- Home

- »

- Processed & Frozen Foods

- »

-

Powdered Fats Market Size, Share And Growth Report, 2030GVR Report cover

![Powdered Fats Market Size, Share & Trends Report]()

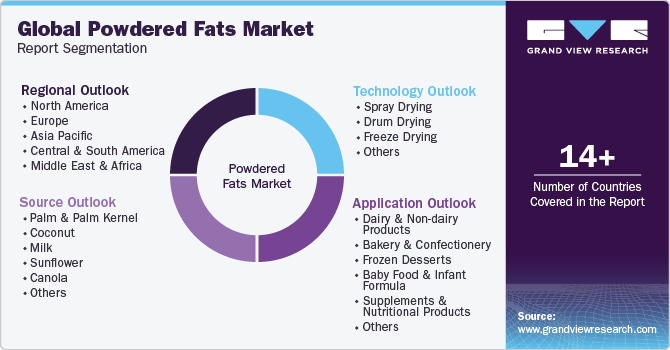

Powdered Fats Market Size, Share & Trends Analysis Report By Source (Palm & Palm Kernels, Milk), By Processing Technology (Spray Drying, Drum Drying), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-159-2

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Powdered Fats Market Size & Trends

The global powdered fats market size was estimated at USD 2.24 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.4% from 2023 to 2030. This market is expected to experience significant growth throughout the forecast period, driven by the growing demand for healthier fats in food applications and rising adoption of powdered fats in nutritional product formulations. There is a growth in demand of healthy fats in food industry, particularly in the baked goods market. It is driven by rising consumer preference for indulgent foods that have a plant-based, clean-label profile, low-fat content, and feature organic fats and oils. Consumers are increasingly mindful of their food choices, seeking unique sensory experiences and prioritizing factors like clean labels, plant-based ingredients, nutritional profiles, and sustainability. As a result, there is a rising interest in powdered fats, especially those derived from sought-after oils like sunflower and coconut.

The 2020 Dietary Guidelines for Americans emphasized reducing trans fats and limiting saturated fats, promoting plant-based oils like canola, corn, and soybean. According to a 2021 FATitudes survey by Cargill, consumers increasingly monitor fats and oils in packaged foods, with 53% of Americans being vigilant about their choices. According to an ADM Outside Voice proprietary research in 2021, clean-label products are in demand, with 69% of consumers preferring simple, recognizable ingredients.

Prominent end-uses in the market include dairy and non-dairy products, bakery & confectionery, frozen desserts, infant formula, nutraceutical supplements, nutritional beverages, instant beverages, seasonings, sauces, and dips. The use of powdered fats in various applications is driven by their versatility and convenience. In the dairy industry, powdered fats enhance shelf stability by resisting oxidation and rancidity, ensuring long-lasting dairy products. The demand for dairy products, both traditional and non-dairy alternatives, remains high, fueling the use of powdered fats in products like cheese, ice creams, and non-dairy creamers. In response to the rising popularity of plant-based options, powdered fats from sources like coconut oil are utilized in non-dairy creamers to meet the demand for lactose-free and plant-based products.

Spray drying, drum drying, freeze drying, encapsulation, and fluidized bed drying are the commonly used processing techniques for powdered fat manufacturing. Spray drying is one of the main manufacturing methods in the industry. This method is suitable for heat-sensitive fats. Spray dried powdered fats are used in various food products, including bakery items, confectionery, instant beverages, dairy alternatives, savory foods, and nutritional supplements. The process removes moisture from the fat source, extending the shelf life of the end products.

Source Insights

Powdered fats derived from palm and palm kernel dominated the market with a revenue share of 34.9% in 2022. Powdered fats derived from palm have a high melting point that reduces the chances of rancidity, making it a preferred choice for applications where stable fats are required, such as in the production of bakery and confectionery, and snacks. Palm fats are also crucial in the animal feed industry owing to their ability to mix in animal feed during preparation.

The food industry is increasingly focused on sustainable sourcing of palm fats. Companies in the market are offering palm fats that are certified sustainable. For instance, Castle Dairy s.a. offers spray-dried powder, containing 80% fully refined palm oil that is certified sustainable according to Roundtable on Sustainable Palm Oil (RSPO) SG standards.

Demand for coconut-based fats is anticipated to grow at a CAGR of 5.5% during the forecast period. The growing demand for healthier options from the oils & fats industry is driving the growth of MCT sourced from natural, purely plant-based sources, specifically high-quality coconut oil. In March 2020, Sternchemie, a German company specializing in functional food lipids and coconut milk powders, launched MCT fats derived from coconut or RSPO-certified palm kernel oil in a powdered version called NutriStern MCT, which contains medium-chain fatty acids with 8 to 12 carbon atoms. These MCT powders are GMO- and allergen-free, making them suitable for various applications, including sports nutrition, weight management, and dietary supplements.

