- Home

- »

- Advanced Interior Materials

- »

-

Precipitated Silica Market Size & Growth Analysis Report, 2030GVR Report cover

![Precipitated Silica Market Size, Share & Trends Report]()

Precipitated Silica Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Rubber, Agrochemicals, Oral Care, Food), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: 978-1-68038-755-1

- Number of Report Pages: 114

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Precipitated Silica Market Summary

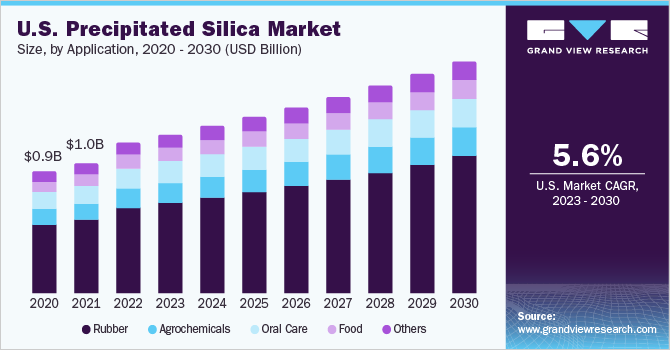

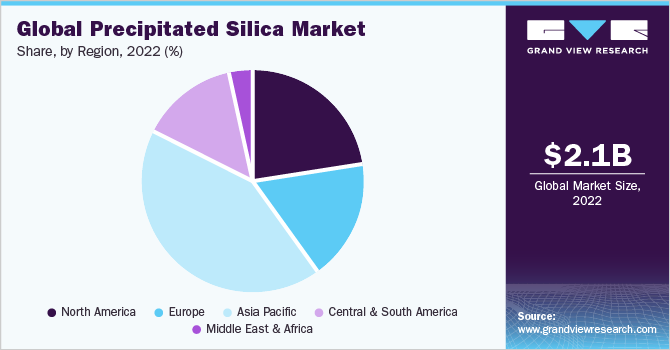

The global precipitated silica market size was estimated at USD 2.15 billion in 2022 and is projected to reach USD 3.72 billion by 2030, growing at a CAGR of 7.1% from 2023 to 2030. The rising demand from rubber, agrochemicals, and oral care industries is the major factor driving the growth of the industry.

Key Market Trends & Insights

- The Asia Pacific held the largest revenue share of 42.7% in 2022.

- China was the largest consumer of precipitated silica in 2022.

- Based on application, rubber segment led the precipitated silica market with a revenue share of around 53.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 2.15 Billion

- 2030 Projected Market Size: USD 3.72 Billion

- CAGR (2023-2030): 7.1%

- Asia Pacific: Largest market in 2022

Tires are the largest application of precipitated silica. Therefore, the market is significantly driven by the dynamics of the global automotive market. Rising disposable income in the Asia Pacific has led to the huge production of automobiles in the region. Asia Pacific is the biggest manufacturer of automobiles in the world which makes Asia Pacific a significant market for precipitated silica.Demand for precipitated silica for fuel-efficient tires is expected to propel aligning to continued reduction in automotive fuel consumption along with an inclination towards vehicle electrification. Governments across the world are creating policies to push the usage of fuel-efficient tires. For instance, in May 2022, the Indian government announced that they are going to bring a new star rating rule to the tire industry. Tires are expected to be rated on the basis of their ability to save fuel, prevent skidding, and ensure safety.

A significant rise in the production of electric vehicles (EVs) is expected to provide a lucrative opportunity for the precipitated silica market. The global EV sales reached 2 million across the world, in the first quarter of 2022. The growth in the demand for EVs is expected to have a positive impact on the precipitated silica market. For instance, in January 2022, Honda Motor Investment Co Ltd announced that Dongfeng Honda Automobile Co Ltd will build a new EV production plant in Hubei Province, China. The production at this plant will begin in 2024 and it will produce 120,000 units annually. Similarly, in November 2021, Volkswagen announced its plans to build a state-of-the-art EV factory in Wolfsburg, Germany.

Tire companies are investing to develop new tires, which are made of entirely sustainable materials and more fuel-efficient. For instance, in 2020, Goodyear pledged to develop a new tire made entirely of sustainable material. The company also pledged to develop sustainable carbon black, which is expected to generate fewer carbon emissions and stronger performance.

Application Insights

Based on application, rubber segment led the precipitated silica market with a revenue share of around 53.0% in 2022. The product is extensively used in the rubber industry, particularly as a reinforcement filler in tires. Tire manufacturers are currently focused on increasing green tire production owing to increasing pressure on vehicle makers to meet rising fuel-economy targets and reduce vehicle emissions. This is anticipated to propel product demand in the forthcoming years. Non-tire applications of the product include silicone rubber, footwear soles, and industrial rubber.

