- Home

- »

- Animal Health

- »

-

Poultry Vaccines Market Size & Share, Industry Report, 2030GVR Report cover

![Poultry Vaccines Market Size, Share & Trends Report]()

Poultry Vaccines Market (2025 - 2030) Size, Share & Trends Analysis Report By Vaccine Type (Attenuated /Live Vaccines, Inactivated Vaccines), By Application (Layer), By Disease Type, By Route of Administration, By Ditsribution Channels, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-100-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Poultry Vaccines Market Summary

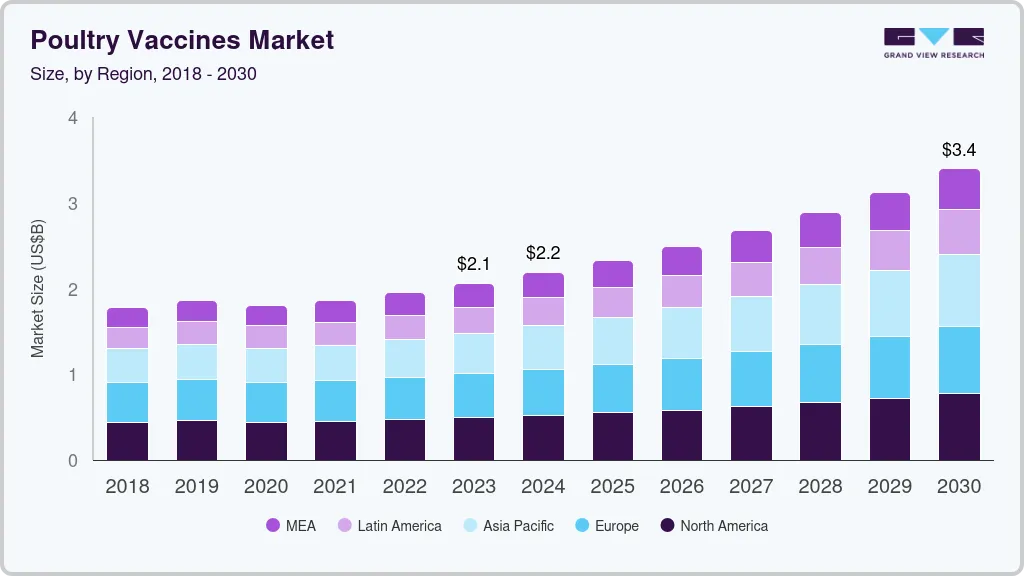

The global poultry vaccines market size was estimated at USD 2,397.7 million in 2024 and is projected to reach USD 3,666.6 million by 2030, growing at a CAGR of 7.6% from 2025 to 2030. The primary factors driving the market include the growing incidence of diseases, improvements in vectored and combination vaccinations, and government funding for widespread vaccination campaigns and creative programs.

Key Market Trends & Insights

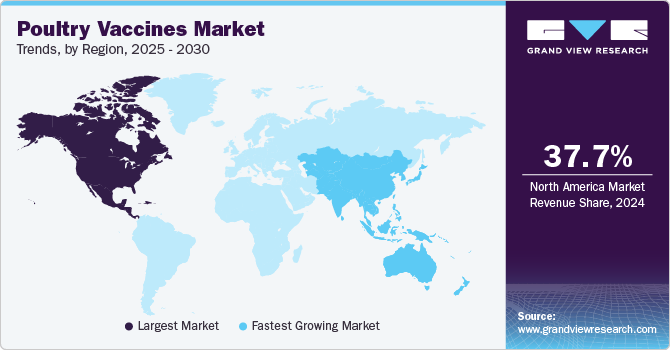

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, breeder accounted for a revenue of USD 1,136.3 million in 2024.

- Layer is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2,397.7 Million

- 2030 Projected Market Size: USD 3,666.6 Million

- CAGR (2025-2030): 7.6%

- North America: Largest market in 2024

The demand for vaccinations is expected to increase due to the increasing popularity of chickens. The number of zoonotic cases has led to an increase in demand for poultry vaccinations. For example, according to a report by the World Health organization, a government institution with headquarters in the United States, the number of zoonotic cases in Africa increased by 64% in 2022.

