- Home

- »

- Next Generation Technologies

- »

-

Precision Machining Market Size, Industry Report, 2033GVR Report cover

![Precision Machining Market Size, Share & Trends Report]()

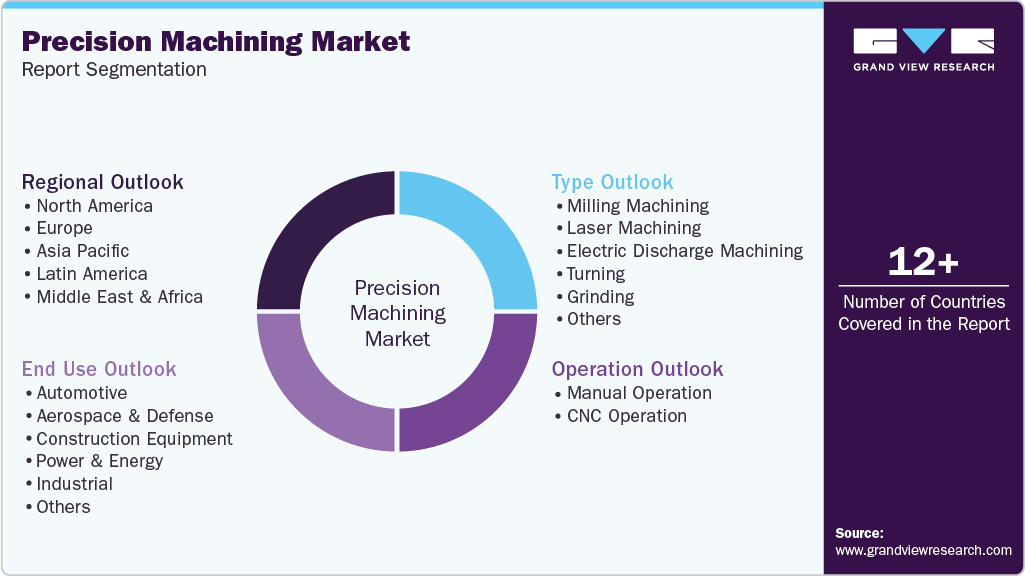

Precision Machining Market (2026 - 2033) Size, Share & Trends Analysis Report By Operation (Manual Operation, CNC Operation), By Type (Manual Operation, CNC Operation), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-459-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Precision Machining Market Summary

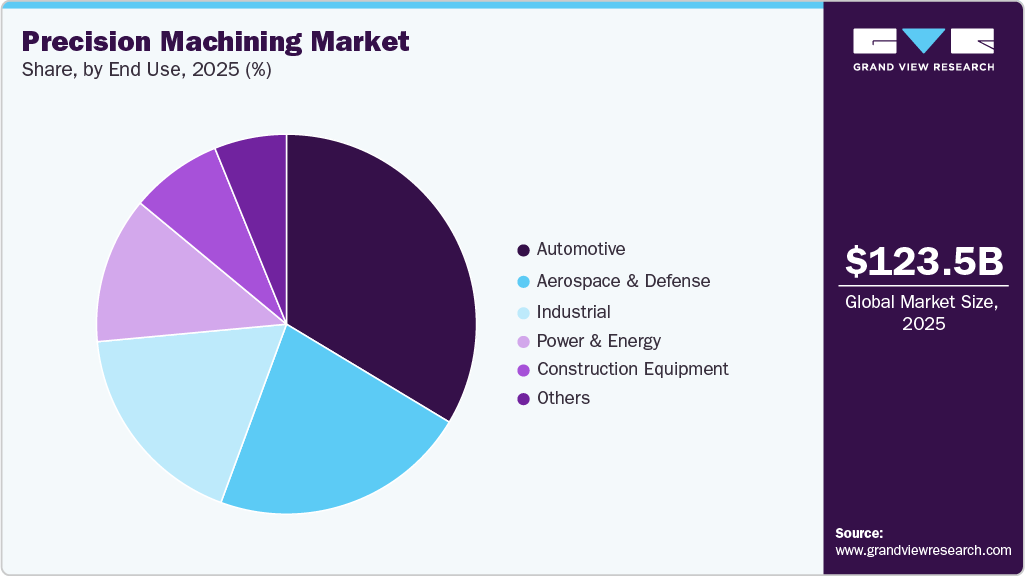

The global precision machining market size was estimated at USD 123.54 billion in 2025 and is projected to reach USD 228.75 billion by 2033, growing at a CAGR of 8.1% from 2026 to 2033. Rising demand for high-precision components across advanced industries and accelerated adoption of CNC automation and smart manufacturing driving the growth of the market.

