- Home

- »

- Advanced Interior Materials

- »

-

Precious Metals E-Waste Recovery Market Size Report 2030GVR Report cover

![Precious Metals E-Waste Recovery Market Size, Share & Trends Report]()

Precious Metals E-Waste Recovery Market Size, Share & Trends Analysis Report By Metal (Gold, Silver), By Source (Household Appliances, IT & Telecommunication), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-223-5

- Number of Report Pages: 104

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

The global precious metals e-waste recovery market size was estimated at USD 5.92 billion in 2023 and is expected to grow at a CAGR of 5.0% from 2024 to 2030. The market growth is expected to be driven by a rise in replacement of old electrical and electronic products with new products. Precious metals account for a significant share of e-waste generation, which contains high-value metals, such as gold, silver, and platinum, among others. Generally, e-waste recovery and recycling includes collection of waste, crushing, classification, and sale of precious elements. In some cases, methods, such as hydrometallurgy, pyro-metallurgy, and bio-hydrometallurgy, are also used for the recovery of precious elements.

A shorter span of life for gadgets is likely to increase the demand for new technology gadgets, which again generates e-waste in a few years. This cycle leads to high volumes of end-of-life products, such as cellphones, speakers, headphones, chargers, batteries, routers, webcams, and connected devices among others. As of 2021, the global recycling rate in the industry was 17.4%. Thus, there is significant scope for expansion in the near future. As per the E-waste Monitor (United Nations), around 57.4 million tons of e-waste was generated in 2021, and the number is expected to grow by 2 million tons every year.

For 1 million recycled cellphones, around 34 kg of gold, 15 kg of palladium, and 350 kg of silver can be recovered. Thus, the market offers lucrative opportunities for players owing to the increased volume of end-of-life products. In terms of volume of e-waste generation, Asia Pacific is the leading region, followed by the Americas and Europe. In addition, the recycling rate in Asia is low compared to advanced economies. The rising population, along with growing middle-class income levels, are likely to act as supporting factors for e-waste generation in Asia Pacific.

Market Concentration & Characteristics

Market growth stage is medium and the pace of its growth are accelerating. The degree of innovation is medium in the market as there is a high demand for the recovery of metals from waste generation. The capital expenditure in the industry is expected to remain high over the coming years as players in ferrous and non-ferrous scrap recycling are also venturing into this industry.

The precious metals e-waste recovery industry is fragmented, with new players entering the market with fresh investments. For instance, in April 2023,Re Sustainability Reldan Refining Ltd. announced an investment of INR 500 crore (~USD 60 million) for e-waste recovery, which will focus on processing and obtaining precious metals. Furthermore, the market is expected to observe a moderate level of merger & acquisition activities.

The industry is characterized by stringent regulations as hazardous content in e-waste recovery can pose a serious threat to the environment and human health. The recovery can expose humans to high levels of toxic materials, such as cadmium, mercury, lead, and arsenic. Methods, such as acid baths and open-air burning, also release toxic contents into the environment.

Service substitutes in the market are expected to remain high over the coming years. Mining of ores is expected to remain a key method for accessing precious metals compared to e-waste recovery. The precious metals e-waste recovery market still needs significant investment to generate significant refined content.

End-user concentration in the market remains at moderately high levels. Precious metals are used in several industries, such as jewelry, electronics manufacturing, medicine, aerospace energy, photography, chemicals, antibiotics, and oil refining, among others. Jewelry and electronics industries account for a significant share of the demand for precious metals.

Source Insights

Based on sources, the consumer electronics segment dominated the market with a share of 40.6% in 2023. Replacement of old consumer electronic products is anticipated to generate a large amount of waste over the coming years. These products include television sets, mobile phones, audio and video systems, gaming consoles, computers, laptops, cameras, smart home devices, wearables, and many more.

Rising penetration of the internet and changing lifestyles are likely to benefit the penetration of consumer electronics. In addition, these products have a relatively shorter life as new models with improved features are released regularly. Components, such as batteries, printed circuit boards (PCBs), and display units, produce significant precious metal content.