The COVID-19 pandemic has significantly impacted the industry. Lockdowns and movement restrictions disrupted the production and distribution of vaccines, leading to delays and shortages in some regions. Financial losses in the chicken industry due to reduced demand in food services (restaurants, hotels) limited farmers’ ability to invest in vaccination programs. Moreover, The pandemic-induced economic slowdown led to reduced consumer purchasing power, affecting the demand for poultry products and, subsequently, poultry health interventions, including vaccines.

The rising prevalence of Infectious Bursal Disease (IBD) significantly drives the industry. IBD, a highly contagious viral infection affecting young chickens, causes immunosuppression, leading to secondary infections and increased mortality. This has heightened the demand for effective vaccines to safeguard poultry health, reduce economic losses, and improve productivity. For instance, according to an article published by National Libraby of Medicine in September 2024, In order to determine the seroprevalence and related risk factors of IBD, a cross-sectional study was carried out between October 2020 and June 2021. With an overall seroprevalence of 47%, 361 of the serum samples that were taken tested positive for the illness. Didessa, Chora, and Gechi districts had varying IBD seroprevalence percentages of 55.9%, 43.3%, and 41.2%, respectively.

The first HVT-based vectored viral vaccine designed for chicken was the original Vaxxitek HVT+IBD, which was introduced by Boehringer Ingelheim Animal Health in 2006. Vaxxitek HVT+IBD+ND, a novel form, was introduced in the United States in 2019. This vaccination is "trivalent," which means it creates immunity to three diseases, Newcastle disease (ND), Infectious Bursal Disease (IBD), and Marek's Disease (MD). Vaxxitek HVT+IBD+ILT, a second trivalent version, was approved for sale in the United States in 2020. It guards against infectious laryngotracheitis (ILT), MD, and IBD. Thus, these innovative new trivalent products provide veterinarians and poultry producers highly useful and cost-effective alternatives.

Application Insights

The breeder segment dominated the market with the largest revenue share of over 44.0% in 2024 due to the growing number of breeder farms that produce eggs that are viable and hatched in a hatchery. The market has grown as a result of these breeding facilities' increased output. Numerous government programs encouraging breeders to vaccinate their chickens, which protects both the vaccinated birds and their offspring, or broilers, are also responsible for the market growth. Moreover, Breeders have longer production cycles compared to layers, allowing for extended periods of vaccination and monitoring. This increases the opportunities for targeted and comprehensive vaccination protocols, ensuring better disease prevention over the birds' lifecycle.

Breeder farms have grown mostly as a result of proactive government initiatives that have led to an increase in the number of feed mills, breeders and integrators, and poultry farmers. For example, the Animal Husbandry Department in the Indian state of Andhra Pradesh increased chicken output by implementing a comprehensive poultry development policy for the state from 2016 to 2020. In order to support export activities, the policy sought to increase production from commercial broilers and layers as well as to promote egg and chicken processing. Such positive government actions are propelling the market even further.

Vaccine Type Insights

Modified/ Attenuated live vaccine type dominated the market with a share of over 51% in 2024. Attenuated live vaccines offer robust immunity with fewer doses compared to inactivated vaccines. This is particularly advantageous for controlling highly infectious diseases like Newcastle Disease, Infectious Bursal Disease (IBD), and Marek’s Disease. Moreover, these vaccines are ideal for mass immunization in large-scale chicken farms. The ability to administer them via spray or water ensures quick and efficient vaccination of large flocks, which is crucial in commercial poultry operations. For instance, Nobilis CAV P4 from Merck & Co., Inc. is a freeze-dried attenuated live vaccines used to passively protect chicks from diseases brought on by the chicken anemia virus by actively immunizing breeders.

Other vaccines segment is anticipated to grow at the fastest CAGR of 10.06% over the forecast period. Recombinant virus vector vaccines, which have the benefits of preventing numerous diseases at once and streamlining the immunization schedule, have been made possible by the advancement of recombinant DNA technology in recent years. More significantly, some can provide long-term immunological protection and trigger a protective immune response when maternal antibodies are present. These benefits substitute for standard vaccines' drawbacks. Moreover, the adoption of recombinant vaccines is expected to grow due to ongoing advancements in biotechnology and increasing awareness of sustainable poultry farming practices. Their role in reducing antibiotic usage further aligns with the global shift towards antibiotic-free animal products.

