- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Porous Ceramic Market Size, Share & Growth Report, 2030GVR Report cover

![Porous Ceramic Market Size, Share & Trends Report]()

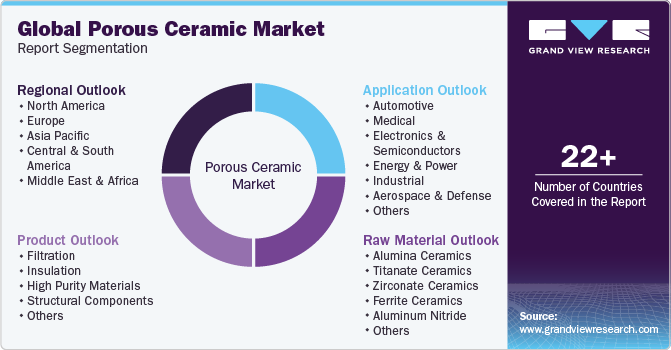

Porous Ceramic Market (2023 - 2030) Size, Share & Trends Analysis Report By Raw Material (Alumina, Titanate, Zirconate, Ferrite, Aluminum Nitride, Others), By Product, By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-933-3

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Porous Ceramic Market Size & Trends

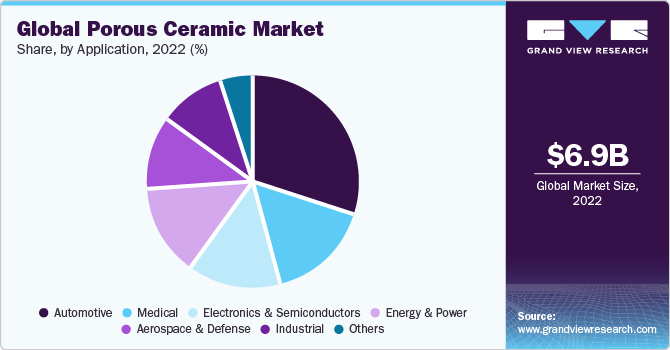

The global porous ceramic market size was valued at USD 6.90 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.0% from 2023 to 2030. The growing demand for filtration products coupled with the increasing penetration of products in medical devices and equipment is driving the market growth. The rising demand for high-quality and functional safety in medical devices and equipment to meet stringent approval standards and withstand challenges in healthcare practices has augmented the need for reliable materials, such as porous ceramics. Thus, wide product usage in the medical devices industry is anticipated to augment the market growth over the forecast period. The U.S. is a prominent producer and consumer of the market.

High-purity porous ceramics find a broad spectrum of applications in microelectronics including piezoelectric devices, custom electronic components, and substrates. The growing demand for electronic devices coupled with the ongoing technological advancements in the U.S. is projected to propel market growth over the forecast period.

The U.S. offers an advanced network of electronics and semiconductors manufacturing clusters. Factors, such as a strong business & technical environment, stringent intellectual property rights regime to protect patents & trademarks, and favorable programs, are augmenting investments in the U.S. electronics and semiconductor industry, thus benefitting market growth.

For instance, in March 2021, the U.S. Department of Energy (DOE) announced a funding of USD 54 million for microelectronics research to power next-generation technologies. According to DOE, the COVID-19 pandemic pointed out the vulnerable & unsecured supply chains and the lack of domestic semiconductor manufacturing in the U.S. This investment is expected to propel semiconductor manufacturing in the country and positively influence the market growth over the forecast period.

The upward growth trajectory, however, faces the restraint of high product costs. The cost involved in the manufacturing process is high owing to the high material & processing costs coupled with high initial investments, which further add to the product cost. Rising prices of alumina restrict their use and impact on market growth.

Porous Ceramic Market Trends

The demand growth for filtration products across industries including manufacturing, automotive, and others is projected to augment the porous ceramic market growth. Furthermore, the rising penetration of porous ceramics in medical equipment and devices is expected to further boost demand over the forecast period.

The increasing demand for high-quality medical equipment and the requirement to adhere to stringent standards of approval has increased the requirement for ceramics. These are being preferred in the medical industry owing to their flexible and customizable properties based on the application requirements. In addition, the outbreak of the COVID-19 pandemic benefited the demand for porous ceramics. For instance, Saint-Gobain Performance Ceramics & Refractories, designed and developed the Crystar air filtration technology, which is a high porosity ceramic filter solution that balances between retention efficiency and air permeability. The company joined with Pracartis and Bouverat-Pernat to develop an efficient face mask called Precimask to limit the spread of COVID-19.

Porous ceramic filtration products are used for the separation of materials in food, pharmaceutical, and chemical and the cleaning of process liquids and industries. In addition, the products are used in gas separation membranes owing to their good permeability, reliability, durability, and high-pressure resistance.

Rising demand for porous ceramic filtration products has encouraged its producers to introduce new products. For instance, in August 2021, CeramTec launched porous ceramic membranes used in crossflow membrane filtration. These multi-channel tubes are made from alumina to be used in micro, ultra, and nanofiltration in several industries including pharmaceuticals and biotechnology.

