- Home

- »

- Beauty & Personal Care

- »

-

Private Label Cosmetics Market Size, Industry Report, 2030GVR Report cover

![Private Label Cosmetics Market Size, Share & Trends Report]()

Private Label Cosmetics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Skincare, Haircare, Color Cosmetics, Fragrance), By Type (Organic/Natural, Conventional/Synthetic), By End Use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-584-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Private Label Cosmetics Market Summary

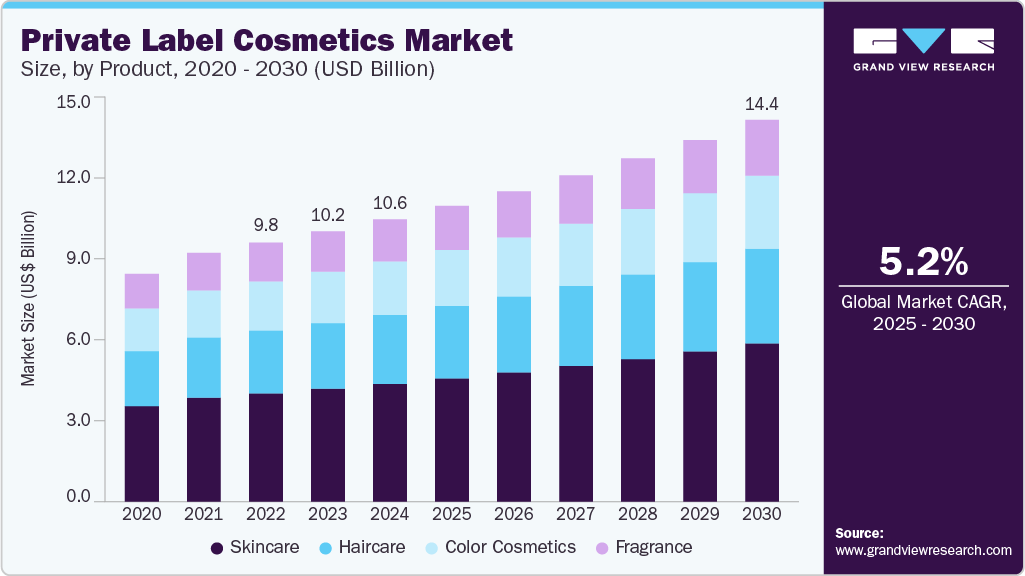

The global private label cosmetics market size was estimated at USD 10.64 billion in 2024 and is projected to reach USD 14.39 billion by 2030, growing at a CAGR of 5.2% from 2025 to 2030. The increasing global demand for private-label cosmetics is attributed to the shift in consumer behavior.

Key Market Trends & Insights

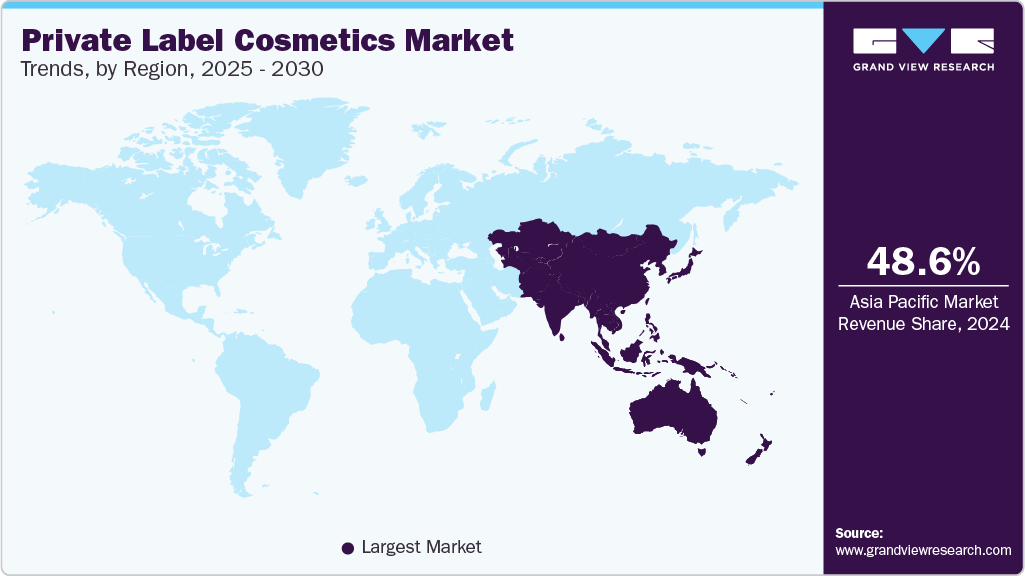

- Asia Pacific dominated the private label cosmetics market with the largest revenue share of 48.56% in 2024.

