- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyurethane Market Size, Share & Growth Report, 2030GVR Report cover

![Polyurethane Market Size, Share & Trends Report]()

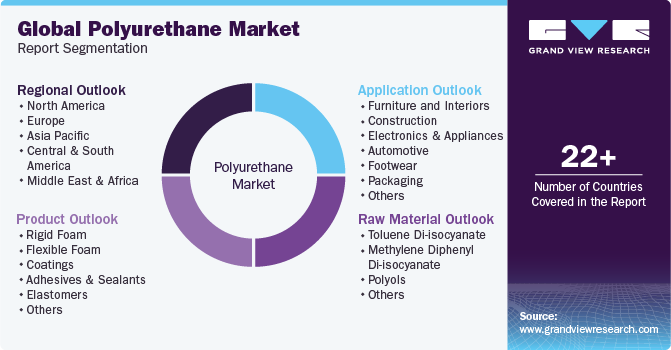

Polyurethane Market Size, Share & Trends Analysis Report By Raw Material (Toluene Di-isocyanate, Methylene Diphenyl Di-isocyanate, Polyols), By Product, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-262-4

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2019 - 2023

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Polyurethane Market Size & Trends

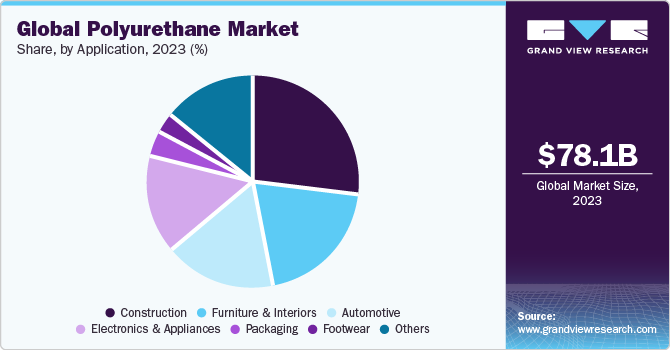

The global polyurethane market size was estimated at USD 78.07 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030. Increasing demand for building insulation in light of sustainability concerns is expected to escalate the demand for polyurethane over the forecast period. Sustainability in building developments is a vast field and encompasses several steps that must be implemented in the primary construction stages since their potential environmental impact is quite significant.

The rising demand for the product from the automotive, construction, packaging sectors in the country is expected to drive the market over the forecast period. The construction sector in the U.S. is expanding at a significant rate owing to positive market fundamentals for commercial real estate along with rising state and federal funding for institutional buildings and public works. Moreover, the ongoing construction projects such as the construction of South San Francisco Civic Center campus, LaGuardia Airport Construction Project, O’Hare Airport Construction Project, and Second Avenue Subway Construction Project is expected to fuel the demand for the product in construction applications, thus boosting the U.S. Polyurethane Market.

The rising demand for the product from the automotive, construction, packaging sectors in the U.S. is expected to drive the market over the forecast period. The U.S. automotive industry has been witnessing growth in automobile production in the past few years. Major players in the market are entering into joint ventures and forming an alliance to increase their production and their reach in the country. For instance, in December 2023, Mobis North America, a Tier 1 automotive supplier, announced plans to build manufacturing operations in Toledo, Ohio. The USD 13.8 million project is estimated to generate 185 employment. Capacity expansion in the countries by major players is expected to positively impact the demand for polyurethane types in the coming years.

Polyurethane market prices are highly influenced by factors such as shipping & labor costs, currency fluctuations, and trade-related tariffs due to diminishing crude oil reserves and civil unrest in the Middle East have. Moreover, increasing demand from end-user industries, technological advancements, and regulatory support have added to the growth opportunities.

