- Home

- »

- Processed & Frozen Foods

- »

-

Potato & Yam Derivatives Market Size & Share Report, 2030GVR Report cover

![Potato & Yam Derivatives Market Size, Share & Trends Report]()

Potato & Yam Derivatives Market Size, Share & Trends Analysis Report By Source (Potato, Sweet Potato, Yam), By Derivative (Whole, Protein, Starch), By Application, By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-093-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global potato & yam derivatives market size was estimated at USD 603.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.3% from 2023 to 2030. The growth in demand for potato & yam derivatives is driven by the growing consumer demand for on-the-go snacks coupled with diverse usage of potato derivatives in the food industry. As a result, there is a growing market for potato and yam derivatives that can enhance the quality, texture, and shelf stability of these products. The rising demand for on-the-go snacks coupled with product innovation and diversification within the food sector is anticipated to fuel the demand for potato & yam derivatives.

Manufacturers are continuously working on introducing new types of snack options to cater to consumer demand. Potato & yam derivatives are easy to incorporate into snack products such as chips, bars, and others. The derivatives offer flexibility in terms of flavor, textures, and nutritional profile thereby encouraging companies to provide a wide range of snack products produced from potato & yam derivatives. For instance, in June 2023, Lay’s Brand under PepsiCo partnered with Transcom Consumer Products to launch Lay’s chips in Bangladesh. The initiative will help the company to meet the local demand for Lay’s chips in the country.

Advancements in farming machinery and technological advancements in the production of potato and other types of yams is fueling the demand in the market.These technologies have altered the production processes, leading to efficient operations. As a result, manufacturing costs have been reduced, and overall output has increased thereby increasing the efficiency of yield. For instance, in June 2023, Australia-based agri-tech company Elders and UK-based insight system Harvest Eye provide potato farmers with up-to-date information on their crops.

The companies utilize cameras and machine learning algorithms to count crops during harvest time. The technology can also be utilized on other root vegetables. In June 2023, PepsiCo India Collaborated with an agriculture crop company Cropin to launch a crop intelligence platform for monitoring potato yields. The platform uses remote sensing data and satellite imagery to assist farmers.

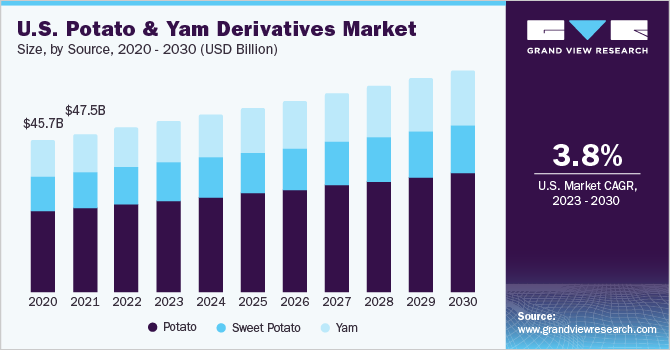

Source Insights

In terms of source, the market is segmented into potato, sweet potato, and yam. The potato segment held the largest revenue share of 53.6% in 2022. Rising demand for potato crops owing to its increasing consumption globally in terms of processed foods such as fries, chips, and other food industry applications is a major factor driving the growth of the segment.

The increasing usage of raw potatoes in food service and quick service restaurants has benefited the segment. According to Potatoes USA, the retail sales of potatoes in Europe experienced a significant boost in revenue during the period from January to March 2023. Frozen potatoes showed the highest growth, with a remarkable increase of 41.9%, fresh potatoes at 12.7%, AND instant potatoes at 16.5%.

The sweet potato segment is expected to witness a significant CAGR of 2.9% during the forecast period. The rise in cases of diabetes and other chronic diseases has led to demand for low-glycemic foods such as sweet potatoes. Sweet potatoes offer high nutrient content compared to other starchy crops. This shift towards healthier eating habits has significantly contributed to the growing demand for sweet potatoes as an essential component of balanced and nutritious meals.

In addition, favorable government policies globally towards investment in farming are also favoring the segment’s growth. In February 2023, the UK government invested USD 18.5 million towards the processing of processed and fresh Irish sweet potatoes in Kenya. The processing plant has a capacity of 60,000-tonne capacity.

Derivative Insights

The starch segment held the largest share of 33.9% in 2022. Growing demand for gluten-free foods due to the increasing prevalence of food allergies, gluten intolerance, and celiac disease has led to a surge in demand for substitute starches derived from gluten-free sources such as yam, sweet potato, and potatoes.

