- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyolefin Compounds Market Size, Industry Report, 2033GVR Report cover

![Polyolefin Compounds Market Size, Share & Trends Report]()

Polyolefin Compounds Market (2025 - 2033 ) Size, Share & Trends Analysis Report By Polymer Type (PP Compounds, PE Compounds, Recycled Polyolefin Compounds), By Application (Automotive, Packaging, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-667-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyolefin Compounds Market Summary

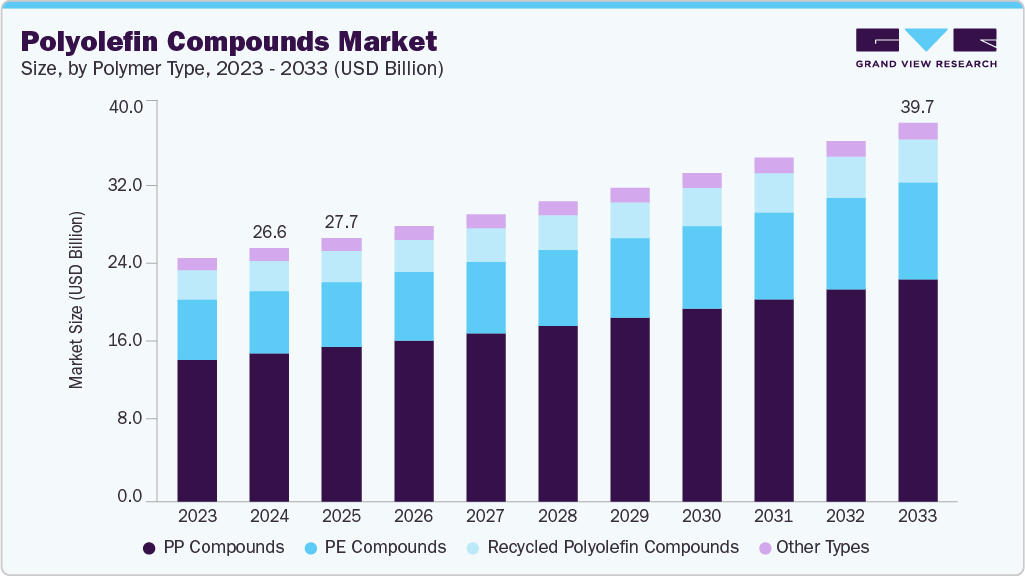

The global polyolefin compounds market size was estimated at USD 26.59 billion in 2024 and is projected to reach USD 39.70 billionby 2033, growing at a CAGR of 4.6% from 2025 to 2033. The rapid expansion of the electrical and electronics sector is driving demand for compounds that offer enhanced electrical insulation and fire safety performance.

Key Market Trends & Insights

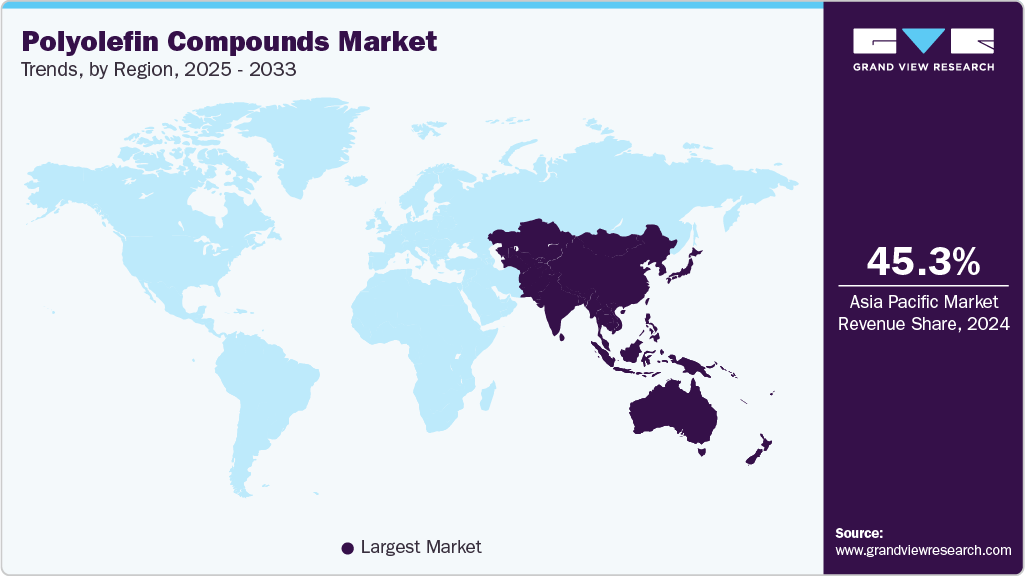

- Asia Pacific dominated the polyolefin compounds market with the largest revenue share of 45.31% in 2024.