Disease Type Insights

The salmonella disease segment accounted for the largest revenue share in 2024. This is owing to the high prevalence of Salmonella in chickens. Attenuated Salmonella strains are the most frequent type of salmonella vaccine, and they can be used as effective and safe oral carrier vaccines to prevent necrotic enteritis by expressing heterologous antigens. To boost their market presence and share, industry participants engage in the research and development as well as the introduction of new vaccines. To prevent and control salmonellosis in layers, breeders, and broilers, Venkys India, for instance, provides a variety of poultry vaccinations, including the Salmonella polyvalent inactivated vaccine.

Avian Influenza is anticipated to grow significantly from 2025 to 2030. Avian cholera, also known as fowl cholera, is a bacterial disease that affects chicken and wild birds. It is caused by the bacterium Pasteurella multocida and can vary in severity, from mild to potentially fatal. For breeders avian cholera is still a serious threat. Vigilance, proper hygiene, and timely intervention are essential to prevent and manage outbreaks. Moreover, mortality rates of 5-20% are fairly common in the early stages of disease and may even reach as high as 45%.

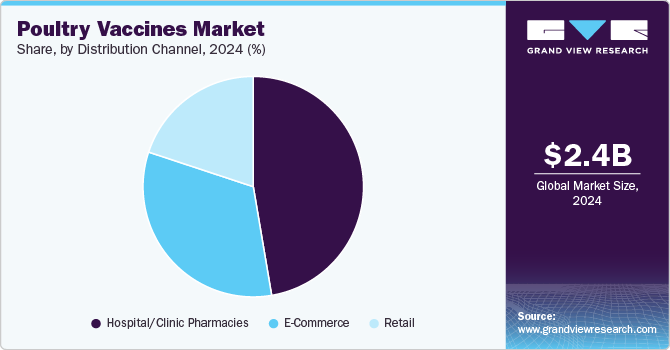

Distribution Channel Insights

Hospital/clinic pharmacies dominated the market with the largest revenue share of 47.3% in 2024 due to their critical role in ensuring the safe and reliable delivery of vaccines. These pharmacies serve as trusted points of access for veterinarians and livestock owners, offering professional guidance on vaccine selection, storage, and administration. Many hospital retail pharmacies collaborate with agricultural extension services to support large-scale vaccination campaigns. This helps in controlling outbreaks of diseases such as avian influenza, newcastle disease, and marek's disease.

E-Commerce segment is expected to grow at a CAGR of 10.1% over the forecast period. The e-commerce segment is significantly drive the market by streamlining the accessibility and distribution of vaccines. E-commerce platforms provide farmers, veterinarians, and poultry producers with easy access to a wide range of vaccines, including specialized and region-specific options, which might not be readily available through traditional channels. Moreover, many e-commerce platforms include detailed product descriptions, usage guidelines, and customer reviews, aiding informed purchasing decisions and increasing vaccine adoption.

Route of Administration Insights

The injectable segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period due to its effectiveness in delivering precise doses and ensuring a robust immune response. Injectable vaccines are widely preferred for controlling major poultry diseases like Newcastle disease, Infectious Bursal Disease (IBD), and Avian Influenza due to their ability to provide long-lasting immunity. Moreover, innovations in vaccine formulation and delivery systems, such as adjuvants and needle-free injectors, are enhancing the safety and efficacy of injectable vaccines.

The intranasal segment is expected to grow at the fastest CAGR from 2025 to 2030. Intranasal vaccines are gaining traction due to their advantages in ease of administration, immunogenicity, and suitability for mass vaccination. These vaccines stimulate local immunity at the mucosal surface, the primary entry point for many pathogens, providing a robust first line of defense. Furthermore, continuous innovations in live attenuated and recombinant vaccines are enhancing the effectiveness of intranasal formulations.

