- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyisobutylene Market Size & Share, Industry Report, 2030GVR Report cover

![Polyisobutylene Market Size, Share & Trends Report]()

Polyisobutylene Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (High Molecular Weight, Medium Molecular Weight, Low Molecular Weight), By End-use (Adhesives & Sealants, Automotive Rubber Components), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-230-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyisobutylene Market Summary

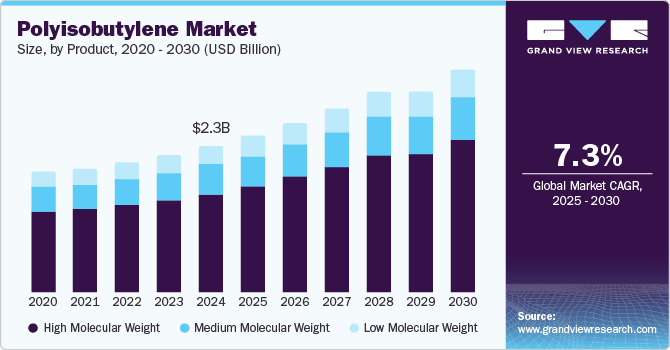

The global polyisobutylene market size was estimated at USD 2.25 billion in 2024 and is projected to reach USD 3.42 billion by 2030, growing at a CAGR of 7.3% from 2025 to 2030. The continued expansion of the worldwide plastics industry and the emergence of advanced high-performance products have created a substantial demand for polyisobutylene (PIB), which is extensively used in the construction and automotive sectors.

Key Market Trends & Insights

- The Asia Pacific polyisobutylene market accounted for the largest global revenue share of 36.7% in 2024.

- The European market for polyisobutylene is expected to grow at the highest CAGR during the forecast period.

- By product, the high molecular weight segment led the market, holding the largest revenue share of 68.2% in 2024.

- By end use, the automotive rubber components segment is expected to grow at the fastest CAGR from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 2.25 Billion

- 2030 Projected Market Size: USD 3.42 Billion

- CAGR (2025-2030): 7.3%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

Polyisobutylene is a gas-impermeable rubber that can restrain air for longer durations than other traditional elastomers. As a result, the product has witnessed a substantial appeal among manufacturers of inner rubber tubes for tires.

The steady expansion of the automotive sector due to increasing consumer disposable income levels and urbanization has acted as a major driver for the global market. PIB is commonly used in engine oils, fuel additives, and lubricants, where it enhances performance by improving viscosity, reducing friction, and extending the lifespan of engine components. Global trends towards more fuel-efficient and environment-friendly vehicles are increasing the demand for high-quality lubricants, boosting PIB consumption. Continued advancements in the chemical and petrochemical industries have further compelled market players to increase the frequency of product launches, as polyisobutylene plays a critical role in meeting the demand for high-performance chemical formulations. The use of this product in high-performance lubricants and greases for industrial machinery, automotive systems, and heavy-duty equipment supports its demand globally.

Stricter environmental regulations implemented by regulatory bodies, especially in the automotive sector, encourage manufacturers to develop more efficient, low-emission vehicles. Polyisobutylene helps enhance the performance of fuel additives, lubricants, and coatings, which enables vehicles to meet these standards. Furthermore, the growing global demand for eco-friendly and biodegradable lubricants, sealants, and packaging has made PIB a highly popular option in sustainable formulations, which aligns with the focus on reducing environmental impact and promoting circular economy principles. In high-tech sectors such as aerospace, PIB is used in specialized applications such as lubricants, coatings, and sealants. The oil & gas sector is another major end-user in the market, as polyisobutylene is widely utilized in drilling fluids for offshore oil and gas exploration due to its ability to maintain stability in extreme conditions.

Product Insights

The high molecular weight segment accounted for the largest revenue share of 68.2% in the global polyisobutylene industry in 2024. This specialized form of polyisobutylene offers superior viscosity, elasticity, and stability and is thus used in demanding applications where enhanced performance is critical. The requirement of high molecular weight polyisobutylene (HMW PIB) is driven by specific industry needs, including those that require high-performance materials with excellent chemical resistance, durability, and versatility. High molecular weight products extensively synthesize resins, plasticizers, and other industrial chemicals. Many industries are facing increasingly stringent regulatory standards regarding emissions, waste management, and material safety. HMW PIB’s ability to enhance the performance of lubricants, fuel additives, and other industrial materials helps organizations comply with these regulations while improving product performance.

The low molecular weight segment is expected to grow at a substantial CAGR in the global market from 2025 to 2030. The demand for low molecular weight polyisobutylene (LMW PIB) is driven by its efficient performance in applications requiring low viscosity, flexibility, and ease of processing. LMW PIB’s lower viscosity and easier processability make it ideal for high-speed manufacturing processes, such as continuous coating or film extrusion. The continued focus of industries on establishing methods to reduce production costs and improve operational efficiency has thus boosted segment demand in recent years. In the automotive sector, the product is used to manufacture tire compounds, particularly for applications requiring flexibility and low viscosity. It is generally used for improving rubber processing and enhancing tire formulations’ elasticity. Another area of application is reducing sound and vibration to improve the overall ride comfort in vehicles.

