- Home

- »

- Renewable Energy

- »

-

Power Tool Batteries Market Size, Industry Report, 2030GVR Report cover

![Power Tool Batteries Market Size, Share & Trends Report]()

Power Tool Batteries Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Lithium-ion, Nickel-Cadmium, Nickel-Metal Hydride), By Application (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-600-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Power Tool Batteries Market Summary

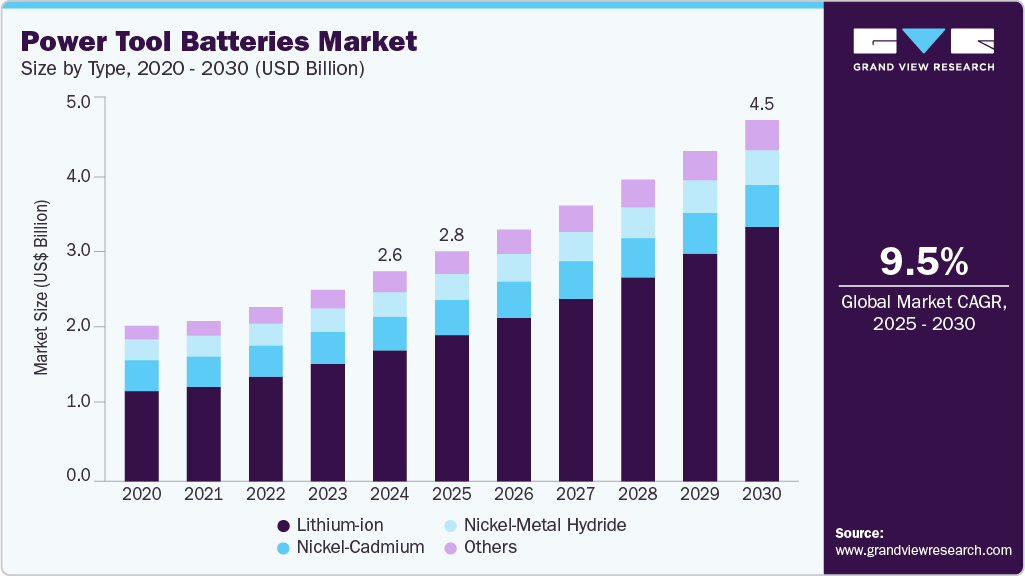

The global power tool batteries market size was estimated at USD 2.61 billion in 2024, and is projected to reach USD 4.49 billion by 2030, growing at a CAGR of 9.5% from 2025 to 2030. The market is witnessing robust growth, fueled by the rising demand for cordless power tools across professional and DIY applications.

Key Market Trends & Insights

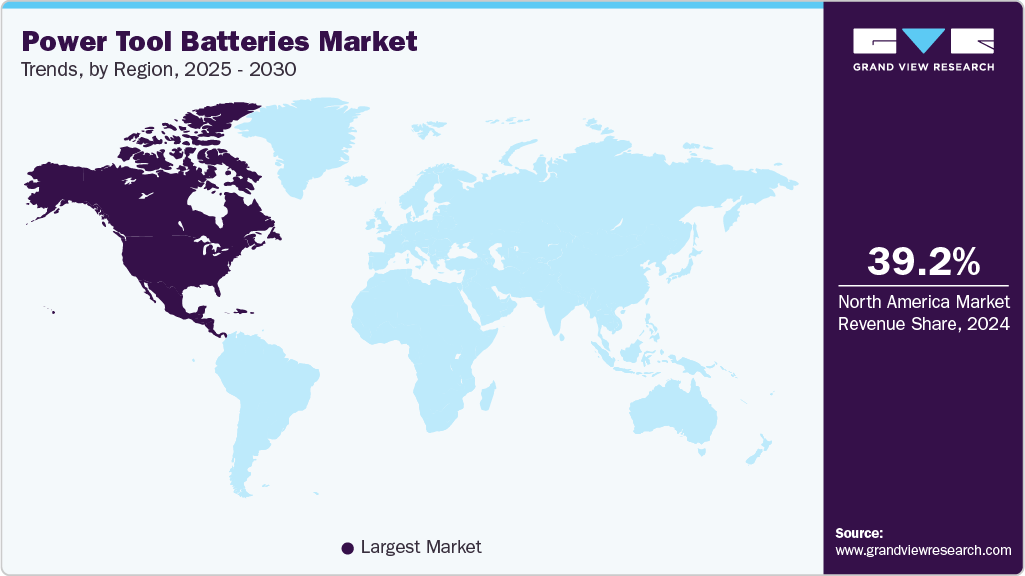

- North America held the largest 39.24% regional revenue share in 2024.