The rising usage of starches in baking, snacks, and beverages is fueling the growth of the segment. For instance, in January 2023, a Netherlands-based provider of starch products, Avebe announced the launch of a plant-based alternative to parmesan cheese. The parmesan cheese is made from potato and can alter in different textures such as firm and extra firm.

The protein segment is expected to showcase the fastest CAGR of 3.8 % during the forecast period. Increasing consumer demand for sustainable and nutritious foods and beverages has fueled the demand for plant-derived proteins. Additionally, the rising vegan populace globally is also supporting the growth of the protein segment. The industry has witnessed a remarkable surge of innovation, leading to the creation of a diverse selection of meat and dairy substitutes that closely replicate the flavor, texture, and nutritional composition of animal-based products.

Thereby, this rapid innovation has made plant-based alternatives attractive to a wider range of flexitarians and the vegan populace. In April 2023, Spain-based provider of potato protein, FreeFromThat collaborated with Avebe to launch Potato Protein+Plus, which is an egg-replacer in several food applications. The product is made from mycelium in mushrooms and potato protein

Application Insights

The food segment held the largest share of 49.6% in 2022. The versatility offered by potato and yam derivatives and their wide range of usage as wedges, fries, and chips is driving the demand for the food segment. Several companies operating in the industry are utilizing advanced processing technology to increase the production of potatoes and other tubers for the food industry. Germany-based Pulsemaster utilizes Pulsed Electric Field (PEF) systems to elevate the yield of potato chips and fries.

The fermented beverages segment is expected to showcase the fastest CAGR of 4.7% during the forecast period. Potatoes offer a unique flavor profile and distinct characteristics that contribute to the enhancement of fermented beverages. Additionally, Potatoes & yams are cultivated in several regions globally thereby enabling easier access to several local and domestic beverage companies worldwide. For example, Sweden-based Karlsson, a provider of vodka offers Gold vodka which is produced from seven types of spring potatoes. The vodka offers an earthy and darker mouthfeel.

Distribution Channel Insights

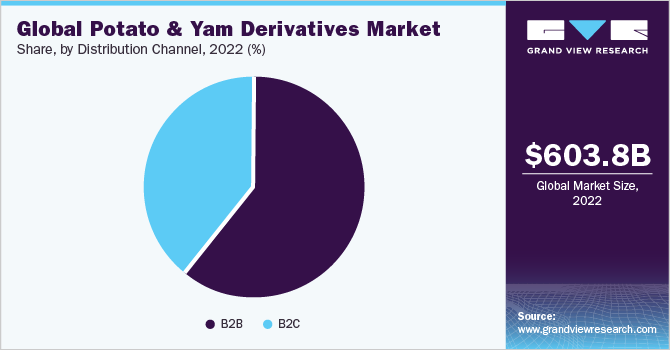

The distribution channel segment is bifurcated into B2B and B2C segment. The B2B segment held the largest share of 61.01% in 2022. The cost-effectiveness of potatoes and yams derivatives plays a crucial role in enhancing profitability for B2B customers. By utilizing these ingredients in their product offerings, companies can improve their profit margins. The lower cost of potatoes and yams enables B2B establishments to achieve a favorable balance between ingredient expenses and pricing, resulting in increased profitability. This advantage allows businesses to remain competitive in the market while still providing value to their customers.

The B2C segment is anticipated to grow at a CAGR of 3.1% during the forecast period. The B2C segment includes online channels, supermarkets, hypermarkets, specialty stores, and other convenience stores. The availability of a wide range of processed foods such as snacks, chips, bars, and other foods is anticipated to drive the growth of the segment. In February 2022, the Swedish provider of plant-based beverages, Dug, offers potato-based milk which is ideal for plant-based cappuccino or latte.

Regional Insights

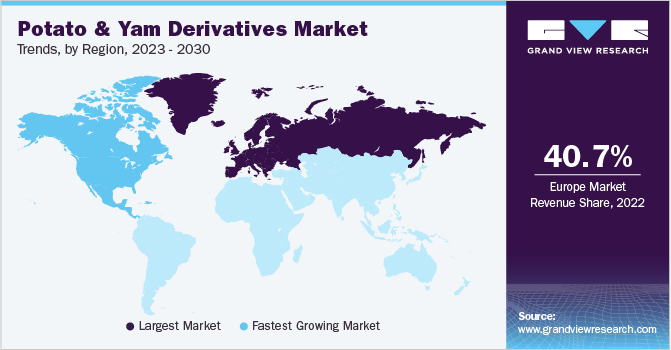

Europe held a dominant revenue share of 40.71% in 2022 owing to the region’s large production capacity of potatoes coupled with favorable farming conditions for diverse varieties of tubers. Rising usage of potatoes in the processing industry in the region and household consumption is driving the growth of the Europe potato & yam derivatives market. In June 2023, Germany-based GRIMME Group acquired Poland-based Agrarada, a provider of potato and beet technology. Through the acquisition, GRIMME Group aims to expand its presence in the Polish market.

