- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyisoprene Market Size And Share, Industry Report, 2030GVR Report cover

![Polyisoprene Market Size, Share & Trends Report]()

Polyisoprene Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Tires & Related Products, Latex, Footwear, Non-automotive Engineering, Belts & Hose, Others), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68038-359-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyisoprene Market Size & Trends

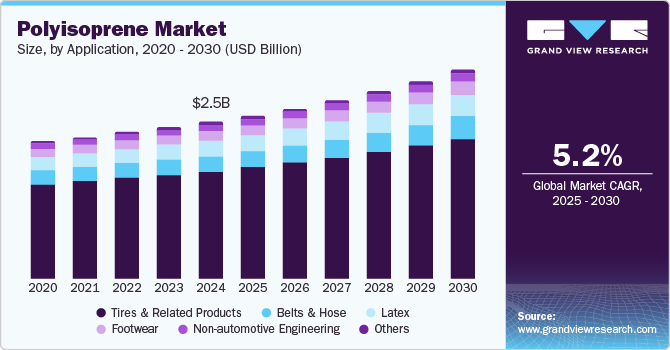

The global polyisoprene market size was valued at USD 2.46 billion in 2024 and is projected to grow at a CAGR of 5.2% from 2025 to 2030. In recent years, continued advancements in end-use sectors such as automotive, consumer goods, and healthcare have led to a sustained demand for polypropylene. With natural rubber production facing various challenges, such as environmental concerns and climate change, polyisoprene offers a viable alternative. Innovations in polyisoprene technology, such as better heat resistance, durability, and elasticity, are expected to further boost its application scope across different sectors during the forecast period.

Polyisoprene offers several useful properties that have proven its utility across major industries. For instance, the material’s biocompatibility has made it ideal for a wide variety of medical applications, including surgical gloves, catheters, and blood bags, among other medical instruments and consumables. Unlike natural rubber, polyisoprene is free from cause latex allergies, making it a preferred choice for medical use. As the market for disposable gloves has significantly surged during and post-COVID period, the consumption of polyisoprene has also witnessed a substantial rise. The material is known for its properties, including stress relaxation, tear resistance, compression set, rebound resilience, and elastic modulus, which can further be enhanced by compounding isoprene with reinforcing fillers, specialty chemicals, plasticizers, and cure systems. Further developments in the medical device segment to address the growing hospital admission rates and improve patient outcomes are expected to influence market expansion in the coming years.

Increasing sales of footwear globally due to the rising population and growing competition among manufacturers presents another notable opportunity for the growth of the polyisoprene industry. The incorporation of this material provides the desired hardness, crystal-clear transparency, mechanical strength, soft touch, and higher levels of abrasion resistance to footwear when compared to traditional thermoplastic elastomer (TPE) soles. Polyisoprene further offers sharp coloring and excellent stability, while its treatment with various sterilization processes results in limited performance deterioration. The material is processed with conventional rubber compounding technology, which enhances its mechanical properties, giving footwear products a notable tensile and tear strength. Such properties enhance product quality, aiding footwear companies in boosting their sales.

Increasingly stringent environmental regulations concerning petrochemical-based materials encourage the use of bio-based polyisoprene. The material offers better recyclability and sustainability benefits compared to other traditional natural rubbers, further enhancing its appeal. Adopting bio-based polyisoprene, produced from renewable feedstock such as bioethanol or sugarcane, results in a reduced carbon footprint and aligns with sustainability goals, which has helped boost its demand across different verticals. Additionally, innovations in polymerization technologies, such as living polymerization or anionic polymerization, have allowed manufacturers to produce polyisoprene with more control over its molecular weight and structure. These improvements result in more consistent and higher-quality materials for various applications, including tires and medical devices.

Application Insights

The tires & related products segment accounted for the largest revenue share of 67.8% in 2024 in the global polyisoprene industry. The increasing global vehicle production rates and technological advancements in various components, including tires, have been major drivers for segment growth. Polyisoprene plays a significant role in tire manufacturing due to its excellent properties, which make it a suitable material for making the tread compound. The use of this material in tires is driven by its ability to provide improved performance in terms of durability, traction, comfort, and fuel efficiency. The high abrasion resistance offered by polyisoprene makes it an ideal material for the tread of tires, which remains constantly in contact with the road surface. This property helps extend the tire's lifespan and reduces the frequency of replacements, thus contributing to cost-effectiveness.

