- Home

- »

- Consumer F&B

- »

-

Pre-workout Supplements Market Size, Industry Report 2030GVR Report cover

![Pre-workout Supplements Market Size, Share & Trends Report]()

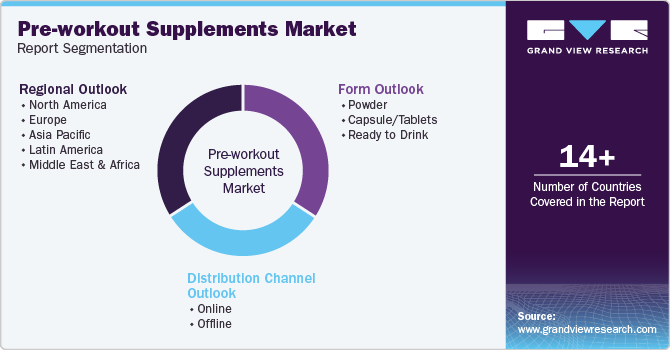

Pre-workout Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Form (Powder, Capsule, Ready To Drink), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-875-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pre-workout Supplements Market Summary

The global pre-workout supplements market size was estimated at USD 19.58 billion in 2024 and is anticipated to reach USD 27.97 billion by 2030, growing at a CAGR of 5.9% from 2025 to 2030. The market growth is attributed to the rising consumer awareness of the health benefits associated with pre-workout supplements, such as improved energy, focus, and endurance during workouts.

Key Market Trends & Insights

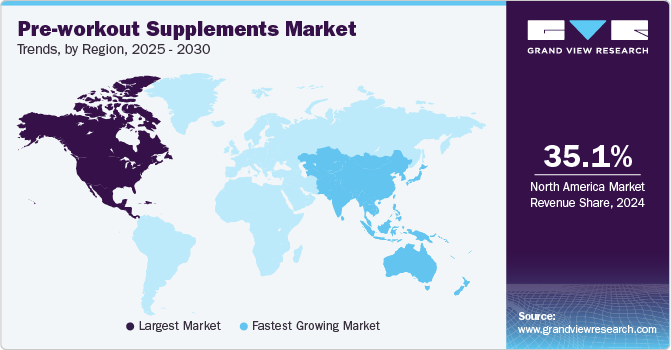

- North America's pre-workout supplements market dominated the global industry with the largest revenue share of 35.1% in 2024.

- The U.S. pre-workout supplements market is expected to grow significantly over the forecast period.

- By form, the powder segment dominated the market with the largest revenue share of 88.1% in 2024.

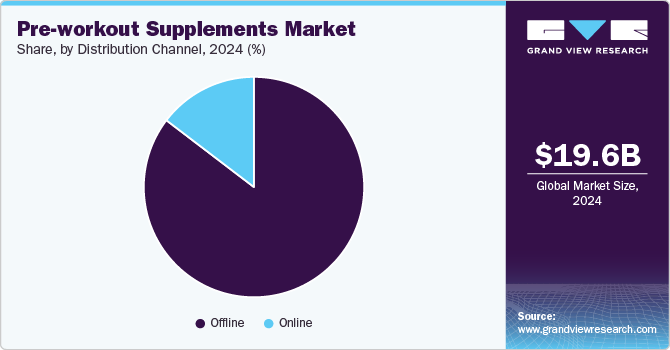

- By distribution channel, the offline channel dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.58 Billion

- 2030 Projected Market Size: USD 27.97 Billion

- CAGR (2025-2030): 5.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing number of health and fitness centers and the growing trend of home workouts contribute to market expansion. The rising popularity of functional foods and beverages that provide additional health benefits beyond basic nutrition is propelling demand. Consumers are becoming more proactive about their fitness routines and seeking products to enhance their performance and overall well-being. The availability of pre-workout supplements in various forms, such as powders, capsules, and ready-to-drink beverages, further supports market growth.

