- Home

- »

- Green Building Materials

- »

-

Polymer Concrete Market Size, Share, Industry Report, 2030GVR Report cover

![Polymer Concrete Market Size, Share & Trends Report]()

Polymer Concrete Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Polymer Impregnated Concrete, Polymer Cement Concrete, Polymer Resin Concrete), By End-use (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-451-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polymer Concrete Market Summary

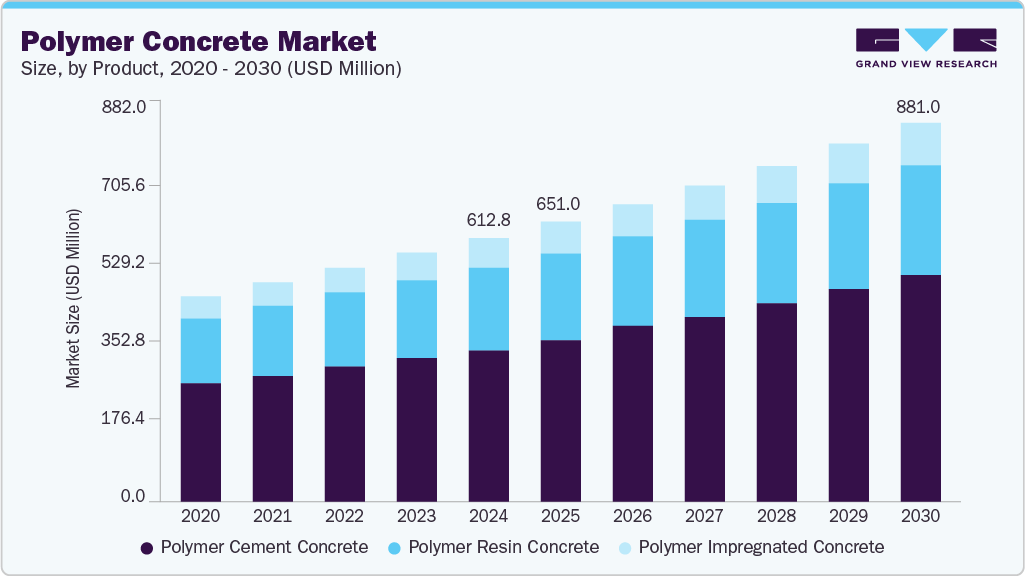

The global polymer concrete market size was estimated at USD 612.8 million in 2024 and is projected to reach USD 881.0 million by 2030, growing at a CAGR of 6.2% from 2025 to 2030. This growth is attributed to the rapid urbanization and industrialization, particularly in emerging markets, which are driving demand for durable infrastructure.

Key Market Trends & Insights

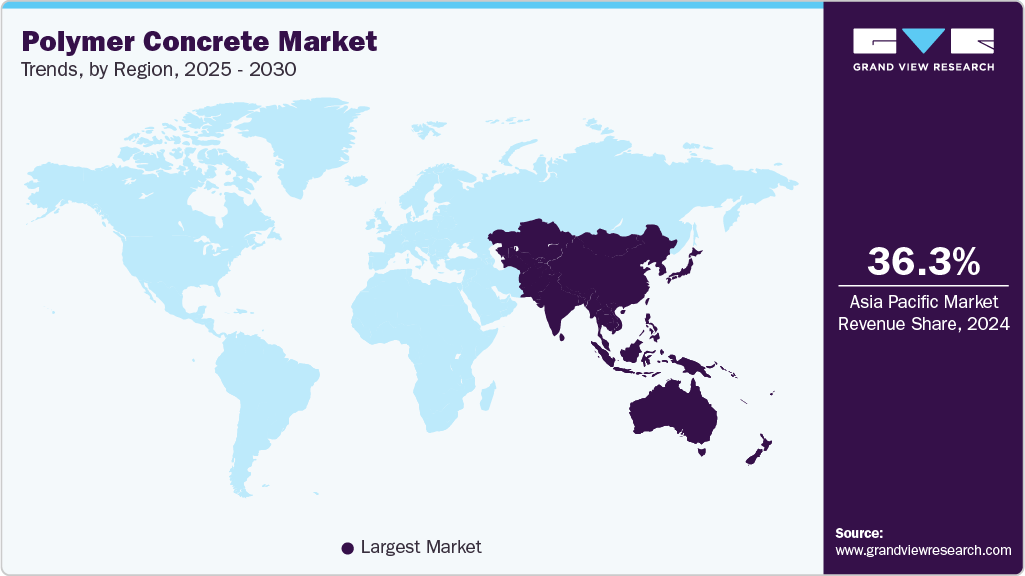

- Asia Pacific polymer concrete market held the largest market revenue share of 36.3% in 2024, driven by rapid urbanization, industrialization, and infrastructure development.

- The U.S. polymer concrete market accounted for the largest market revenue share in 2024 and is expected to grow at a significant CAGR over the forecast period.

- By product, the polymer cement concrete segment dominated the market in 2024, accounting for the largest revenue share of 57.7%.

