- Home

- »

- Advanced Interior Materials

- »

-

Polypropylene Nonwoven Fabric Market Size Report, 2030GVR Report cover

![Polypropylene Nonwoven Fabric Market Size, Share & Trends Report]()

Polypropylene Nonwoven Fabric Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Spunbonded, Staples), By Application (Hygiene, Industrial), By Region, And Segment Forecasts

- Report ID: 978-1-68038-105-4

- Number of Report Pages: 201

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Polypropylene Nonwoven Fabric Market Summary

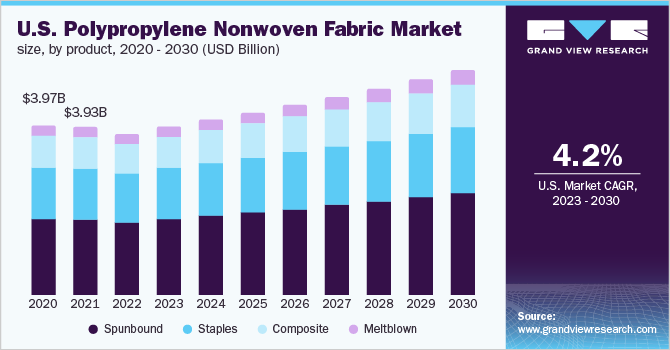

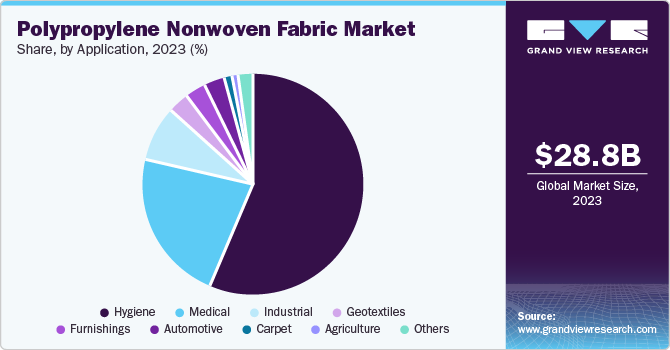

The global polypropylene nonwoven fabric market size was estimated at USD 28.83 billion in 2023 and is projected to reach USD 45.29 billion by 2030, growing at a CAGR of 6.8% from 2024 to 2030. The product demand is expected to witness significant growth over the projected period on account of rising product demand in end-use industries including hygiene, medical, automotive, agriculture, and furnishing.

Key Market Trends & Insights

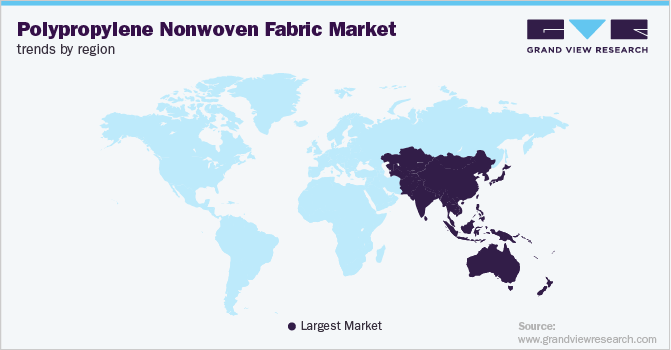

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, Germany is expected to register the highest CAGR from 2024 to 2030.

- In terms of product, Spunbound led the market and accounted for a revenue of USD 13.07 billion in 2023

- In terms of application, The hygiene segment accounted for the largest share in 2023 and is expected to grow at a CAGR of 7.9% from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 28.83 Billion

- 2030 Projected Market Size: USD 45.29 Billion

- CAGR (2024-2030): 6.8%

- Asia Pacific: Largest market in 2023

High demand for polypropylene non-woven fabric in the hygiene industry for manufacturing sanitary products for babies, women, and adults is likely to drive industry growth. Spunbonded technology is the most widely used manufacturing process for polypropylene non-woven fabrics. Low cost and easy production process associated with this technology have been the key factor for a higher market share of these products. The demand for meltblown and composite products is expected to grow in geotextiles and industrial applications on account of their high moisture barrier and high strength properties. However, the high cost associated with meltblown polypropylene nonwoven fabrics is expected to hamper their market growth over the projected period.