Agrochemicals application is forecasted to register a CAGR of 6.4% over the forecast period. To add visco-elastic characteristics to liquid agrochemicals, precipitated silica is utilized. It is utilized rheology modifier and as an anti-settling additive. It prevents the agglomeration of active ingredients in liquid formulations to avoid sedimentation. In addition, the product is used as a process aid, free-flowing aid, milling aid, and anti-cracking aid in solid agrochemicals.

Growing awareness regarding oral hygiene across the globe is expected to stimulate product demand, especially from the toothpaste industry. In the production of transparent and medicated toothpaste, precipitated silica serves as a polishing, whitening, and cleansing ingredient. Rising consumer awareness regarding healthy lifestyle, wellness, and hygiene is expected to propel the product demand in oral care application over the forecast period.

Other applications include paints and coatings, defoamers, plastics, and adhesives and sealants. The product is extensively utilized in paints and coatings, wherein it acts as anti-settling, matting, thickening, and thixotropic agents. The silica grade of products for paints and coatings is utilized to provide enhanced efficiency in medium polar and non-polar solvents.

Regional Insights

The Asia Pacific held the largest revenue share of 42.7% in 2022 and it is expected to maintain its dominance over the forecast period. The massive industrialization, increasing production of automotive tires, and huge construction spending in the region are expected to drive the product demand.

China was the largest consumer of precipitated silica in 2022 and the country is expected to remain the dominant consumer across the forecast period. Factors such as growing investment in EVs and increasing demand for the product in various industries such as rubber, oral care, and food is driving the market growth in the country.

North America was the second-largest contributor with a revenue share in 2022. The rising demand for tires is significantly driving rubber applications in the region. Tire shipments for electric passenger cars and trucks in the region are poised to register significant growth over the next few years. This is anticipated to propel the product demand in North America.

Growing production of heavy commercial vehicles in the U.S. auto industry has led to rising demand for advanced and high efficient rubber tires, which is expected to have a positive influence on precipitated silica demand in the tire industry. For instance, in September 2021, Ford Motor Company announced plans to set up two new campuses in Tennessee and Kentucky, for the production of the electric F-Series trucks and batteries. These campuses will be environmentally and technologically advanced and the products are intended to power the future electric Ford and Lincoln vehicles. The production from these plants will begin in 2025.

Key Companies & Market Share Insights

Key market players are extending their existing manufacturing capacities or setting up new plants and entering into collaborations & partnerships with tire manufactures. For instance, in September 2022, Evonik Industries entered into a partnership with Phichit Bio Power Co., Ltd. and Pörner Group to provide the supply of sustainable tires manufactured from precipitated silica which would reduce the carbon footprints significantly. Some prominent players in the global precipitated silica market include:

-

Anten Chemical Co. Ltd.

-

Huber Engineered Materials

-

Evonik Industries

-

PPG Industries Incorporated

-

IQE Group

-

Solvay SA

-

PQ Corporation

-

MLA Group

-

Tosoh Silica Corporation

-

W.R. Grace & Co.

-

Madhu Silica Pvt. Ltd

Precipitated Silica Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.29 billion

Revenue forecast in 2030

USD 3.72 billion

Growth Rate

CAGR of 7.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; Spain; France; Italy; China; India; Japan; Brazil; Saudi Arabia; United Arab Emirates; South Africa

Key companies profiled

Anten Chemical Co. Ltd.; Huber Engineered Materials; Evonik Industries AG; PPG Industries, Inc.; IQE Group; Solvay S.A.; PQ Corporation; MLA Group; Tosoh Silica Corporation; Oriental Silicas Corporation; W.R. Grace & Co.; Madhu Silica Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Precipitated Silica Market Report Segmentation

This report forecasts revenue and volume growth at country & regional levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global precipitated silica market report based on application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Rubber

-

Agrochemicals

-

Oral Care

-

Food

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global precipitated silica market size was estimated at USD 2.15 billion in 2022 and is expected to reach USD 2.29 billion in 2023.

b. The global precipitated silica market is expected to grow at a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 3.72 billion by 2030.

b. The rubber segment dominated the market with a revenue share of over 53.0% in 2022. Tire manufacturers are currently focused on increasing green tire production owing to increasing pressure on vehicle makers to meet rising fuel-economy targets and reduce vehicle emissions.

b. Some key players operating in the precipitated silica market include Evonik Industries, W.R. Grace & Co., Huber Engineered Materials, Solvay SA, PPG Industries Incorporated, Tosoh Silica Corporation, Madhu Silica Pvt. Ltd, and PQ Corporation.

b. Key factors that are driving the market growth include rising demand from rubber, agrochemicals, and oral care industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.