Key Market Trends & Insights

- Asia Pacific dominated the precision machining industry and accounted for a share of 40.7% in 2025.

- India’s precision machining market is expected to grow at a notable growth rate during the forecast period.

- By operation, the CNC operation segment dominated the market in 2025 and accounted for the largest share of 78.9%.

- By type, the milling machining segment held the largest market in 2025.

- By end-use, the automotive segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 123.54 Billion

- 2033 Projected Market Size: USD 228.75 Billion

- CAGR (2026-2033): 8.1%

- Asia Pacific: Largest market in 2025

The increasing complexity of components used in automotive, aerospace & defense, medical devices, and electronics is driving strong demand for precision machining. Tighter tolerances, complex geometries, and lightweight designs require advanced machining capabilities that traditional manufacturing methods cannot achieve. As industries continue to innovate, precision machining is becoming essential for producing high-value, performance-critical parts. In addition, artificial intelligence and machine learning are increasingly being embedded into precision machining workflows to optimize tool paths, predict machine wear, and reduce scrap rates. This shift toward intelligent machining is enhancing competitiveness and supporting higher margins for advanced manufacturers.

The rising demand for high-performance materials is another major trend propelling the market. Industries such as aerospace, defense, and medical devices require more advanced materials, including composites, titanium, and other lightweight metals that can withstand extreme conditions. Precision machining is crucial for working with these materials, as it enables the creation of parts with exact specifications and tight tolerances. This trend is particularly evident in the aerospace industry, where lightweight components are crucial for achieving fuel efficiency and optimal performance in aircraft and space vehicles.

The automotive industry's shift towards electric vehicles (EVs) is also driving demand for precision machining. EVs require different components than traditional internal combustion engine vehicles, and many of these parts, such as electric powertrains, batteries, and lightweight frames, necessitate precision machining. As the automotive sector transitions to more sustainable technologies, manufacturers are investing in precision machining to meet the stringent requirements for accuracy and durability in electric vehicle (EV) components. The growing focus on reducing vehicle weight to improve efficiency further highlights the importance of precision machining in the automotive industry.

Medical device manufacturing is another critical area where precision machining is gaining momentum. The need for highly accurate and customized components has skyrocketed as the healthcare industry moves toward more complex and minimally invasive surgical tools, implants, and diagnostic equipment. Precision machining enables the production of tiny, intricate parts with the tight tolerances required for medical devices, where precision is critical to ensure safety and performance. The increasing demand for personalized medical treatments, such as custom prosthetics and implants, is further fueling growth in this sector.

Global supply chain realignments are significantly shaping the market landscape. Companies are increasingly prioritizing supply chain diversification to reduce reliance on single-source regions and mitigate operational risks. This shift has accelerated the reshoring and nearshoring of manufacturing activities, particularly across North America and Europe, driving higher investments in precision machining technologies. Consequently, demand for localized production capabilities is rising as manufacturers seek to improve supply chain resilience, shorten lead times, and ensure greater operational flexibility. At the same time, this trend is supporting growth in established markets while also promoting the adoption of advanced machining solutions in emerging economies.

Operation Insights

The CNC operation segment dominated the market in 2025 and accounted for the largest share of 78.9%. CNC operation dominates the market because it delivers high precision, efficiency, and scalability. Industries such as automotive, aerospace, and medical devices are increasingly adopting CNC machining to produce complex parts with tighter tolerances and faster production times. The automation involved in CNC operations reduces human error and enables continuous, round-the-clock manufacturing, thereby driving cost efficiency. Emerging technologies, including AI integration and real-time data analytics, further enhance CNC capabilities, making it the go-to choice for advanced manufacturing.

The manual operation segment is expected to grow at a moderate CAGR over the forecast period. Despite the rise of automation, manual machining remains relevant, especially in custom, small-batch, or specialized work where flexibility is required. Skilled machinists can adjust parameters in real time, making manual operation valuable for intricate, low-volume projects that require a high level of craftsmanship. Sectors such as repair services and smaller manufacturing industries still rely on manual operations for tasks that don’t justify full CNC automation. As industries such as construction and industrial machinery expand, a growing need remains for manual machining in areas that require a human touch for precise adjustments.