- China polyolefin compounds market is expected to grow significantly during the forecast period.

- By polymer type, the PE compounds segment is expected to grow at the fastest CAGR of 5.0% from 2025 to 2033 in terms of revenue.

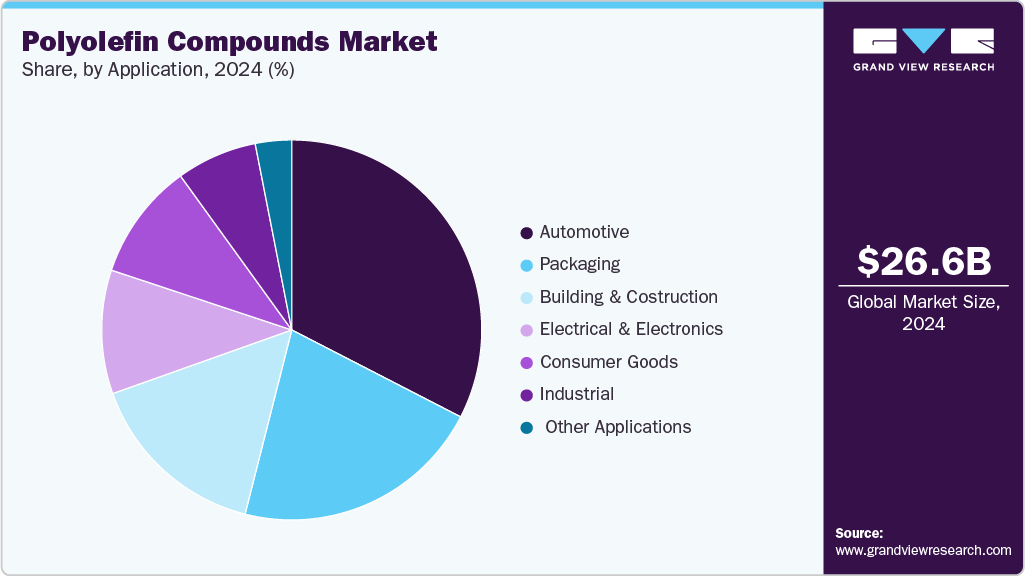

- By application, the packaging segment is expected to grow at fastest CAGR of 5.1% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 26.59 billion

- 2033 Projected Market Size: USD 39.70 billion

- CAGR (2025-2033): 4.6%

- Asia Pacific: Largest market in 2024

Manufacturers rely on these materials to produce reliable and lightweight components for consumer devices and wiring applications. The polyolefin compounds market is witnessing a shift toward high performance formulations that balance mechanical strength with lightweight characteristics. Manufacturers are increasingly incorporating advanced fillers and functional additives to meet the exacting specifications of end‑use industries. Sustainability considerations are also influencing formulation strategies as stakeholders seek materials with lower carbon footprints. This trend reflects a broader industry move toward customized solutions that deliver both technical excellence and environmental stewardship.

Drivers, Opportunities & Restraints

Rapid growth in the automotive and packaging sectors is propelling demand for polyolefin compounds. Original equipment manufacturers are focused on reducing vehicle weight to improve fuel efficiency and electric vehicle range, driving adoption of reinforced and modified polyolefins. In the packaging arena, the need for superior barrier properties and impact resistance in applications such as food and medical packaging further boosts market uptake. Regulatory pressures to curb single‑use plastics are also incentivizing the development of advanced compound formulations.

There is a significant opportunity in bio‑based and circular economy applications for polyolefin compounds. Companies that invest in feedstock innovations such as bio‑ethanol derivatives or chemically recycled monomers can differentiate their offerings. Collaboration along the value chain to establish take‑back and recycling schemes can unlock new revenue streams and strengthen sustainability credentials. By positioning compounds as part of an integrated lifecycle solution, manufacturers can tap into growing customer demand for traceable and eco‑conscious materials.

