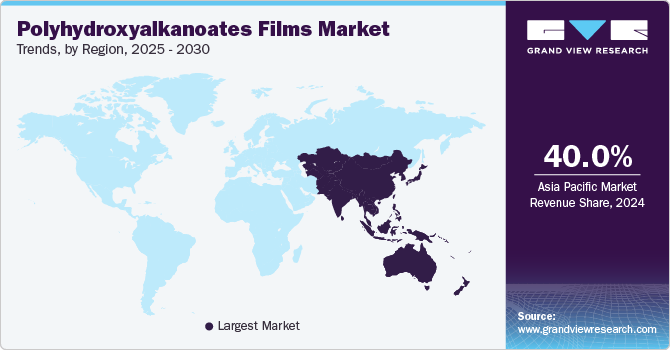

Regional Insights

Asia Pacific dominated the polyhydroxyalkanoates films market and accounted for the largest revenue share of over 40.0% in 2024. It is anticipated to grow at the fastest CAGR over the forecast period, due to the rising environmental concerns, rapid urbanization, and government regulations on plastic waste. Countries such as China, Japan, and South Korea are introducing policies to curb single-use plastics, leading to heightened interest in biodegradable alternatives. Moreover, the availability of agricultural and organic feedstock in countries such as India and Indonesia offers a cost-effective raw material base for PHA production. As a result, manufacturers are increasingly looking to Asia Pacific as both a consumer and production hub for PHA films.

China's PHA films market growthcan be attributed to its aggressive stance on plastic pollution and massive manufacturing capabilities. The Chinese government’s 2020 policy to phase out single-use plastics across major cities and sectors by 2025 has created strong momentum for biodegradable alternatives such as PHA. Major domestic companies, such as Bluepha and Zhejiang Hisun Biomaterials, are expanding their PHA production capacities and launching film-grade products targeting the packaging and agriculture sectors.

North America Polyhydroxyalkanoates Films Market Trends

Government initiatives such as bans on single-use plastics and extended producer responsibility (EPR) schemes are pushing industries toward alternative materials. Additionally, the U.S. bioplastics industry benefits from robust R&D institutions and biopolymer startups such as Danimer Scientific and RWDC Industries, which are actively developing and commercializing PHA-based solutions for packaging, agriculture, and consumer goods. This innovation-friendly environment is fostering faster commercialization of PHA films. Moreover, consumer preference for eco-friendly and compostable products is significantly influencing market dynamics in North America.

U.S. Polyhydroxyalkanoates Films Market Trends

The growth of the U.S. PHA films industrycan be attributed to a confluence of regulatory pressures, corporate sustainability goals, and technological innovation. Federal and state-level policies banning single-use plastics have created a compelling case for biodegradable alternatives. Another significant driver in the U.S. market is the increasing adoption of ESG (Environmental, Social, and Governance) frameworks by corporations.

Europe Polyhydroxyalkanoates Films Market Trends

The region’s growth in the PHA films industry can be attributed to its comprehensive environmental regulations and circular economy strategies. The European Union’s Single-Use Plastics Directive, which mandates reductions in plastic waste and encourages the adoption of biodegradable materials, has been instrumental in boosting demand for PHA-based films. Countries such as France, Italy, and the Netherlands have implemented national-level plastic bans and subsidies for compostable packaging.

The Germany PHA films market’s growth is primarily driven by its advanced industrial base and commitment to research and development. The country’s “Green Deal” and strict waste management policies provide a favorable ecosystem for biodegradable plastics. Furthermore, German consumers are highly willing to pay for sustainable products, which is encouraging retailers and brands to adopt biodegradable packaging.

Key Polyhydroxyalkanoates Films Company Insights

The competitive environment of the PHA films market is characterized by a mix of established bioplastics manufacturers and emerging biotech firms, all vying for market share in the rapidly growing sustainable packaging sector. The market remains moderately consolidated, with high barriers to entry due to the complexity of PHA production and patent-driven innovation. Strategic partnerships, collaborations with consumer goods companies, and government-backed sustainability initiatives are shaping competition, while the rising demand for biodegradable alternatives to conventional plastics further intensifies rivalry among players aiming to differentiate through performance, price competitiveness, and environmental credentials.

-

In April 2024, CJ Biomaterials, Inc., a division of South Korea-based CJ CheilJedang and a leading producer of PHA biopolymers, introduced two groundbreaking PHA-based compounds—PHACT CA1270P (clear) and PHACA1240PF (opaque). These are specifically developed for blown, cast, and machine direction orientation (MDO) film applications. These 100% bio-based compounds, created in collaboration with NatureWorks by combining Ingeo PLA with PHACT PHA, mark a major advancement in sustainable flexible packaging. The new materials are designed for a range of applications such as food packaging, shopping bags, shrink-wrap, and agricultural films, providing a viable compostable alternative to traditional plastic films and supporting efforts to reduce plastic waste and methane emissions from landfills.

-

In May 2021, EarthFirst Films by PSI, a global bioplastic film technology and manufacturing company, completed the first commercial run of a PHA (polyhydroxyalkanoate) home compostable packaging film, marking a significant milestone in sustainable packaging. Made from Danimer Scientific’s NODAX PHA, the new film is designed for diverse applications across food, beverage, grocery retail, quick-service restaurants, stadium food service, and other consumer packaged goods and industrial segments.

Key Polyhydroxyalkanoates Films Companies:

The following are the leading companies in the polyhydroxyalkanoates films market. These companies collectively hold the largest market share and dictate industry trends.

- Danimer Scientific

- CJ Biomaterials, Inc.

- NatureWorks

- NatureWorks

- KANEKA CORPORATION

- PolyFerm Canada

- Tianjin GreenBio Materials Co., Ltd

- Genecis Bioindustries

- Earthfirst Films

- BOSK

Polyhydroxyalkanoates Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.54 billion

Revenue forecast in 2030

USD 19.90 billion

Growth rate

CAGR of 9.7% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Danimer Scientific; CJ Biomaterials, Inc.; NatureWorks; Bluepha; KANEKA CORPORATION; PolyFerm Canada; Tianjin GreenBio Materials Co., Ltd; Genecis Bioindustries; Earthfirst Films; BOSK

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyhydroxyalkanoates Films Market Report Segmentation

This report forecasts volume and revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyhydroxyalkanoates films market report based on application, end use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging Films

-

Agricultural Films

-

Medical & Hygiene Films

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Retail & Consumer Goods

-

Healthcare & Pharmaceuticals

-

Agriculture

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global polyhydroxyalkanoates films market size was estimated at USD 11.59 billion in 2024 and is expected to reach USD 12.54 billion in 2025.

b. The global polyhydroxyalkanoates films market is expected to grow at a compound annual growth rate of 9.7% from 2025 to 2030 to reach USD 19.90 billion by 2030.

b. Packaging Films dominated the PHA (Polyhydroxyalkanoates) Films market in the application segment with a share of over 64% of the overall revenue in 2024. PHA films are increasingly used in packaging applications due to their biodegradable nature and compatibility with food products.

b. Some of the key players operating in the PHA (Polyhydroxyalkanoates) Films market include Danimer Scientific; CJ Biomaterials, Inc.; NatureWorks; Bluepha; KANEKA CORPORATION; PolyFerm Canada; and Tianjin GreenBio Materials Co., Ltd, among others.

b. The PHA films market is driven by rising demand for biodegradable and compostable packaging solutions and increasing regulatory pressure to reduce plastic pollution. Additionally, growing consumer preference for sustainable alternatives boosts market adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.