Form Insights

The powder segment dominated the market with the largest revenue share of 88.1% in 2024. Powdered pre-workout supplements offer a high degree of customization, allowing users to adjust the dosage according to their specific needs and preferences. Also, powders are more cost-effective than other forms like ready-to-drink beverages and capsules. The convenience of mixing powders with water or other beverages makes them a popular choice among fitness enthusiasts. Furthermore, the wide variety of flavors and formulations available in powder form caters to diverse consumer tastes and dietary requirements. The ability to easily integrate powdered supplements into different workout routines and the perception of higher potency also contribute to their popularity.

The ready-to-drink segment is expected to grow at the fastest CAGR of 6.6% over the forecast period. The increasing demand for convenience among fitness enthusiasts is a major driver, as ready-to-drink pre-workout supplements offer a quick and easy way to consume the necessary nutrients without the need for mixing or preparation. The portability of RTD products makes them an attractive option for busy individuals who need a convenient solution to fuel their workouts on the go. Additionally, the growing popularity of functional beverages that provide specific health benefits, such as enhanced energy and endurance, is propelling market demand. The availability of RTD pre-workout supplements in a variety of flavors and formulations caters to diverse consumer preferences, further driving their popularity

Distribution Channel Insights

The offline channel dominated the market with the largest revenue share in 2024. Traditional retail outlets such as supermarkets, hypermarkets, and specialty nutrition stores remain popular among consumers who prefer to physically inspect and purchase their supplements. The ability to see, touch, and sometimes use sample products before buying builds consumer trust and satisfaction. Additionally, the expert advice from in-store staff can guide consumers in making informed choices tailored to their fitness needs. The wide availability of pre-workout supplements in various forms and flavors in these offline channels caters to diverse consumer preferences. Seasonal promotions, discounts, and loyalty programs offered by brick-and-mortar stores also attract a substantial customer base.

The online channel is expected to grow at the fastest CAGR over the forecast period. The increasing popularity of e-commerce platforms and their convenience are making it easier for consumers to purchase pre-workout supplements from the comfort of their homes. Online platforms offer a wide variety of products, detailed descriptions, customer reviews, and ratings, helping consumers make informed decisions. Additionally, the influence of digital marketing and social media advertising is effectively reaching a broader audience and boosting online sales. Exclusive online discounts, promotions, and subscription services further incentivize consumers to shop for pre-workout supplements online. The rise of health-conscious consumers seeking functional foods and supplements is also contributing to the growth of the online channel.

Regional Insights

North America's pre-workout supplements market dominated the global industry with the largest revenue share of 35.1% in 2024. The rising awareness of the benefits of pre-workout supplements, such as enhanced energy, focus, and endurance, is boosting consumer demand. The increasing number of fitness centers, gyms, and health clubs across North America, particularly in the U.S. and Canada, is further propelling the market. Additionally, the growing trend of health and wellness, coupled with the rising interest in personal fitness and bodybuilding, is driving the adoption of pre-workout supplements. The region's well-developed retail infrastructure, including both traditional and online channels, ensures wide accessibility to various pre-workout products. The influence of fitness influencers and social media platforms, which promote the effectiveness of these supplements, is also playing a crucial role in market expansion.

U.S. Pre-workout Supplements Market Industry

The U.S. pre-workout supplements market is expected to grow significantly over the forecast period. The increasing consumer focus on health and fitness and the rising trend of personalized workout routines are significantly boosting demand for pre-workout supplements. The proliferation of gyms, fitness centers, and boutique fitness studios across the country is encouraging more individuals to adopt fitness regimes that include pre-workout supplementation. Additionally, the influence of fitness influencers and social media personalities who promote the benefits of pre-workout products is driving consumer interest and adoption. The growing awareness of the importance of nutrition in enhancing workout performance and recovery is further propelling market growth.