Furthermore, Spain’s potato & yam derivatives industry is expected to showcase the fastest CAGR of 3.86% over the forecast period. Favorable initiatives by the government coupled with rising consumer demand for potato and yam-based products in the country are anticipated to drive the demand for the overall market. In April 2023, Spain-based Patatas Mendelez announced the launch of a state-of-the-art factory to improve the yield of potato crops.

The North America potato & yam derivatives market is expected to grow at a CAGR of 3.50% from 2023 to 2030. The presence of major key players in the region coupled with advances in farming techniques is expected to drive the demand for potato & yam derivatives in the region. In March 2021, U.S.-based American Key Food Products (AKFP) announced the launch of native and pre-gelatinized waxy potato starch for the North American market. The starches are ideal for use in sauces, salad dressings, baked goods, soups, and fruit fillings.

Asia Pacific is expected to witness a steady CAGR of 8.2% over the forecast period, owing to the increasing demand for fast food products. The growing demand for frozen and processed foods in developing countries is anticipated to drive regional demand in the forthcoming years.

Key Companies & Market Share Insights

Competition among companies is expected to be intense, primarily due to the presence of several players. In response to changing consumer trends, several companies are expanding their product portfolios to gain a competitive advantage. Major players include Pepees S.A., Agrana Beteiligungs - AS, Tate & Lyle, Avebe, Tereos, Ingredion Incorporated, Emsland, Ingredion Incorporated, Olu Foods, Basic American Foods, Roquette, Keystone Potato, and Rakusens Ltd

Manufacturers of Potato & Yam Derivatives are constantly innovative products and utilizing technological advancements to meet consumer needs. In September 2022, American Key Food Products announced the launch of tapioca starch. Starch is ideal for frozen food applications. Some prominent players in the global potato & yam derivatives market include:

-

Pepees S.A.

-

Agrana Beteiligungs - AS

-

Tate & Lyle

-

Avebe

-

Tereos

-

Ingredion Incorporated

-

Emsland

-

Olu Foods

-

Basic American Foods

-

Roquette

-

Keystone Potato

-

Rakusens Ltd

-

Conagra Brands Inc.

Potato & Yam Derivatives Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 624.92 billion

Revenue forecast in 2030

USD 784.9 billion

Growth Rate (Revenue)

CAGR of 3.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in kilo tons, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, derivative, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa; UAE

Key companies profiled

Pepees S.A.; Agrana Beteiligungs - AS; Tate & Lyle; Avebe; Tereos; Ingredion Incorporated; Emsland; Ingredion Incorporated; Olu Foods; Basic American Foods; Roquette; Keystone Potato; Rakusens Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Potato & Yam Derivatives Market Report Segmentation

This report forecasts volume and revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global potato & yam derivatives market report based on source, derivative, application, distribution channel, and region:

-

Source Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Potato

-

Sweet Potato

-

Yam

-

-

Derivative Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Whole

-

Protein

-

Starch

-

Tapioca

-

Flour

-

Feed

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Food

-

Animal Feed

-

Fermented Beverages

-

Others

-

-

Distribution Channel Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

B2B

-

B2C

-

Online

-

Hypermarkets/Supermarkets

-

Specialty Stores

-

Others

-

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global potato & yam derivatives market size was estimated at USD 603.83 billion in 2022 and is expected to reach USD 624.92 billion in 2023.

b. The global potato & yam derivatives market is expected to grow at a compound annual growth rate of 3.3% from 2023 to 2030 to reach USD 784.9 billion by 2030.

b. Europe dominated the potato & yam derivatives market with a share of 40.7% in 2022. This is attributable to the region’s large production capacity of potatoes coupled with favorable farming conditions for diverse varieties of tubers.

b. Some key players operating in the potato & yam derivatives market include Pepees S.A., Agrana Beteiligungs – AS, Tate & Lyle, Avebe, Tereos, Ingredion Incorporated, Emsland , Ingredion Incorporated, Olu Foods, Basic American Foods, Roquette, Keystone Potato, and Rakusens Ltd.

b. Key factors that are driving the market growth include the growing consumer demand for on-the-go snacks, coupled with the diverse usage of potato derivatives in the food industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."