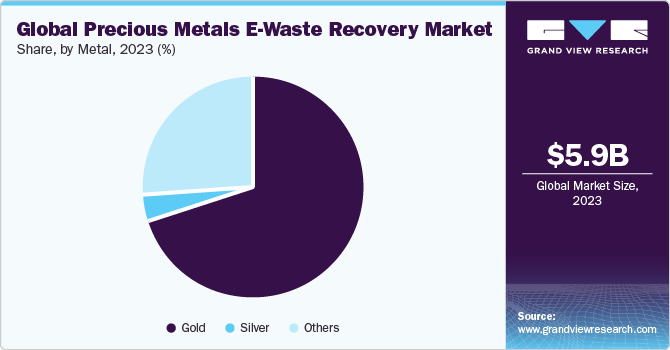

Metal Insights

Gold accounted for the largest revenue share of more than 70.0% in 2023. There are several methods to recover gold from electronic waste. These methods include extraction using cyanide, pyro-metallurgy, acid treatment, bioleaching, and hydrometallurgy, among others. Scarcity & difficulty in the extraction of gold, and thus high-value attributes, primarily contribute to the share of the segment.

The extraction of silver is expected to provide opportunities to market players as this will reduce the dependence on mining. Excellent electrical and thermal conductivity has benefited the increased demand for silver in the electrical and electronics manufacturing sector. Traditional low-grade silver from mining is insufficient for silver consumption in this sector; thus investment is needed to extract silver from electronic waste.

Regional Insights

North America accounted for a share of around 35% in 2023 and is expected to grow at a significant CAGR from 2024 to 2030. Electronic waste generation in the region is increasing at a rapid pace, and thus, there is a need to recycle such waste and extract important materials from it. As per research by the University of Waterloo, electronic waste in Canada has increased to 25.3 kg in 2020 from 8.3 kg per person in 2000.

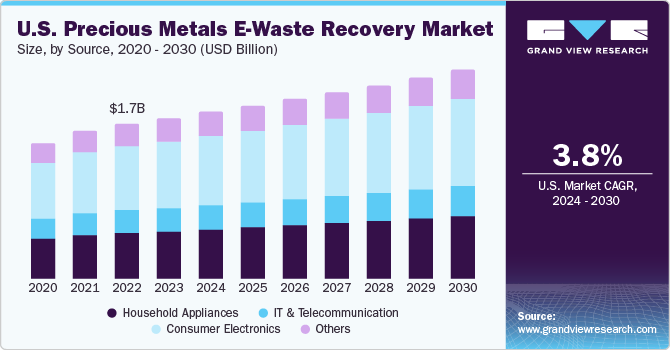

U.S. Precious Metals E-Waste Recovery Market Trends

The U.S. precious metals e-waste recovery market is expected to have significant growth over the forecast period. The government initiatives, coupled with new investment in e-waste recycling in the U.S., are expected to benefit regional market growth. The Environmental Protection Agency (EPA) signed an agreement with the United Nations University in 2010 and 2015 to jointly work in the field of electronic waste recovery. The U.S. government has also announced the National Strategy for Electronics Stewardship (NSES) to improve the management and recycling of electronic waste.

Asia Pacific Precious Metals E-Waste Recovery Market Trends

The precious metals e-waste recovery market in Asia Pacific is expected to witness substantial growth in the coming years. Initiatives like Swacch Bharat Abhiyan and zero waste plan by several APAC countries are expected to increase awareness about recycling of e-waste. This is further expected to increase the regional market growth.

The China precious metals e-waste recovery market held the largest share in the Asia Pacific regional market in 2023. China is one of the leading electronic waste producers in the world. The electronic waste recovery sector in the country is unorganized, and several small- and medium-sized companies are engaged in dismantling end-of-life products and selling them to giant electronic companies like Foxconn. However, the recycling rate in the country is low compared to developed countries in Europe.

The precious metals market in India is anticipated to witness lucrative growth from 2024 to 2030. India is the world’s third-largest market for the production of electronic waste, as per the Department of Information Technology, India, and this waste is expected to grow by 10% over the coming years. As per the same source, around 95% of electronic waste is handled by the informal sector, while the remaining 5% is handled by the formal sector. The informal sector works independently, which makes it difficult for the government to enforce any regulations.

Europe Precious Metals E-Waste Recovery Market Trends

The Europe precious metals market will witness significant growth from 2024 to 2030. The penetration of precious metal e-waste recovery has been growing at a lucrative pace in Europe. In January 2023, the European Bank for Reconstruction and Development (EBRD) announced financing of Euro 120 million (~ USD 128 million) for a recycling facility in Poland. This facility will extract precious and other rare metals from electric vehicle (EV) batteries, automotive waste, and other electronic waste.

The precious metals e-waste recovery market in Sweden is growing at a steady pace. Sweden has one of the best electronic waste collection and recycling systems in the world. El-Kretsen is the national collection system, wherein the electronic waste recycling value chain includes 15 transport companies, 290 municipalities, and 30 recycling facilities. This also includes collection points in municipalities where one can hand in electronic waste. As reported by the European Environment Agency, as of 2020, Sweden’s e-waste recycling rate was around 38.3%.