- The private label cosmetics industry in the U.S. accounted for a market revenue share of 89.24% in North America in 2024.

- By product, the skincare segment led the market with the largest revenue share of 41.70% in 2024.

- By type, the organic/natural cosmetic segment led the market with the largest revenue share of 85.59% in 2024.

- By end use, the women segment led the market with the largest revenue share of 63.30% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.64 Billion

- 2030 Projected Market Size: USD 14.39 Billion

- CAGR (2025-2030): 5.2%

- Asia Pacific: Largest market in 2024

Consumers are becoming more value-conscious, seeking high-quality products at affordable prices. Private-label cosmetics, which are often priced lower than branded counterparts, offer an attractive alternative without compromising on quality.Private-label cosmetics allow retailers and businesses to have more control over product development and branding. Unlike traditional national brands, private labels collaborate directly with contract manufacturers, giving them the flexibility to tailor product formulations, packaging, and design according to their unique brand identity and target audience preferences. This agility enables private labels to quickly respond to emerging trends such as vegan beauty, cruelty-free products, or eco-friendly packaging. Moreover, with advancements in cosmetic manufacturing technology, the quality gap between private labels and legacy brands has significantly reduced, making private labels more appealing to consumers.

For instance, in 2024, Sephora's global expansion success was largely driven by its focus on private-label products, particularly the Sephora Collection. By offering high-quality, affordable alternatives to premium beauty brands, Sephora strengthened its appeal among price-sensitive but quality-conscious consumers. This strategy not only improved profit margins but also differentiated Sephora in a competitive retail market. In addition, Sephora's investment in immersive events like "Sephoria" helped the brand connect with customers across new markets, fostering deeper engagement and brand loyalty. These combined efforts significantly boosted Sephora’s international presence and were a key factor in the company’s record-breaking financial performance for the year.

Furthermore, Brands are actively shifting towards packaging solutions made from post-consumer recycled (PCR) plastics, biodegradable materials, and refillable components to reduce environmental impact and align with global sustainability goals. This transition not only helps lower carbon emissions and plastic waste but also enhances brand image among environmentally conscious consumers. Private label manufacturers are collaborating with packaging innovators to develop aesthetically appealing yet sustainable options, such as recyclable glass containers, mono-material packaging, and compostable alternatives, ensuring both functionality and eco-responsibility. As regulatory pressures on plastic use intensify, the adoption of sustainable packaging has become a strategic priority, enabling private label cosmetic brands to stay competitive and appeal to a growing segment of green-conscious buyers.

For instance, in June 2024, Geka, a beauty packaging manufacturer, introduced a new post-consumer recycled polypropylene (PCR-PP) material designed specifically for cosmetic applications. This innovative material contains at least 95% recycled plastic, is fully compliant with food safety standards, and is safe for use with cosmetic formulations, including direct contact components. Geka highlights that this sustainable alternative reduces carbon emissions by 75% compared to traditional virgin plastics. This development marks a significant step toward fully recyclable cosmetic packaging without compromising on aesthetics or performance.

In addition, the globalization of beauty trends has significantly influenced the private-label cosmetics industry, enabling brands to cater to diverse markets by localizing products according to regional preferences, skin tones, and cultural nuances. In emerging markets such as Asia-Pacific and the Middle East, private-label cosmetics are experiencing rapid growth due to rising disposable incomes, urbanization, and increasing awareness of personal grooming.

In the Asia-Pacific region, the resurgence of K-beauty has led brands to expand their shade ranges to cater to diverse skin tones. For instance, TIRTIR expanded its foundation shades from 3 to 40, influenced by feedback from influencers and consumers on social media. Similarly, U.S.-based K-beauty brands like Cle Cosmetics have pioneered inclusivity with extended shade ranges, while Korean brands are adapting quickly to meet global demand.

