- Home

- »

- Advanced Interior Materials

- »

-

Powder Compacting Pressers Market, Industry Report, 2030GVR Report cover

![Powder Compacting Pressers Market Size, Share & Trends Report]()

Powder Compacting Pressers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Mechanical, Electric), By Application (Powder Metallurgy, Ceramic & Cement), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-319-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Powder Compacting Pressers Market Trends

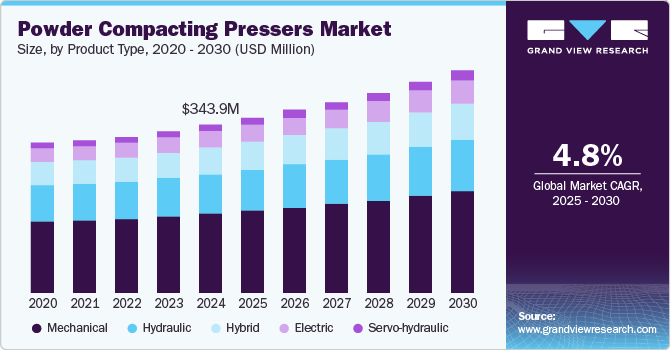

The global powder compacting pressers market size was valued at USD 343.9 million in 2024 and is expected to expand at a CAGR of 4.8% from 2025 to 2030. This growth is attributed to the rising demand for Internet of Things (IoT) technology in automobile production enhances manufacturing efficiency. In addition, the need for lightweight components in aerospace and military applications fuels the market, as powder compacting pressers facilitate the production of complex shapes quickly and cost-effectively. Furthermore, the increasing adoption of second-hand machines in developing regions supports market expansion, particularly in Asia Pacific, where businesses seek affordable solutions to meet growing project demands.

Powder compacting pressers are specialized machines that form intricate shapes from various powder materials and are witnessing significant demand across multiple industries. This surge is particularly evident in the automotive and aerospace sectors, where these machines are essential for producing high-precision components such as engine parts, transmission gears, and aircraft structures. The need for lightweight and durable components, coupled with the rise of electric vehicles and increased aircraft production, is driving the adoption of powder compacting pressers in these fields.

In addition, advancements in powder compacting technology are propelling market growth. Innovations in new powder materials and innovative press designs enhance the efficiency and precision of these machines. High-speed presses and automated feeding systems have notably improved production rates while reducing labor costs. The development of advanced powder materials with superior properties further broadens the applicability of powder compacting pressers.

Furthermore, government initiatives and environmental regulations also play a crucial role in shaping the market landscape. Many governments are advocating for powder compaction technology due to its energy efficiency and lower environmental impact compared to traditional manufacturing methods. These pressers save energy and minimize waste generation, aligning with sustainable manufacturing practices that are increasingly prioritized by regulatory bodies.

Product Type

The mechanical powder segment held the dominant position in the market, with the largest revenue share of 46.9% in 2024. This growth is attributed to their suitability for large-scale production and high-speed operations. In addition, mechanical pressers account for a significant market share due to their ability to deliver fast production speeds, making them ideal for industries requiring efficient manufacturing processes. Furthermore, the demand for cost-effective solutions in automotive and aerospace applications drives the need for these machines, as they can produce complex components swiftly and reliably, thereby enhancing overall productivity.

The electric powder segment is expected to grow at a CAGR of 6.4 over the forecast period, driven by technological advancements that enhance energy efficiency and precision. Electric pressers are increasingly replacing hydraulic models as they offer better performance without the environmental drawbacks associated with hydraulic fluids. In addition, their compact design requires less space, making them suitable for various manufacturing settings. Furthermore, the rising demand for sustainable manufacturing practices aligns with adopting electric pressers, which are quieter and more environmentally friendly, thus appealing to industries focused on reducing their carbon footprint.

Application Insights

The powder metallurgy segment led the market and accounted for the largest revenue share of 58.1% in 2024, owing to the increasing demand for high-performance materials in various industries. In addition, powder metallurgy processes enable the production of complex shapes and components with excellent mechanical properties, making them ideal for automotive, aerospace, and industrial applications. Furthermore, the ability to create lightweight and durable parts using powder metallurgy enhances product performance while reducing manufacturing costs. Moreover, advancements in powder compaction technology are expanding the range of materials and applications, further fueling market growth.

The ceramic and cement application segment is expected to grow at a CAGR of 5.5% from 2025 to 2030, primarily driven by the growing need for high-quality ceramic products in the electronics, healthcare, and construction industries. In addition, the ability to produce precise and uniform components through powder compaction is essential for achieving desired material properties in ceramics. Furthermore, as construction activities increase globally, the need for durable cement products drives the adoption of powder compacting techniques. Moreover, innovations in ceramic materials and processing methods also contribute to expanding this segment, enhancing the efficiency and effectiveness of powder compacting pressers in producing advanced ceramic solutions.