MEA Precious Metals E-Waste Recovery Market Trends

The Middle East & Africa precious metals market will have a steady growth from 2024 to 2030 driven by the growing importance of sustainability and several government initiatives focused on spreading awareness of the benefits of recycling. However, the region is expected to witness difficulties due to a lack of proper infrastructure for collecting and recycling e-waste.

The precious metals market in South Africa held a prominent share of the overall Middle East & Africa regional market. Over 90% of electrical and electronic waste in the country is currently mismanaged, wherein most of the waste ends up in landfills or handled by the informal sector. The market in the country is governed by the National Waste Strategy and National Environmental Waste Act. As per the Department of Forestry, Fisheries and the Environment, the country generates approximately 360 kilotons annually, which is around 5 to 8% of municipal solid waste.

Key Precious Metals E-Waste Recovery Company Insights

Some of the key players operating in the market include Umicore N.V., Aurubis AG, and SIMS Ltd.

-

Umicore’s business includes clean technologies, such as recycling, emission control catalysts, materials for rechargeable batteries, and photovoltaics. The company divides its operations into four business divisions: Recycling, Catalysis, Energy Materials, and Performance Materials. Recycling accounts for 78% of its total revenues

-

Aurubis AG is a global supplier of non-ferrous metals and an established recycler. Aurubis processes complex e-waste, metal concentrates, scrap metals, industrial residue for metals, and metal-bearing recycling raw materials

Reldan and All Green Recycling are some of the emerging market participants.

-

Reldan’s key business includes reclaiming and reprocessing precious metals. In 2011, the company constructed a modern LEED-Silver-certified facility for metal refining. The company’s geographic presence is limited to the U.S., India, and Mexico. The company recovers gold, silver, platinum, and palladium

-

All Green Recycling is an electronic waste recycling company. The company’s core competencies include customized IT recycling services, logistics, and data security services. Some of the company’s clients are AT&T, Verizon, Belk, and Northup Grumman

Key Precious Metals E-Waste Recovery Companies:

The following are the leading companies in the precious metals e-waste recovery market. These companies collectively hold the largest market share and dictate industry trends.

- Sims Limited

- Aurubis AG

- Materion Corporation

- Umicore NV

- Boliden AB

- EnviroLeach Technologies

- Johnson Matthey Plc

- DOWA Holdings Co., Ltd.

- TES-AMM Pte. Ltd.

- Heraeus Holding GmbH

- Tanaka Precious Metals

- Metallix Refining Inc.

- Reldan

- All Green Recycling

Recent Developments

-

In November 2023, Johnson Matthey successfully designed a mass balance process to recover 100% recycled platinum group metals. This process has been reviewed and accepted by Carbon Trust as being in line with industry standards

-

In January 2023, DOWA Ecosystem, Indonesia commenced its operations at DESI, East Java, Indonesia. The company has a landfill to accept hazardous materials and will carry out recycling using different methods. It includes waste classification, blending, and detoxification

Precious Metals E-Waste Recovery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.22 billion

Revenue forecast in 2030

USD 8.75 billion

Growth rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Metal, source, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Belgium; UK; Italy; Sweden; China; Japan; India; South Korea; Malaysia Brazil; UAE; Egypt; South Africa

Key companies profiled

Sims Ltd.; Aurubis AG; Materion Corp.; Umicore NV; EnviroLeach Technologies; Johnson Matthey Plc; DOWA Holdings Co., Ltd.; TES-AMM Pte. Ltd.; Heraeus Holding GmbH; Tanaka Precious Metals; Metallix Refining Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Precious Metals E-Waste Recovery Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global precious metals e-waste recovery market report based on metal, source, and region:

-

Metal Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Gold

-

Silver

-

Others

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Household Appliances

-

IT & Telecommunication

-

Consumer Electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Belgium

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

UAE

-

Egypt

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global precious metals e-waste recovery market size was estimated at USD 5.92 billion in 2023 and is expected to increase to USD 6.22 billion in 2024.

b. The global precious metals e-waste recovery market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 8.75 billion by 2030.

b. Consumer electronics dominated the precious metals e-waste recovery market with a revenue share of over 40.0% in 2023, owing to rising demand for updated models of electronic products.

b. Some of the key players operating in the precious metals e-waste recovery market include Sims Limited, Aurubis AG, Materion Corporation, Umicore NV, EnviroLeach Technologies, Johnson Matthey Plc, DOWA Holdings Co., Ltd., and TES-AMM Pte. Ltd.,

b. The key factors that are driving the precious metals e-waste recovery market include replacement of old electronic products with new products and rising demand for recycled metal.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."