In the Middle East, brands like Asteri Beauty have developed products tailored to the region's climate, such as "desert-proof" makeup featuring local ingredients like date-seed oil for hydration and long-lasting formulas built to resist extreme heat conditions. In addition, local celebrity brands like Peacefull Skincare, launched by Salama Mohamed, have built their brand around community values such as inclusivity and acceptance, catering to an increasingly demanding skincare consumer by using Korean science and technology and region-adapted formulations. These developments underscore the dynamic growth of private-label cosmetics globally, as brands adapt to regional demands and leverage opportunities presented by globalization and shifting consumer preferences.

Consumer Insights

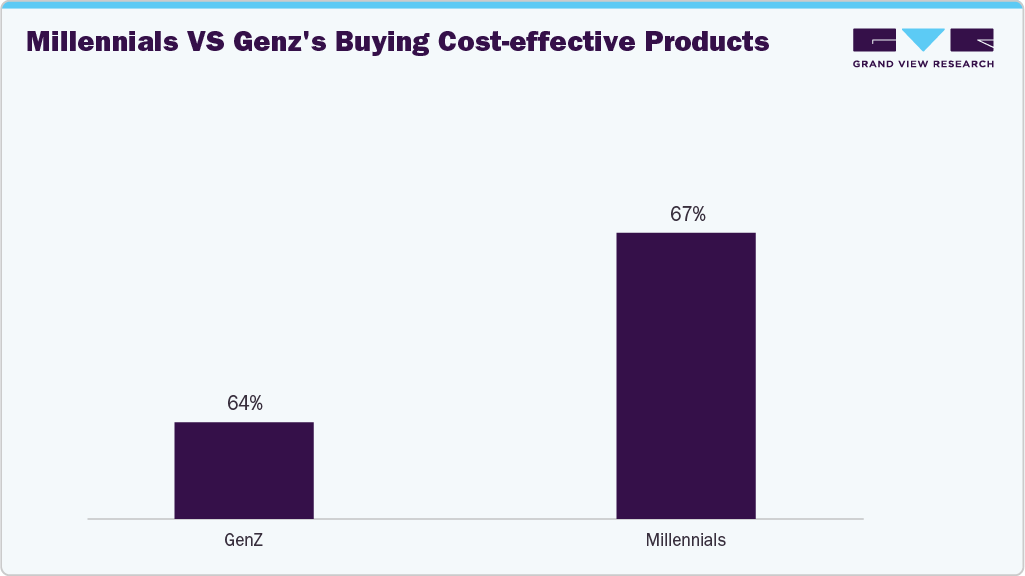

Millennials and Gen Z are reshaping the private label cosmetics industry by seeking affordable yet high-quality alternatives to premium brands. A significant 64% of Gen Z and 67% of Millennials opt for "dupes," cost-effective products that emulate luxury items, highlighting a shift towards value-driven purchasing. This trend is amplified by social media influence, with 90% of Gen Z beauty consumers having bought products based on influencer recommendations in the past year. Platforms like TikTok and Instagram play a pivotal role in product discovery, making private-label cosmetics more accessible and appealing to younger audiences.

Beyond affordability, these generations prioritize ethical considerations in their beauty choices. Approximately 46% of Gen Z consumers are willing to pay more for sustainable products, and 45% would discontinue using brands that lack inclusivity or social responsibility. This underscores a demand for transparency, eco-friendliness, and diversity in product offerings. Retailers and brands are responding by enhancing their private-label lines to align with these values, focusing on clean ingredients, sustainable packaging, and inclusive marketing strategies.

Furthermore, as economic challenges persist, a notable trend has emerged where consumers are increasingly opting for private-label products to manage their spending more effectively. Recent findings show that 28% of shoppers have switched from well-known brands to store-owned alternatives, primarily due to cost considerations. Interestingly, two-thirds of these consumers (66%) believe private-label items offer quality on par with established brands. Furthermore, 38% of those who made the switch indicated they were unlikely to return to branded goods, suggesting a lasting change in shopping habits driven by perceived value and satisfaction.

This growing acceptance of private-label goods spans various product categories, such as food, household essentials, clothing, personal care, and beauty products. Retailers are responding by expanding their private-label assortments and strategically positioning these items in stores to catch consumer attention. Leveraging data analytics, retailers fine-tune product offerings to match customer expectations and preferences better. This strategy not only caters to budget-conscious shoppers but also strengthens brand loyalty by delivering personalized shopping experiences at competitive prices.