Europe Pre-workout Supplements Market Industry

The Europe pre-workout supplements market held a considerable share in 2024 owing to the increasing emphasis on healthy lifestyles and fitness activities across European countries, is boosting demand for pre-workout supplements. The region's strong tradition of sports and athletic events, coupled with the growing popularity of gym memberships and fitness classes, is encouraging the adoption of these products. Additionally, the rising awareness of the benefits of pre-workout supplements in enhancing energy, endurance, and overall workout performance is attracting a broad consumer base. The influence of European regulations that ensure high-quality and safe ingredients in supplements further supports market growth. Furthermore, the expansion of online retail channels and the presence of major international and local brands in the European market make pre-workout supplements more accessible to consumers.

Asia Pacific Pre-workout Supplements Market Industry

Asia Pacific pre-workout supplements market is expected to grow at the fastest CAGR of 6.1% over the forecast period. The increasing adoption of Western fitness trends and the rising popularity of gym culture in countries such as China, India, Japan, and Australia are significantly boosting demand for pre-workout supplements. The growing awareness of the health benefits associated with these supplements, including improved energy levels and enhanced workout performance, is attracting health-conscious consumers. The region's expanding middle class, with rising disposable incomes and a greater focus on health and wellness, is also driving market growth. The influence of social media and fitness influencers who promote pre-workout products is also contributing to the market expansion.

Key Pre-workout Supplements Company Insights

Some key companies in the pre-workout supplements market include FINAFLEX, EFX Sports, SynTech Nutrition, BPI Sports, and others.

-

FINAFLEX is a prominent player in the pre-workout supplements industry, offering a variety of pre-workout supplements designed to enhance performance and energy levels. One of their popular products is WRN Pre-Workout, which features a blend of ingredients such as L-Citrulline Malate, Creatine Monohydrate, Beta-Alanine, and Caffeine. This formula is designed to improve blood flow, increase strength, and enhance endurance during workouts.

-

EFX Sports is another leading brand in the pre-workout supplements industry, offering a range of products designed to boost energy, stamina, and performance. Its flagship product, Training Ground PRE, is a fully disclosed, banned-substance-free pre-workout formula that includes ingredients such as Agmatine Sulfate, Beta-Alanine, Caffeine, Citrulline Malate, and Kre-Alkalyn. This product is formulated to enhance muscle power, strength, and growth. EFX Sports also offers other products such as Karbolyn Fuel, a high-performance carbohydrate supplement, and Nytric EFX, a massive pump agent.

Key Pre-workout Supplements Companies:

The following are the leading companies in the pre-workout supplements market. These companies collectively hold the largest market share and dictate industry trends.

- FINAFLEX

- EFX Sports

- SynTech Nutrition

- BPI Sports

- eFlow Nutrition LLC

- Magnum Worldwide

- Allmax Nutrition

- MusclePharm

- MuscleTech

- MAN Sports Nutrition

Recent Developments

-

In August 2024, GAT Sport officially launched Nitraflex ULTRA, a next-generation pre-workout supplement in Strawberry Watermelon, Blue Raspberry, and Peach Pineapple. This product, designed to exceed the performance of its predecessor, Nitraflex Advanced, features cutting-edge ingredients such as the Nitraflex ULTRA Pump & Performance Blend, SuperSodium, DopaPhen, and Dynamine. Nitraflex ULTRA aims to enhance energy, focus, hydration, and muscle performance for athletes.

-

In June 2024, Gold's Gym launched its new Premium Pre-Workout, a sports nutrition product tailored for athletes seeking optimal performance. Inspired by the original Gold's Gym in Venice, California, this supplement is exclusively available on Amazon with Prime shipping options.

Pre-workout Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.98 billion

Revenue forecast in 2030

USD 27.97 billion

Growth Rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil

Key companies profiled

FINAFLEX; EFX Sports; SynTech Nutrition; BPI Sports; eFlow Nutrition LLC; Magnum Worldwide; Allmax Nutrition; MusclePharm; MuscleTech; MAN Sports Nutrition

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pre-workout Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pre-workout supplements market report based on form, distribution channel, and region:

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Capsule/Tablets

-

Ready to Drink

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.