- Technological advancements continue to shape the U.S. power tool batteries industry landscape.

- By type, lithium-ion batteries held the largest market revenue share of over 62.43% in 2024.

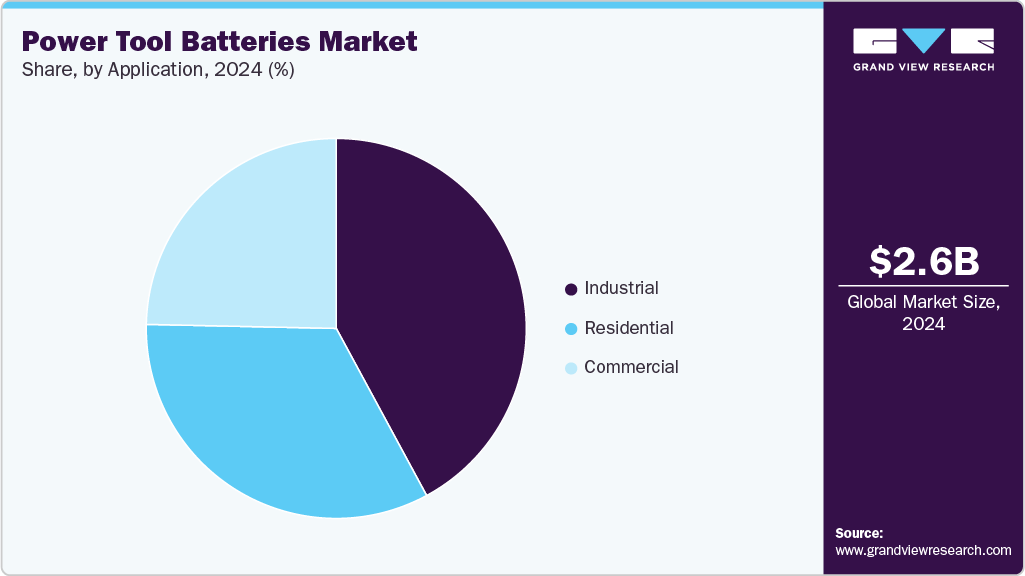

- By application, the industrial segment held the largest revenue share of 42.11% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.61 Billion

- 2030 Projected Market Size: USD 4.49 Billion

- CAGR (2025-2030): 9.5%

- North America: Largest market in 2024

Key factors such as advancements in lithium-ion battery technology, increasing focus on energy efficiency, and the growing popularity of battery-powered equipment over traditional corded tools are driving market expansion. Moreover, favorable regulations promoting sustainable construction practices and the ongoing shift toward electrification in the tools industry support battery adoption globally. Technological innovations, particularly in battery chemistry and thermal management systems, significantly enhance power tool batteries' performance and lifespan. These advancements enable faster charging, higher energy density, and improved safety, making cordless tools more efficient and reliable for industry users.

Additionally, integrating smart battery technologies that allow for real-time monitoring of battery health and usage contributes to operational efficiency and cost savings. As consumers and industries increasingly prioritize portability and sustainability, the demand for advanced battery-powered tools continues to align with global trends toward cleaner, more efficient energy solutions.

The commercial and residential construction sectors are increasingly shifting toward battery-powered tools to enhance job site mobility and reduce emissions. The modular design and compatibility of battery systems across multiple tools within a brand ecosystem offer users greater flexibility and cost-effectiveness. Subscription-based or battery-as-a-service (BaaS) models are also emerging, allowing users to access premium battery technology without substantial upfront investment. This transition is especially pronounced in rapidly developing regions like Asia Pacific, where urban growth and infrastructure expansion boost demand for cordless solutions.