For instance, in June 2024, Walmart expanded its luxury beauty offerings by introducing Pretty Smart, a makeup brand founded by industry veteran Marissa Shipman. Exclusively available in 2,800 U.S. Walmart stores and online, Pretty Smart offers over 100 products across complexion, cheek, eye, and lip categories, all priced under USD 10. The brand emphasizes quality ingredients and affordability, achieved through vertical integration and U.S.-based manufacturing. This launch aligns with Walmart's strategy to enhance its premium beauty assortment, aiming to provide accessible luxury and compete with other major retailers in the beauty sector.

Product Insights

The skincare segment led the market with the largest revenue share of 41.70% in 2024. As consumers become more knowledgeable about ingredients and their benefits, they are seeking personalized and effective skincare solutions without the high price tag. Private label brands are meeting this demand by offering innovative formulations, often using natural and sustainable ingredients, while maintaining competitive pricing. In addition, retailers are investing in private label skincare to differentiate their offerings and build customer loyalty, further driving market growth.

For instance, in September 2024, Walgreens launched a new premium skincare line that offers high-quality products at affordable prices, aiming to make luxury skincare accessible to budget-conscious consumers. The line includes items such as the Gentle Cleanser (USD 10.49), Glycolic Acid Purifying Cleanser (USD 12.99), 2% BHA Liquid Exfoliant (USD 11.99), Azelaic Acid Suspension 10% (USD 8.99), Moisturizing Facial Cream (USD 12.99), Super Invisible SPF 40 (USD 14.99), Hydrating Lip Mask (USD 9.99), Watermelon AHA Mask (USD 18.99), and Body Butter Firming Cream (USD 22.99). These products are formulated to be comparable to premium brands like Youth to the People, SkinCeuticals, Paula’s Choice, The Ordinary, Kiehl’s, Supergoop!, Laneige, Glow Recipe, and Sol de Janeiro, but at least 50% less expensive.

The haircare segment is projected to grow at the fastest CAGR of 5.5% over the forecast period, due to shifting consumer preferences toward affordable, high-quality alternatives that address specific hair concerns. With increased awareness of scalp health, damage repair, and the benefits of natural and sustainable ingredients, consumers are seeking personalized solutions without the premium price tag. Private label brands are capitalizing on this trend by offering innovative formulations, such as sulfate-free shampoos, nourishing hair masks, and plant-based treatments, at competitive prices.

Type Insights

The organic/natural cosmetic segment led the market with the largest revenue share of 85.59% in 2024. Growing concerns over synthetic chemicals, allergens, and harmful additives have led many consumers to prefer clean, plant-based formulations. Private label brands are responding to this shift by developing affordable organic and natural products that offer transparency, sustainability, and quality without the premium pricing of established brands. In addition, the rise of eco-friendly and cruelty-free movements has further fueled this demand, encouraging retailers to expand their private label offerings with greener alternatives that appeal to environmentally and health-conscious shoppers.

For instance, in June 2024, Vasa Cosmetics launched a new organic skincare line. This collection includes products such as a ceramide-rich face toner infused with guava, cucumber, and avocado extracts; a broad-spectrum SPF 50+ sunscreen featuring turmeric and saffron; and a snail mucin serum enhanced with snow mushroom extract. These offerings emphasize natural ingredients and cater to consumers seeking affordable, high-quality skincare solutions.

The conventional/synthetic cosmetic segment is projected to grow at the fastest CAGR of 5.1% over the forecast period. These products often offer longer shelf life, effective formulations, and vibrant colors that are difficult to achieve with purely natural alternatives. In addition, advancements in cosmetic chemistry have made synthetic ingredients safer and more efficient, meeting consumer expectations for quality and results at a lower cost. Retailers favor private label synthetic products because they can be produced at scale with controlled costs, allowing them to offer competitive prices while maintaining high margins.

End Use Insights

The women segment led the market with the largest revenue share of 63.30% in 2024. Women are drawn to private-label brands that provide tailored solutions for different skin types, tones, and preferences, often inspired by current beauty trends. Unlike traditional high-end brands, private labels are quick to adapt to consumer demands, offering innovative products such as multi-purpose cosmetics and clean beauty formulations at competitive prices. In addition, the trust women place in well-known retailers further boosts their confidence in trying private label products. As self-care and personal grooming continue to be priorities, private label cosmetics present an accessible way for women to maintain their beauty routines without overspending, contributing to their growing popularity.