Application Insights

Demand from bakery & confectionery accounted for the largest revenue share of 34.9% in 2022. The sector is witnessing a growing demand for fat-filled milk powder rather than whole milk powder owing to its high-fat content. Consumers are increasingly interested in clean-label and all-natural bakery products, especially European consumers who regularly check ingredient lists. In February 2019, FrieslandCampina developed two new dairy-based fat powders, including butter-based Vana-Lata BB75B and cream-based CB72B for the bakery industry. These powdered fats can be used in bakery applications to create indulgent and sensory products while meeting consumers' demands for clean-label and all-natural ingredients.

The use of powdered fats in dairy and non-dairy products is projected to grow at the fastest CAGR of 5.4% over the forecast period. Dairy products often have a limited shelf life, which drives the use of powdered fats. Powdered fats offer stability to dairy products, especially in terms of shelf life. They resist oxidation and rancidity leading to long-lasting products.

The demand for plant-based options is rising, especially among lactose-intolerant consumers. In response to these trends, convenience store operators are diversifying their product offerings, incorporating plant-based milk alternatives like almond milk and innovative items such as Silk Almond Creamer to cater to evolving consumer tastes. It will drive the demand for plant-based powdered fats in non-dairy applications like coconut powder in coffee creamers and plant-based milk smoothies.

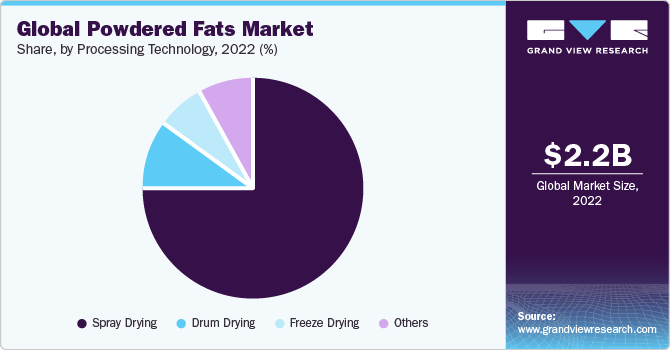

Processing Technology Insights

Demand for spray dried powdered fats dominated the market in 2022 with a revenue share of 75.0%. Spray drying is a widely used technique where a liquid fat or oil is atomized into fine droplets and dried quickly with hot air to form powder particles, thus highly suitable for heat-sensitive fats. Spray-dried fat powders find applications in diverse food products, including bakery items, confectionery, instant beverages, dairy alternatives, savory foods, and nutritional supplements.

Freeze dried powdered fats demand is anticipated to grow at a CAGR of 4.2% over the forecast period. Freeze-drying technology preserves the nourishing qualities of raw materials and retains their natural flavor, vitamins & minerals, and bioactive enzymes. Freeze-dried powdered fats are witnessing demand from the beverage industry owing to the convenience of being incorporated into various applications, such as smoothies, juices, and yogurt. Manufacturers of nutritional drinks are seeking freeze-dried coconut powders due to their versatility.

Regional Insights

In 2022, Asia Pacific held the largest revenue share of 34.15% in the global market. The growing demand for ready-to-eat and processed foods in the region has led to various manufacturers offering powdered fat for different applications. Powdered fats are increasingly used in food applications as they provide concentrated flavor and texture. Moreover, traditional oils and butter are less cost-effective for industrial production. To meet the rising demand for processed foods in the region, several emerging and key players offer a diverse range of powdered fats.

In China, factors such as rising meat consumption and high demand for processed foods among consumers are driving the demand for powdered fats. The rising awareness of nutrition and health has led several consumers in the country to seek a protein-rich diet.

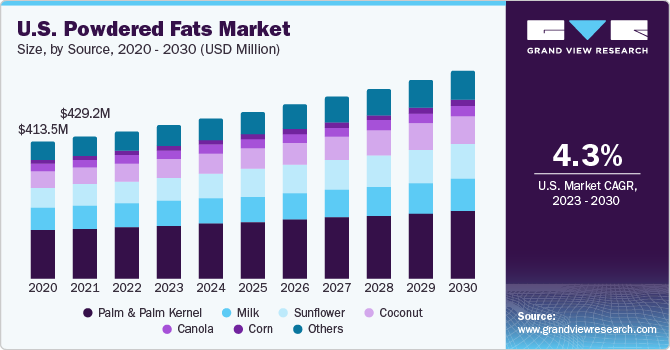

Demand in North America is expected to grow at a CAGR of 4.1% during the forecast period. The growing popularity of non-dairy milk alternatives and vegan products is boosting the demand for fat powders in the region. Due to increasing demand, several companies are launching products that enhance the richness and provide mouthfeel. For instance, All American Foods, a U.S.-based manufacturer of non-dairy & dairy products, offers Pro Mix high-fat powders that help improve the creamy flavor and texture in gravies, dips, soups, and other food applications.

