- Home

- »

- Advanced Interior Materials

- »

-

Global Prepreg Market Size, Share & Growth Report, 2030GVR Report cover

![Prepreg Market Size, Share & Trends Report]()

Prepreg Market (2023 - 2030) Size, Share & Trends Analysis Report By Fiber (Glass, Carbon, Aramid), By Resin (Thermoset, Thermoplastic), By Manufacturing Process (Hot-melt, Solvent Dip), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-171-9

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Prepreg Market Summary

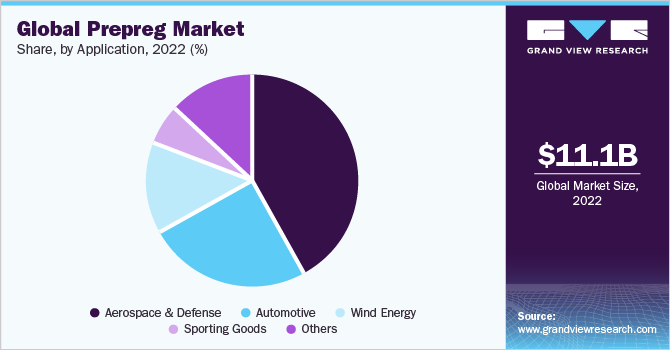

The global prepreg market size was estimated at USD 11.05 billion in 2022 and is projected to reach USD 25.18 billion by 2030, growing at a CAGR of 10.8% from 2023 to 2030. The market is expected to witness robust growth on account of the increasing use of prepreg materials in the aerospace and automotive industries.

Key Market Trends & Insights

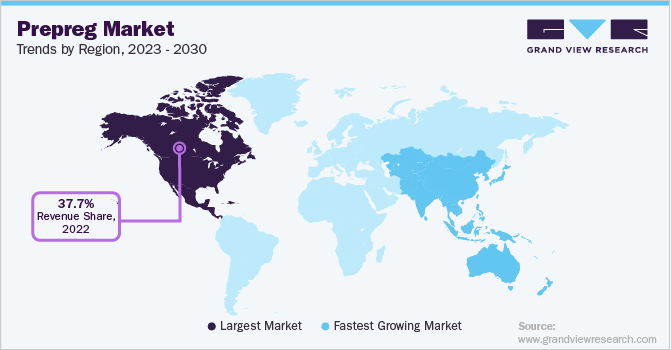

- The North America accounted for a market share of 37.71% in 2022.

- The Asia Pacific is projected to become the fastest-growing regional market at a CAGR of 12.2% during the forecast period.

- Based on resins, the thermoset segment dominated the market and accounted for a share of 73.03% in 2022.

- Based on manufacturing process, the hot-melt segment held the highest market share of 74.22% in 2022.

- Based on application, the aerospace & defense application segment accounted for the largest share of over 42.21% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 11.05 Billion

- 2030 Projected Market USD 25.18 Billion

- CAGR (2023-2030): 10.8%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Surging demand for light and durable materials with increased efficiency in the manufacturing of aerospace components has driven the prepreg industry in the past few years. Furthermore, the rising use of lightweight blades in wind turbines to improve fuel efficiency is another key driver of the prepreg industry. The prepreg fibers with superior strength and lightweight are vital for the aircraft manufacturing industry. Replacing traditional materials with lightweight composites is an effective path towards meeting the aim of producing lightweight aircraft to increase fuel efficiency, decrease emissions, and reduce material usage, which translates into a growing adoption of prepreg materials.

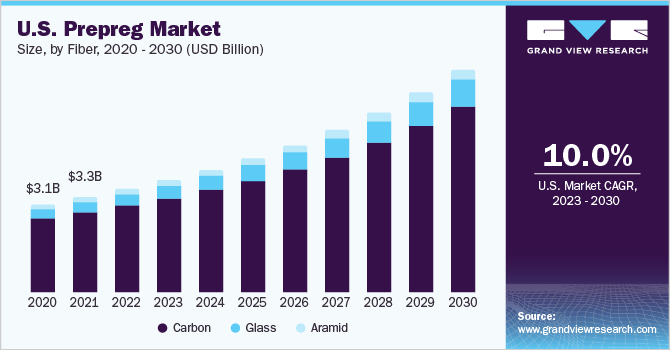

U.S. led the North America regional prepreg industry in 2022 and will expand further at a significant CAGR during the forecast period. Rising demand for materials with low density, low electrical conductivity, and high durability and strength across various industries such as aerospace & defense, automotive, and wind energy is projected to augment the market growth for prepreg.

The aerospace & defense systems manufacturers in the U.S. are registering strong gains from the export of manufactured aircraft parts, which has led to an upward trend in the consumption of prepreg. This can be attributed to the increasing use of prepreg in the parts of aircraft, helicopters, defense aircraft, and aero engines.