Volatility in crude oil prices continues to pose challenges for polyolefin compound producers, as feedstock costs directly impact margin stability. Supply chain disruptions, whether from logistical bottlenecks or geopolitical events, can lead to raw material shortages and production delays.

Market Concentration & Characteristics

The market growth stage of the polyolefin compounds market is medium, and the pace is accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companies like LyondellBasell Industries N.V., SABIC, Borealis AG, Dow Inc., ExxonMobil Chemical, Mitsui Chemicals, Inc., Braskem, Ravago Group, Avient Corporation, RTP Company, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and application to meet evolving industry demands.

In many enduse applications, engineering thermoplastics such as polypropylene alloys, polyamide blends, and PVC compete directly with polyolefin compounds. These alternative polymers often offer superior heat resistance or chemical compatibility, prompting manufacturers to weigh performance benefits against cost differences. Natural fiber composites and bio‑resins are also gaining traction as eco‑friendly options. As a result, compound producers must continuously innovate to maintain competitive advantage in terms of both technical

Stringent environmental regulations and circular economy mandates are reshaping the polyolefin compounds landscape. Governments worldwide now enforce minimum recycled content thresholds and levy taxes on virgin plastic production. Producers face growing pressure to document material traceability and reduce carbon footprints across their supply chains. Compliance requirements drive investment in advanced sorting and compounding technologies, while nonconformity risks fines and reputational damage.

Polymer Type Insights

PP compounds dominated the polyolefin compounds market across the polymer type segmentation in terms of revenue, accounting for a market share of 58.44% in 2024, driven by the need for robust, cost‑effective materials in high‑volume applications. Their excellent balance of stiffness, chemical resistance, and processability makes them ideal for consumer electronics housings and household appliances. Recent advances in mineral‑fill technologies have further enhanced dimensional stability under thermal stress. As a result, manufacturers continue to favor PP compounds to meet stringent performance requirements while controlling production costs.

The PE compounds segment is anticipated to grow at a significant CAGR of 5.0% through the forecast period. A key factor fueling the rapid growth of polyethylene compounds is their versatility in flexible applications and emerging infrastructure projects. Innovations in cross‑linking and graft‑polymerization have significantly improved impact strength and environmental stress crack resistance. This makes PE compounds highly attractive for corrosion‑resistant piping and durable wire and cable insulation. The material’s recyclability and compatibility with bio‑based additives also underpin its accelerated adoption.

Application Insights

Automotive led the polyolefin compounds market across the application segmentation in terms of revenue, accounting for a market share of 32.71% in 2024. Rigorous emissions standards and electrification trends are compelling OEMs to cut vehicle weight without sacrificing safety. Polyolefin compounds, particularly reinforced PP and PE blends, offer an optimal mix of lightness and energy‑absorption properties.

Their integration into bumpers, interior trims, and under‑the‑hood components enables improved crash performance while boosting overall vehicle efficiency. Consequently, polyolefin compounds command the largest share of automotive polymer demand today.

The packaging segment is expected to expand at a substantial CAGR of 5.1% through the forecast period. The explosion of e-commerce and heightened consumer expectations for product protection have driven demand for engineered polyolefin compounds. High‑viscosity PE blends and specialized PP formulations deliver superior toughness in stretch films, caps, and closures.

Meanwhile, innovations in multi-layer co-extrusion allow manufacturers to create lightweight structures with enhanced barrier performance. These capabilities have positioned packaging as the fastest-growing application segment in the polyolefin compounds market.

Regional Insights

Asia Pacific held the largest share of 45.31% in terms of revenue of the polyolefin compounds market in 2024 and was the fastest growing market. Rapid urbanization and industrialization across Asia Pacific are creating vast opportunities for polyolefin compounds in construction materials, electrical infrastructure, and consumer electronics. Governments in several countries are prioritizing renewable energy and smart grid projects, which require reliable insulation and protective components. In addition, the booming e‑commerce market is driving a surge in demand for compounds that enhance the performance and durability of flexible packaging solutions.

China polyolefin compounds marketis expected to grow significantly during the forecast period. China’s strategic focus on new energy vehicles under its Dual‑Carbon goals is spurring large‑scale adoption of lightweight polyolefin compounds in battery casings and interior modules. The nation’s expansive e‑commerce and cold chain logistics sectors also rely on high‑barrier compounds for temperature‑controlled packaging. Local capacity expansions by leading compounders are supported by government incentives aimed at reducing carbon intensity and fostering domestic innovation in materials science.