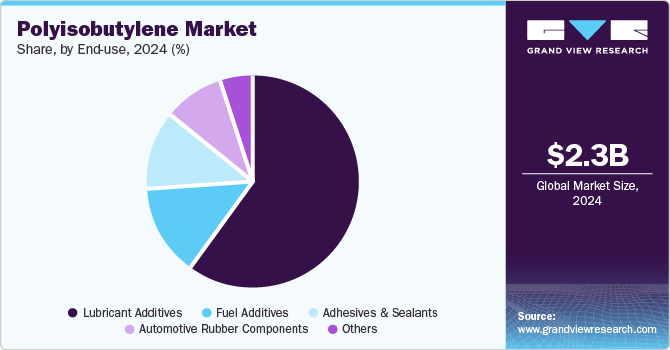

End-use Insights

The lubricant additives segment accounted for the largest revenue share in the global market in 2024. The continued growth of the global automotive sector and the subsequent demand for high-performance engine oils support market expansion. Polyisobutylene (PIB), particularly the high molecular weight (HMW) variant, is widely used in the formulation of lubricant additives due to its unique properties, including high viscosity, oxidation stability, and shear stability. These characteristics make PIB a valuable component in developing various types of lubricants, including engine oils, industrial oils, and hydraulic fluids. PIB helps lubricants maintain their viscosity even under high shear conditions when the lubricant is subjected to forces that cause the fluid to flow easily. This is particularly important in engine oils, where the lubricant must withstand the high shear rates generated by engine components such as pistons and bearings.

The automotive rubber components segment is expected to grow at the fastest CAGR during the forecast period in the polyisobutylene industry. Increasing advancements in the automotive sector and the need to ensure more efficiency in various vehicle components have resulted in the strong growth of this segment. Polyisobutylene has the unique ability to offer flexibility at low temperatures, notable wear resistance, and high gas impermeability, highlighting its use in tire inner liners, particularly in tubeless tires. Moreover, its resistance to chemicals and aging has made it useful in applications such as hoses, seals, and gaskets. PIB further helps reduce rolling resistance in tires, which is important for improving vehicle fuel efficiency. Increasing prioritization of safety features among consumers is another notable factor aiding market expansion, as the product is used in tire rubber formulations to improve wet traction and road grip.

Regional Insights

North America polyisobutylene market accounted for a substantial revenue share in the global market in 2024. The well-established automotive, chemicals, and consumer goods industries in regional economies such as the U.S. and Canada have strongly appealed to this market. Environmental regulations concerning automotive emissions and fuel efficiency are also contributing to PIB demand in North America. As manufacturers seek higher-quality and more efficient fuels and lubricants to meet stringent standards implemented by government authorities, the role of polyisobutylene in improving fuel stability and enhancing performance has become increasingly important. Additionally, polyisobutylene is used in the formulation of environment-friendly, biodegradable lubricants, which aligns with the growing demand for more sustainable and eco-friendly solutions among regional customers.

U.S. Polyisobutylene Market Trends

The U.S. polyisobutylene market accounted for the largest revenue share in the regional polyisobutylene industry in 2024. The demand for this product is majorly generated by the rapidly advancing automotive sector due to the popularity of electric vehicles (EVs) and a noticeable rise in construction activities due to increasing urbanization. The U.S. automotive industry has witnessed a steady growth in automobile production in recent years. Major players in this market are entering into partnerships and collaborations to increase their production output and reach in the country. This has provided a major avenue for chemical and performance material companies to launch innovative products and expand their footprint. The implementation of the Bipartisan Infrastructure Law (BIL), which was signed into effect in November 2021, has provided a significant push to the construction sector. This has resulted in the extensive demand for materials such as polyisobutylene, which are utilized in the manufacturing of adhesives & sealants used in windows and doors.

Asia Pacific Polyisobutylene Market Trends

The Asia Pacific polyisobutylene market accounted for the largest global revenue share of 36.7% in 2024. The demand for polyisobutylene (PIB) has steadily grown in regional economies such as India, China, and Japan, owing to the unique properties that have made it vital for various end-use industries. Polyisobutylene is a high-performance polymer used in a wide range of applications, such as adhesives, sealants, lubricants, automotive products, and rubber production. For instance, the fast pace of expansion of the automotive industry in the region has created substantial demand for polyisobutylene in automotive lubricants and sealants and as an additive in fuel and engine oil for improved performance. The product is also incorporated to enhance the performance of construction materials, making it very popular in the fast-growing construction and infrastructure sectors.