The U.S. held the largest share in terms of revenue and accounted for 65% of the total market share in 2023. The U.S. emerged as one of the largest markets for polypropylene nonwoven fabric, in 2023, owing to huge demand from the healthcare industry on account of the COVID outbreak in the country. The country witnessed an increase in demand for disposable polypropylene nonwovens, which are primarily manufactured using spunbonded technology, owing to its wide usage in personal protective equipment.

The market is highly fragmented due to the presence of a large number of small players operating worldwide. It is characterized by high competition on prices that places a heavy demand on the development of innovative products and production efficiency thereby increasing competitive rivalry in the market. In addition, major manufacturers of polypropylene nonwoven fabric work together with their customers, raw material suppliers, and machinery manufacturers to research, develop, and implement new products to compete based on product differentiation and low-cost technology.

The largest polypropylene nonwoven producers are Berry Global, Freudenberg, Kimberly-Clark Corp., Ahlstrom-Munksjo Oyj, and Johns Manville Corp. Furthermore, prominent players in the market are focusing on enhancements in business by expanding their geographical reach and introducing application-specified products. Mergers, acquisitions, joint ventures, and agreements are considered by these players to expand their portfolio and business reach.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The polypropylene non-woven fabrics market is highly fragmented owing to the presence of numerous manufacturers. The companies in the market invest highly on R&D to improve product quality and reduce product weight. High production capacities, wide distribution network and goodwill in the market are the key factors that offer competitive advantage for the multinationals in this business. The companies in the market use mergers and acquisition and capacity expansion strategies in order to strengthen their position in the competitive market.

Polypropylene (PP) non-woven fabrics are manufactured by means of different technologies. The companies are emphasizing on development of innovative specialty products for various industrial applications. Additionally, polypropylene (PP) non-woven fabrics manufacturers are further investing towards development of new technologies of production, and usage of sustainable materials for making nonwovens.

Several regulations have been enforced for the production of and use of PP non-woven fabrics in different application industries. In addition, regulations are enforced about the use of raw material in the production of PP non-woven fabric.

The polypropylene nonwoven fabrics are majorly used in the market on account of its characteristics such as resistance to many chemical solvents, acids and bases among several others which offers premium quality nonwoven fabrics for application industries. However, the development of bio-based polypropylene on account of growing environmental concerns related to disposal is expected to hamper the market growth over the forecast period.

The buyers of PP nonwoven fabrics are the major producers of hygiene and medical products. The product property required by these players address specific requirements to meet government regulations and customer specific requirements for lower basis weights and softness indicates high bargaining power of buyers.

Product Insights

Spunbound led the market and accounted for a revenue of USD 13.07 billion in 2023 as it is the simplest and the most cost-efficient technology used for manufacturing polypropylene nonwoven fabrics. Excellent properties offered by spunbonded nonwoven fabrics coupled with high process efficiency associated with this technology are likely to drive the product demand in various applications. These applications include geotextiles, hygiene, medical, packaging, and shoe manufacturing among others. Spunbonded is the most widely used technology for manufacturing nonwoven fabrics.

The characteristics offered by these products vary from lightweight, flexible structures to highly stiff and heavy structures, thus offering wide application scope across end-use industries. The spunbonded nonwoven fabrics are characterized by random fibrous structures, high opacity, high tear strength, low drape ability, high liquid retention capacity, and excellent fray and crease resistance. The spunbonded nonwoven fabrics offer excellent tensile strength and filtration properties on account of their ability to resist chemical attack and provide a moisture barrier.

Staples polypropylene nonwoven fabrics are gaining importance in medical applications over other polypropylene nonwoven fabrics on account of their finer filtration and low-pressure drop properties. Increasing staple polypropylene nonwoven penetration in medical applications such as gloves, medical packaging, surgical gowns, masks, drapes, and covers is expected to augment the market growth. Surgical drapes, gowns, and masks are expected to be primary products driving demand for staples polypropylene nonwoven fabrics. Therefore, stapes polypropylene nonwoven fabric demand is expected to further increase around the world.

Composite had a revenue of USD 4.32 billion in 2023 as they exhibit high strength owing to the rise in the sanitary and hygiene industry. The polypropylene nonwoven composite fabric is used to manufacture baby diapers, sanitary napkins, and adult diapers. In addition, these fabrics are also used to manufacture medical and surgical products such as drapes, masks, caps, and gowns. Growing demand for these products as filtration material and oil absorbents is expected to further bolster its market growth in the future.

