- Home

- »

- Catalysts & Enzymes

- »

-

Polymerization Initiators Market Size And Share Report, 2030GVR Report cover

![Polymerization Initiators Market Size, Share & Trends Report]()

Polymerization Initiators Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Persulfate, Peroxide, Azo compounds), By Application (Polyethylene, Polypropylene, Polystyrene), By Region And Segment Forecasts

- Report ID: GVR-4-68040-361-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polymerization Initiators Market Trends

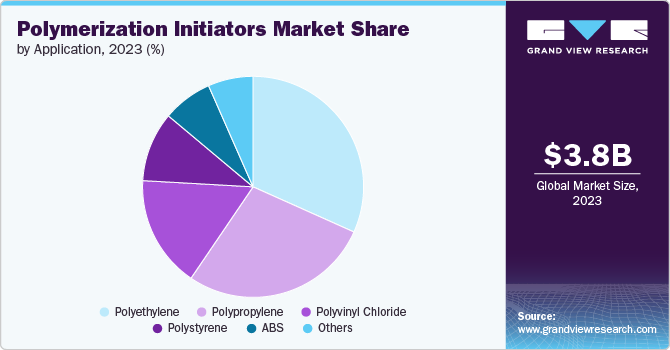

The global polymerization initiators market size was estimated at USD 3.80 billion in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. The increasing need for advanced materials with enhanced properties, such as durability, flexibility, and heat resistance, has fueled the demand for polymerization initiators. This demand is driving the expansion of the market, particularly in sectors such as automotive, electronics, and packaging. The increasing consumer inclination towards the usage of peroxide-based polymerization initiators for better efficiency, durability, and quality of end products is a driving factor for market growth. Additionally, the rising demand for polymerization initiators in the production of thermoplastics and the increasing market share of biodegradable plastics have fueled the growth in demand.

The growing investment in research and development to advance polymerization processes, coupled with the increasing production of polymers, is a significant driver for the demand for polymerization initiators. This trend is contributing to increased market penetration and is expected to drive market growth due to the growing sales from various end-use industries such as automotive, construction, and food processing.

The rising demand for polymers in various sectors such as healthcare, automotive, packaging, fashion, and sports is a key driver for the polymerization initiator market. This includes the increasing demand for polymers in the automotive sector to manufacture tires, interiors and exterior components, bumpers, and wheel covers, among other.

The expanding demand for lightweight materials in the automotive industry, increasing construction activities, and rising consumption of plastics are driving the demand for polymerization initiators across the globe. Furthermore, the focus on technological advancements and innovation in regions such as Asia Pacific is propelling the demand for polymerization initiators

Type Insights

The persulfate type segment dominated the market with a revenue share of 32.67% in 2023 owing to the several factors, including its extensive use in various industries such as polymer, electronics, cosmetics, personal care, pulp and paper, textiles, water treatment, oil and gas, and soil remediation. Additionally, the rise in the demand for cosmetics products globally is expected to contribute to the growth of the persulfates market, further solidifying the dominance of the sodium persulfate segment.

The demand for peroxides in polymerization initiators is driven by their crucial role as radical initiators in the polymer industry. Peroxides, such as organic peroxides, are widely used as initiators in the polymerization process, particularly in the manufacturing of plastics, rubber, and coatings. They play a vital role in initiating free radicals and controlled crosslinking in various polymers, contributing to the production of a wide range of polymer products.

The demand for azo compounds in polymerization initiators is significant due to their widespread use as free radical initiators in various polymerization processes. Azo compounds, such as 2,2'-azobis (isobutyronitrile) (AIBN), are widely employed as thermal initiators in free radical polymerization reactions.

Application Insights

The polyethylene segment dominated the market with a revenue share of 31.7in 2023 owing to the fact that polyethylene is commonly used in polymerization initiators, particularly in the context of free radical polymerization. In high-pressure free radical polymerization processes, low-density polyethylene (LDPE) is particularly important for the manufacture of engineering and commodity plastics. The use of polyethylene in polymerization initiators extends to diverse applications, including the production of engineering plastics and commodity plastics. Additionally, polyethylene's role in the initiation phase of free radical polymerization processes contributes to the synthesis of various polymers used in different industries.

In the context of free radical polymerization, polypropylene can be involved in the initiation phase, which is the first step of the polymerization process where an active center is created from which a polymer chain is generated. Free radicals, which are formed by various mechanisms involving separate initiator molecules, can initiate the polymerization process. This type of initiation is especially useful for coating metal surfaces with polymer films.

Polypropylene's usage in polymerization initiators is significant in the market, as evidenced by the global polymerization initiator market report, which highlights the use of polypropylene in the polymerization initiator market segmentations. The report also indicates the increasing use of polymers such as polypropylene in the healthcare sector for packaging medical liquids and manufacturing, underscoring the diverse applications of polypropylene in polymerization initiators.

Polyvinyl chloride (PVC) is utilized in the polymerization process through the use of initiators, particularly in the context of free radical polymerization. The addition polymerization of chloroethene to produce poly(chloroethene) proceeds by a free-radical mechanism. In the industrial preparation of polyvinyl chloride, a free radical is used to initiate the chain reaction. Organic peroxides with the general formula R-O-O-R are often used as initiators because they can split into free radicals at elevated temperatures. These initiators play a crucial role in the polymerization process, allowing the formation of a very large polyvinyl chloride molecule.