High manufacturing costs of aramid, carbon, and glass fibers, which are used as raw materials for the production of prepreg inflate the final product price. Increased raw material prices are projected to pose a threat to market expansion. However, the rising adoption of advanced processing and assembly techniques to minimize the lead time and enhance product quality is projected to benefit the market growth of prepreg.

Major market players of prepreg have a strong presence across the various stages of the value chain including raw material supply and product manufacturing. This enables them to procure raw materials at affordable prices and gain a competitive edge. In addition, companies are focusing on R&D investments to develop high-quality products, which is likely to stimulate industry growth.

Fiber Insights

The carbon fiber segment accounted for the highest market share of prepreg with over 84.66% in 2022. It is projected to retain its leading position throughout the forecast period. Growing concerns about fuel consumption and CO2 emissions have urged automotive parts manufacturers to use carbon fiber composite materials as substitutes for metal components. This is projected to fuel the demand for carbon fibers over the forecast period.

Carbon fiber exhibits superior properties, such as high stiffness, lightweight, high tensile strength, high chemical resistance, high-temperature tolerance, and low thermal expansion. This is projected to result in the growing acceptance of carbon fiber across various industries, such as aerospace & defense, automotive, sports equipment, construction, and others.

The glass fiber segment is expected to grow at a CAGR of 11.4% during the forecast period as it is extensively used as reinforcement fiber for polymeric resins including unsaturated polyester and epoxy. In addition, it is used as a reinforcing material in the manufacturing of products, such as tent poles, crossbows, automobile bodies, hockey sticks, paper honeycomb, and boat hulls.

Aramid fiber exhibits properties such as high strength, good resistance to abrasion & organic solvents, low flammability, and good fabric integrity at elevated temperatures. This promotes its usage in the manufacturing of equipment, protective clothing, and accessories for application industries including military and construction.

Resin Insights

The thermoset resins segment dominated the market and accounted for a share of 73.03% in 2022. This segment is projected to grow further at a significant growth rate during the forecast period. Thermoset resins are in a liquid state at room temperature, which allows easy impregnation of reinforcing fibers. In addition, these resins are bonded by a three-dimensional network, which makes the fiber stronger as compared to thermoplastic resins.

Thermoset resins exhibit superior properties, such as excellent resistance to corrosives and solvents, resistance to heat and high temperature, excellent adhesion, high strength, and elasticity. This is projected to promote its usage across several application industries, thereby driving the segment growth.

The thermoplastic resin segment was valued at USD 2,981.5 million in 2022. It is likely to be the fastest-growing resin at a CAGR of 11.1% during the forecast period. These resins have high demand as they can be molded in different structures and shapes. Major applications of these resins include packaging containers, water & soda bottles, safety glass lenses, toys, grocery bags, piping, airplane armrests, window frames, and footwear.

Moreover, they offer superior aesthetic finishing, high resistance to chemicals, and a hard crystalline or rubbery surface, which makes them highly preferable in applications, such as drainpipes, gutters, and vinyl siding. Manufacturers are focusing on the use of thermoplastic matrix during prepreg production, owing to its advantage of temperature stability. As a result, the demand for thermoplastics is expected to increase at a promising rate over the forecast period, owing to their functional advantages over thermoset resins.

Manufacturing Process Insights

The hot-melt manufacturing process segment held the highest market share of 74.22% in 2022. It is projected to expand further at the fastest CAGR during the forecast period. The process is widely used on account of its benefits, such as easy handling, control over resin content, and excellent product quality.

The lower cost of production using the hot-melt process is estimated to promote its adoption in the manufacturing of automotive parts and aircraft structures. In addition, the process does not involve the use of any type of solvent, which makes it environmentally friendly.

The solvent dip manufacturing process is also projected to register a significant CAGR during the forecast period. The solvent dip segment reached a valuation of USD 2,850.3 million in 2022. The resin used in the process is initially dissolved in a solvent bath to prepare a solution that is later used as a dipping solution. In the next step, the resin-containing fiber is reheated to ensure an even distribution of the resin across the fiber.

The cost of the solvent dip process is lower than the hot-melt manufacturing process. However, the solvent used in the process easily evaporates off the prepreg, which weakens the overall strength of the final composite material. Moreover, the use of chemicals in the solvent leads to several environmental issues, thus the waning acceptability of the manufacturing process is likely to slow down its growth over the forecast period.

Application Insights

The aerospace & defense application segment accounted for the largest share of over 42.21% in 2022. It is estimated to expand at a significant growth rate during the forecast period. Prepreg fibers exhibit a high demand in this industry on account of the rising need for highly durable and lightweight aircraft parts.

It’s a highly preferred material for fabricating different parts and components in the aerospace industry as it enables a constant resin ratio across the finished product. Hence, it enhances the mechanical and physical properties of the end components. In addition, increasing production of commercial aircraft on account of increasing passenger traffic is projected to drive segment growth.

