- Home

- »

- IT Services & Applications

- »

-

Privacy Management Software Market Size Report, 2030GVR Report cover

![Privacy Management Software Market Size, Share & Trends Report]()

Privacy Management Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Deployment Mode (On-premises, Cloud), By Enterprise Size, By Application (Risk Management, Data Governance), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-359-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Privacy Management Software Market Summary

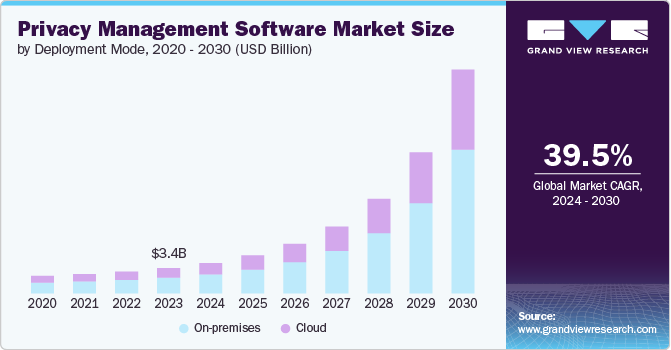

The global privacy management software market size was estimated at USD 3.41 billion in 2023 and is projected to reach USD 30.15 billion by 2030, growing at a CAGR of 39.5% from 2024 to 2030. The rising incidence of data breaches and cyber-attacks has heightened the need for enhanced data security and privacy measures, prompting businesses to invest in sophisticated software to protect sensitive information.

Key Market Trends & Insights

- North America was the largest revenue generating market in 2023.

- Asia Pacific is expected to grow significantly at a CAGR of over 41.0% from 2024 to 2030.

- By application, the regulatory compliance segment accounted for the largest market share of nearly 30.0% in 2023.

- By enterprise size, the large enterprise segment accounted for the largest market share in 2023.

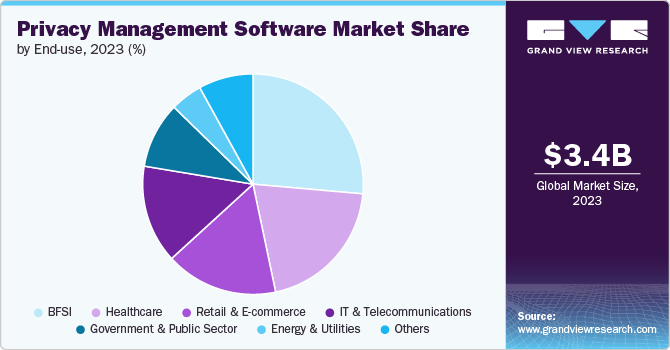

- By end use, the BFSI end use segment accounted for the largest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.41 Billion

- 2030 Projected Market Size: USD 30.15 Billion

- CAGR (2024-2030): 39.5%

- North America: Largest market in 2023

Moreover, growing consumer awareness and concern regarding personal data privacy have pressured companies to implement transparent and comprehensive privacy practices, boosting the demand for privacy management tools. The proliferation of data-driven business models and the expansion of digital services are significant drivers of the privacy management software market. For instance, with over 247.2 million subscribers globally, Netflix's success is attributed to its sophisticated recommendation engine. By incorporating machine learning and data analytics, along with a dedication to streaming optimization, Netflix provides a personalized cinematic experience for each user, thereby cementing its status as a pioneering leader in the entertainment industry. As businesses increasingly rely on data analytics to inform strategic decisions, optimize operations, and enhance customer experiences, the volume and sensitivity of data being collected and processed have surged. This escalation necessitates robust privacy management solutions to ensure data handling practices comply with stringent regulatory standards and mitigate the risks associated with data breaches and unauthorized access. In addition, the widespread adoption of digital services, from e-commerce to cloud computing, has amplified the complexity of managing personal data across diverse platforms and jurisdictions. Consequently, organizations are compelled to implement advanced privacy management software to maintain data integrity, build consumer trust, and sustain competitive advantage in a data-centric landscape.

Increasing regulatory requirements significantly drive the privacy management software market. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S. impose stringent obligations on organizations to manage and protect personal data. Compliance with these regulations necessitates comprehensive privacy management solutions to ensure data handling practices meet legal standards, thereby avoiding substantial fines and reputational damage. Furthermore, as governments worldwide continue to implement and tighten data privacy laws, businesses across various sectors are compelled to adopt advanced privacy management software to navigate the complex regulatory landscape, safeguard consumer trust, and maintain operational integrity.

Deployment Mode Insights

The on-premises segment accounted for the largest market share of over 62% in 2023 in the privacy management software market. The need for enhanced control and security primarily drives on-premise deployment. Organizations with stringent data security requirements or those operating in highly regulated industries often prefer on-premise solutions to maintain direct oversight of their data infrastructure. This approach ensures that sensitive information remains within the organization's physical premises, reducing potential exposure to external threats and compliance risks associated with third-party data handling. In addition, on-premise deployment allows for greater customization and integration with existing IT systems, making it an attractive option for businesses with complex or unique data management needs.

