- Home

- »

- Electronic Devices

- »

-

POS Printer Market Size And Share, Industry Report, 2030GVR Report cover

![POS Printer Market Size, Share, & Trends Report]()

POS Printer Market (2025 - 2030) Size, Share, & Trends Analysis By Type (Thermal Printers, Impact/Dot Matrix Printers, Inkjet Printers), By Design, By Connectivity, By Output Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-625-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

POS Printer Market Summary

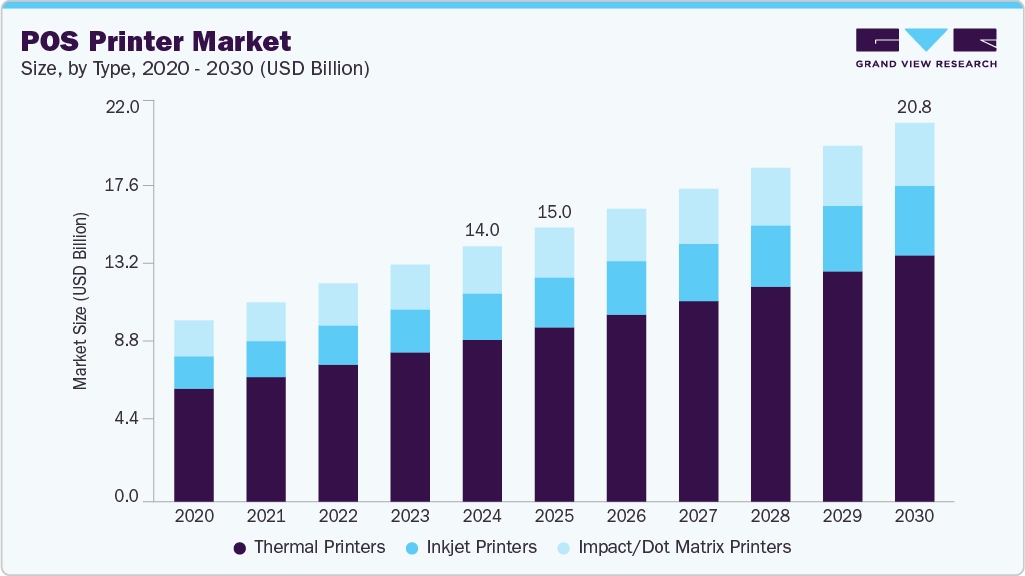

The global POS printer market size was estimated at USD 14.02 billion in 2024 and is projected to reach USD 20.80 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030, driven by the rapid digitization of retail and service industries across the globe. One of the significant factors fueling this expansion is the increasing adoption of digital and contactless payment methods.

Key Market Trends & Insights

- North America dominated the POS printer market and accounted for a revenue share of over 33.0% in 2024.

- The POS printer market in the U.S. is expected to grow significantly at a CAGR of 5.0% from 2025 to 2030.

- Based on type, the thermal printers segment dominated the market and accounted for the revenue share of over 63.0% in 2024.

- By design, the desktop POS printers segment dominated the market and accounted for the revenue share of over 51.0% in 2024.

- By connectivity, the wired segment dominated the market and accounted for the revenue share of over 52.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.02 Billion

- 2030 Projected Market Size: USD 20.80 Billion

- CAGR (2025-2030): 6.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As businesses transition from traditional cash-based systems to card and mobile-based transactions, there is a growing need for reliable and fast printing solutions to efficiently produce receipts and transaction records. This shift is particularly evident in sectors like retail, hospitality, healthcare, and banking, where customer interaction at the point of purchase is frequent and critical. The widespread adoption of mobile and cloud-based POS systems also contributes to market growth. Small and medium-sized enterprises (SMEs) are increasingly using these modern systems due to their affordability, flexibility, and scalability. Mobile POS systems, in particular, are gaining traction as they allow businesses to serve customers remotely and in non-traditional settings such as food trucks, pop-up shops, and events. Compact and wireless POS printers that can connect via Bluetooth or Wi-Fi are in high demand to complement these setups, driving innovation and investment in this market segment.

Technological advancements are also pivotal in enhancing the appeal of POS printers. Features such as thermal printing, wireless connectivity, high-speed output, and compatibility with multiple platforms (Android, iOS, Windows) make modern POS printers more efficient and user-friendly. These innovations reduce operational costs, enhance customer service speed, and offer durability in high-volume usage environments, making them an attractive investment for businesses. For instance, in April 2025, Star Micronics, a Japanese electronic components and printer manufacturing company, announced that it would showcase its latest POS, payment, and kiosk solutions, featuring the new TSP100IV X4 receipt and TSP100IVSK X4 linerless label printers. Built for retail and hospitality, they offer advanced connectivity and support for fixed, mobile, and cloud applications.