Application Insights

The hygiene application segment accounted for the largest share in 2023 and is expected to grow at a CAGR of 7.9% from 2024 to 2030. Nonwoven fabric materials offer excellent smoothness, softness, comfort, stretchability, fluid-barring capacity, and absorption as compared to traditional textiles. Thus, are gaining high demand for manufacturing hygiene products.

These products help in retaining fences inside the fabric and retain and absorb urine thus isolating wetness from the skin. These products are odorless and offer excellent smoothness unlike traditional fabrics, thus are likely to gain high demand over the projected period. The increasing geriatric population, leading to the rising occurrence of chronic diseases such as diabetes is likely to drive demand for adult incontinence products, over the forecast period. Thus, positively influencing the demand for polypropylene nonwoven fabrics.

The industrial application segment accounted for the fastest-growing segment in 2023 with a CAGR of 9.4% over the forecast period. Polypropylene nonwoven fabrics are used for manufacturing coated fabrics, display felts, tapes, conveyor belts, cable insulation, air conditioner filters, semiconductor polishing pads, noise absorber felt, etc. in industrial applications. Thus, resulting in increased demand for polypropylene nonwoven fabric in industrial applications.

Medical emerged as the second largest application segment for the industry in 2023. Polypropylene nonwoven fabrics are used for manufacturing surgical caps, gowns, masks, drapes, bed linen, gloves, shrouds, underpads, heat packs, ostomy bag liners, incubator mattresses, etc. in the medical industry. The increasing number of surgical procedures is expected to act as a major driving factor for the demand for polypropylene nonwoven fabrics in the medical industry.

Regional Insights

Asia Pacific dominated the polypropylene nonwoven fabric market and is projected to grow at a CAGR of 8.4% in terms of revenue during the forecast period 2024-2030. This growth can be attributed to the growing demand for durable polypropylene nonwoven fabrics in industries such as construction, agriculture, and automobile over the forecast period. In addition, polypropylene nonwoven fabrics are majorly used in consumer products such as disposable diapers, adult incontinence products, and feminine care products, thus driving product demand.

The polypropylene nonwoven fabric market in China is expected to witness growth on account of presence of major hygiene product manufacturers such as Kimberley Clark, Diao and Berry Global. Furthermore, polypropylene nonwoven fabric market in India is expected to grow at a second fastest CAGR of 8.2% over the period of 2024-2030 owing to use of product for crop protection using products such as seed blanket, crop cover, root bags and turf protection products for improved agriculture.

The demand for polypropylene nonwoven fabrics in North America is likely to witness moderate growth over the projected period owing to the continuous demand from the hygiene, medical, and automotive industry. The industry growth in recent years is likely to grow at a slower pace over the forecast period owing to the market achieving maturity.

The nonwoven industry in Europe is witnessing growth in terms of production on account of the presence of several established nonwoven fabric manufacturers in the region. The nonwoven industry in well-established economies such as France is expected to witness steady growth, whereas countries including the U.K., Romania, Russia, Slovenia, and the Czech Republic are expected to gain traction in terms of production growth. This is expected to fuel the growth of the industry for polypropylene nonwoven fabric industry over the forecast period.

Central & South America was valued at USD 2.36 million in 2023 and is expected to grow at a CAGR of 7.9% over the forecast period. High consumer awareness regarding health, hygiene, and safety is expected to positively impact the polypropylene nonwoven fabrics industry over the forecast period. The economic recovery in the region is expected to support the modest growth in the polypropylene nonwoven fabrics industry. Furthermore, increasing healthcare expenditure in the region is expected to drive the hygiene and medical segment’s growth over the forecast period.

Key Companies & Market Share Insights

Key players in the market are entering into agreements with emerging and small-scale players to expand their distribution capacities and increase the geographical presence of their products. Furthermore, manufacturers are focusing on other efficient and effective distribution channels. As a result, companies are likely to establish partnerships with e-commerce portals to ensure that buyers have timely access to polypropylene nonwoven fabric products.

The innovation, development, and production of polypropylene nonwovens are influenced by the presence of major players, which contribute to a large share of the market. While many of the leading companies are based in developed regions such as North America and Europe, many companies based in emerging economies in Asia continue to invest and grow, increasing their share in the market.

-

In July 2023, Berry Global partnered with Deaconess Midtown Hospital and Nexus Circular for an initiative to recycle sterile, non-hazardous, plastic packaging as well as nonwoven fabric safely and effectively from the hospital’s surgical center. As a result, approximately 500 pounds of clean, used plastic, majorly consisting of the exterior packaging of surgical tools and unused nonwoven surgical gowns and cloths, will be diverted from landfills weekly.

