- Home

- »

- Plastics, Polymers & Resins

- »

-

Post-consumer Recycled Plastics Market Size Report, 2030GVR Report cover

![Post-consumer Recycled Plastics Market Size, Share & Trends Report]()

Post-consumer Recycled Plastics Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Bottles, Non-bottle Rigid), By Type (Polyethylene, Polypropylene, Polyvinyl Chloride), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-806-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Post-consumer Recycled Plastics Market Summary

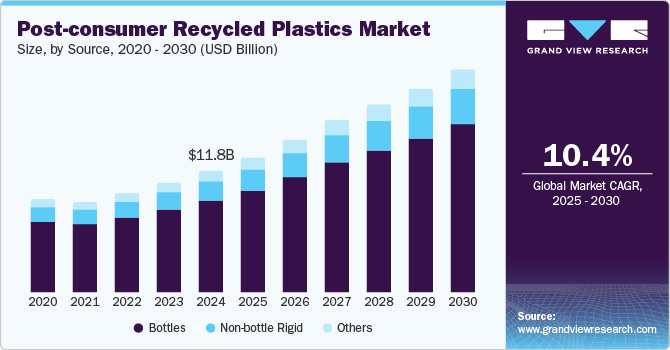

The global post-consumer recycled plastics market size was estimated at USD 11.78 billion in 2024 and is projected to reach USD 21.64 billion by 2030, growing at a CAGR of 10.4% from 2025 to 2030. The market growth is attributed to the increasing environmental concerns, and stringent plastic waste management regulations encourage industries to adopt sustainable practices.

Key Market Trends & Insights

- The Asia Pacific post-consumer recycled plastics market dominated the global market and accounted for the largest revenue share of 45.1% in 2024.

- The North America post-consumer recycled plastics market is expected to grow at a CAGR of 10.7% over the forecast period.

- By source, the bottles segment held the largest revenue share of 75.4% in 2024.

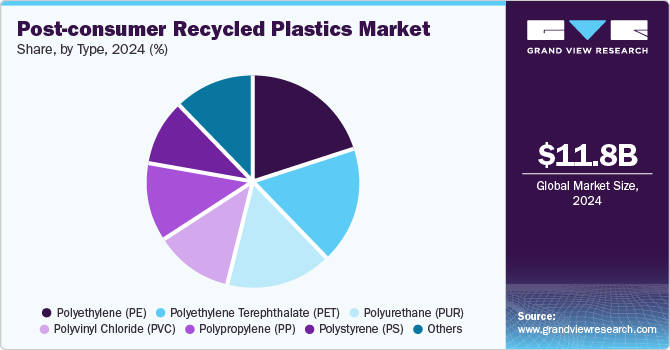

- By type, the Polyethylene (PE) led the market and accounted for the largest revenue share of 20.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.78 Billion

- 2030 Projected Market Size: USD 21.64 Billion

- CAGR (2025-2030): 10.4%

- Asia Pacific: Largest market in 2024

Furthermore, corporate sustainability commitments and government initiatives promoting circular economy practices are essential in increasing the utilization of post-consumer recycled plastics across various sectors, including packaging, automotive, and construction, thus fostering a more sustainable future.

Post-consumer recycled plastics (PCR plastics) refer to plastic materials used by consumers, discarded, and subsequently processed to create new products. Several factors significantly influence the growth of the PCR plastics market.

Technological advancements, particularly in artificial intelligence and robotics, are revolutionizing recycling processes and enhancing efficiency in sorting recyclable materials. These innovations improve the separation of valuable plastics from non-recyclables, addressing challenges heightened by increased recycling demands during global events such as the COVID-19 pandemic. In addition, rising environmental awareness among consumers and businesses propels the shift towards PCR plastics. This trend is driven by the aim to minimize plastic waste and conserve natural resources while reducing ecological footprints. Furthermore, using recycled materials helps lower greenhouse gas emissions and energy consumption, resonating with consumers and industries, thereby driving the market’s growth.

Moreover, regulatory support plays a crucial role in this market's expansion. Governments worldwide enforce stricter regulations to combat plastic pollution, promoting mandates for recycled material usage and restrictions on single-use plastics. Such policies create a favorable environment for PCR plastics adoption. Consumer demand for sustainable products further drives this market, as individuals increasingly prefer items made from recycled materials across various sectors, including food and personal care.