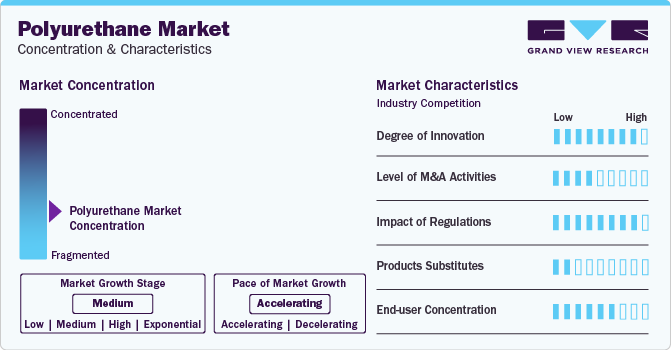

Market Concentration & Characteristics

Market growth is driven by high demand for building insulationin light of sustainability concerns for residential and non-residential sector. Sustainability in building developments is a vast field and encompasses several steps that must be implemented in the primary construction stages since their potential environmental impact is quite significant.

With growing demand patterns, companies such as China National Building Material Industry Corporation and Sika AG are increasing their production capacities. Moreover, the industry is largely characterized by dominance of regional players, leading within their respective regional markets.

Green buildings are increasingly entering the construction market owing to the increasing investments in smart energy-efficient commercial and residential buildings. These buildings offer profitable opportunities along with environmental and federal regulations, providing a meaningful response to growing consumer expectations for sustainability.

In addition, polyurethane manufacturers are largely supported by their local governments. Controlled studies have demonstrated that polyurethane adhesives used with mechanical fasteners in house framing can provide good resistance during severe weather events. Increased effectiveness in building materials has ultimately generated higher demand for polyurethane in the building & construction industry.

Raw Material Insights

The polyols material segment held the largest share of over 30.0% in 2023. Polyols are compounds with multiple hydroxyl functional groups. Polyester polyols is the most common polyurethane raw material. They are employed in the manufacturing of several polymers including polyurethane which finds application in the building, automotive, furniture, and other industries. The polyols-based polyurethane market is influenced by various drivers that contribute to its growth and development.

Duplex Polyurethane Market segment is anticipated to grow at a significant CAGR from 2024 to 2030, in terms of Polyurethane Market value. TDI is a critical component in the production of polyurethane which are used in several industries including automotive & building & construction. The market for toluene di-isocyanate (TDI)-based polyurethane is influenced by various drivers that impact demand and shape industry dynamics. TDI is also employed in the formulation of polyurethane adhesives and sealants. These materials offer strong bonding capabilities and are used in various industries for joining and sealing applications.Moreover, the automotive sector is a significant driver for TDI-based polyurethane as it is commonly used in automotive applications, particularly in the production of flexible foams for seating and interior components.

Product Insights

Rigid foam product accounted for a revenue share of 31.42% in 2023 and is likely to dominate the market over the forecast period. Rigid foam polyurethane types are high-performance closed-cell plastics utilized in end-use industries, such as transportation, packaging, and industrial insulations and appliances, owing to their structural stability, which assists manufacturers to design thermally insulating products. Rigid foams possess sound insulation properties, higher mechanical strength, and thermal resistance making them highly suitable for extreme weather conditions and harsh environments.

Moreover, the polyurethane-based flexible foams is expected to grow significantly in the coming years. They are a type of polymer foam that is widely used in various applications due to its flexibility, resilience, and comfort. TDI and MDI are the most commonly used isocyanates in the production of polyurethane-based flexible foams. The automotive industry uses flexible foams extensively in seating, headrests, and interior components. Urbanization and rising automotive trends influence the demand for PU-based flexible foam products in the automotive industry.

Application Insights

The construction segment dominated the market and accounted for the largest revenue share of over 26% in 2023. The demand for polyurethane in construction end-use is expected to witness significant growth over the forecast period owing to various beneficial characteristics of polyurethane foam including excellent thermal insulation, lightness, chemical inertness, and bacterial and pest resistance. Growing urbanization and industrialization, especially in emerging economies, such as China and India, and the rising infrastructure development activities in the Middle East are expected to fuel the growth of the construction industry, in turn, creating demand for polyurethane foam and insulation.