Despite the market's promising outlook, challenges such as the high cost of advanced lithium-ion batteries, recycling complexities, and safety concerns related to overheating or thermal runaway remain. However, continuous R&D and growing regulatory support for battery standardization and recycling infrastructure are expected to address these issues over time. As industries move toward cordless, energy-efficient solutions, power tool batteries are set to play a central role in shaping the future of tool performance, sustainability, and user convenience.

Drivers, Opportunities & Restraints

The growing demand for cordless convenience, improved tool mobility, and enhanced workplace safety drives the adoption of power tool batteries across various end use industries. As construction, automotive, and manufacturing sectors increasingly shift to battery-powered tools, the need for high-performance, long-lasting batteries has become paramount. Additionally, rising awareness of carbon emissions and sustainability targets encourages using energy-efficient cordless tools, further fueling market growth. Power tool batteries offer a cleaner and quieter alternative to gas- or cord-powered equipment, making them a preferred choice in urban and indoor environments.

Opportunities within the power tool batteries market are expanding due to rapid advancements in battery technology and evolving user expectations. Developing lithium-ion and solid-state batteries with higher energy density, faster charging, and extended lifespan opens new application areas. Emerging economies have significant growth potential where urbanization and industrialization increase the demand for portable power tools. Furthermore, the rise of smart batteries-featuring Bluetooth connectivity, usage tracking, and performance optimization-presents new value-added opportunities for manufacturers. Commercial contractors and DIY consumers are driving the demand for interchangeable battery platforms that work across multiple tools, offering efficiency and cost savings.

Despite a favorable growth trajectory, the market faces several challenges. High production costs of advanced battery chemistries, limited availability of raw materials like lithium and cobalt, and supply chain disruptions can hinder profitability and scalability. Environmental concerns related to battery disposal and recycling remain unresolved in many regions, posing regulatory and sustainability hurdles. Additionally, performance limitations in extreme temperatures and safety issues such as overheating and short-circuiting can affect user trust and product reliability. Overcoming these restraints through innovation, regulation, and infrastructure development will be key to sustaining long-term market growth.

Type Insights

The Lithium-ion segment dominated the power tool batteries industry, accounting for the largest revenue share in 2024 due to its superior energy density, lightweight design, and longer lifespan compared to other chemistries. These batteries support faster charging and deliver consistent power output, making them ideal for DIY enthusiasts for heavy-duty industrial applications and everyday use. Their ability to retain charge over extended periods and low self-discharge rates further enhance their appeal. As the demand for cordless tools continues to rise across various sectors, Lithium-ion batteries remain the preferred choice due to their performance efficiency and decreasing cost trends fueled by mass production and ongoing innovation.

Nickel-cadmium (Ni-Cd), Nickel-Metal Hydride (NiMH), and other battery types continue to serve niche markets, often where cost sensitivity or specific environmental conditions dictate their use. While Ni-Cd batteries offer durability and tolerance to extreme temperatures, their environmental concerns and memory effects have led to declining usage. Though more environmentally friendly, NiMH batteries typically offer lower energy density than lithium-ion options. However, advancements in alternative chemistries and recycling technologies are expected to improve these battery types' competitiveness gradually. Nonetheless, Lithium-ion remains the industry benchmark, supported by continual R&D and widespread manufacturer adoption across power tool platforms.

Application Insights

The industrial segment led the power tool batteries market with the largest revenue share in 2024, primarily driven by the increasing reliance on cordless power tools in the manufacturing, automotive, construction, and maintenance sectors. Industries are rapidly adopting battery-powered tools to improve operational flexibility, reduce workplace hazards associated with cords, and meet stricter environmental and safety regulations. High-performance lithium-ion batteries are particularly favoured in this segment for their extended runtime, fast recharging capabilities, and ability to handle heavy-duty workloads. As automation and mechanization continue to rise, the demand for reliable, durable battery systems in industrial settings is expected to maintain strong momentum.

The commercial and residential segments also contribute to market growth, propelled by the expanding DIY culture, small business operations, and professional tradespeople seeking efficient and portable solutions. In the commercial sector, contractors and service providers benefit from the mobility and efficiency of battery-operated tools, which help reduce downtime and increase productivity on job sites. Meanwhile, homeowners are increasingly investing in cordless tools for everyday tasks in the residential space, attracted by their ease of use and safety. Across all applications, advancements in battery interoperability-allowing a single battery platform to power multiple tools-enhance user convenience and drive broader adoption.