Type Insights

The milling machining segment held the largest market in 2025. Milling machining is the dominant segment in the market due to its versatility and ability to handle a wide range of materials and complex geometries. It is widely used across various industries, including automotive, aerospace, and industrial manufacturing, to produce precise components with high accuracy. The flexibility of milling machines to perform multiple operations, such as drilling and cutting, in one setup makes them a crucial tool in modern manufacturing. Advances in multi-axis CNC milling have enhanced their efficiency, allowing for faster production times and reduced operational costs. With its proven reliability and broad range of applications, milling machining remains the backbone of precision machining processes worldwide.

The laser machining segment is expected to grow at the fastest CAGR of 9.9% during the forecast period. Laser machining is an emerging segment with significant growth potential, particularly in industries such as electronics, medical devices, and aerospace, where high precision and minimal material waste are crucial. This technology excels in cutting, engraving, and micro-machining, allowing manufacturers to create intricate designs on small-scale components with exceptional accuracy. The non-contact nature of laser machining also makes it ideal for working with delicate materials that are challenging for traditional methods. As demand for miniaturization and complex parts increases, particularly in high-tech sectors, laser machining is poised for rapid growth. Its ability to handle cutting-edge materials and reduce production times positions it as a key player in the future of precision manufacturing.

End Use Insights

The automotive segment dominated the market in 2025. The need for high-precision components in engines, transmissions, and other critical systems drives the segment's growth. Precision machining plays a crucial role in producing the intricate parts required for traditional internal combustion engines and EVs. With the global shift toward EVs and more stringent emissions regulations, automotive manufacturers are increasingly relying on precision machining to create lightweight, high-performance parts that improve efficiency. In addition, the demand for high-quality components in the automotive aftermarket continues to drive growth in this segment.

The aerospace & defense segment is expected to witness the fastest CAGR over the forecast period. The aerospace & defense sector is experiencing emerging market growth due to the increasing demand for lightweight, durable, and complex components. Precision machining is crucial for producing critical components, such as turbine blades, landing gear, and aircraft structural elements, that must meet stringent safety and performance standards. As advancements in aerospace technology, including space exploration and next-generation aircraft, drive innovation, the need for precision-machined parts is becoming more pronounced. In defense, modernization efforts, and the production of more advanced military equipment also require precision machining for high-tolerance components.

Regional Insights

Asia Pacific Precision Machining Market Trends

Asia Pacific dominated the precision machining industry and accounted for a share of 40.7% in 2025. The region’s booming manufacturing sectors, particularly in China, Japan, and South Korea, make a significant contribution to the market's growth. The presence of strong automotive, electronics, and aerospace industries in this region fuels high demand for precision-machined components. Moreover, the rapid industrialization in emerging economies such as India and Southeast Asia is further contributing to the growth of this market. Asia Pacific benefits from a well-established supply chain, competitive labor costs, and the growing adoption of advanced machining technologies. As a result, the region is expected to continue leading the global market in production capacity and innovation.

India’s precision machining market is expected to grow at a notable CAGR during the forecast period. This growth is driven by increasing demand from end-use industries, including aerospace, automotive, and medical devices. In addition, large-scale manufacturing programs supported by government initiatives, including the Make in India and Production Linked Incentive (PLI) schemes, are drawing significant domestic and foreign investment into the sector.

The China precision machining market held a significant market share in 2025. The China precision machining market is driven by a combination of large-scale manufacturing demand, technological advancement, and strong policy support, positioning the country as a global hub for precision components.

Europe Precision Machining Market Trends

Europe precision machining market is expected to register a moderate CAGR from 2026 to 2033. Countries such as Germany, France, and the UK are at the forefront, with well-established engineering industries that rely heavily on precision machining to produce high-quality components. The region is also witnessing an increasing adoption of advanced machining technologies to remain competitive in the global market. Europe’s commitment to sustainable practices and the production of lightweight components, particularly in the automotive and aerospace industries, is boosting the need for precision machining.

The UK precision machining market is expected to grow at the fastest growth rate during the forecast period. The country’s market growth is driven by strong demand from high-value manufacturing sectors, advanced engineering capabilities, and continued investments in technology and innovation.

The Germany precision machining market held a substantial market share in 2025, driven by the country’s strong industrial base, leadership in high-precision engineering, and continuous investment in advanced manufacturing technologies.