The furniture and interiors segment also observed a significant decline in 2020, in terms of automotive production and sales. Flexible foam is used for cushioning in a variety of consumer and commercial products such as furniture, bedding, carpet cushion, fibers, and textiles. Foams and other PU products are expected to gain significance in the region on account of the rising consumer awareness regarding the sustainability of lightweight and low-cost polyurethane. Growing residential construction and infrastructure activities are also fueling the rigid polyurethane foam demand in Mexico.

Regional Insights

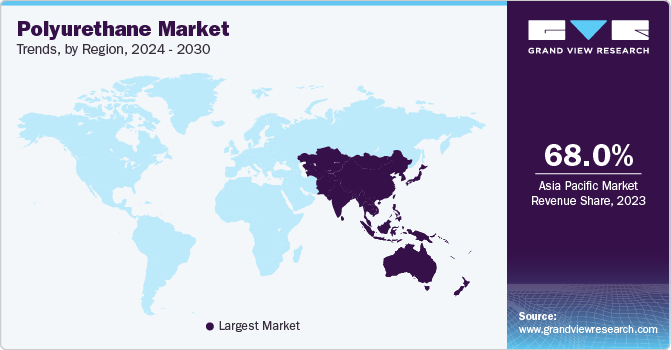

Asia Pacific dominated the market and held a revenue share of over 68.0% in 2023 The market is driven by the growth of the major end-use industries such as automotive, electronics and appliances, packaging, furniture and interior, and construction. The Asia Pacific region is characterized by a large amount of skilled labor and low costs, along with the easy availability of land. A shift in the production landscape toward emerging economies, particularly China and India, is expected to positively influence the Asia Pacific Polyurethane market growth over the forecast period. Per capita consumption in India, Vietnam, Thailand, and Indonesia is gradually increasing, which is likely to remain a key contributing factor for market growth. Traditionally, China polyurethane market was driven by high demand in infrastructure applications, increasing usage in the production of automotive components, electronics and consumer products.

In terms of revenue, Europe is likely to grow at a CAGR of over 3.5% from 2024 to 2030. The increasing infrastructure spending and the rising number of government initiatives, such as smart cities and subsequent FDI in the construction and development sector are propelling the growth of the construction industry. The furniture and construction industries in Europe have witnessed significant growth owing to a stringent regulatory framework to reduce greenhouse gas (GHG) emission levels. This factor has resulted in increased investments in rigid PU foam by regional automotive manufacturers.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In December 2023, Pearl Polyurethane Systems, which is known for polyurethane (PU) insulation solutions and other PU-based applications, opened a distribution center in Maharashtra, India. The new site is an important milestone in the company's ambition to expand its reach and better serve clients across the Indian subcontinent.

-

In June 2023, Recital NV/SA launched the latest range of polyurethane insulation boards comprising 25% bio-circular raw materials for the purpose of reducing carbon dioxide emissions by 43%.

-

In June 2023, DIC Corporation has introduced the HYDRAN GP series of waterborne polyurethane resins that are environment friendly, and provides an alternative to solvent-based polyurethane resins

- In May 2023, Covestro AG inaugurated the latest production line, and launched Desmopan® UP thermoplastics polyurethane (TPU) series for providing paint protection film in the wind and automotive industry.

Key Polyurethane Companies:

- Dow, Inc.

- BASF SE

- Covestro AG

- Huntsman International LLC

- Eastman Chemical Company

- Mitsui & Co. Plastics Ltd.

- Mitsubishi Chemical Corporation

- Recitel NV/SA

- Woodbridge

- DIC Corporation

- RTP Company

- The Lubrizol Corporation

- RAMPF Holding GmbH & Co. KG

- Tosoh Corporation

Polyurethane Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 78.07 billion

Revenue forecast in 2030

USD 105.29 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Historical data

2019 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Raw material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; South Korea; Singapore; Taiwan; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; and South Africa