Regional Insights

The North America poultry vaccines market dominated the global market and accounted for 37.7% of the total revenue share in 2024. This is due to a number of factors including the existence of major market participants, rising animal protein consumption, and advancements in technology. Significant companies with U.S. headquarters, such as Elanco, Merck & Co., Inc., and Zoetis Services LLC, contribute to the regional share. These players drive innovation, ensure the availability of high-quality products, and enhance global market penetration. Their extensive distribution networks and R&D investments help introduce advanced vaccines to combat diseases.

U.S. Poultry Vaccines Market Trends

The U.S. poultry vaccines market held a significant share of the North America market in 2024. The growth is attributed to the initiatives undertaken by key market players. For instance, in October 2024, Boehringer Ingelheim declared that its TUR-3 vaccination can now be imported due to an authorization issued by the U.S. Department of Agriculture. TUR-3, a lethal vaccine already licensed for use in Europe, will be offered for primary immunization of turkey and chicken flocks in the United States against avian metapneumovirus subtype B.

Europe Poultry Vaccines Market Trends

The Europe poultry vaccines market is driven by the increasing prevalence of diseases. Poultry diseases such as avian influenza, Newcastle disease, infectious bronchitis, and coccidiosis pose substantial threats to poultry health and production. The economic losses associated with these diseases, including reduced egg production, mortality, and trade restrictions, have emphasized the importance of disease prevention and control.

The UK poultry vaccines market is expected to grow significantly due to rising prevalence of infectious bronchitis. According to an article published by The Pirbright Institute, despite the availability of numerous vaccinations, infectious bronchitis is still a significant issue in the UK poultry business and is the most commercially significant infectious disease afflicting hens in the UK. Since most strains of the infectious bronchitis virus (IBV) do not grow in cell cultures, IBV vaccines are currently made in hen eggs, which is a lengthy and costly procedure.

Asia Pacific Poultry Vaccines Market Trends

The poultry vaccines market in Asia Pacificis expected to grow at the fastest CAGR over the forecast period. The growth of the market in the region is mainly due to the vaccination campaigns organized by the governments of the countries. For instance, according to Department of Animal Husbandry and Animal Welfare, Government of Puducherry, India, In a Union Territory, chicken farming is rapidly expanding. The Department has taken up the implementation of various programs, such as the chicken vaccination schedule, to popularize poultry farming in this Union territory because it has good potential as a supplemental source of income and even as the primary source of livelihood for farmers.

India poultry vaccines market is growing at a significant rate and held a significant share in 2024. Funding for product development by key players is a significant driver of the chicken vaccines market. These initiatives help improve the effectiveness, safety, and accessibility of vaccines, catering to the growing demand for robust disease prevention in the poultry sector. For example, GALVmed funded the two of the most successful product development thermotolerant ND vaccines, which are convenient to transport and administer to poultry.

Latin America Poultry Vaccines Market Trends

The poultry vaccines market in Latin America exhibits high growth potential, driven by the region's large and expanding livestock population and increasing emphasis on disease prevention. For instance, estimated 1,590 milion chicken population in Brazil in 2023 This growth stems from an increased demand for poultry meat and eggs, which encourages farmers to expand production. However, larger poultry populations are often accompanied by a higher risk of disease outbreaks. Vaccination becomes critical in maintaining flock health, improving survival rates, and ensuring productivity.

Brazil poultry vaccines market exhibits high growth potential, due to country’s extensive poultry industry couple with several government initiatives undertaken for livestock health. Brazil is the biggest exporter of chicken in the world, accounting for about 40% of worldwide supplies. Exporting poultry to international markets demands adherence to stringent health and safety regulations. Countries importing Brazilian poultry often require robust vaccination programs to prevent the spread of diseases like avian influenza, Newcastle disease, and infectious bronchitis. As Brazil seeks to diversify its export destinations, newer markets with specific disease prevention requirements push the adoption of comprehensive vaccination protocols.

Middle East & Africa Poultry Vaccines Market Trends

The poultry vaccines market in Middle East and Africa growth is driven particularly by the rising poultry consumption, increasing prevalence of chicken diseases, and advancements in vaccines development. The growing demand for poultry meat and eggs as affordable protein sources is encouraging large-scale poultry farming, necessitating effective vaccination programs to ensure flock health and productivity. Moreover, the introduction of advanced vaccines, including recombinant and vector-based solutions, improves disease control and supports market growth.