Regulatory frameworks and government initiatives further support market growth. Many governments are implementing policies to formalize the economy and promote digital payments. Initiatives such as India’s Digital India program and similar efforts in Southeast Asia and Latin America encourage businesses to adopt electronic transaction systems, which invariably increases the demand for POS printers capable of generating compliant documentation like tax invoices and receipts.

Type Insights

The thermal printers segment dominated the market and accounted for the revenue share of over 63.0% in 2024 due to their lower environmental footprint. As they do not require ink or toner, they generate less waste and require fewer consumables, aligning with the growing focus on eco-friendly business practices. Manufacturers are also innovating with BPA-free thermal paper and energy-efficient models to meet environmental standards and consumer expectations.

Inkjet printers is anticipated to grow at a CAGR of 6.9% during the forecast period. In emerging markets, where small businesses are increasingly digitizing their sales processes, inkjet POS printers are gaining traction due to their lower upfront costs and the ability to handle standard receipts and marketing materials with a single device. As local businesses strive to enhance their customer experience and branding without significant capital expenditure, inkjet printers offer a balanced solution between performance and affordability.

Design Insights

The desktop POS printers segment dominated the market and accounted for the revenue share of over 51.0% in 2024, driven by the increasing demand for reliable and space-efficient transaction solutions across various industries such as retail, hospitality, healthcare, and banking. These printers are designed to be compact yet powerful, making them ideal for installation in fixed locations like checkout counters, service desks, and reception areas. Their popularity is closely tied to the digital transformation of point-of-sale environments, where businesses seek efficient and user-friendly tools to enhance customer interaction and operational efficiency.

The mobile POS printers segment is expected to grow significantly over the forecast period, owing to the proliferation of mobile point-of-sale systems, especially among small and medium-sized enterprises (SMEs) and startups. These businesses are leveraging smartphones and tablets as POS terminals, requiring compact, wireless printers that can easily pair with mobile devices via Bluetooth or Wi-Fi.

Connectivity Insights

The wired segment dominated the market and accounted for the revenue share of over 52.0% in 2024, driven by the need for secure and uninterrupted printing in industries that handle sensitive transactions. Wired connections (such as USB, Serial, or Ethernet) reduce the risk of data breaches and wireless hacking, making them preferable for enterprises with strict data security policies. For instance, in healthcare and banking sectors, where compliance with regulations like HIPAA or PCI-DSS is critical, wired POS printers ensure a stable and secure printing process.

The wireless segment is expected to grow at a significant CAGR over the forecast period owing to the global shift toward flexibility, mobility, and digital connectivity in business operations. As retail, hospitality, healthcare, logistics, and service-oriented businesses increasingly adopt mobile-first strategies, the demand for wireless POS printers, capable of connecting via Bluetooth, Wi-Fi, or NFC, has grown significantly. These printers enable staff to print receipts, invoices, and order tickets on the move, improving transaction speed and customer service quality in fast-paced, dynamic environments.

Output Type Insights

The receipt printers segment dominated the market and accounted for the revenue share of over 50.0% in 2024, driven by the regulatory requirement for proof of purchase and tax documentation, particularly in developing economies and heavily regulated industries. Many governments mandate printed receipts for VAT/GST reporting, consumer protection, and fraud prevention. As a result, businesses across the retail, healthcare, and transportation sectors are required to integrate receipt printers into their POS systems to comply with legal standards, driving consistent demand across geographies.

Label printers is expected to grow at a significant CAGR during the forecast period due to the increasing need for accurate, efficient, and high-quality labeling across diverse industries such as retail, logistics, healthcare, and food services. As businesses prioritize inventory management, product identification, and regulatory compliance, the demand for specialized label printing solutions has surged. Unlike traditional receipt printers, label printers are designed to produce adhesive labels with barcodes, QR codes, product details, or shipping information, making them essential tools for streamlining operations and ensuring traceability.