Prepreg fibers are increasingly being used as an alternative to metal wire and organic fiber in structural composite applications in automobiles as they have superior mechanical properties as compared to other synthetic fibers. In addition, the increasing demand for batteries from the automotive industry is expected to further propel the prepreg demand.

The wind energy application segment is estimated to register a CAGR of 11.7% during the forecast period. Increasing demand for renewable energy sources coupled with the use of high-strength materials for manufacturing wind turbine parts is projected to stimulate the prepreg demand. In addition, its benefits, such as low maintenance requirement, long shelf life, high strength-to-weight ratio, and corrosion resistance, are likely to propel the demand for prepreg materials further.

Regional Insights

North America accounted for a market share of 37.71% in 2022. It is estimated to grow further at a significant CAGR during the forecast period. This growth is attributed to the rapidly expanding aerospace industry in North America. Rising awareness among the population regarding the benefits of using wind energy is also expected to drive the wind sector market growth.

The North America region is expected to cater to nearly one-third of the global operational fleet demand, resulting in an increased production of airframe and aircraft parts over the period. Ascending demand for new-generation aircraft is expected to boost the growth of the aircraft manufacturing industry, thereby supporting the regional prepreg industry over the forecast period.

Asia Pacific is projected to become the fastest-growing regional market at a CAGR of 12.2% during the forecast period. This growth is attributed to rapidly expanding application industries in developing countries including China, India, and Japan. The wind energy application segment is estimated to register the maximum CAGR during the forecast period, while the aerospace & defense segment accounts for the major share of the APAC regional prepreg industry. Europe is estimated to witness steady development over the forecast years.

Process innovation, improving R&D, and expansion of automobile production in countries, such as Germany, the U.K., Spain, and France, are expected to fuel the automotive industry growth in the region. Thus, the rapid expansion of the automotive industry coupled with rising demand for lightweight materials is anticipated to promote the market growth of prepreg in Europe. The rising number of wind energy projects in countries, such as Germany and the Czech Republic, is also projected to fuel the market growth of prepreg.

Key Companies & Market Share Insights

Upstream and downstream integrations across the value chain are considered by the leading players to maintain the business flow in the industry. The market is moving towards fragmentation on account of the presence of a large number of global and regional players. Major companies have a strong distribution network and product brands in the global market.

They are adopting various growth strategies for building a business framework, which will ensure stable profitability in the future. These strategies include prioritizing high-performance and eco-friendly businesses, restructuring the value chain, and creating new supply chains. Some prominent players in the global prepreg market include:

-

Park Electrochemical Corp.

-

Axiom Materials, Inc.

-

Mitsubishi Rayon Co., LTD

-

Royal Ten Cate NV

-

Teijin Limited

-

Hexcel Corporation

-

Gurit Holding

-

SGL Group

-

Toray Industries

-

Cytec Industries.

Prepreg Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.14 billion

Revenue forecast in 2030

USD 25.18 billion

Growth Rate

CAGR of 10.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in tons, revenue in USD million, and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, competitive landscape, growth factors, trends

Segments covered

Fiber, resin, manufacturing process, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; Bulgaria; Czech Republic; Poland; Turkey; China; India; Japan; Brazil; Argentina; Israel

Key companies profiled

Park Electrochemical Corp.; Axiom Materials, Inc.; Mitsubishi Rayon Co.; LTD, Royal Ten Cate NV; Teijin Limited; Hexcel Corporation; Gurit Holding; SGL Group; Toray Industries; Cytec Industries.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Prepreg Market Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global prepreg market report based on fiber, resin, manufacturing process, application, and region:

-

Fiber Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Carbon

-

Glass

-

Aramid

-

-

Resin Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Thermoset

-

Thermoplastic

-

-

Manufacturing Process Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Hot-melt

-

Solvent dip

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Wind Energy

-

Sporting Goods

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Bulgaria

-

Czech Republic

-

Poland

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Israel

-

-

Frequently Asked Questions About This Report

b. The prepreg market size was estimated at USD 11.05 billion in 2022 and is expected to reach USD 12.14 billion in 2023.

b. The prepreg market is expected to grow at a compound annual growth rate a CAGR of 10.8% from 2023 to 2030 to reach USD 25.18 billion by 2030.

b. Europe dominated the prepreg market with a share of 38.35% in 2022. Rapidly growing automobile production in countries is expected to stimulate product demand in the region.

b. Some key players operating in the prepreg market Park Electrochemical Corp., Axiom Materials, Inc., Mitsubishi Rayon Co., LTD, Royal Ten Cate NV, Teijin Limited, Hexcel Corporation, Gurit Holding, SGL Group, Toray Industries, and Cytec Industries.

b. Key factors driving the prepreg market growth include growing demand for light and durable materials for the manufacture of aerospace components.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.