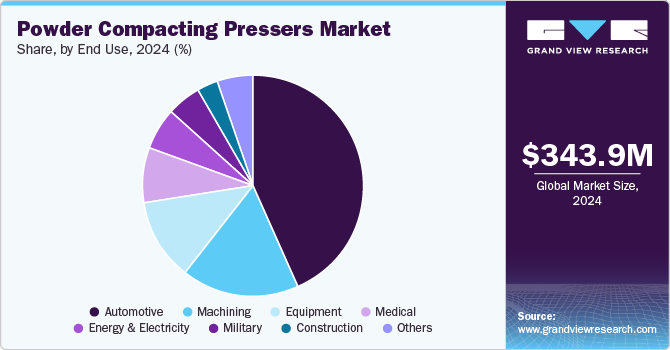

End Use Insights

The automotive segment dominated the market and accounted for the largest revenue share of 42.9% in 2024. This growth is attributed to the increasing production of vehicles, particularly in emerging economies. Furthermore, the demand for lightweight and high-performance components drives manufacturers to adopt powder compacting technology, which allows for the efficient production of complex parts such as engine components and transmission gears. Moreover, the rising adoption of electric vehicles necessitates advanced manufacturing processes, further boosting the need for powder compacting pressers in the automotive sector.

The medical segment is expected to grow at a CAGR of 6.1% over the forecast period, owing to heightened health awareness and increased consumer spending on healthcare products. In addition, these machines are essential for producing a range of medical devices, including dental products such as crowns and bridges and surgical instruments such as clamps and forceps. Furthermore, the shift towards biocompatible materials, such as zirconium oxide for dental applications, also drives demand. As the medical industry continues to expand, the reliance on powder compacting technology for manufacturing precise and durable components will likely increase significantly.

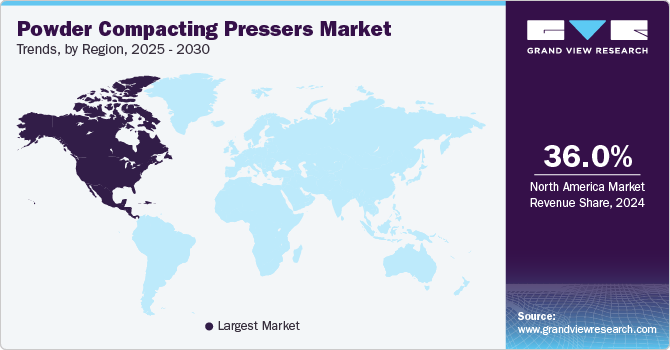

Regional Insights

The North America powder compacting pressers market dominated the global market and accounted for the largest revenue share of 36.0% in 2024. This growth is attributed to the region's strong industrial base and advanced manufacturing technologies. The presence of major aerospace and automotive companies significantly boosts demand for high-precision components. In addition, increased consumer spending and investment in research and development further enhance market prospects. Furthermore, the region is also witnessing a growing interest in IoT technologies, which improve manufacturing efficiency, making powder compacting pressers increasingly vital for meeting production demands across various sectors.

U.S. Powder Compacting Pressers Market Trends

The powder compacting pressers market in the U.S. benefits from substantial defense spending and a robust aerospace sector. The country is home to numerous leading manufacturers and innovative companies that utilize powder compacting technology to produce complex components efficiently. Furthermore, the shift towards electric vehicles is driving the need for lightweight parts, propelling the demand for advanced powder compacting solutions. This combination of factors positions the U.S. as a key player in the global powder compacting pressers market.

Asia Pacific Powder Compacting Pressers Market Trends

Asia Pacific powder compacting presser market is expected to grow at a CAGR of 5.4% over the forecast period, owing to rapid industrialization and increasing manufacturing capabilities. Countries such as China and India are investing heavily in their automotive and aerospace industries, leading to higher demand for efficient production technologies. In addition, the region's focus on adopting advanced materials and sustainable manufacturing practices contributes to the growth of powder compacting solutions. Furthermore, the rising need for high-precision components in various sectors further supports this upward trend.

The global powder compacting pressers market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by its vast manufacturing landscape and strong demand for advanced production technologies. In addition, the country's booming automotive industry is particularly influential, as manufacturers seek efficient methods to produce lightweight components. Furthermore, government initiatives promoting innovation and technological advancement are driving investments in powder metallurgy processes, enhancing the capabilities of local manufacturers, and increasing the adoption of powder compacting pressers.

Europe Powder Compacting Pressers Market Trends

Europe powder compacting pressers market is expected to witness significant growth, primarily driven by stringent environmental regulations and a strong emphasis on sustainability. European manufacturers are increasingly adopting energy-efficient production methods, which align with the capabilities of modern powder compacting technology. In addition, the automotive sector's demand for lightweight materials and high-performance components also drives growth in this region. Furthermore, ongoing research and development efforts contribute to innovations that enhance product quality and expand applications for powder compacting pressers.