Source Insights

The bottles segment held the dominant position in the market, with the largest revenue share of 75.4% in 2024, owing to the extensive use of plastic bottles across various industries, particularly in food and beverage packaging. In addition, the well-established recycling infrastructure for plastic bottles enhances their recyclability, making them a significant source of post-consumer recycled plastics. Furthermore, increasing consumer awareness about sustainability and plastic waste's environmental impact encourages manufacturers and consumers to prioritize bottle recycling. Moreover, regulatory incentives promoting the use of recycled materials also support this segment's growth, aligning with global sustainability goals.

The non-bottle rigid segment is expected to grow at a CAGR of 10.2% over the forecast period, driven by the rising demand for durable plastic products, including pallets, crates, and containers. This segment's expansion is fueled by the increasing purchase of difficult-to-recycle rigid plastics, gaining attention from exporters and manufacturers. Furthermore, advancements in recycling technologies are improving the recovery and processing of non-bottle rigid plastics, making them more viable for recycling initiatives. Moreover, as businesses seek to reduce their environmental footprint and comply with stricter regulations, the non-bottle rigid segment is becoming an essential component of the post-consumer recycled plastics market, reflecting a broader commitment to sustainability.

Type Insights

Polyethylene (PE) led the market and accounted for the largest revenue share of 20.1% in 2024. This growth is attributed to its widespread application in packaging, particularly in flexible and rigid formats. In addition, the increasing demand for sustainable packaging solutions has prompted manufacturers to incorporate recycled PE into their products, aligning with environmental regulations and consumer preferences for eco-friendly materials. Furthermore, advancements in recycling technologies have improved the efficiency of processing PE waste, making it a more viable option for recycling initiatives.

Polystyrene (PS) is expected to grow at a CAGR of 11.3% from 2025 to 2030, owing to its lightweight and effective insulation properties that make it a popular choice in packaging and construction. In addition, the rising consumer awareness regarding sustainability pushes manufacturers to explore recycled PS options, thus increasing its market presence. Furthermore, regulatory pressures to reduce plastic waste encourage companies to invest in recycling technologies and develop more sustainable PS products. Moreover, as food packaging and electronics industries continue to demand reliable materials, the adoption of recycled PS is expected to grow, reflecting a broader commitment to environmental stewardship.

Regional Insights

The Asia Pacific post-consumer recycled plastics market dominated the global market and accounted for the largest revenue share of 45.1% in 2024. This growth is attributed to increasing government initiatives promoting recycling and sustainability. Countries in the region are implementing stringent regulations to manage plastic waste effectively, encouraging industries to adopt eco-friendly practices. In addition, the rising demand for sustainable packaging solutions in various sectors, including automotive and consumer goods, further drives this market. Furthermore, urbanization and population growth contribute to higher plastic consumption, creating a substantial supply of recyclable materials that support market expansion.

China Post-consumer Recycled Plastics Market Trends

The post-consumer recycled plastics market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by significant growth in the food and beverage sector, which relies heavily on plastic packaging. Furthermore, e-commerce and food delivery services have led to increased plastic waste generation, creating a pressing need for effective recycling solutions. Moreover, government policies aimed at reducing plastic waste and promoting recycling initiatives are also driving the market's growth. As technology improves, the efficiency of recycling processes enhances the production of high-quality post-consumer recycled plastics.

North America Post-consumer Recycled Plastics Market Trends

The North America post-consumer recycled plastics market is expected to grow at a CAGR of 10.7% over the forecast period, owing to rising environmental regulations to reduce plastic pollution. Companies increasingly commit to sustainability goals by incorporating recycled materials into their products. In addition, the demand for eco-friendly packaging solutions across various industries further supports this trend. Furthermore, advancements in recycling technologies are making it easier for businesses to utilize post-consumer recycled plastics effectively, enhancing overall market growth.

The post-consumer recycled plastics market in Canada dominated North America and accounted for the largest revenue share in 2024, driven by strong government policies promoting recycling and waste reduction initiatives. In addition, comprehensive recycling programs encourage consumers and businesses to participate actively in sustainability efforts. Furthermore, as awareness of environmental issues grows among Canadians, there is an increasing demand for products made from recycled materials.

Europe Post-consumer Recycled Plastics Market Trends

Europe post-consumer recycled plastics market is expected to grow significantly over the forecast period due to stringent regulations aimed at reducing plastic waste and promoting circular economy practices. In addition, the European Union has introduced mandates requiring the use of recycled materials in packaging applications, which has spurred demand for post-consumer recycled plastics. Furthermore, consumer preferences are shifting towards sustainable products, prompting manufacturers to adopt eco-friendly practices. This regulatory support, combined with rising awareness about environmental impacts, drives the growth of the market across Europe.