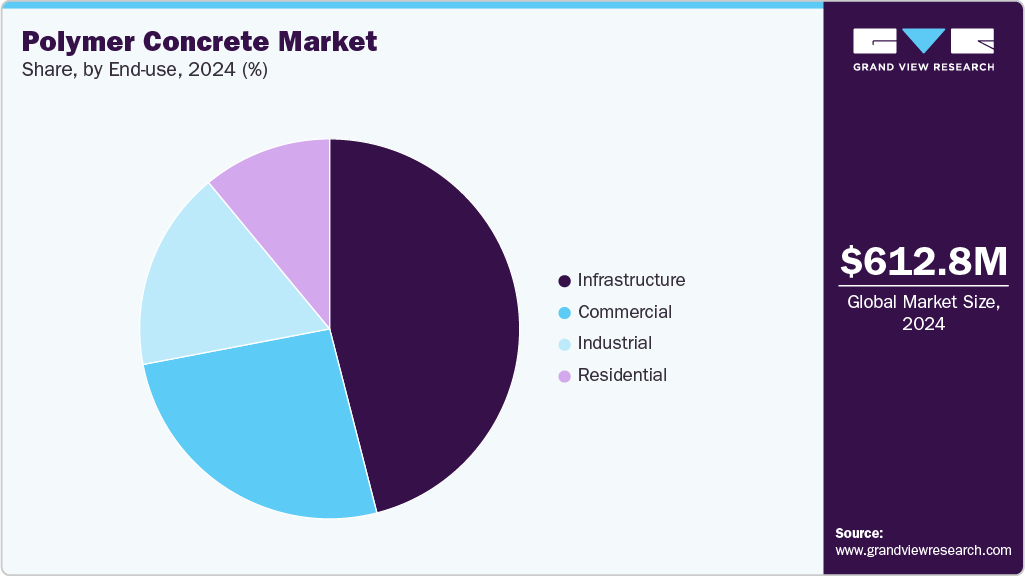

- By end-use, the infrastructure segment led the market in 2024 with the largest revenue share.

Market Size & Forecast

- 2024 Market Size: USD 612.8 Million

- 2030 Projected Market Size: USD 881.0 Million

- CAGR (2025-2030): 6.2%

- Asia Pacific: Largest market in 2024

Governments are investing heavily in roads, bridges, tunnels, airports, and power plants, which require materials that can withstand harsh environmental conditions and have long service lives, such as polymer concrete. This material possesses excellent durability, high strength, and chemical resistance, on account of which it is increasingly preferred for these applications.Polymer concrete is highly resistant to corrosive chemicals, making it ideal for chemical processing, wastewater treatment, and oil and gas industries. It performs well in environments where traditional materials fail, including marine settings and areas exposed to harsh chemicals. This material offers high compressive and tensile strength, strong bonding with reinforcements, and low water permeability. As a result, it is commonly used in flooring, pipes, tanks, and other industrial applications that require durability under heavy mechanical loads.

The growing number of industrial facilities, particularly in emerging economies, is a key driver of market growth. In addition, developed regions like North America and Europe face aging infrastructure. Polymer concrete, known for its superior durability over traditional materials, is used to repair and rehabilitate bridges, highways, and public utilities because it requires less maintenance and delivers longer-lasting results.

Raw materials for polymer concrete, such as synthetic resins, are more expensive than those used in traditional concrete, like Portland cement. This raises the overall cost, making polymer concrete less suitable for projects with limited budgets. In addition, its manufacturing process is more complex, requiring precise formulation and quality control, which further increases costs. Consequently, polymer concrete is mainly used in high-performance applications where the extra expense is justified.

As sustainability becomes a priority in construction, polymer concrete offers benefits in durability and reduced maintenance, supporting long-lasting and environmentally friendly building goals. Its longer lifespan compared to traditional materials helps lower the environmental impact of repairs and replacements. This has led to increased use in energy-efficient and green-certified buildings, as it helps reduce carbon footprints by minimizing the need for replacement. This trend creates new opportunities as developers and governments increasingly adopt sustainable building practices.

Product Insights

The polymer cement concrete segment dominated the market in 2024, accounting for the largest revenue share of 57.7%, and is expected to grow at a significant CAGR during the forecast period. This product is widely used in repair, renovation, and new construction projects due to its versatility and cost-effectiveness. It offers superior adhesion to various surfaces, making it ideal for repair and overlay applications. The addition of polymers improves bonding between old and new surfaces.

Polymer cement concrete provides high compressive, tensile, and flexural strength compared to traditional concrete and other polymer concrete types, making it suitable for heavy-duty structural uses. It also reaches full strength within hours, significantly reducing downtime in construction or repair, which is a major advantage for time-sensitive projects. This product is preferred in high-performance applications where exceptional strength, durability, and chemical resistance are essential.

End-use Insights

The infrastructure segment led the market in 2024 with the largest revenue share. This sector is the biggest consumer of polymer concrete, driven by the demand for durable, low-maintenance materials in public works projects. Governments and municipalities use polymer concrete in key infrastructure applications such as bridges, overpasses, roads, and highways. These projects require materials that can last for decades with minimal upkeep, and polymer concrete offers a longer lifespan and greater resistance to environmental damage compared to traditional concrete.