The growth of the powder compacting pressers market in Germany is attributed to its advanced engineering capabilities and strong industrial base. Furthermore, the country's focus on precision manufacturing makes it a key player in producing high-quality components for various industries, including automotive and aerospace. Moreover, Germany's commitment to sustainability drives investments in energy-efficient technologies, further boosting demand for innovative powder compacting solutions. This combination of factors positions Germany as a significant contributor to the regional market's growth.

Key Powder Compacting Pressers Company Insights

Key companies in the global powder compacting pressers industry include SMS group GmbH, Gasbarre Products, Inc., Ajax CECO Erie Press, and others. These companies are adopting various strategies to enhance their market presence and competitive edge. These include launching innovative products incorporating advanced technologies, forming strategic partnerships to expand market reach, and entering agreements to enhance collaboration across industries. Furthermore, mergers and acquisitions are being pursued to consolidate resources and capabilities, allowing companies to better meet the evolving demands of sectors such as automotive and aerospace, ultimately driving growth in the powder compacting pressers market.

-

Osterwalder AG designs and manufactures high-performance powder compacting presses, catering to various industries that require precision and efficiency in component production. The company operates primarily in the powder metallurgy sector, providing innovative solutions for the manufacturing of complex parts. The company’s offerings include a range of mechanical and servo-electric presses, which are essential for producing lightweight and durable components used in automotive, aerospace, and other advanced engineering applications.

-

Cincinnati Incorporated operates in the metal fabrication segment, focusing on producing high-quality equipment such as laser cutting systems, press brakes, and shears. Their powder metal compacting and sizing presses are designed for high-speed production of precision components, serving industries such as automotive and aerospace.

Key Powder Compacting Pressers Companies:

The following are the leading companies in the powder compacting pressers market. These companies collectively hold the largest market share and dictate industry trends.

- KomageGellnerMaschinenfabrik KG

- SMS group GmbH

- Osterwalder AG

- MaschinenfabrikLauffer GmbH & Co.KG

- Gasbarre Products, Inc.

- Ajax CECO Erie Press

- Beckwood Press

- Digital Press

- DORST Technologies GmbH & Co. KG

- Cincinnati Incorporated

- Nanjing East Precision Machinery CO., LTD.

- Dongguan Yihui Hydraulic Machinery Co., Ltd.

- Santec Exim Pvt. Ltd.

- Quintus Technologies AB

- SACMI IMOLA S.C.

Recent Developments

- In December 2024, Osterwalder announced the delivery of its first 1000 kN multi-plate servo-electric press, designed specifically for powder compacting processes. This innovative press enhances efficiency and precision in manufacturing, catering to industries requiring high-performance powder compacting pressers. The servo-electric technology allows for greater control over the pressing process, resulting in improved product quality and reduced energy consumption. This development marks a significant advancement in the capabilities of powder compacting machinery.

Powder Compacting Pressers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 358.2 million

Revenue forecast in 2030

USD 453.6 million

Growth Rate

CAGR of 4.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, end use, region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, China, India, Japan, South Korea, Australia, Germany, UK, France, Poland, Russia, Spain, Sweden, Brazil, Argentina, Peru, South Africa, and Saudi Arabia.

Key companies profiled

KomageGellnerMaschinenfabrik KG; SMS group GmbH; Osterwalder AG; MaschinenfabrikLauffer GmbH & Co.KG; Gasbarre Products, Inc.; Ajax CECO Erie Press; Beckwood Press; Digital Press; DORST Technologies GmbH & Co. KG; Cincinnati Incorporated; Nanjing East Precision Machinery CO., LTD.; Dongguan Yihui Hydraulic Machinery Co., Ltd.; Santec Exim Pvt. Ltd.; Quintus Technologies AB; SACMI IMOLA S.C.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

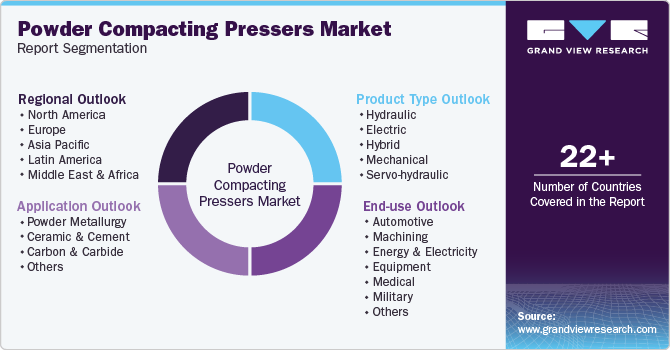

Global Powder Compacting Pressers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the powder compacting pressers market report based on product type, application, end use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hydraulic

-

Electric

-

Hybrid

-

Mechanical

-

Servo-hydraulic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder Metallurgy

-

Ceramic & Cement

-

Carbon & Carbide

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Machining

-

Energy & Electricity

-

Equipment

-

Medical

-

Military

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Austria

-

Belgium

-

Denmark

-

France

-

Germany

-

Italy

-

Poland

-

Russia

-

Spain

-

Sweden

-

The Netherlands

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Argentina

-

Brazil

-

Colombia

-

Chile

-

Peru

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.