The latex segment is expected to advance at the fastest CAGR during the forecast period in the polyisoprene industry. Increasing awareness and concerns regarding latex allergies among consumers and healthcare professionals have heightened the demand for latex-free products, driving the use of polyisoprene-based solutions. Natural rubber latex contains proteins that can cause allergic reactions; however, polyisoprene is free from these proteins, making it a safer option for medical personnel and patients. The extensive use of latex in the medical and consumer goods sector has highlighted polyisoprene as a notable alternative owing to its elasticity, biocompatibility, and hypoallergenic characteristics. Commonly used items such as rubber bands and balloons also use this material due to its high elasticity and stretchability, which aided market growth through this application segment.

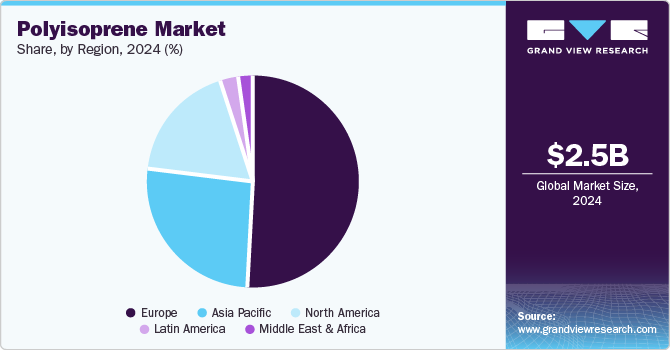

Regional Insights

North America accounted for a substantial revenue share in the global polyisoprene industry in 2024. The fast pace of advancements in major end-use industries, including automotive, construction, and medical, has created a healthy market demand for this material. Polyisoprene is widely known for its versatility and sustainability, which has further driven its usage scope in new applications for regional manufacturers. The well-established medical industry in the U.S. and Canada has provided further growth opportunities to this market, as polyisoprene is used in manufacturing medical devices, including injection closures and prosthetics used in orthopedics.

U.S. Polyisoprene Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024, as polyisoprene finds extensive usage in the economy’s automotive and medical industries, boosting its production and distribution. Moreover, the shift toward bio-based materials is driven by increasing awareness of the environmental impact of natural rubber latex and the need to reduce carbon footprint in these sectors, further supporting market expansion in the economy. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the Occupational Safety and Health Administration (OSHA) have implemented specific guidelines that promote latex-free materials, further shaping the demand for polyisoprene, particularly in healthcare products.

Europe Polyisoprene Market Trends

The Europe polyisoprene market accounted for the largest global revenue share of 50.9% in 2024 due to the widespread use of this material in various notable application areas in major economies. The region continues to be a leading consumer of polyisoprene-based medical gloves, especially due to concerns over latex allergies among healthcare professionals. Polyisoprene offers hypoallergenic alternatives to natural rubber latex, making it a preferred choice in healthcare settings. Furthermore, increasing health consciousness among regional consumers has driven the use of latex-free alternatives in products, including condoms and footwear, which further drives market advancements.

Germany accounted for a substantial revenue share in the regional market in 2024, owing to the substantial product demand in well-established verticals such as automotive and healthcare. The country is home to major automotive manufacturers, including Volkswagen, BMW, and Mercedes-Benz, which has resulted in a constant demand for high-performance tires. The rapidly expanding use of premium-quality and safe personal protective equipment (PPE), including medical gloves, has further strengthened market developments with regard to polyisoprene in the economy.