-

In February 2023, Asahi Kasei announced an agreement with Mitsui Chemicals regarding the establishment of a new joint venture company through the integration of their nonwovens businesses. The new company would be named Mitsui Chemicals Asahi Life Materials Co. and would be based in Tokyo, Japan. The resulting company’s sites in Japan would include Mitsui’s Nogoya Works plant in Aichi and its Sunrex subsidiary in Mie. Outsourced production will be provided by Asahi Kasei’s Moriyama plant.

- In September 2022, Suominen launched its tri-layer nonwoven, ‘FIBRELLA Strata’, for various industries and applications, particularly in the baby market. The tri-layer structure of the product is stated to offer high levels of softness and an exceptional cleaning performance.

Key Polypropylene Nonwoven Fabric Companies:

- Kimberly-Clark Corporation

- Berry Global, Inc.

- Lydall, Inc.

- First Quality Nonwovens Inc.

- PFNonwovens a.s.

- Schouw & Co.

- Mitsui Chemicals Inc.

- FITESA

- Toray Industries Inc.

- Freudenberg Group

- Ahlstrom-Munksjo Oyj

- Johns Manville Corporation

- Suominen Corporation

- Asahi Kasai Corporation

Polypropylene Nonwoven Fabric Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 30.53 billion

Revenue forecast in 2030

USD 45.29 billion

Growth Rate

CAGR of 6.8% from 2024 to 2030

Actual estimates/Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Spain, Italy, Russia, China, Japan, India, South Korea, Oceania, Taiwan, Thailand, Malaysia, Brazil, Argentina, Saudi Arabia, Turkey, South Africa, Egypt, UAE

Key companies profiled

Kimberly-Clark Corporation, Berry Global, Inc., Lydall, Inc., First Quality Nonwovens Inc., PFNonwovens a.s., Schouw & Co., Mitsui Chemicals Inc., FITESA, Toray Industries Inc., Freudenberg Group, Ahlstrom-Munksjo Oyj, Johns Manville Corporation, Suominen Corporation, Asahi Kasai Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polypropylene Nonwoven Fabric Market Report Segmentation

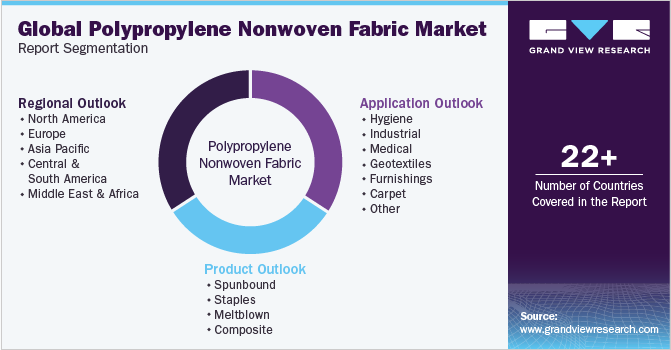

This report forecasts revenue growth at regional and country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the polypropylene nonwoven fabric market on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Spunbound

-

Staples

-

Meltblown

-

Composite

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Hygiene

-

Industrial

-

Medical

-

Geotextiles

-

Furnishings

-

Carpet

-

Agriculture

-

Automotive

-

Others

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Oceania

-

Taiwan

-

Thailand

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

Turkey

-

South Africa

-

Egypt

-

UAE

-

-

Frequently Asked Questions About This Report

b. The polypropylene nonwoven fabric market size was estimated at USD 28.83 billion in 2023 and is expected to reach USD 30.83 billion in 2024.

b. The polypropylene nonwoven fabric market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 45.29 billion by 2030.

b. Spunbound product dominated polypropylene nonwoven fabric market with a share of over 45.0% in 2023 owing to its random fibrous structures, high opacity, high tear strength, low drape ability, high liquid retention capacity and excellent fray and crease resistance.

b. Some of the key players operating in the polypropylene nonwoven fabric market include Kimberly-Clark Corporation, Berry Global, Inc., Lydall, Inc., PFNonwovens a.s., Mitsui Chemicals Inc., FITESA, Toray Industries Inc.

b. The key factor which is driving polypropylene nonwoven fabric market is rising product demand in end-use industries including hygiene, medical, automotive, agriculture and furnishing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.