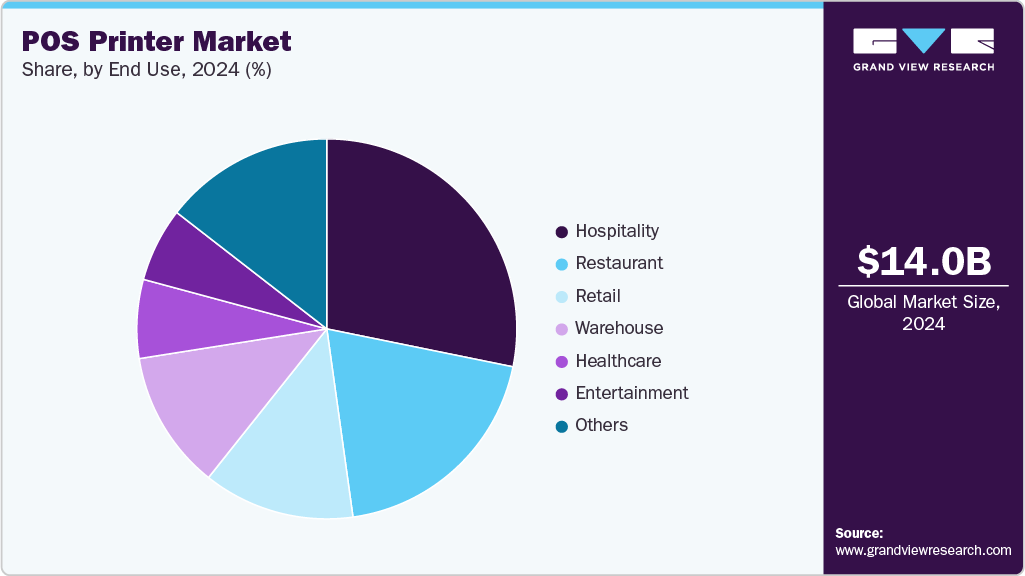

End Use Insights

The hospitality segment dominated the market and accounted for the revenue share of over 28.0% in 2024, driven by the increasing reliance on digital transaction systems, seamless customer experiences, and efficient service delivery. As hotels, restaurants, cafés, bars, and event venues modernize their operations to keep pace with rising consumer expectations, POS printers have become indispensable tools for issuing receipts, order tickets, kitchen dockets, guest bills, and loyalty vouchers. These functions are central to maintaining speed, accuracy, and professionalism in customer service, making POS printers a crucial investment for hospitality businesses.

The retail segment is expected to grow at a significant CAGR over the forecast period as the expansion of omnichannel retailing also plays an important role in driving demand for POS printers. As retailers blend online and offline experiences-such as click-and-collect, ship-from-store, and return-to-store models-there is a growing need for versatile printers that can handle both customer-facing transactions and back-office tasks like inventory labeling and shipping documentation. Label and barcode printers, in particular, are seeing increased use in retail warehouses and stockrooms to streamline product tracking and fulfillment.

Regional Insights

North America dominated the POS printer market and accounted for a revenue share of over 33.0% in 2024, driven by widespread adoption of advanced retail technologies and robust infrastructure supporting digital payments. Integrating POS printers with cloud-based and AI-driven retail management systems accelerates modernization across the retail and hospitality sectors. Additionally, increasing demand for contactless and mobile payment solutions in restaurants, supermarkets, and convenience stores drives demand for wireless and mobile POS printers that enhance transaction speed and convenience.

U.S. POS Printer Industry Trends

The POS printer market in the U.S. is expected to grow significantly at a CAGR of 5.0% from 2025 to 2030, driven by high consumer spending and a rapidly growing quick-service restaurant (QSR) sector. This sector demands efficient receipt and kitchen printing solutions for order accuracy and speed. The growing trend of omnichannel retailing, including buy-online-pick-up-in-store (BOPIS) models, boosts demand for versatile label and receipt printers to support complex inventory and customer management.

Europe POS Printer Industry Trends

The POS printer market in Europe is anticipated to grow considerably from 2025 to 2030 due to stringent regulations on fiscal compliance and receipt printing, especially concerning VAT and e-invoicing mandates, which require retailers to upgrade POS hardware accordingly. The continent's increasing adoption of smart retail technologies and automation across the hospitality industry, including hotels and restaurants, supports demand for customized, high-quality receipt and kitchen printers.

The UK POS printer market is expected to grow rapidly in the coming years, owing to the expansion of contactless payments and the rise of mobile POS systems in retail and hospitality sectors, particularly following COVID-19. UK businesses are keen on reducing queue times and improving customer throughput, fueling demand for fast, wireless POS printers.

The POS printer market in Germanyheld a substantial market share in 2024. The country’s strong manufacturing and logistics sectors, where barcode and label printing for inventory and shipment tracking are critical. The presence of a large number of small and medium-sized enterprises (SMEs) adopting digital POS solutions to enhance operational efficiency drives demand for cost-effective, wired, and wireless printers.

Asia Pacific POS Printer Industry Trends

The POS printer market in Asia Pacific is projected to emerge as the fastest-growing market, exhibiting a CAGR of 8.9% from 2025 to 2030 due to increasing retail digitization and rising adoption of e-commerce, combined with a surge in modern retail formats such as hypermarkets, supermarkets, and specialty stores. Rapid urbanization and increasing disposable incomes are accelerating the demand for automated billing and customer engagement tools across emerging economies.