Regional Insights

The North America power tool batteries market commands the largest share globally, fueled by high demand across construction, automotive, and home improvement sectors. A strong focus on productivity, worker safety, and energy efficiency supports the widespread adoption of cordless tools in both professional and consumer markets. Lithium-ion battery innovation remains at the forefront, with U.S.-based manufacturers investing heavily in next-gen chemistries, faster-charging solutions, and smart battery systems. Additionally, growing DIY trends and government incentives promoting energy-efficient equipment bolster battery sales across the region. While the U.S. has a dominant market share, Canada also sees growing demand due to increased residential renovation activity and infrastructure development.

U.S. Power Tool Batteries Market Trends

Technological advancements continue to shape the U.S. power tool batteries industry landscape, with a surge in demand for high-capacity, long-life lithium-ion solutions across commercial and industrial applications. Integrating Bluetooth-enabled smart batteries, rapid chargers, and battery platforms compatible across tool lines improves convenience and operational efficiency for contractors and tradespeople. These developments align with sustainability goals and workplace efficiency standards, making the U.S. a hub for innovation and consumption within the global power tool batteries sector.

Asia Pacific Power Tool Batteries Market Trends

The Asia Pacific power tool batteries industry is witnessing rapid growth, driven by robust urbanization, expanding industrial activity, and increasing adoption of cordless tools. Countries like China and India are experiencing significant demand from their booming construction and manufacturing sectors. Battery technology localization, rising DIY culture, and supportive government programs promoting local tool production are accelerating market penetration. Innovations like cost-effective lithium-ion variants and extended warranty battery packs are gaining traction. At the same time, regional players focus on scalable, budget-friendly options to meet the needs of a diverse consumer base.

Europe Power Tool Batteries Market Trends

A strong focus on sustainability, carbon neutrality, and smart construction practices supports Europe’s market growth. The EU’s Green Deal and circular economy goals are encouraging manufacturers to offer energy-efficient, recyclable, and low-emission power tool battery solutions. Demand is particularly strong in countries like Germany, the UK, and the Nordic region, where the professional trades sector relies heavily on cordless tools for indoor and outdoor applications. Trends such as battery-sharing platforms and modular power packs are emerging as manufacturers respond to cost and sustainability pressures with innovative solutions.

Latin America Power Tool Batteries Market Trends

Latin America is gradually gaining momentum in the power tool batteries industry, driven by increased construction, mining, and agricultural demand. Countries like Brazil, Mexico, and Chile are witnessing growth in both industrial and DIY segments, supported by the affordability and portability of battery-powered tools. While lithium-ion remains the dominant chemistry, market penetration is still challenged by high costs and limited local manufacturing. However, rising investment in infrastructure projects and the growing presence of international tool brands are expected to fuel steady regional expansion.

Middle East & Africa Power Tool Batteries Market Trends

The Middle East & Africa power tool batteries industry is growing steadily, propelled by construction booms in the Gulf region and expanding electrification across Sub-Saharan Africa. The adoption of cordless power tools is accelerating due to the need for mobile, durable, and efficient equipment on remote and large-scale job sites. Countries like Saudi Arabia and the UAE are leading the transition, driven by ambitious infrastructure plans and sustainable building initiatives under programs like Vision 2030 and Energy Strategy 2050. The increasing availability of affordable tools and batteries in Africa unlocks new growth opportunities, particularly in residential and light industrial applications.

Key Power Tool Batteries Company Insights

Some of the key players in the power tool batteries market include Bosch Ltd, Makita Corporation, Stanley Black & Decker Inc., Samsung SDI Co. Ltd, and Panasonic Corporation.

-

In February 2024, Makita Corporation unveiled a new 40V max XGT lithium-ion battery line designed to deliver higher power output and longer runtime for heavy-duty power tools. This launch is part of the company’s strategy to strengthen its position in the professional-grade cordless tool segment.

-

In January 2024, Stanley Black & Decker Inc. announced a partnership with a major battery technology firm to co-develop next-generation solid-state batteries for power tools. The initiative aims to enhance energy density, reduce charging times, and improve battery safety, aligning with the rising demand for high-performance cordless solutions across industrial and commercial sectors.