Region Insight

North America is witnessing a growing demand for lightweight materials in the automotive industry, which is driving the market growth for polymerization initiators. This trend aligns with the industry's focus on developing materials that contribute to lightweight and fuel-efficient vehicles.

Asia Pacific Polymerization Initiators Market Trends

Asia Pacific is the largest consumer and producer of polymerization initiators, with over 20 countries housing prominent manufacturing companies of polymerization initiators. Notably, China, Japan, and India are key locations where most suppliers are situated, reflecting the region's significant influence on the global market.

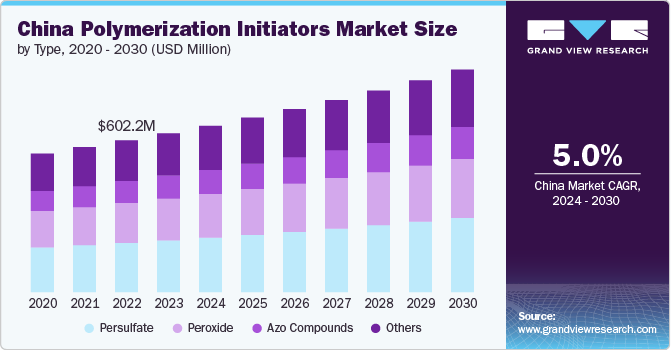

The polymerization initiators market in China plays a pivotal role in the market, being one of the largest consumers and producers of polymerization initiators in the Asia Pacific region. The abundant supply of raw materials and lower costs in China are projected to boost the sales of the commercial and industrial sectors, thereby driving market growth in the region.

Europe Polymerization Initiators Market Trends

There is a notable trend towards a rising preference for bio-based and green initiators in the polymerization initiator market. This shift aligns with global efforts to reduce the environmental footprint of the industry.

Key Polymerization Initiators Company Insights

Some of the key players operating in the market include Arkema S.A, LANXESS AG, BASF SE, Lyondellbasell Industries, Akzonobel, Celanese Corporation, United Initiators, Adeka Corporation, Akkim Kimya, Nouryon.

-

Arkema SA is a global company that specializes in the production of specialty chemicals, advanced materials, and coating solutions. The company is headquartered in Colombes, France, and operates in over 55 countries worldwide. Arkema's products find applications in diverse sectors such as transportation, oil extraction, renewable energies, consumer goods, electronics, construction, coatings, water treatment, and more.

-

LANXESS AG is a prominent player in the specialty chemicals industry, with a focus on the development, manufacturing, and marketing of a diverse range of products including plastics, rubber, intermediates, and specialty chemicals. The company operates globally, with a presence in Europe, Asia Pacific, Latin America, and North America.

Key Polymerization Initiators Companies:

The following are the leading companies in the polymerization initiators market. These companies collectively hold the largest market share and dictate industry trends.

- Arkema S.A

- LANXESS AG

- BASF SE

- Lyondellbasell Industries

- Akzonobel

- Celanese Corporation

- United Initiators

- Adeka Corporation

- Akkim Kimya

- Nouryon

Recent Developments

-

In January 2024, Nouryon has recently completed an expansion of nearly 50% of its production capacity for Levasil colloidal silica products at its Green Bay, Wisconsin facility in the United States. This expansion is a response to the increasing demand for these crucial components across various applications.

-

In May 2024, Arkema has acquired Dow's flexible packaging laminating adhesives business. This acquisition is expected to generate annual sales of around USD 250 million for Arkema and expand its portfolio of solutions for flexible packaging, aligning with the company's strategy to offer innovative products with high technological content and continue to grow in the attractive adhesives segment

-

In December 2023, In a move to enhance its offerings in high-performance polymers, the France-based company Arkema acquired a majority stake in PI Advanced Materials in June 2023. This acquisition, valued at USD 797 million, will result in the full integration of PI Advanced Materials into Arkema's operations.

Polymerization Initiators Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.96 billion

Revenue forecast in 2030

USD 5.12 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa, Saudi Arabia

Key companies profiled

Arkema S.A; LANXESS AG; BASF SE; Lyondellbasell Industries; Akzonobel; Celanese Corporation; United Initiators; Adeka Corporation; Akkim Kimya; Nouryon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polymerization Initiators Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polymerization initiators market report based on type, application, region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Persulfate

-

Peroxides

-

Azo Compounds

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene

-

Polypropylene

-

Polyvinyl Chloride

-

Polystyrene

-

ABS (Acrylonitrile Butadiene Styrene)

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polymerization initiators market was valued at USD 3.80 billion in 2023 and is projected to reach USD 3.96 billion by 2024

b. The global polymerization initiators market was valued at USD 3.80 billion in 2023 and is projected to reach USD 5.12 billion by 2030, growing at a CAGR of 4.4% from 2024 to 2030.

b. Asia Pacific dominated the polymerization initiators market with a share of 26.7% in 2019.Asia Pacific is the largest consumer and producer of polymerization initiators, with over 20 countries housing prominent manufacturing companies of polymerization initiators. Notably, China, Japan, and India are key locations where most suppliers are situated, reflecting the region's significant influence on the global market.

b. Some key players operating in the polymerization initiators market include Arkema S.A, LANXESS AG, BASF SE, Lyondellbasell Industries, Akzonobel, Celanese Corporation, United Initiators, Adeka Corporation, Akkim Kimya, Nouryon.

b. Key factors that are driving the market growth include the increasing need for advanced materials with enhanced properties, such as durability, flexibility, and heat resistance, has fueled the demand for polymerization initiators.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.