Key companies profiled

Dow, Inc.; BASF SE; Covestro AG; Huntsman International LLC; Eastman Chemical Company; Mitsui & Co. Plastics Ltd.; Mitsubishi Chemical Corporation; Reticel NV/SA; Woodbridge; DIC Corporation; RTP Company; The Lubrizol Corporation; RAMPH Holding GmbH & Co. KG; and Tosoh Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyurethane Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyurethane Market report based on raw material, product, application, and region:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Toluene Di-isocyanate

-

Methylene Diphenyl Di-isocyanate

-

Polyols

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Rigid Foam

-

Flexible Foam

-

Coatings

-

Adhesives & Sealants

-

Elastomers

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Furniture and Interiors

-

Construction

-

Electronics & Appliances

-

Automotive

-

Footwear

-

Packaging

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Taiwan

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polyurethane market size was estimated at USD 75.19 billion in 2022 and is expected to reach USD 78.06 billion in 2023.

b. The global polyurethane market is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 105.29 billion by 2030.

b. Asia Pacific dominated the polyurethane market with a share of 45.10% in 2022. This is attributable to the developing automotive industry and increasing polymer consumption.

b. Some key players operating in the polyurethane market include BASF SE; Covestro; Huntsman Corp.; Eastman Chemical Co.; Mitsui Chemicals, Inc.; Mitsubishi Chemical Corp.; Nippon PU Industry Corp. Ltd; RTP Company; Lubrizol Corp.; and Rampf Holding GmbH & Co. KG.

b. Key factors that are driving the polyurethane market growth include increasing demand for lightweight and durable products in the automotive, construction, and electronics industries and PU applications for insulation purposes in various end-use industries.

b. The construction application segment led the global polyurethane market in 2022 and accounted for a revenue share of more than 26.75%.

Table of Contents

Chapter 1. Polyurethane Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Polyurethane Market: Executive Summary

2.1. Market Insights

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Polyurethane Market: Variables, Trends & Scope

3.1. Global Polyurethane Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Outlook

3.3. Technology Overview

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.6. Porter’s Five Forces Analysis

3.6.1. Supplier Power

3.6.2. Buyer Power

3.6.3. Substitution Threat

3.6.4. Threat from New Entrant

3.6.5. Competitive Rivalry

3.7. PESTEL Analysis

3.7.1. Political Landscape

3.7.2. Economic Landscape

3.7.3. Social Landscape

3.7.4. Technological Landscape

3.7.5. Environmental Landscape

3.7.6. Legal Landscape

Chapter 4. Polyurethane Market: Raw Material Outlook Estimates & Forecasts

4.1. Polyurethane Market: Raw Material Movement Analysis, 2023 & 2030

4.2. Toluene Di-isocyanate

4.2.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

4.3. Methylene Diphenyl Di-isocyanate

4.3.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

4.4. Polyols

4.4.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

4.5. Others

4.5.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

Chapter 5. Polyurethane Market: Product Outlook Estimates & Forecasts

5.1. Polyurethane Market: Product Movement Analysis, 2023 & 2030

5.2. Flat

5.2.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

5.3. Long

5.3.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

Chapter 6. Polyurethane Market: Application Outlook Estimates & Forecasts

6.1. Polyurethane Market: Application Movement Analysis, 2023 & 2030

6.2. Building & Construction

6.2.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.3. Automotive & Transportation

6.3.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.4. Consumer Goods

6.4.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.5. Mechanical Engineering & Heavy Industries

6.5.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.6. Food Manufacturing

6.6.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.7. Electronic Appliances

6.7.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.8. Others

6.8.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

Chapter 7. Polyurethane Market Regional Outlook Estimates & Forecasts

7.1. Regional Snapshot

7.2. Polyurethane Market: Regional Movement Analysis, 2023 & 2030

7.3. North America

7.3.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.3.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.3.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.3.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.3.5. U.S.