The growth of the post-consumer recycled plastics market in Germany is expected to be driven by its advanced waste management systems and strong recycling culture. Furthermore, the country has implemented effective policies encouraging recycling and using post-consumer recycled materials across various industries. Moreover, as German consumers become increasingly environmentally conscious, there is a growing demand for products made from recycled plastics. This trend is further supported by technological advancements that improve recycling efficiency and product quality, contributing to a more sustainable future.

Key Post-consumer Recycled Plastics Company Insights

Key global companies in the post-consumer recycled plastics industry include BASF SE, SABIC, Evonik Industries AG, and others. These companies are adopting various strategies to enhance their market presence and gain competitive advantage. Strategic partnerships are being formed to leverage shared resources and expertise in recycling technologies, which helps improve operational efficiencies. Furthermore, companies are focusing on new product launches that incorporate post-consumer recycled materials, catering to the growing consumer demand for sustainable products.

-

Evonik Industries AG manufactures diverse additives designed to enhance the mechanical recycling process, improving the efficiency and quality of recycled plastics. Operating within the circular economy segment, the company aims to transform plastic waste into valuable reusable materials through its TEGO Cycle additives and other advanced processing aids, thereby supporting sustainable practices across the plastics value chain.

-

Sumitomo Chemical Co., Ltd. manufactures various materials, such as polymers, resins, and specialty chemicals, facilitating recycling processes. In the plastics and chemicals segment, the company focuses on enhancing the recyclability of plastics and developing innovative solutions that contribute to a sustainable circular economy, addressing environmental challenges associated with plastic waste.

Key Post-consumer Recycled Plastics Companies:

The following are the leading companies in the post-consumer recycled plastics market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- SABIC

- Evonik Industries AG

- Sumitomo Chemical Co., Ltd.

- Arkema

- LyondellBasell Industries N.V.

- Celanese Corporation

- Eastman Chemical Company

- Chevron Phillips Chemical Company

- SUEZ SA

- Exxon Mobil Corporation

- Covestro AG

Recent Developments

-

In October 2024, Renault Group and Suez announced a partnership to improve the automotive circular economy. This collaboration aims to provide solutions for integrating post-consumer recycled plastics into the automotive sector. The initiative focuses on improving waste management, recycling processes, and creating closed-loop systems for automotive parts.

-

In September 2024, SUEZ announced its investment in Purple Alternative Surface, a French start-up that recycles plastic waste into permeable paving solutions. This partnership aims to enhance the production capacity of these innovative pavements to 200,000 m² annually, significantly increasing their ability to utilize post-consumer recycled plastics. By leveraging SUEZ's expertise, the collaboration seeks to address environmental challenges while promoting sustainable practices in construction and public works, ultimately contributing to a circular economy and reducing greenhouse gas emissions.

-

In November 2023, LyondellBasell announced its decision to construct the first industrial-scale catalytic advanced recycling plant in Wesseling, Germany. Utilizing its proprietary MoReTec technology, this facility is expected to convert post-consumer recycled plastics into feedstock for new plastic production, with an annual capacity of 50,000 tonnes. The plant is envisioned to recycle plastic packaging waste generated by over 1.2 million people annually. This initiative is part of LyondellBasell's commitment to addressing plastic waste and advancing a circular economy by enhancing recycling capabilities.

Post-consumer Recycled Plastics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.18 billion

Revenue forecast in 2030

USD 21.64 billion

Growth Rate

CAGR of 10.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, type, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, China, India, Japan, Malaysia, Brazil, and Saudi Arabia

Key companies profiled

BASF SE; SABIC; Evonik Industries AG; Sumitomo Chemical Co., Ltd.; Arkema; LyondellBasell Industries N.V; Celanese Corporation; Eastman Chemical Company; Chevron Phillips Chemical Company; SUEZ SA; Exxon Mobil Corporation; Covestro AG.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Post-consumer Recycled Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global post-consumer recycled plastics market report based on source, type, and region.

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Non-bottle Rigid

-

Others

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polypropylene (PP)

-

Polystyrene (PS)

-

Polyethylene (PE)

-

Polyvinyl Chloride (PVC)

-

Polyurethane (PUR)

-

Polyethylene Terephthalate (PET)

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Malaysia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.