- Home

- »

- Renewable Chemicals

- »

-

Precision Chemicals Market Size, Industry Report, 2033GVR Report cover

![Precision Chemicals Market Size, Share & Trends Report]()

Precision Chemicals Market (2025 - 2033) Size, Share & Trends Analysis Report By Grade (High-Purity Chemicals, Ultra-Pure Chemicals), By Application (Pharmaceuticals, Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-825-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Precision Chemicals Market Summary

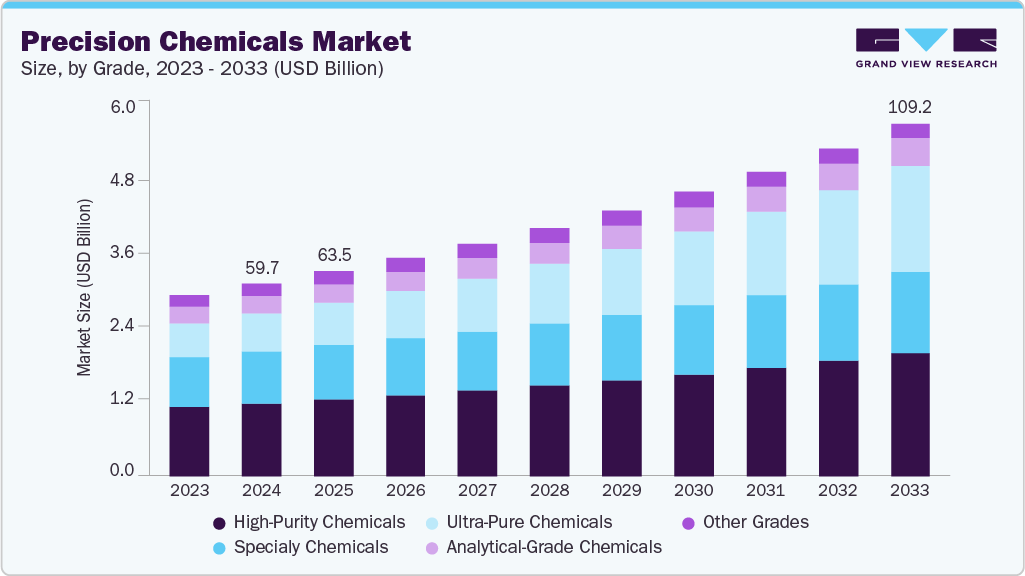

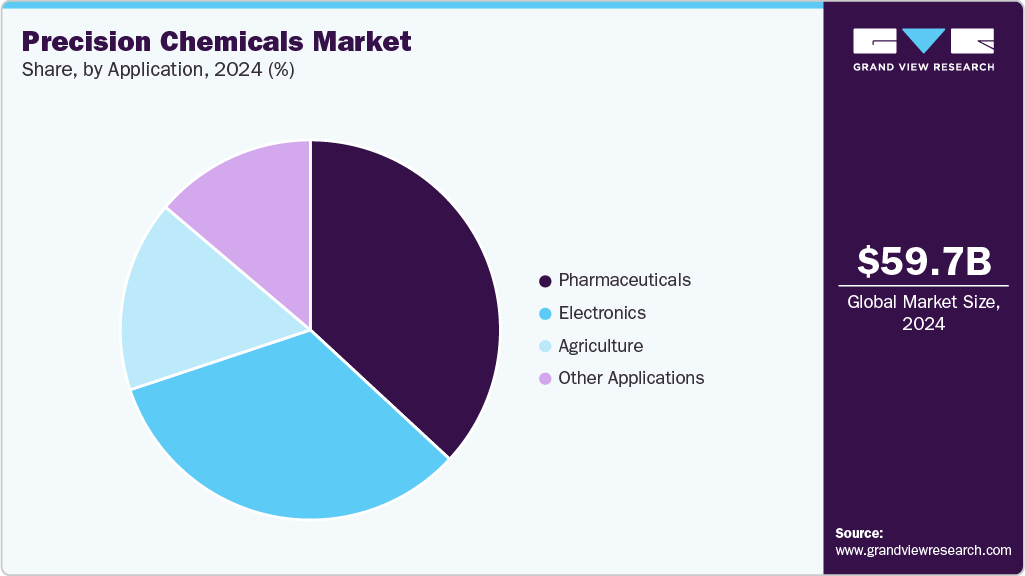

The global precision chemicals market size was estimated at USD 59.74 billion in 2024 and is projected to reach USD 109.25 billion by 2033, growing at a CAGR of 7.0% from 2025 to 2033. The precision chemicals industry is driven by the growing demand for high-performance, application-specific chemical formulations across advanced industries, including pharmaceuticals, electronics, agrochemicals, and specialty manufacturing.