Asia Pacific Polyisoprene Market Trends

The Asia Pacific region is expected to witness the fastest CAGR in the global market for polyisoprene from 2025 to 2030. The improving healthcare infrastructure in economies such as India and China has highlighted the need for high-quality medical devices and components in hospitals and clinics. The demand for polyisoprene is expected to be driven by its extensive usage in the medical sector for manufacturing medical fluid transport tubing, surgical tubing, and other consumable products. The fast-growing fashion and sportswear industry has further helped strengthen polyisoprene demand, as polyisoprene is extensively used for shoe soles, insoles, and other footwear components.

China accounted for the largest revenue share in the Asia Pacific market for isoprene in 2024. The country is a major global producer and consumer of vehicles, with a CEIC report stating that motor vehicle production stood at around 30.2 million in December 2023, an increase of over 3 million from December 2022. This has subsequently driven the production volume of components such as tires, creating growth avenues for polyisoprene manufacturers and suppliers. Furthermore, the economy's electric vehicle (EV) market is expanding rapidly, with government support and consumer demand for eco-friendly vehicles providing significant traction to this sector. Polyisoprene plays an essential role in developing low-rolling resistance tires for EVs, which require sustainable tire materials.

Key Polyisoprene Company Insights

Some major companies involved in the global polyisoprene industry include The Goodyear Tire & Rubber Company, ZEON CORPORATION, and JSR Corporation, among others.

-

The Goodyear Tire & Rubber Company is a U.S.-based organization involved in developing and manufacturing tires for commercial and personal vehicles, as well as off-the-road vehicles, aircraft, and racing cars. The company has a wide range of products, including the BUDENE polybutadiene rubber, the SLF solution styrene butadiene rubber, and the Natsyn isoprene rubber. The Natsyn range includes offerings such as Natsyn 2200, Natsyn 2210, Natsyn 2205, Natsyn RNS 7597, and Natsyn RNS 5726A. These products cater to various applications such as medical gloves, industrial seals and gaskets, adhesives, automotive tires, and consumer goods such as footwear and condoms.

-

Zeon Corporation is a Japanese chemicals manufacturer specializing in developing synthetic rubber and specialty materials. The company has several business divisions, including synthetic rubbers, chemicals, aroma chemicals, specialty chemicals, energy materials, plastic films, and medical products. These solutions serve a range of industries, including transportation, electronics, telecommunication, civil and architecture, lifestyle products, and industrial applications. Zeon offers polyisoprene rubber as part of its synthetic rubber portfolio, with the main products being the Nipol IR2200 and its low Mooney grade variant, the Nipol IR2200L.

Key Polyisoprene Companies:

The following are the leading companies in the polyisoprene market. These companies collectively hold the largest market share and dictate industry trends.

- The Goodyear Tire & Rubber Company

- KURARAY CO., LTD.

- Kent Elastomer Products

- Minnesota Rubber & Plastics

- ZEON CORPORATION

- JSR Corporation

- SIBUR Holding PJSC

Recent Developments

-

In October 2023, Goodyear Tire & Rubber Company announced its collaboration with Visolis, a sustainable technology company. The partnership aims to produce isoprene by upcycling bio-based materials. This collaboration leveraged Visolis's technology, which converts waste materials into monomers, to manufacture premium-quality isoprene using lignocellulosic feedstocks, which are non-edible biomass and agricultural materials.

-

In April 2023, Kuraray Co., Ltd. announced the initiation of operations at its new Thailand-based plant for the company’s isoprene-related business. The new facility has been built to address the rising consumer demand for various materials, including the heat-resistant polyamide resin PA9T (Genestar) that is developed using the company’s proprietary technology, the hydrogenated styrenic elastomer HSBC (SEPTON), and the isobutylene derivative MPD (3-methyl-1,5-pentanediol).

Polyisoprene Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.56 billion

Revenue forecast in 2030

USD 3.29 billion

Growth rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Germany; China; India; Japan

Key companies profiled

The Goodyear Tire & Rubber Company; KURARAY CO., LTD.; Kent Elastomer Products; Minnesota Rubber & Plastics; ZEON CORPORATION; JSR Corporation; SIBUR Holding PJSC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyisoprene Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyisoprene market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Tires & Related Products

-

Latex

-

Footwear

-

Non-automotive Engineering

-

Belts & Hose

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Europe

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.