South Africa poultry vaccines market is anticipated to grow at the fastest CAGR during the forecast period in MEA region. This growth is attributed to the presence of leading organisations offering poultry vaccines. For instance, Ceva offers IBD vaccines, salmonella vaccines, and others. These organizations invest in research and development to produce vaccines that are more effective against evolving chicken diseases, including avian influenza, Newcastle disease, and infectious bronchitis. This innovation attracts more poultry farmers to adopt vaccination practices. These companies establish extensive distribution channels, ensuring that vaccines reach even remote areas. This enhances accessibility and supports poultry farming on a larger scale..

Key Poultry Vaccines Company Insights

The Industry is competitive due to presence of small and large participants. The several strategic initiatives such as mergers and acquisitions, new product launches, and regional expansion are undertaken by key industrialists to increase their global footprints. Companies are expanding the range of products they offer in order to cater to more uses.

Key Poultry Vaccines Companies:

The following are the leading companies in the poultry vaccines market. These companies collectively hold the largest market share and dictate industry trends.

- Boehringer Ingelheim International GmbH

- Zoetis Services LLC

- Vaxxinova International BV

- Merck & Co., Inc.

- Calier

- KM Biologics (Meiji Animal Health)

- Elanco

- Hester Biosciences Limited

- Ceva Santé Animale

- Phibro Animal Health Corporation

Recent Developments

-

In November 2024, Boehringer Ingelheim, a biopharmaceutical company has introduced a next-generation vaccination for Marek's disease in chicken in India.

-

In October 2024, The U.S. Department of Agriculture (USDA) approved a vaccine against avian metapneumovirus (aMPV) subtype B in commercial turkey and chicken flocks. In countries other than the United States, chickens and turkeys are frequently vaccinated against avian metapneumovirus using both live and inactivated vaccines. The National Turkey Federation has requested the USDA to permit the importation of a vaccination against avian metapneumovirus in the United States.

Poultry Vaccines Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 2.54 billion

The revenue forecast in 2030

USD 3.66 billion

Growth rate

CAGR of 7.60% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/ billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, vaccine type, disease type, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Denmark, Sweden, Norway, Japan; China; India; Australia; South Korea; Thailand, Brazil; Argentina; South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

Boehringer Ingelheim International GmbH; Zoetis Services LLC; Vaxxinova International BV; Merck & Co., Inc.; Calier; KM Biologics (Meiji Animal Health); Elanco; Hester Biosciences Limited; Ceva Santé Animale; Phibro Animal Health Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Poultry Vaccines Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global poultry vaccines market report based on the application, vaccine type, disease type, route of administration, distribution channel, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Brolier

-

Layer

-

Breeder

-

-

Vaccine Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Disease type Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Bronchitis

-

Infectious Bursal Diseases

-

Infectious Laryngotracheitis

-

Egg Drop Syndrome

-

Adenovirus

-

Duck Viral Enteritis

-

Inclusion Body Hepatitis

-

Coccidiosis

-

Avian Influenza

-

Marek's Disease

-

Newcastle Disease

-

Salmonella

-

Avian Encephalomyelitis

-

Fowl Cholera

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Injectable

-

Intranasal

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-Commerce

-

Hospital/Clinic Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Rest of Asia-Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LA

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global poultry vaccines market size was estimated at USD 2.39 billion in 2024 and is expected to reach USD 2.54 billion in 2025.

b. The global poultry vaccines market is expected to grow at a compound annual growth rate of 7.60% from 2025 to 2030 to reach USD 3.66 billion by 2030.

b. North America dominated the poultry vaccines market with a share of over 37% in 2024. This is attributable owing to an increase in consumption of poultry-related food products, consumer awareness concerning food safety, and high incidence of avian diseases.

b. Some key players operating in the poultry vaccines market include Merck & Co. Inc.; Zoetis; Boehringer Ingelheim International GmbH; Ceva; Hester Biosciences Limited; Elanco; Vaxxinova International BV; Venkys India; Calier; KM Biologics; and Phibro Animal Health Corporation among others

b. Key factors that are driving the poultry vaccines market growth include rising vaccination to curb avian disease outbreaks and soaring demand for poultry-related food products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.