North America Polyolefin Compounds Market Trends

Robust investment in infrastructure renewal and energy projects is fueling demand for polyolefin compounds that deliver durability and chemical resistance in piping and cable applications. Abundant shale gas feedstock provides cost advantages to compounders, enabling competitive pricing in North America. Advances in closed‑loop recycling systems are also encouraging the use of high‑quality recycled resins. As a result, manufacturers are scaling up production capacities to meet both industrial and consumer demands.

U.S. Polyolefin Compounds Market Trends

In the U.S., the rapid electrification of the automotive fleet and aggressive fuel economy targets are driving OEMs to adopt lightweight polyolefin compounds in body panels and interior components. Concurrently, stringent packaging waste regulations at state and federal levels are prompting brands to source compounds with higher recycled content. The push for domestic supply chain resilience has also led to onshoring of compounding facilities, further supporting market growth.

Europe Polyolefin Compounds Market Trends

Europe’s circular economy framework and strict single‑use plastic directives are accelerating the shift toward polyolefin compounds engineered for recyclability and lower environmental impact. The region’s strong automotive and aerospace sectors demand high‑performance materials that meet rigorous safety and crash‑worthiness standards. Investment in advanced compounding technologies, such as compatibilization and reactive extrusion, is enabling compliance with EU sustainability mandates while maintaining product quality.

Key Polyolefin Compounds Company Insights

The polyolefin compounds market is highly competitive, with several key players dominating the landscape. Major companies include LyondellBasell Industries N.V., SABIC, Borealis AG, Dow Inc., ExxonMobil Chemical, Mitsui Chemicals, Inc., Braskem, Ravago Group, Avient Corporation, and RTP Company. The polyolefin compounds market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Polyolefin Compounds Companies:

The following are the leading companies in the polyolefin compounds market. These companies collectively hold the largest market share and dictate industry trends.

- LyondellBasell Industries N.V.

- SABIC

- Borealis AG

- Dow Inc.

- ExxonMobil Chemical

- Mitsui Chemicals, Inc.

- Braskem

- Ravago Group

- Avient Corporation

- RTP Company

Recent Developments

-

In April 2025, Nordmann introduced WANSUPER, a next-generation polyolefin elastomer (POE) developed by its partner Wanhua Chemical, designed to enhance the flexibility, durability, and impact resistance of polyolefin products such as polyethylene, polypropylene, and ethylene vinyl acetate.

-

In June 2024, Borealis AG announced the installment of a semi-commercial demonstration compounding line for recyclate-based polyolefins (rPO) in Beringen, Belgium, with construction during 2024 and full operation expected in the first half of 2025.

Polyolefin Compounds Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27.70 billion

Revenue forecast in 2033

USD 39.70 billion

Growth rate

CAGR of 4.6% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Polymer type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

LyondellBasell Industries N.V.; SABIC; Borealis AG; Dow Inc.; ExxonMobil Chemical; Mitsui Chemicals, Inc.; Braskem; Ravago Group; Avient Corporation; RTP Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyolefin Compounds Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the polyolefin compounds market report on the basis of polymer type, application, and region:

-

Polymer Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

PP Compounds

-

PE Compounds

-

Recycled Polyolefin Compounds

-

Other Types

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Packaging

-

Building & Construction

-

Electrical & Electronics

-

Consumer Goods

-

Industrial

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global polyolefin compounds market size was estimated at USD 26.59 billion in 2024 and is expected to reach USD 27.70 billion in 2025.

b. The global polyolefin compounds market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2033 to reach USD 39.70 billion by 2033.

b. PP compounds dominated the polyolefin compounds market across the polymer type segmentation in terms of revenue, accounting for a market share of 58.44% in 2024, driven by the need for robust, cost effective materials in high volume applications.

b. Some key players operating in the polyolefin compounds market include LyondellBasell Industries N.V., SABIC, Borealis AG, Dow Inc., ExxonMobil Chemical, Mitsui Chemicals, Inc., Braskem, Ravago Group, Avient Corporation, and RTP Company

b. The rapid expansion of the electrical and electronics sector is driving demand for compounds that offer enhanced electrical insulation and fire safety performance. Manufacturers rely on these materials to produce reliable and lightweight components for consumer devices and wiring applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.