However, porous ceramic products are manufactured using technologies such as partial sintering, sacrificial fugitives, replica template, direct foaming, and others. The product manufacturing process includes paste extrusion and additive manufacturing methods. The production cost is high, which is attributed to high CAPEX, and raw material cost. This is expected to restrict the growth of the market across the forecast period.

Raw Material Insights

The alumina ceramics segment held the largest market share of 43.8% in 2022. Alumina or aluminum oxide exhibits superior electrical insulation properties and is increasingly being used as an advanced ceramic material. In addition, alumina is resistant to wear and corrosion, which makes it highly preferable for use in applications including pump components, automotive sensors, and electronics.

Alumina-based products are highly preferred across the semiconductor, electrical, and medical industries owing to their excellent properties, such as low specific heat, low bulk density, and low thermal conductivity. The rising need for the product, coupled with superior properties of alumina is compelling market players to invest in R&D activities for product innovations, thereby promoting the demand for alumina-based products.

The titanate ceramics segment is projected to grow at the fastest CAGR of 13.4% over the forecast period, owing to its deployment in producing porous piezoceramic ceramics. It is also used in a capacitor as a dielectric material. It is increasingly being used in microphones and transducers as a piezoelectric material. In addition, the pyroelectric and ferroelectric properties of barium titanate are used to manufacture un-cooled sensors that find applications in thermal cameras.

Application Insights

The automotive application segment dominated the market and accounted for a revenue share of 30.0% in 2022. Automotive is a key application wherein porous ceramics are extensively used owing to their superior properties, such as high mechanical strength, abrasion resistance, chemical stability, and thermal stability. Investments in the automotive industry, especially for developing Electric Vehicles (EVs) are anticipated to fuel the market growth over the forecast period.

Medical is another key application segment of the market. The increasing penetration of additive manufacturing for producing complex parts of medical devices and equipment is expected to prove beneficial for market growth. For instance, in November 2020, Scientists from the Skoltech Center for Design, Manufacturing, and Materials developed a method using additive manufacturing for designing and manufacturing complex ceramic bone implants.

The growth of the electronics & semiconductors segment is attributable to the increasing demand for spark plugs, capacitors, resistors, inductors, sensors, chips, substrates, etc., in smartphones, television sets, computers, and consumer appliances. With advancements in technology, the electronics & semiconductors sector is anticipated to grow rapidly, thus driving the market over the forecast period.

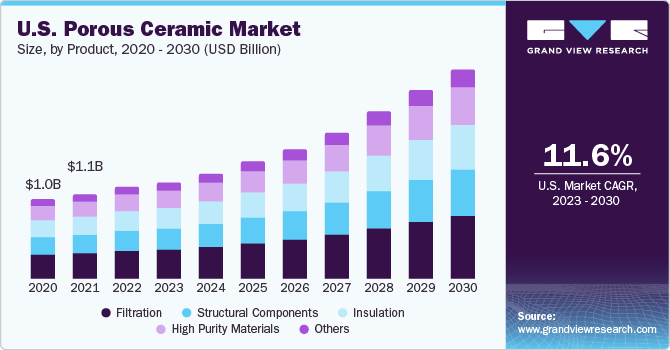

Product Insights

The filtration segment held the largest market share of 34.0% in 2022. Porous ceramic-based filters help filter particles from air and liquids under normal as well as extreme temperature and pressure conditions. They find use in various industries, such as automotive, chemical, pharmaceuticals, and food. Thus, the growing requirement of filtration is anticipated to augment product demand over the coming years.

The high-purity materials segment is expected to grow at the fastest CAGR of 13.4% over the forecast period. Components manufactured using high-purity materials exhibit a superior surface finish owing to fine average grain size. They provide several advantages over low-purity materials, such as excellent hardness, flexural strength, and dielectric strength. In addition, these materials impart high thermal shock resistance to the components made from them.

Insulation is anticipated to register the second-fastest CAGR, in terms of revenue, over the forecast period. Technological advancements in the ceramic production process have led to the development of highly porous ceramic foams, which are increasingly being used for thermal insulation in blast furnaces and refractories. The rising need for refractories is thus expected to augment the segment growth over the forecast period.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 41.6% in 2022. The region is anticipated to continue its dominance over the forecast period. The rising demand for porous ceramic as a filtration material can be attributed to rapid industrialization coupled with the stringent imposition of regulations by governments of different countries to maintain environmental standards. Stringent laws enforced by the Government of China are anticipated to promote the growth of the market in the country. In addition, stringent rules against excessive industrial pollution discharge on industries are expected to positively aid water and air filtration systems in China. This trend is expected to contribute to the demand for porous ceramics over the predicted timeline.

North America is anticipated to register a growth of 11.2%, in terms of revenue, across the forecast period. Various government initiatives to encourage sustainable development are expected to play a critical role in boosting the demand for ceramic filters in North America. In addition, technological advancements such as the implementation of nanotechnology in the filtration process are projected to offer traction to fine ceramic materials, thereby bolstering the overall growth of the market in the region over the forecast period.