7.3.5.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.3.5.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.3.5.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.3.5.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.3.6. Canada

7.3.6.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.3.6.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.3.6.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.3.6.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.3.7. Mexico

7.3.7.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.3.7.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.3.7.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.3.7.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.4. Europe

7.4.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.4.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.4.2.1. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.4.2.2. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.4.2.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.4.3. Germany

7.4.3.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.4.3.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.4.3.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.4.3.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.4.4. France

7.4.4.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.4.4.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.4.4.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.4.4.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.4.5. UK

7.4.5.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.4.5.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.4.5.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.4.5.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.4.6. Italy

7.4.6.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.4.6.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.4.6.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.4.6.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.4.7. Spain

7.4.7.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.4.7.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.4.7.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.4.7.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.4.8. Sweden

7.4.8.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.4.8.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.4.8.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.4.8.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.4.9. Denmark

7.4.9.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.4.9.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.4.9.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.4.9.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.4.10. Norway

7.4.10.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.4.10.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.4.10.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.4.10.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.5. Asia Pacific

7.5.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.5.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.5.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.5.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.5.5. China

7.5.5.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.5.5.2. Market estimates and forecast, by form, 2019 - 2030 (USD Million) (Kilotons)

7.5.5.3. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.5.5.4. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.5.5.5. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.5.6. South Korea

7.5.6.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.5.6.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.5.6.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.5.6.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.5.7. Japan

7.5.7.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.5.7.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.5.7.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.5.7.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.5.8. India

7.5.8.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.5.8.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.5.8.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.5.8.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.5.9. Thailand

7.5.9.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.5.9.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.5.9.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.5.9.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.5.10. Taiwan

7.5.10.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.5.10.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.5.10.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.5.10.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.5.11. Singapore

7.5.11.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.5.11.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.5.11.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.5.11.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.5.12. Vietnam

7.5.12.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.5.12.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.5.12.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.5.12.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.6. Central & South America

7.6.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.6.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.6.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.6.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.6.5. Brazil

7.6.5.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.6.5.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.6.5.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.6.5.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.6.6. Argentina

7.6.6.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.6.6.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.6.6.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.6.6.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.7. Middle East & Africa

7.7.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.7.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.7.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.7.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.7.5. Saudi Arabia

7.7.5.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.7.5.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.7.5.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.7.5.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.7.6. UAE

7.7.6.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.7.6.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.7.6.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.7.6.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

7.7.7. South Africa

7.7.7.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

7.7.7.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

7.7.7.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

7.7.7.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company Categorization

8.3. Company Ranking

8.4. Heat Map Analysis

8.5. Market Strategies

8.6. Vendor Landscape

8.6.1. List of raw material supplier, key manufacturers, and distributors

8.6.2. List of prospective end-users

8.7. Strategy Mapping

8.8. Company Profiles/Listing

8.8.1. Acerinox S.A.

8.8.1.1. Company Overview

8.8.1.2. Financial Performance

8.8.1.3. Product Benchmarking

8.8.2. POSCO

8.8.2.1. Company Overview

8.8.2.2. Financial Performance

8.8.2.3. Product Benchmarking

8.8.3. Baosteel Group

8.8.3.1. Company Overview

8.8.3.2. Financial Performance

8.8.3.3. Product Benchmarking

8.8.4. Aperam Stainless

8.8.4.1. Company Overview

8.8.4.2. Financial Performance

8.8.4.3. Product Benchmarking

8.8.5. Jindal Stainless

8.8.5.1. Company Overview

8.8.5.2. Financial Performance

8.8.5.3. Product Benchmarking

8.8.6. Yieh United Steel Corp. (YUSCO)

8.8.6.1. Company Overview

8.8.6.2. Financial Performance

8.8.6.3. Product Benchmarking

8.8.7. Outokumpu

8.8.7.1. Company Overview

8.8.7.2. Financial Performance

8.8.7.3. Product Benchmarking

8.8.8. ArcelorMittal

8.8.8.1. Company Overview

8.8.8.2. Financial Performance

8.8.8.3. Product Benchmarking

8.8.9. Nippon Steel Corporation

8.8.9.1. Company Overview

8.8.9.2. Financial Performance

8.8.9.3. Product Benchmarking

8.8.10. ThyssenKrupp Stainless GmbH

8.8.10.1. Company Overview

8.8.10.2. Financial Performance

8.8.10.3. Product Benchmarking

List of Tables

Table 1 Polyurethane Market estimates and forecasts, 2019 - 2030 ((USD Million) (Kilotons)