Key Power Tool Batteries Companies:

The following are the leading companies in the power tool batteries market. These companies collectively hold the largest market share and dictate industry trends.

- Bosch Ltd

- Hilti Corporation

- Hitachi Ltd

- Makita Corporation

- Panasonic Corporation

- Ryobi Limited

- Samsung SDI Co. Ltd

- Sony Group Corporation

- Stanley Black & Decker Inc.

- Techtronic Industries Company Limited

Power Tool Batteries Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.86 billion

Revenue forecast in 2030

USD 4.49 billion

Growth rate

CAGR of 9.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Spain; UK; France; Italy; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Bosch Ltd; Hitachi Ltd; Makita Corporation; Panasonic Corporation; Ryobi Limited; Samsung SDI Co. Ltd; Sony Group Corporation; Stanley Black & Decker Inc.; Techtronic Industries Company Limited; Hilti Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

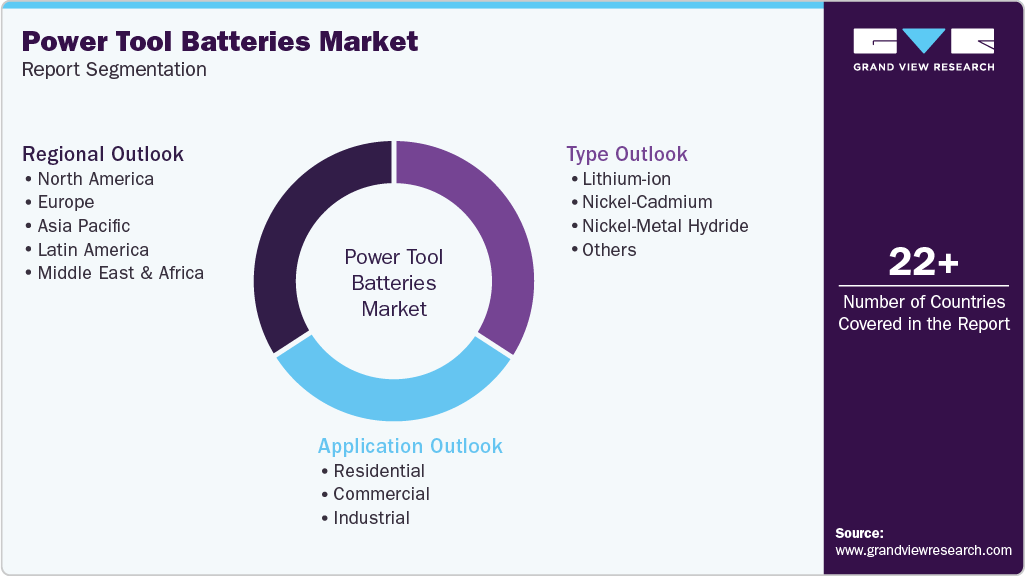

Global Power Tool Batteries Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global power tool batteries market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lithium-ion

-

Nickel-Cadmium

-

Nickel-Metal Hydride

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global power tool batteries market size was estimated at USD 2.61 billion in 2024 and is expected to reach USD 2.86 billion in 2025.

b. The global power tool batteries market is expected to grow at a compound annual growth rate of 9.5% from 2025 to 2030 to reach USD 4.49 billion by 2030.

b. The lithium-ion segment accounted for the largest global power tool batteries market share with a revenue share of over 62.43% in 2024. Known for their high energy density, lightweight design, and longer lifecycle, lithium-ion batteries have become the preferred choice for both professional and DIY users. Their fast-charging capability and compatibility with a wide range of cordless tools make them essential in transitioning away from corded equipment, particularly in industrial and commercial applications.

b. Some of the key vendors of the global power tool batteries market are Bosch Ltd, Hitachi Ltd, Makita Corporation, Panasonic Corporation, and Ryobi Limited. Other prominent companies are Samsung SDI Co. Ltd, Sony Group Corporation, Stanley Black & Decker Inc., Techtronic Industries Company Limited, and Hilti Corporation.

b. The key factors driving the global power tool batteries market include the rising adoption of cordless power tools across industries and advancements in battery technologies like lithium-ion for longer runtimes and faster charging—growing construction, automotive, and industrial demand also fuel market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.