Key Market Trends & Insights

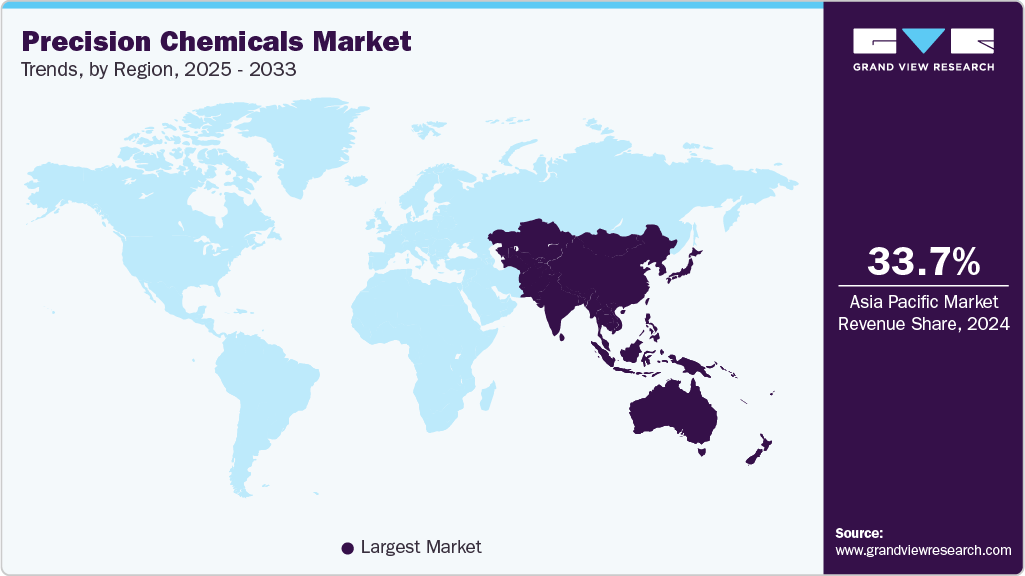

- Asia Pacific dominated the global precision chemicals market with the largest revenue share of 33.7% in 2024.

- The precision chemicals market in China is expected to grow at the fastest CAGR of 9.1% from 2025 to 2033.

- By grade, the high-purity chemicals segment led the market with the largest revenue share of 37.9% in 2024.

- By application, the electronics segment is expected to grow at the fastest CAGR of 8.7% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 59.74 Billion

- 2033 Projected Market Size: USD 109.25 Billion

- CAGR (2025-2033): 7.0%

- Asia Pacific: Largest Market in 2024

Unlike commodity chemicals, precision chemicals are designed to deliver consistent performance, high purity, and exact functional properties.Another strong driver is rapid technological advancement and innovation in end-use industries. In sectors such as semiconductors, advanced materials, biotechnology, and battery manufacturing, the margin for error is extremely low, which increases the need for chemicals with precise composition, controlled reactivity, and minimal impurities. The rise of emerging technologies such as electric vehicles, renewable energy storage systems, and next-generation electronics is creating demand for specialized surface treatment chemicals, electronic-grade solvents, high-purity reagents, and advanced functional additives, directly supporting market expansion.

Moreover, the precision chemicals industry is benefiting from increasing regulatory and quality standards across industries. Stricter safety, environmental, and performance regulations are pushing manufacturers to adopt precision chemicals that meet specific purity and sustainability benchmarks. At the same time, growing customer preference for reliable, high-quality, and sustainable chemical products is encouraging producers to invest in advanced manufacturing processes and R&D capabilities. This shift toward value-added, customized chemical solutions is positioning precision chemicals as a critical growth segment within the broader specialty chemicals market

Market Concentration & Characteristics

The precision chemicals industry is characterized by its high value, low volume, and application-specific nature, distinguishing it clearly from bulk and commodity chemicals. These chemicals are produced with tight specifications, high purity levels, and well-controlled molecular structures to meet the exact performance requirements of advanced industries such as pharmaceuticals, electronics, biotechnology, and energy storage. As a result, the market places strong emphasis on quality consistency, traceability, and process control, making manufacturing more technically intensive and capital demanding. Product differentiation is based not only on chemical composition but also on performance reliability in highly sensitive operating environments.

Another key characteristic of the precision chemicals industry is its innovation-driven and customer-centric structure. Demand is largely influenced by rapid technological advancements in end-use sectors, requiring continuous product customization and collaborative development between suppliers and customers. Long-term supply contracts, high switching costs, and strict qualification processes are common, especially in sectors like semiconductors and pharmaceuticals. In addition, the precision chemicals industry reflects a growing focus on sustainable and green chemistry, with companies developing eco-friendly and low-toxicity alternatives that align with global regulatory changes and corporate sustainability goals, further shaping competitive dynamics.