Ketogenic diets have gained popularity in the U.S., which are driving the demand for products having low-carb and high-fat content. The trend has captured the attention of health-conscious consumers seeking these products. In response, several key players in the powdered fats industry are capitalizing on the trend by launching such products in the country.

Key Companies & Market Share Insights

The market is characterized by the presence of large, mature players and emerging companies. The mature players leverage their long-standing relationships with suppliers, distributors, and clients to reinforce their strong positions in the market. Portfolio diversification and acquisition of quality standard certifications are some of the important operating strategies adopted by these large companies. The emerging players in this industry are characterized by innovations, R&D investments, and the ability to adapt to changing market & technology trends.

Key Powdered Fats Companies:

- Kerry Group plc

- Royal FrieslandCampina N.V.

- Aarkay Food Products Ltd.

- Insta Foods

- Castle Dairy s.a.

- Zeon Lifesciences Ltd.

- LUS Health Ingredients BV

- Hill Natural Extract

- Tiba Starch & Glucose Manufacturing Co. S.A.E

Recent Developments

-

In March 2021, LUS Health Ingredients launched a new vegan range of powdered fats called Veganergy. The range included a diverse selection of vegan fats derived from plant sources, carefully crafted to mimic the texture and flavor of traditional animal-based fats.

-

In January 2021, Compound Solutions launched olive oil fat powder with 50% extra virgin olive oil. It is a collaboration between Compound Solutions and Boundary Bend. The amalgamation of both oil leads to no rancidity unlike other oils. The powder is expected to stir even in water. It is expected to boost the demand from vegan consumers.

-

In March 2020, Sternchemie launched BergaBest MCT oils as spray-dried powders with an MCT content of up to 70%. MCT oils are ideal for nutritional supplements and low-carb diets. The product is easily dispersible and contains clean ingredients.

Powdered Fats Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.33 billion

Revenue forecast in 2030

USD 3.17 billion

Growth rate

CAGR of 4.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, processing technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.;Canada;Mexico; UK; Germany; France; Spain; Italy; Netherlands; Belgium; China; India; Japan; Australia & New Zealand; Brazil; Argentina; Colombia; Peru; Chile; Guatemala; Honduras; El Salvador; South Africa

Key companies profiled

Kerry Group plc; Royal FrieslandCampina N.V.; Aarkay Food Products Ltd.; Insta Foods; Castle Dairy s.a.; Zeon Lifesciences Ltd., LUS Health Ingredients BV; Hill Natural Extract; Tiba Starch & Glucose Manufacturing Co. S.A.E

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Powdered Fats Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global powdered fats market report based on source, processing technology, application, and region.

-

Source Outlook (Revenue, USD Million, 2017 - 2030)

-

Palm & Palm Kernel

-

Coconut

-

Milk

-

Sunflower

-

Canola

-

Corn

-

Others

-

-

Processing Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Spray Drying

-

Drum Drying

-

Freeze Drying

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Dairy & Non-dairy Products

-

Bakery & Confectionery

-

Frozen Desserts

-

Baby Food & Infant Formula

-

Supplements & Nutritional Products

-

Beverages

-

Seasonings & Flavorings

-

Sauces, Dressings, & Condiments

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Netherlands

-

Belgium

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

Peru

-

Chile

-

Guatemala

-

Honduras

-

El Salvador

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global powdered fats market size was estimated at USD 2.24 billion in 2022 and is expected to reach USD 2.33 billion in 2023.

b. The global powdered fats market is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 3.17 billion by 2030.

b. Asia Pacific dominated the powdered fats market with a share of 34.15 % in 2022. This is attributable to the growing demand for ready-to-eat and processed foods in the region.

b. Some key players operating in the powdered fats market include Kerry Group plc, Royal FrieslandCampina N.V., Aarkay Food Products Ltd., Insta Foods, Castle Dairy s.a., Zeon Lifesciences Ltd., LUS Health Ingredients BV, Hill Natural Extract, and Tiba Starch & Glucose Manufacturing Co. S.A.E.

b. Key factors that are driving the powdered fats market growth include the growing demand for healthier fats in food applications and the rising adoption of powdered fats in nutritional product formulations worldwide.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."