China polyisobutylene market accounted for the largest revenue share in the Asia Pacific PIB market in 2024 and is further expected to maintain its position through 2030. The automotive and construction sectors in the economy are among the largest in the world, which has created significant growth avenues for performance materials such as polyisobutylene. Additionally, the positioning of China as a global leader in petrochemical production aids market expansion, as PIB is used in producing synthetic resins, plasticizers, and other specialty chemicals. Furthermore, it is also used in high-performance lubricants and greases for industrial machinery, contributing to its demand in the country’s heavy manufacturing sectors. China has been investing heavily in expanding its petrochemical production capacity, which is crucial for the availability and cost-effectiveness of polyisobutylene. This expansion is expected to influence industry advancements in the coming years.

Europe Polyisobutylene Market Trends

The European market for polyisobutylene is expected to grow at the highest CAGR during the forecast period, aided primarily by the extensive developments in the automotive sector that have necessitated the widespread use of this product in different application areas. PIB is used in engine oils, lubricants, and fuel additives, where it helps improve viscosity, reduce friction, and increase engine efficiency. Implementing stringent emission regulations by the European Union (EU) and focusing on optimizing fuel efficiency in regional economies continue to act as notable factors driving the demand for high-performance lubricants, further boosting polyisobutylene consumption.

France polyisobutylene market accounted for a substantial revenue share in the European market in 2024, owing to the healthy growth of the country’s construction industry and the well-established personal care and consumer goods sector. Increased government investments in infrastructural projects and positive regional economic development have encouraged the French government to focus on developing affordable housing and sustainable energy infrastructure. The positive outlook in France’s construction industry is expected to propel the demand for PIB-based adhesives, including hot melt adhesives (HMA) that are used to construct doors, windows, and tile insulation. Meanwhile, the product is also used widely in cosmetics and personal care products, including shampoos, conditioners, lotions, and other skincare items. As French consumers increasingly demand high-quality and luxurious personal care products, the use of polyisobutylene in formulations that require smooth textures and stability is steadily rising.

Key Polyisobutylene Company Insights

Some major companies involved in the global polyisobutylene industry include BASF, Daelim, and TPC Group, among others.

-

BASF SE is a multinational chemical company that develops products for various major sectors, including chemicals, plastics, performance products, and agricultural solutions. Under the Fuel and Lubricant Solutions segment of the company’s Automotive & Transportation division, it offers polyisobutenes, brake fluids, fuel performance solutions, aviation fuel additives, and lubricants, among other solutions. BASF is known for its OPPANOL range of PIBs used in the automotive, construction, food packaging, and electrical & electronics industries. The company also produces highly reactive polyisobutene (HR-PIB), which is available in a range of molecular weights and viscosities.

-

TPC Group is an American chemical company involved in developing value-added products derived from petrochemical raw materials, particularly C4 hydrocarbons. The company offers products in CC4 Processing, Butadiene, Butene-1, Polyisobutylene, Isobutylene derivatives, and fuel products. The company manufactures multiple grades of polyisobutylene at its Houston, Texas facility that cater to lubricants, fuel additives, sealants, adhesives, and packaging, among other end-use. Notable products, which provide different properties, include TPC 5130, TPC 5230, TPC 1350, TPC 595, TPC 545, and TPC 175.

Key Polyisobutylene Companies:

The following are the leading companies in the polyisobutylene market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Daelim Co., Ltd.

- TPC Group

- INEOS

- Kothari Petrochemicals Limited

- Braskem

- ENEOS Corporation

- Zhejiang Shunda New Material Co., Ltd.

- Shandong Hongrui New Material Technology Co., Ltd.

- Group of Companies «Titan»

Recent Developments

-

In August 2023, BASF announced that it had increased the production capacity for the company’s medium molecular weight PIBs, which are marketed under the OPPANOL B name, by 25% at its Ludwigshafen facility in Germany. This development aimed to address the rising global demand for premium medium molecular weight polyisobutylene, which is used in application areas such as window sealants, surface protective films, and binder material for batteries.

-

In July 2023, Omsky Kauchuk, part of the Titan Group, announced the commencement of construction of a 10-kiloton polyisobutylene production plant and technical butane processing facility in Omsk. The development of the PIB plant aims to reduce the country’s heavy reliance on imports and leverage Russian technologies to increase production efficiency.

Polyisobutylene Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.41 billion

Revenue forecast in 2030

USD 3.42 billion

Growth rate

CAGR of 7.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in tons, and CAGR from 2025 to 2030

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; France; Italy; China; India; Brazil

Key companies profiled

BASF SE; Daelim Co., Ltd.; TPC Group; INEOS; Kothari Petrochemicals Limited; Braskem; ENEOS Corporation; Zhejiang Shunda New Material Co., Ltd.; Shandong Hongrui New Material Technology Co., Ltd; Group of Companies «Titan»

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyisobutylene Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyisobutylene industry report based on product, end-use, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

High Molecular Weight

-

Medium Molecular Weight

-

Low Molecular Weight

-

-

End-use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Adhesives & Sealants

-

Automotive Rubber Components

-

Fuel Additives

-

Lubricant Additives

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.