The cloud-based segment is anticipated to grow at a significant CAGR over the forecast period. The cloud deployment of privacy management software is propelled by the advantages of scalability, cost-effectiveness, and accessibility. Cloud-based privacy management solutions offer the flexibility to scale resources according to organizational growth and changing regulatory demands without significant capital investment in hardware and maintenance. This model particularly appeals to small and medium-sized enterprises (SMEs) and organizations with distributed workforces, as it provides easy access to privacy management tools from any location with an internet connection. Furthermore, cloud solutions often come with automated updates and advanced features, enabling organizations to stay current with the latest privacy regulations and technological advancements with minimal operational disruption.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share in 2023. For large enterprises, the adoption of privacy management software is primarily driven by the complexity and volume of data they handle and the stringent regulatory requirements they must comply with. These organizations often operate across multiple jurisdictions, each with their own data protection laws, necessitating robust privacy management solutions to ensure compliance and mitigate the risk of substantial fines. In addition, large enterprises face heightened scrutiny from regulators and the public, making implementing advanced privacy management tools that provide comprehensive data governance, risk assessment, and incident response capabilities imperative. The ability to integrate these tools with existing IT infrastructure and scale them to accommodate vast amounts of data further reinforces the appeal of privacy management software for large enterprises.

The small & medium enterprise (SME) segment is anticipated to expand at a compound annual growth rate of over 40% during the forecast period. SMEs are driven to adopt privacy management software primarily for cost-efficiency and competitive advantage. Privacy management software offers SMEs an affordable solution to achieve compliance without requiring extensive in-house resources or expertise. Furthermore, leveraging such software can differentiate SMEs in the marketplace by demonstrating a commitment to data privacy and security, attracting privacy-conscious customers and business partners. The ease of implementation and user-friendly interfaces of many privacy management solutions also cater to SMEs' limited IT capacities, making these tools an essential component of their operational strategy.

Application Insights

The regulatory compliance application segment accounted for the largest market share of nearly 30% in 2023 in the privacy management software market. The primary driver for applying privacy management software for regulatory compliance is the increasing complexity and stringency of data protection laws worldwide. Privacy management software provides the tools to automate and streamline compliance processes, reducing the risk of non-compliance and associated penalties. These solutions enable organizations to implement standardized data protection practices, conduct regular audits, and maintain comprehensive records of data handling activities, thus ensuring continuous compliance with evolving regulatory requirements. In addition, privacy management software often includes features for monitoring regulatory updates and integrating compliance controls into daily operations, making it an essential tool for organizations aiming to stay ahead of legal obligations.

The data discovery and mapping segment is anticipated to grow at the highest CAGR during the forecast period. The application of privacy management software for data discovery and mapping is driven by the need for comprehensive visibility and control over organizational data. As businesses generate and accumulate vast amounts of data across various systems and locations, understanding where sensitive information resides and how it flows becomes increasingly challenging. Privacy management software facilitates the discovery and mapping of data by using advanced scanning and classification techniques to accurately identify and categorize data assets. This capability is crucial for creating a detailed inventory of personal data, assessing data processing activities, and identifying potential privacy risks. Effective data discovery and mapping enable organizations to implement targeted data protection measures, enhance data governance, and respond promptly to data subject access requests and breach incidents.

End-use Insights

The BFSI end use segment accounted for the largest market share in 2023. The application of privacy management software in the BFSI sector is driven by the critical need to protect susceptible financial data and comply with stringent regulatory requirements. The BFSI sector handles vast amounts of personal and financial information, making it a prime target for cyber-attacks and data breaches. Privacy management software provides robust security measures to safeguard this data, ensuring organizations can protect their customers' information and maintain trust. In addition, the BFSI sector is subject to rigorous regulatory standards, such as the Payment Card Industry Data Security Standard (PCI DSS) and anti-money laundering (AML) laws. Privacy management software helps BFSI organizations navigate these complex regulatory landscapes by automating compliance processes, facilitating audits, and providing comprehensive reporting capabilities.

The healthcare segment is anticipated to grow at a CAGR of over 41% during the forecast period. In the healthcare sector, the application of privacy management software is primarily driven by the imperative to protect patient data and adhere to stringent healthcare regulations. Healthcare organizations manage an extensive range of sensitive personal health information (PHI), which is governed by regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. and the General Data Protection Regulation (GDPR) in Europe. Privacy management software enables healthcare providers to implement robust data protection measures, ensuring PHI's confidentiality, integrity, and availability.

Regional Insights

North America Privacy Management Software Market Trends

North America held the major share of over 38% of the privacy management software market in 2023. In North America, the privacy management software market is experiencing growth driven by stringent data protection regulations such as the California Consumer Privacy Act (CCPA) and increasing consumer awareness of data privacy. Organizations are adopting advanced privacy management solutions to ensure compliance and protect against data breaches, focusing on integrating artificial intelligence and machine learning for enhanced data governance.

U.S. Privacy Management Software Market Trends

The privacy management software market in the U.S. is expected to grow significantly from 2024 to 2030. In the U.S., the market is characterized by a strong emphasis on regulatory compliance due to a patchwork of state-level privacy laws and federal initiatives. Companies increasingly invest in privacy management software to navigate this complex regulatory environment, leveraging features such as automated compliance monitoring, risk assessments, and incident response management to maintain robust data protection practices.