Grade Insights

The high-purity chemicals segment led the market with the largest revenue share of 37.9% in 2024. This segment caters to industries that require very low levels of impurities but do not need atomic-level precision. These chemicals are widely used in pharmaceutical synthesis, specialty coatings, agrochemicals, and advanced manufacturing, where consistent quality and controlled composition are crucial for product performance. They typically meet purity levels in the range of 99.5%-99.9% and are produced under tightly controlled conditions to ensure batch-to-batch consistency. Growing demand for high-performance formulations and stricter quality standards across industrial and pharmaceutical applications continues to drive this segment.

The ultra-purity chemicals-based segment is anticipated to grow at the fastest CAGR of 12.1% during the forecast period. This segment represents the most advanced grade, offering extremely high purity levels (often 99.99% and above) with trace-level impurity control. These chemicals are primarily used in semiconductor manufacturing, display panels, advanced batteries, and biotechnology, where even minute contamination can impact product functionality. They require sophisticated purification technologies, cleanroom production environments, and stringent quality control measures. As industries such as EV batteries, semiconductors, and microelectronics continue to expand, the demand for ultra-purity chemicals is expected to grow at a faster pace compared to other grades.

Application Insights

The pharmaceuticals industry segment led the market with the largest revenue share of 36.9% in 2024. The precision chemicals are critical inputs across drug discovery, active pharmaceutical ingredient (API) synthesis, and formulation processes. These chemicals must meet extremely stringent purity, consistency, and regulatory standards to ensure product efficacy and patient safety. They are used in catalysts, reagents, intermediates, and excipients, where small variations can significantly impact reaction outcomes and the final quality of the drug. With the growth of biologics, complex generics, and personalized medicine, demand for customized and high-purity precision chemicals has increased. The expansion of pharmaceutical manufacturing in emerging economies, along with stricter global regulatory requirements, continues to drive long-term demand in this segment.

The electronics segment is expected to grow at the fastest CAGR of 8.7% from 2025 to 2033. The increasing complexity and miniaturization of electronic devices drives this. Precision chemicals are utilized in photolithography, etching, cleaning, deposition, and surface treatment processes during the manufacturing of semiconductors and displays. These applications require ultra-high-purity chemicals with extremely low contamination levels to ensure optimal performance and yield. As industries such as semiconductors, electric vehicle (EV) batteries, artificial intelligence hardware, and consumer electronics continue to advance, the demand for highly controlled and ultra-pure chemical formulations is increasing, making electronics a key driver of growth for the precision chemicals industry.

Regional Insights

Asia Pacific dominated the global precision chemicals market with the largest revenue share of 33.7% in 2024. The market is driven by strong demand from the semiconductor, electronics manufacturing, pharmaceutical, and battery materials sectors. Countries such as China, Japan, South Korea, and Taiwan lead in consumption due to their large-scale investments in chip fabrication and advanced manufacturing. The region benefits from lower production costs and an expanding R&D ecosystem, encouraging both global and local players to expand their capacity.

China Precision Chemicals Market Trends

The precision chemicals market in China is the largest consumer and one of the fastest-growing producers of precision chemicals, driven by its massive electronics, battery, and pharmaceutical manufacturing base. Strong government support for semiconductor self-sufficiency and advanced materials development is boosting demand for ultra-purity chemicals. The country is also expanding domestic capabilities to reduce dependence on imported high-end precision chemicals.

North America Precision Chemicals Market Trends

The precision chemicals market in North America is set to grow at a significant CAGR over the forecast period. This led by strong demand from the pharmaceutical, semiconductor, and biotechnology sectors. The region is characterized by advanced R&D infrastructure, strong intellectual property frameworks, and leading global chemical innovators. Growing investment in domestic semiconductor manufacturing and pharmaceutical production reshoring is driving demand for ultra-pure and customized chemical formulations.

The precision chemicals market in the U.S. is a global leader, supported by strong demand from pharmaceuticals, semiconductors, aerospace, and advanced materials. Major investments in domestic chip manufacturing and life sciences research are accelerating the consumption of ultra-purity chemicals. The country also hosts leading global chemical companies with advanced purification technologies and strong innovation capabilities.

Europe Precision Chemicals Market Trends

The precision chemicals market in Europe is a technologically advanced, supported by strong pharmaceutical, specialty manufacturing, and electronics industries. The region emphasizes sustainability, green chemistry, and regulatory compliance, driving demand for high-performance and low-impact precision chemicals. Countries like Germany, France, and the Netherlands lead in innovation and high-value applications. Europe’s push for semiconductor independence and clean energy technologies is also accelerating growth.