For instance, in April 2024, Lady Burd launched a new product line. The range includes smooth highlighting sticks in shades like Lavender Lights and Pink Lights, designed to complement diverse skin tones. In addition, the line features skincare products such as a cleansing oil formulated with olive and jojoba oils, and a bakuchiol serum that offers retinol-like benefits without irritation.

The men segment is projected to grow at the fastest CAGR of 5.0% over the forecast period. As societal norms evolve, more men are embracing self-care routines, leading to greater demand for tailored skincare and grooming products. Private label brands, offering high-quality yet affordable alternatives to well-established labels, have become a popular choice for male consumers seeking products suited to their specific needs. In addition, the convenience and personalization that private label products often provide, combined with increasing accessibility through online and retail platforms, are contributing factors to this growth. As men continue to prioritize appearance and self-care, the market for private label cosmetics designed specifically for them is poised for continued expansion.

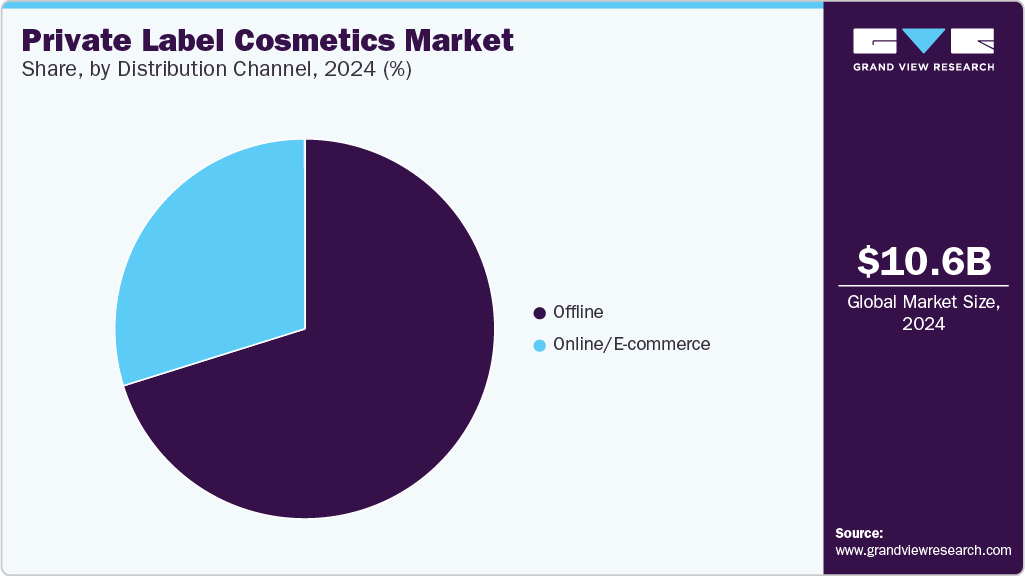

Distribution Channel Insights

The offline segment led the market with the largest revenue share of 70.10% in 2024. Offline retail spaces, such as supermarkets, department stores, and specialty shops, are strategically expanding their private label offerings, providing consumers with a wide variety of affordable and quality alternatives to well-known brands. In addition, the in-store shopping experience allows brands to offer personalized assistance and promotions, further enhancing the appeal of private label products. As more shoppers return to physical stores post-pandemic, the demand for private label cosmetics through offline channels is expected to continue growing.

The online segment is estimated to grow at the fastest CAGR of 5.7% over the forecast period. Consumers are turning to online shopping for its ease of access, allowing them to browse and purchase products from the comfort of their homes. Moreover, online platforms often provide detailed product information, customer reviews, and targeted recommendations, helping consumers make informed decisions. With the rise of social media marketing and influencer collaborations, private label cosmetics are gaining more visibility and trust among online shoppers. These factors, combined with the growing trend of personalized and direct-to-consumer shopping experiences, are driving the growth of private label cosmetics sales through online channels.

Regional Insights

The private label cosmetics market in North America is expected to grow at a significant CAGR during the forecast period. Shoppers are increasingly seeking affordable yet high-quality beauty products, leading them to explore store-owned or exclusive brands as alternatives to premium labels. In addition, private label products offer improved formulations, trendy packaging, and innovative ingredients that rival established brands. Retailers are also capitalizing on this trend by offering greater variety and customization, appealing to consumers' desire for personalized beauty solutions.