Europe Privacy Management Software Market Trends

The privacy management software market in Europe is growing significantly at a CAGR of over 39% from 2024 to 2030. In Europe, the General Data Protection Regulation (GDPR) remains the primary catalyst for the privacy management software market. Organizations across the continent are focused on maintaining GDPR compliance, which requires robust data protection measures and transparent data handling practices. The market is seeing increased adoption of privacy management software with advanced features such as data mapping, impact assessments, and consent management to ensure ongoing regulatory adherence and protect consumer rights.

Asia Pacific Privacy Management Software Market Trends

The privacy management software market in the Asia Pacific is growing significantly at a CAGR of over 41% from 2024 to 2030. In the Asia Pacific region, rapid digitalization and the expansion of e-commerce are critical drivers of the privacy management software market. Countries such as India, Japan, and Australia are implementing stricter data privacy laws, prompting businesses to adopt comprehensive privacy management solutions. The market is also influenced by growing consumer demand for data privacy and security, pushing organizations to prioritize privacy management in their operations.

Key Privacy Management Software Company Insights:

Key players operating in the network emulator market include OneTrust, LLC., TrustArc Inc., Securiti, BigID Inc., Spirion, LLC, One Identity LLC, DataGrail, Inc., Collibra, International Business Machines Corporation, and DataGuard. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In March 2024, TrustArc Inc., a provider of data privacy management and governance solutions, announced two product innovations to revolutionize the privacy landscape: NymityAI and Responsible AI Certification. These products will be available starting March 27, 2024. Launching these innovations underscores TrustArc's dedication to aiding businesses in adopting responsible artificial intelligence (AI) practices through a verified and credible methodology while enhancing their privacy program management with the most comprehensive legal research application available via NymityAI.

-

In February 2024, BigID Inc., a data protection firm, announced new access governance capabilities designed to enhance security posture, achieve zero-trust security, mitigate insider risk, and accelerate compliance with artificial intelligence regulations. These new access governance controls focus on remediating overexposed sensitive data and over-privileged users, enabling customers to manage, monitor, and revoke access to sensitive data across both cloud and on-premise environments. The solution supports platforms including on-premise SMB file shares, Microsoft 365, and Amazon Web Services Inc. S3, among others. By leveraging this new solution, organizations can automatically investigate, identify, and remediate access rights violations involving sensitive structured and unstructured data. The service proactively reduces the risk of data overexposure and overprivileged users, monitors potential insider threats, and manages external user and group access to sensitive data.

Key Privacy Management Software Companies:

The following are the leading companies in the privacy management software market. These companies collectively hold the largest market share and dictate industry trends.

- BigID Inc.

- Collibra

- DataGrail, Inc.

- DataGuard

- International Business Machines Corporation

- One Identity LLC

- OneTrust, LLC.

- Securiti

- Spirion, LLC

- TrustArc Inc.

Privacy Management Software Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.10 billion

Revenue forecast in 2030

USD 30.15 billion

Growth rate

CAGR of 39.5% from 2024 to 2030

Actual data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Deployment mode, enterprise size, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

OneTrust, LLC.; TrustArc Inc.; Securiti; BigID Inc.; Spirion, LLC; One Identity LLC; DataGrail, Inc.; Collibra; International Business Machines Corporation; DataGuard

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Privacy Management Software Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the privacy management software market report based on deployment mode, enterprise size, application, end-use, and region:

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Data Discovery and Mapping

-

Risk Management

-

Data Governance

-

Regulatory Compliance

-

Incident Response

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government and Public Sector

-

Healthcare

-

Retail and E-commerce

-

IT and Telecommunications

-

Energy and Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global privacy management software market size was estimated at USD 3.41 billion in 2023 and is expected to reach USD 4.10 billion in 2024

b. The global privacy management software market is expected to grow at a compound annual growth rate of 39.5% from 2024 to 2030 to reach USD 30.15 billion by 2030

b. North America dominated the privacy management software market with a market share of 38.67% in 2023. In North America, the privacy management software market is experiencing growth driven by stringent data protection regulations such as the California Consumer Privacy Act (CCPA) and increasing consumer awareness of data privacy. Organizations are adopting advanced privacy management solutions to ensure compliance and protect against data breaches, focusing on integrating artificial intelligence and machine learning for enhanced data governance.

b. Some key players operating in the privacy management software market include OneTrust, LLC., TrustArc Inc., Securiti, BigID Inc., Spirion, LLC, One Identity LLC, DataGrail, Inc., Collibra, International Business Machines Corporation, and DataGuard.

b. The privacy management software (HSM) market is driven by several key factors. The rising incidence of data breaches and cyber-attacks has heightened the need for enhanced data security and privacy measures, prompting businesses to invest in sophisticated software to protect sensitive information. Moreover, growing consumer awareness and concern regarding personal data privacy have pressured companies to implement transparent and comprehensive privacy practices, boosting the demand for privacy management tools.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.