North America Precision Machining Market Trends

The North America precision machining market is expected to grow at a notable CAGR during the forecast period. North America is a prominent region in the market, largely due to its advanced aerospace, defense, and automotive industries. The region is home to major aerospace and automotive manufacturers that require high-precision components for complex applications. In addition, the growing emphasis on advanced manufacturing technologies, including CNC machining and additive manufacturing, is fueling growth in this region. The region also benefits from a skilled workforce and significant investments in research and development, which help maintain its competitive edge. With the rise of electric vehicles and the ongoing demand for defense equipment, North America is expected to continue experiencing a demand for precision machining.

U.S. Precision Machining Market Trends

The U.S. precision machining market held a dominant position in the region in 2025. The U.S. stands out as a major hub for precision machining, driven by its leadership in high-tech industries, including aerospace, defense, and medical devices. The country’s well-established manufacturing sector and focus on innovation make it a key market for advanced machining technologies, such as multi-axis CNC machines and laser machining. Furthermore, the U.S. defense sector’s need for precision components is a significant driver as the government continues to invest in military modernization.

Key Precision Machining Company Insights

Some of the key companies in the precision machining industry include DMG Mori Co., Ltd., Sandvik Machining Solutions and Barnes Group Inc., among others. The market players are focusing on technological advancements and strategic partnerships to strengthen their market position. Companies are increasingly adopting automation, CNC technology, and advanced materials to meet growing industry demands for high-precision components in sectors such as aerospace, automotive, and medical devices. Many are also expanding their global footprint through mergers, acquisitions, and collaborations to access new markets and enhance their production capabilities.

-

DMG Mori is a globally recognized manufacturer of high-precision CNC machine tools and machining centers, with a strong presence across automotive, aerospace, industrial machinery, and medical sectors. The company’s portfolio includes turning centers, milling machines, multi-axis machining solutions, and additive hybrid systems, enabling complex part production with micron-level accuracy.

-

Sandvik Machining Solutions, part of the Sandvik Group, is a key global supplier of precision cutting tools, tooling systems, and machining solutions. Sandvik’s product portfolio includes solid and indexable cutting tools, advanced inserts, tool holders, and digital machining solutions that improve tool life, reduce cycle times, and support machining of difficult materials.

Key Precision Machining Companies:

The following are the leading companies in the precision machining market. These companies collectively hold the largest market share and dictate industry trends.

- Ascentec Engineering

- Barnes Group Inc.

- DMG Mori Co., Ltd.

- ELCON PRECISION LLC

- UNITED MACHINING

- GrovTec Machining

- Hexcel Corporation

- Sandvik Machining Solutions

- Oberg Industries

- Gemsons

Recent Developments

-

In October 2025, Kranti Industries Limited, a provider of automotive components and precision engineering, entered a strategic joint venture with the Kores Group to set up an advanced precision machining facility in Halol, Gujarat. The new entity, KRAKO Precision Private Limited, aims to strengthen the partners’ advanced engineering capabilities and address increasing demand from both domestic and global markets.

Precision Machining Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 132.93 billion

Revenue forecast in 2033

USD 228.75 billion

Growth rate

CAGR of 8.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Operation, type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Ascentec Engineering; Barnes Group Inc.; DMG Mori Co., Ltd.; ELCON PRECISION LLC; UNITED MACHINING; GrovTec Machining; Hexcel Corporation; Sandvik Machining Solutions; Oberg Industries; Gemsons

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Precision Machining Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global precision machining market report based on operation, type, end use, and region.

-

Operation Outlook (Revenue, USD Million, 2021 - 2033)

-

Manual Operation

-

CNC Operation

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Milling Machining

-

Laser Machining

-

Electric Discharge Machining

-

Turning

-

Grinding

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Aerospace & Defense

-

Construction Equipment

-

Power & Energy

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global precision machining market size was estimated at USD 123.54 billion in 2025 and is expected to reach USD 132.93 billion in 2026.

b. The global precision machining market is expected to grow at a compound annual growth rate of 8.1% from 2026 to 2033 to reach USD 228.75 billion by 2033.

b. Asia Pacific dominated the precision machining industry and accounted for a share of 40.7% in 2025. The region’s booming manufacturing sectors, particularly in China, Japan, and South Korea, are a significant factor contributing to the growth of the market.

b. Some key players operating in the precision machining market include Ascentec Engineering, Barnes Group Inc., DMG Mori Co., Ltd., ELCON PRECISION LLC, UNITED MACHINING, GrovTec Machining, Hexcel Corporation, Sandvik Machining Solutions, Oberg Industries, Gemsons.

b. Key factors that are driving the market growth include the growing adoption of automation and robotics in machining and the rising demand for high-performance materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.