Japan POS printer market is expected to grow rapidly in the coming years, driven by the country’s advanced technological infrastructure and early adoption of mobile POS solutions. Japanese retailers and hospitality providers prioritize precision and reliability, increasing demand for compact, fast, and high-quality thermal POS printers. The aging population and focus on efficiency have accelerated self-service kiosks and automated checkout systems, all requiring integrated POS printers for receipts and tickets.

The POS Printer market in China held a substantial market share in 2024, due to the explosive growth of e-commerce and omnichannel retail, combined with one of the world’s largest and fastest-growing retail sectors. High smartphone penetration and the popularity of mobile payment platforms such as Alipay and WeChat Pay have driven the adoption of wireless and mobile POS printers. The booming food delivery and logistics industries also heavily depend on mobile receipt and label printers to efficiently manage high volumes of orders.

Key POS Printer Company Insights

Key players in the POS printer industry are Epson Corporation, Star Micronics Co., Ltd., Zebra Technologies Corporation, Citizen Systems, and Honeywell International Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships and collaborations, and agreements, to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In February 2025, BIXOLON introduced the SRP-380plus 3-inch POS printer, with print speeds up to 500 mm/sec and 180 or 203 dpi resolution options.It offers advanced graphic control and high reliability. It features 70 million-line MCBF and a 3 million-cut auto cutter for demanding environments.

-

In January 2025, Epson Corporation launched the TM-T20IV thermal receipt printer, designed for easy integration with both PC-POS and mPOS systems. Combining speed, reliability, and affordability in a compact design, this versatile printer aims to boost flexibility and efficiency in retail and hospitality settings.

-

In November 2024, TSC Auto ID Technology acquired enterprise mobility specialist Bluebird Inc. to expand its global presence and strengthen its position in the auto-ID market. The move aims to combine both companies’ strengths to accelerate global growth and enhance their portfolio of integrated auto-ID solutions and services.

Key POS Printer Companies:

The following are the leading companies in the POS printer market. These companies collectively hold the largest market share and dictate industry trends.

- Bixolon

- Citizen Systems

- Epson Corporation

- Honeywell International Inc.

- HP Development Company

- Mitsubishi Electric Corporation

- NGX Technologies

- Posiflex Technology, Inc.

- Seiko Instruments Inc.

- Sewoo Tech

- Shenzhen Xprinter Technology Co., Ltd.

- Star Micronics Co., Ltd.

- Toshiba Tec Corporation

- TSC Auto ID Technology Co., Ltd.

- Zebra Technologies Corporation

POS Printer Market Report Scope

Report Attribute

Details

Market size in 2025

USD 15.04 billion

Revenue forecast in 2030

USD 20.80 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, design, connectivity, output type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Bixolon; Citizen Systems; Epson Corporation; Honeywell International Inc.; HP Development Company; Mitsubishi Electric Corporation; NGX Technologies; Posiflex Technology, Inc.; Seiko Instruments Inc.; Sewoo Tech; Shenzhen Xprinter Technology Co., Ltd.; Star Micronics Co., Ltd.; Toshiba Tec Corporation; TSC Auto ID Technology Co., Ltd.; Zebra Technologies Corporation

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global POS Printer Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global POS Printer market report based on type, design, connectivity, output type, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Thermal Printers

-

Impact/Dot Matrix Printers

-

Inkjet Printers

-

-

Design Outlook (Revenue, USD Billion, 2018 - 2030)

-

Desktop POS Printers

-

Mobile POS Printers

-

Kiosk POS Printers

-

-

Connectivity Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wired

-

Wireless

-

-

Output Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Receipt Printers

-

Label Printers

-

Ticket Printers

-

Multi-functional Printers

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Restaurant

-

Hospitality

-

Healthcare

-

Retail

-

Warehouse

-

Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global POS printer market size was estimated at USD 14.02 billion in 2024 and is expected to reach USD 15.04 billion in 2025.

b. The global POS printer market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 20.80 billion by 2030.

b. The thermal printers segment dominated the market and accounted for the revenue share of over 63.0% in 2024 due to their lower environmental footprint. As they do not require ink or toner, they generate less waste and require fewer consumables, aligning with the growing focus on eco-friendly business practices.

b. Some key players operating in the POS printer market include Bixolon, Citizen Systems, Epson Corporation, Honeywell International Inc., HP Development Company, Mitsubishi Electric Corporation, NGX Technologies, Posiflex Technology, Inc., Seiko Instruments Inc., Sewoo Tech, Shenzhen Xprinter Technology Co., Ltd., Star Micronics Co., Ltd., Toshiba Tec Corporation, TSC Auto ID Technology Co., Ltd., Zebra Technologies Corporation

b. Key factors driving the POS printer market growth include the increasing adoption of digital and contactless payment methods. As businesses transition from traditional cash-based systems to card and mobile-based transactions, there is a growing need for reliable and fast printing solutions that can produce receipts and transaction records efficiently.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.