Table 2 200 series Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 3 300 series Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 4 400 series Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 5 Duplex series Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 6 Polyurethane Market estimates and forecasts, by other Raw Materials, 2019 - 2030 (USD Million) (Kilotons)

Table 7 Polyurethane Market estimates and forecasts, by long products, 2019 - 2030 (USD Million) (Kilotons)

Table 8 Polyurethane Market estimates and forecasts, by flat products, 2019 - 2030 (USD Million) (Kilotons)

Table 9 Polyurethane Market estimates and forecasts, in building & construction, 2019 - 2030 (USD Million) (Kilotons)

Table 10 Polyurethane Market estimates and forecasts, in automotive & transportation, 2019 - 2030 (USD Million) (Kilotons)

Table 11 Polyurethane Market estimates and forecasts, in consumer goods, 2019 - 2030 (USD Million) (Kilotons)

Table 12 Polyurethane Market estimates and forecasts, in mechanical engineering & heavy industries, 2019 - 2030 (USD Million) (Kilotons)

Table 13 North America Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 14 North America Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 15 North America Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons))

Table 16 North America Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 17 US Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 18 US Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 19 US Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 20 US Polyurethane Market estimates and forecasts, by application, 2019 - 2030 ((USD Million) (Kilotons)

Table 21 Canada Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 22 Canada Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 23 Canada Polyurethane Market estimates and forecasts, by product, 2018-(USD Million) (Kilotons)

Table 24 Canada Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 25 Mexico Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 26 Mexico Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 27 Mexico Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 28 Mexico Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 29 Europe Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 30 Europe Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 31 Europe Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 32 Europe Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 33 Germany Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 34 Germany Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 35 Germany Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 36 Germany Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 37 France Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 38 France Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 39 France Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 40 France Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 41 UK Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 42 UK Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 43 UK Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 44 UK Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 45 Italy Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 46 Italy Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 47 Italy Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 48 Italy Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 49 Spain Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 50 Spain Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 51 Spain Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 52 Spain Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 53 Sweden Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 54 Sweden Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 55 Sweden Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 56 Sweden Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 57 Denmark Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 58 Denmark Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 59 Denmark Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 60 Denmark Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 61 Denmark Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 62 Norway Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 63 Norway Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 64 Norway Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 65 Norway Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 66 Asia Pacific Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 67 Asia Pacific Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 68 Asia Pacific Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 69 Asia Pacific Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 70 China Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 71 China Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 72 China Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 73 China Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 74 Japan Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 75 Japan Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 76 Japan Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 77 Japan Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 78 South Korea Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 79 South Korea Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 80 South Korea Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 81 South Korea Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 82 India Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 83 India Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 84 India Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 85 India Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 86 Thailand Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 87 Thailand Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 88 Thailand Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 89 Thailand Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 90 Taiwan Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 91 Taiwan Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 92 Taiwan Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 93 Taiwan Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 94 Singapore Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 95 Singapore Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 96 Singapore Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 97 Singapore Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 98 Vietnam Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 99 Vietnam Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 100 Vietnam Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 101 Vietnam Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 102 Central & South America Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 103 Central & South America Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 104 Central & South America Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 105 Central & South America Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 106 Brazil Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 107 Brazil Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 108 Brazil Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 109 Brazil Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 110 Argentina Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 111 Argentina Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 112 Argentina Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 113 Argentina Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 114 Middle East & Africa Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 115 Middle East & Africa Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 116 Middle East & Africa Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 117 Middle East & Africa Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 118 Saudi Arabia Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 119 Saudi Arabia Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 120 Saudi Arabia Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 121 Saudi Arabia Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 122 UAE Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 123 UAE Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 124 UAE Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 125 UAE Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

Table 126 South Africa Polyurethane Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 127 South Africa Polyurethane Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million) (Kilotons)

Table 128 South Africa Polyurethane Market estimates and forecasts, by product, 2019 - 2030 (USD Million) (Kilotons)

Table 129 South Africa Polyurethane Market estimates and forecasts, by application, 2019 - 2030 (USD Million) (Kilotons)