Regulations imposed by the U.S. government including the Clean Air Act (CAA) directs EPA to establish National Ambient Air Quality Standards (NAAQS) and regulate toxic emissions across industries. Ceramic filters are being increasingly utilized to eliminate volatile organic compounds and gaseous emissions from industrial establishments. Thus, various regulations enforced by the U.S. government, including the CAA, to protect the public from exposure to harmful toxic gases are expected to drive the demand for filters, thereby, positively influencing the growth of the market in the country.

Key Companies & Market Share Insights

The global market is characterized by strong competition owing to the presence of prominent manufacturers serving major geographies across the globe. These prominent manufacturers compete based on product quality and price to increase the application scope of the product in industries including healthcare, aerospace, oil & gas, and mining among others. Technical innovations and improvements in the production process have resulted in the manufacturing of products with superior durability and an extended lifespan. The market players are increasingly investing in mergers & acquisitions to achieve a stronghold in the competition by offering advanced ceramic products at competitive prices. For instance, in May 2019, Kyocera Corp. announced the acquisition of the advanced ceramics business operations of Friatec GmbH by Kyocera Fineceramics GmbH. The acquisition is projected to help Kyocera Corp. to provide better services to its customers through local production and sales.

Key Porous Ceramic Companies:

- Applied Materials, Inc.

- CoorsTek, Inc.

- Innovacera

- KeraNor AS

- Kyocera Corp.

- Morgan Advanced Materials

- NGK Spark Plug Co., Ltd.

- Nishimura Advanced Ceramics Co., Ltd.

- Porvair plc

- STC Superior Technical Ceramics

- Toto Ltd.

Recent Development

-

In October 2022, Artemis completed the acquisition of McDanel Advanced Ceramic Technologies. This strategic move was driven by the aim to enhance their portfolio of high-purity products and services. Additionally, it enables the company to provide consumers with top-notch products of superior quality.

-

In August 2021, XJet, a prominent global manufacturer specializing in innovative solutions and technologies for ceramic and metal additive manufacturing, unveiled the introduction of alumina technical ceramic to its ever-growing array of additive manufacturing materials. This valuable addition follows months of rigorous testing, during which the material demonstrated consistent success and performance.

-

In July 2021, HexaTech, Inc. revealed the enhancement of its product line featuring 2-inch diameter, single crystal aluminum nitride (AlN) elements known for their exceptional deep-UV transparency. Demonstrating a deep-UV absorption coefficient of 30 cm-1 at 265 nm, these new product offerings provide high-transparency AlN substrates tailored for end-use applications. This strategic expansion aligns with the company’s commitment to delivering cutting-edge technological solutions within the industry, while simultaneously solidifying its market presence.

-

In July 2018, Tethon3D introduced their latest innovation, the high alumina Tethonite Ceramic Powder designed specifically for 3D printing applications. The company emphasized its ongoing commitment to advancing ceramic powder materials, underscoring its dedication to continuous development. This initiative underscores Tethon3D’s goal of providing products that cater to the expanding demands of end-use industries.

Porous Ceramic Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.49 billion

Revenue forecast in 2030

USD 16.58 billion

Growth rate

CAGR of 12.0 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018- 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion, Volume in Kilo Tons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; Indonesia; Brazil

Key companies profiled

Applied Materials, Inc.; CoorsTek, Inc.; Innovacera; KeraNor AS; Kyocera Corp.; Morgan Advanced Materials; NGK Spark Plug Co., Ltd.; Nishimura; Advanced Ceramics Co., Ltd.; Porvair plc; STC Superior Technical Ceramics; Toto Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Porous Ceramic Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global porous ceramic market based on raw material, product, application, and region:

-

Raw Material Outlook (Revenue, USD Million, Volume, Kilo Tons, 2018 - 2030)

-

Alumina Ceramics

-

Titanate Ceramics

-

Zirconate Ceramics

-

Ferrite Ceramics

-

Aluminum Nitride

-

Others

-

-

Product Outlook (Revenue, USD Million, Volume, Kilo Tons, 2018 - 2030)

-

Filtration

-

Insulation

-

High Purity Materials

-

Structural Components

-

Others

-

-

Application Outlook (Revenue, USD Million, Volume, Kilo Tons, 2018 - 2030)

-

Automotive

-

Medical

-

Electronics & Semiconductors

-

Energy & Automotive

-

Industrial

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume, Kilo Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global porous ceramic market size was estimated at USD 6.90 billion in 2022 and is expected to reach USD 7.49 billion in 2023.

b. The global porous ceramic market is expected to grow at a compound annual growth rate of 12.0% from 2023 to 2030 to reach USD 16.58 billion by 2030.

b. Automotive was the key application segment of the porous ceramic market, with a revenue share of above 30.0% of the market in 2022.

b. Some of the key players operating in the porous ceramic market include INNOVACERA, KeraNor AS, Kyocera Corporation, Morgan Advanced Materials, NGK SPARK PLUG CO., LTD, Nishimura Advanced Ceramics Co., Ltd., NORITAKE CO., LIMITED, Pall Corporation, and Porvair plc.

b. The rising focus on the production of filtration equipment is anticipated to augment market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.