In the commercial sector, polymer concrete is widely used in projects such as retail centres, office buildings, hotels, and hospitals. Its superior performance makes it ideal for areas with heavy foot traffic, wear and tear, and chemical exposure. In addition, the material’s ability to be moulded into various designs is highly valued in commercial architecture, especially for hotels and office buildings that require attractive exteriors and interiors.

Regional Insights

The North America polymer concrete market is expected to grow at a significant CAGR over the forecast period, considering several key trends, including aging infrastructure, industrial growth, and environmental regulations. Growing awareness of environmental sustainability and stricter regulations regarding water management and pollution control are driving adoption of polymer concrete in applications such as drainage systems, sewer infrastructure, and water treatment plants in region.

U.S. Polymer Concrete Market Trends

The U.S. polymer concrete market accounted for the largest market revenue share in 2024 and is expected to grow at a significant CAGR over the forecast period. The country faces substantial aging infrastructure challenges, including deteriorating bridges, highways, water treatment plants, and sewage systems. The need for durable and low-maintenance materials in repairing and modernizing these structures is driving demand for polymer concrete in the country.

Europe Polymer Concrete Market Trends

The Europe polymer concrete market is anticipated to grow at the significant CAGR from 2025 to 2030. The region's emphasis on sustainable development, green building practices, and infrastructure renovation is primarily fueling the market's growth. The material's long lifespan, low maintenance requirements, and resistance to chemicals make it a sustainable option for infrastructure and building projects.

Asia Pacific Polymer Concrete Market Trends

Asia Pacific polymer concrete market held the largest market revenue share of 36.3% in 2024, driven by rapid urbanization, industrialization, and infrastructure development. Governments in countries like China and India heavily invest in large-scale infrastructure projects such as bridges, highways, tunnels, and water treatment plants. The rapid urban growth is also fueling smart city and advanced infrastructure initiatives, which increase demand for polymer concrete. In addition, rising awareness of environmental sustainability supports its use in sewer systems, drainage, and water treatment facilities. These factors collectively contribute to strong market growth in Asia Pacific.

Key Polymer Concrete Company Insights

Some key players operating in the market include BASF SE, Sika AG, Interplastic Corporation, and Dudick, Inc. Key players are undertaking several strategic initiatives, such as product launches, geographical expansions, mergers and acquisitions, and others in emerging and economically favorable regions.

-

BASF SE is engaged in the manufacturing and distribution of chemicals and related products throughout the world. It operates in several industries including chemicals, materials, industrial solutions, surface technologies, nutrition & care, and agricultural solutions.

-

Sika AG is a manufacturer and supplier of specialty chemicals. It manufactures products targeting markets including concrete, waterproofing, roofing, flooring, sealing & bonding, refurbishment, and industrial.

Key Polymer Concrete Companies:

The following are the leading companies in the polymer concrete market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SEpolymer concrete market

- Sika AG

- Interplastic Corporation

- Dudick Inc.

- Forté Composites, Inc.

- ULMA Architectural Solutions

- Lidco Building Technologies

- Kwik Bond Polymers, LLC

- ErgonArmor

- TPP Manufacturing Sdn. Bhd.

Recent Developments

-

In February 2025, Dar Alwd presented its advanced polymer concrete solutions at MOEI Innovation Week in Dubai, strengthening its position in sustainable infrastructure development.

-

In April 2024, Sika AG acquired a concrete polymer company, named Kwik Bond Polymers, LLC. This acquisition is expected to help Sika AG’s system, which works on refurbishing concrete structures.

Polymer Concrete Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 651.0 million

Revenue forecast in 2030

USD 881.0 million

Growth Rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Spain; Italy; China; Japan; South Korea; India; Brazil; Argentina

Key companies profiled

BASF SE; Sika AG; Interplastic Corporation; Dudick Inc.; Forté Composites, Inc.; ULMA Architectural Solutions; Lidco Building Technologies; Kwik Bond Polymers, LLC; ErgonArmor; TPP Manufacturing Sdn. Bhd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polymer Concrete Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polymer concrete industry report based on product, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymer Impregnated Concrete

-

Polymer Cement Concrete

-

Polymer Resin Concrete

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Infrastructure

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa (Middle East Africa)

-

Frequently Asked Questions About This Report

b. The global polymer concrete market size was estimated at USD 576.8 billion in 2023 and is expected to reach USD 612.8 billion in 2024.

b. The global polymer concrete market is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2030 to reach USD 881.0 billion by 2030.

b. Polymer cement concrete product type accounted for the largest revenue share of over 57.4% in 2023 owing to its broad range of applications, cost-effectiveness, and ease of use in both repair and new construction.

b. Some key players operating in the polymer concrete market include BASF SE, Sika AG, Interplastic Corporation, Dudick Inc., Forté Composites, ULMA Architectural Solutions, Lidco Building Technologies, Kwik Bond Polymers, LLC, and ErgonArmor.

b. The key factors that are driving the market growth is the rapid urbanization and industrialization, particularly in emerging markets, which are driving demand for durable infrastructure and material such as polymer concrete.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.