The Germany precision chemicals market is Europe’s technology and chemical innovation hub, with strong demand for precision chemicals from the pharmaceutical, automotive, and electronics industries. The country’s advanced manufacturing ecosystem and emphasis on quality, sustainability, and process efficiency support the use of high-purity and customized chemical formulations. Germany also plays a critical role in European semiconductor and battery manufacturing initiatives.

Latin America Precision Chemicals Market Trends

The precision chemicals market in Latin America represents an emerging market for precision chemicals, driven mainly by growth in pharmaceutical manufacturing, agrochemicals, and industrial production. Brazil and Mexico are the key contributors, supported by expanding domestic pharma industries and increasing foreign manufacturing investments. While the market is still developing, the rising industrial sophistication and adoption of technology are improving long-term growth prospects for precision-grade products.

Middle East and Africa Precision Chemicals Market Trends

The precision chemicals market in Middle East & Africa is at a nascent stage but shows long-term potential due to investments in pharmaceutical production, petrochemical diversification, and electronics assembly. Gulf countries are focusing on reducing import dependency and developing high-value manufacturing ecosystems. Although current consumption is limited compared to other regions, infrastructure development and industrial diversification strategies are expected to create future demand.

Key Precision Chemicals Company Insights

Some of the key players operating in the market include TCI Chemicals, SABIC, DuPont, and Atkin Chemicals.

-

BASF SE is a chemical manufacturing company with a presence across Asia Pacific, North America, Central & South America, Europe, and the Middle East & Africa. The company operates through six business segments, namely chemical, material, industrial solutions, surface technologies, agricultural solutions, and nutrition & care. The chemical segment encompasses petrochemicals and their intermediates. The material segment comprises performance polymers and monomers. The Industrial Solutions segment includes performance chemicals, dispersions & pigments. The agricultural solution segment includes products for farming, landscape management, and pest control. The nutrition & care segment is further sub-segmented into nutrition & health and care. The company provides a wide range of surfactants for textile, paint & coatings, homecare, and food processing industries.

Key Precision Chemicals Companies:

The following are the leading companies in the precision chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Dow

- DuPont

- SABIC

- Evonik Industries AG

- Huntsman Corporation

- Covestro AG

- Wacker Chemie AG

- Eastman Chemical Company

- Syngenta AG

- Mitsubishi Chemical Corporation

- LANXESS AG

- Solvay S.A.

- Albermarle Corporation

- AkzoNobel N.V.

Precision Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 63.58 billion

Revenue forecast in 2033

USD 109.25 billion

Growth rate

CAGR of 7.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, application, region

Regional scope

North America; Europe; Asia Pacific: Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Dow; DuPont; SABIC; Evonik Industries AG; Huntsman Corporation; Covestro AG; Wacker Chemie AG; Eastman Chemical Company; Syngenta AG; Mitsubishi Chemical Corporation; LANXESS AG; Solvay S.A.; Albemarle Corporation; AkzoNobel N.V.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Precision Chemicals Market Report Segmentation

This report forecasts volume & revenue growth at the global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global precision chemicals market report based on grade, application, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

High-Purity Chemicals

-

Ultra-Purity Chemicals

-

Specialty Chemicals

-

Analytical-Grade Chemicals

-

Other Grades

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Pharmaceuticals

-

Electronics

-

Agriculture

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global precision chemicals market size was estimated at USD 59,735.8 million in 2024 and is expected to reach USD 63,575.5 million in 2025.

b. The global precision chemicals market is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2033 to reach USD 109,248.1 million by 2033.

b. The Asia Pacific precision chemicals market accounted for the largest revenue share of 33.7% in 2024. The market is driven by strong demand from semiconductors, electronics manufacturing, pharmaceuticals, and battery materials. Countries such as China, Japan, South Korea, and Taiwan dominate consumption due to large-scale investments in chip fabrication and advanced manufacturing

b. Some key players operating in the precision chemicals market include BASF SE; Dow; DuPont; SABIC; Evonik Industries AG; Huntsman Corporation; Covestro AG; Wacker Chemie AG; Eastman Chemical Company; Syngenta AG; Mitsubishi Chemical Corporation; LANXESS AG; Solvay S.A., Albemarle Corporation, and AkzoNobel N.V.

b. The market is driven by the growing demand for high-performance, application-specific chemical formulations across advanced industries such as pharmaceuticals, electronics, agrochemicals, and specialty manufacturing. Unlike commodity chemicals, precision chemicals are designed to deliver consistent performance, high purity, and exact functional properties

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.