List of Figures

Fig. 1 Market segmentation

Fig. 2 Information procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Validation

Fig. 5 Market snapshot

Fig. 6 Segmental outlook- Raw material, product, and application

Fig. 7 Competitive outlook

Fig. 8 Polyurethane Market, 2019-2030 (USD Million) (Kilotons)

Fig. 9 Value chain analysis

Fig. 10 Market dynamics

Fig. 11 Porter’s Analysis

Fig. 12 PESTEL Analysis

Fig. 13 Polyurethane Market, by raw material: Key takeaways

Fig. 14 Polyurethane Market, by raw material: Market share, 2023 & 2030

Fig. 15 Polyurethane Market, by product: Key takeaways

Fig. 16 Polyurethane Market, by product: Market share, 2023 & 2030

Fig. 17 Polyurethane Market, by application: Key takeaways

Fig. 18 Polyurethane Market, by application: Market share, 2023 & 2030

Fig. 19 Polyurethane Market, by region: Key takeaways

Fig. 20 Polyurethane Market, by region: Market share, 2023 & 2030What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Polyurethane Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Polyurethane Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Polyurethane Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Polyurethane Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- North America Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- North America Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- North America Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- U.S.

- U.S. Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- U.S. Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- U.S. Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- U.S. Polyurethane Market, By raw material

- Canada

- Canada Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Canada Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Canada Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Mexico

- Mexico Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Mexico Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Mexico Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Mexico Polyurethane Market, By raw material

- North America Polyurethane Market, By raw material

- Europe

- Europe Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Europe Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Europe Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Germany

- Germany Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Germany Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Germany Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Germany Polyurethane Market, By raw material

- France

- France Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- France Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- France Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- U.K.

- U.K. Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- U.K. Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- U.K. Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- U.K. Polyurethane Market, By raw material

- Italy

- Italy Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Italy Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Italy Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Italy Polyurethane Market, By raw material

- Sweden

- Sweden Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Sweden Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Sweden Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Sweden Polyurethane Market, By raw material

- Spain

- Spain Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Spain Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Spain Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Spain Polyurethane Market, By raw material

- Denmark

- Denmark Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Denmark Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Denmark Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Denmark Polyurethane Market, By raw material

- Norway

- Norway Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Norway Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Norway Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Norway Polyurethane Market, By raw material

- Europe Polyurethane Market, By raw material

- Asia Pacific

- Asia Pacific Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Asia Pacific Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Asia Pacific Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- China

- China Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- China Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- China Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- China Polyurethane Market, By raw material

- South Korea

- South Korea Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- South Korea Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- South Korea Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Japan

- Japan Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Japan Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Japan Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Japan Polyurethane Market, By raw material

- India

- India Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- India Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- India Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- India Polyurethane Market, By raw material

- Thailand

- Thailand Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Thailand Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Thailand Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Thailand Polyurethane Market, By raw material

- Taiwan

- Taiwan Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Taiwan Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Taiwan Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Taiwan Polyurethane Market, By raw material

- Singapore

- Singapore Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Singapore Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Singapore Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Singapore Polyurethane Market, By raw material

- Vietnam

- Vietnam Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Vietnam Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Vietnam Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Vietnam Polyurethane Market, By raw material

- Asia Pacific Polyurethane Market, By raw material

- Central & South America

- Central & South America Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Central & South America Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Central & South America Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Brazil

- Brazil Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Brazil Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Brazil Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Brazil Polyurethane Market, By raw material

- Argentina

- Argentina Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Argentina Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Argentina Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Central & South America Polyurethane Market, By raw material

- Middle East & Africa

- Middle East & Africa Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Middle East & Africa Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Middle East & Africa Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Saudi Arabia

- Saudi Arabia Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- Saudi Arabia Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Saudi Arabia Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Saudi Arabia Polyurethane Market, By raw material

- UAE

- UAE Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- UAE Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- UAE Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- South Africa

- South Africa Polyurethane Market, By raw material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

- South Africa Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- South Africa Polyurethane Market, By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- South Africa Polyurethane Market, By raw material

- Middle East & Africa Polyurethane Market, By raw material

- North America

Polyurethane Market Dynamics

Driver: High demand for building insulation in light of sustainability concerns

The global energy crisis has augmented the development of green buildings and several sustainable construction initiatives. Sustainability in building development encompasses several steps that must be implemented in the primary construction stages as their potential environmental impact is significant. Green buildings are thus increasingly making their mark in the construction market due to increasing investments in smart energy-efficient commercial and residential buildings. These buildings not only offer profitable opportunities but are also acceptable by environmental and federal regulations, providing a meaningful response to increasing consumer expectations for sustainability. Increased effectiveness in building materials has ultimately generated higher demand for efficient insulating materials to regulate HVAC solutions and counteract the amount of energy lost due to inefficient insulation.

PU foams are subsequently being utilized as extremely efficient insulation materials, leading to greater energy saving. PU foams are most widely used in spray form for sealing holes, cracks, joints, and bonding other building materials, which ultimately reduces the amount of conditioning or heating required inside the building. Additionally, these foams also provide a barrier against noise, effectively sound-proofing conference rooms, music studios, hospital wards, and other spaces requiring less distraction from external/ambient sounds.

Driver: Increasing demand for lightweight and high-performance composites from automotive industry

PU is widely used in automotive applications such as seating, instrument panels, exterior panels, engine encapsulation, and cables & wires as an alternative to metals. The growth of automotive industry on account of increasing income levels and growing industrialization is also expected to have a positive impact on global PU market. The reduced weight offered by PU components also helps control carbon emission and boost performance of the vehicle in terms of handling and acceleration.

Auto manufacturers, for enhancing the performance of automobiles and following the trend of lightweight vehicles, are mainly focusing on auto components, which are manufactured from various types of plastics. For improving fuel efficiency in vehicles, manufacturers have shifted toward using plastics in automotive components such as instrument panels, exterior panels, automotive interiors, and engine cabins. Plastics, as an alternative to metal components, are useful in reducing the overall vehicle weight and achieving the desired fuel efficiency. This trend, coupled with growing automotive production, is expected to further drive the demand for polyurethanes in automotive applications such as exterior body panels, engine encapsulation, and interior panels.

Restraint: Growing environmental concerns

The raw materials associated with PU production, such as TDI & MDI, are deemed hazardous to the environment due to the industrial release of TDI that pollutes the air. Environment Canada and Health Canada have assessed TDI levels and concluded that their concentration is hazardous to human health. To ensure sound environmental management of TDI releases, Environment Canada has published a Pollution Prevention (P2) Planning Notice. Other agencies and regulatory bodies in the U.S. and Europe have also introduced numerous regulations and guidelines for the same. Furthermore, landfills in Europe, especially of waste tires and PU products, have been banned to exploit the vast potential of PU as a source of energy similar to coal, while also preventing environmental pollution.

Release of toxic gases as a result of burning fossil fuels is expected to cause major restraints for petrochemical manufactures over the forecast period. Petrochemical products derived from crude oil release hazardous gases into the atmosphere, which is expected to impact greenhouse gases (GHG) concentration in the atmosphere and increase the carbon footprint. Developed countries such as the U.S., Canada, the UK, and Germany have reduced carbon emissions over the past few years owing to stringent government regulations for environmental concerns.

What Does This Report Include?

This section will provide insights into the contents included in this polyurethane market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Polyurethane market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Polyurethane market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the polyurethane market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for polyurethane market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of polyurethane market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Polyurethane Market Categorization:

The polyurethane market was categorized into four segments, namely raw material (Toluene Di-isocyanate, Methylene Diphenyl Di-isocyanate, Polyols), product (Rigid Foam, Flexible Foam, Coatings, Adhesives & Sealants, Elastomers), application (Furniture and Interiors, Construction, Electronics & Appliances, Automotive, Footwear, Packaging), and regions (North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa)

Segment Market Methodology:

The polyurethane market was segmented into raw material, product, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The polyurethane market was analyzed at a regional level. The global was divided into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty-four countries, namely, the U.S.; Canada; Mexico; Germany; France; the UK.; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; South Korea; Singapore; Taiwan; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; and South Africa.