U.S. Private Label Cosmetics Market Trends

The private label cosmetics industry in the U.S. accounted for a market revenue share of 89.24% in North America in 2024. Major retailers and pharmacies are expanding their in-house beauty collections, offering products that cater to rising preferences for clean ingredients, eco-friendly packaging, and cruelty-free formulations. This growing acceptance is fueled by improvements in product performance and increased transparency from retailers, which builds consumer confidence in store-owned brands. In addition, the seamless availability of private label cosmetics through physical stores and online platforms, combined with exclusive product launches and tailored marketing strategies, is driving more consumers to choose these value-oriented options.

Asia Pacific Private Label Cosmetics Market Trends

Asia Pacific dominated the private label cosmetics market with the largest revenue share of 48.56% in 2024. As middle-class populations grow, particularly in China, India, and Southeast Asia, there is an increasing demand for value-driven products that do not compromise on quality. Private label cosmetics benefit from this trend as they offer competitive pricing and cater to local beauty needs more precisely than global brands.

Europe Private Label Cosmetics Market Trends

The private label cosmetics market in Europe is anticipated to grow at a significant CAGR during the forecast period. Retail giants such as Carrefour, Lidl, and DM Drogerie Markt are expanding their private label cosmetic ranges, offering products that meet European standards for safety, sustainability, and ingredient transparency. Moreover, European consumers place strong emphasis on eco-friendly packaging, cruelty-free testing, and natural formulations, which private label brands are quick to adopt to remain competitive.

Key Private Label Cosmetics Company Insights

The private label cosmetics industry comprises both well-established manufacturers and agile new entrants. Leading players focus on delivering customized product solutions, emphasizing innovation, quality, and unique formulations that align with shifting consumer demands. By partnering with prominent retail chains and e-commerce platforms, these companies capitalize on broad distribution channels to enhance brand visibility and expand their reach. In addition, strategic collaborations and flexible production capabilities enable key players to address niche segments and tap into emerging markets effectively.

Key Private Label Cosmetics Companies:

The following are the leading companies in the private label cosmetics market. These companies collectively hold the largest market share and dictate industry trends.

- SKINLYS MENTIONS LÉGALES

- NF Skin.

- HSA Cosmetics

- CarasaLab

- Lady Burd

- COSMEWAX S.A.

- kdc/one

- INTERCOS S.P.A

- TOA Inc.

- VITELLE LAB

Recent Developments

-

In September 2024, Cosmewax, a Spanish private label cosmetics manufacturer, announced an expansion by building a new production facility in Puzol, Valencia. This new project will focus on skincare products and is expected to increase the company’s production capacity by 50%. The factory will incorporate advanced technology and eco-friendly solutions, such as solar energy systems.

-

In April 2024, Intercos S.p.A., a global leader in cosmetic product development and manufacturing, entered into a new commercial agreement with The Estée Lauder Companies. Under this agreement, Estée Lauder will transfer the majority of its U.S.-based cosmetic powder production to Intercos America Inc., further solidifying their strategic partnership, which has spanned over four decades. This move underscores Intercos's established expertise and innovation in the cosmetic powders segment, reinforcing its leadership in the global market.

Private Label Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.15 billion

Revenue forecast in 2030

USD 14.39 billion

Growth rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

SKINLYS MENTIONS LÉGALES; NF Skin.; HSA Cosmetics; CarasaLab; Lady Burd; COSMEWAX S.A.; kdc/one; INTERCOS S.P.A; TOA Inc.; VITELLE LAB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Private Label Cosmetics Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global private label cosmetics market report based on the product, type, end use, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Skincare

-

Haircare

-

Color Cosmetics

-

Fragrance

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Organic/Natural

-

Conventional/Synthetic

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Supermarkets & Hypermarkets

-

Pharmacies & Drugstores

-

Specialty Beauty Stores

-

Others

-

-

Online/E-Commerce

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global private label cosmetics market was estimated at USD 10.64 billion in 2024 and is expected to reach USD 11.15 billion in 2025.

b. The global private label cosmetics market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 14.39 billion by 2030.

b. Asia Pacific dominated the private label cosmetics market with a share of around 48.56% in 2024, driven by rapid urbanization and rising consumer awareness. The region’s expanding middle class and growing e-commerce sector further propelled this growth.

b. Some of the key players operating in the private label cosmetics market include SKINLYS MENTIONS LÉGALES, NF Skin., HSA Cosmetics, CarasaLab, Lady Burd, COSMEWAX S.A., kdc/one, INTERCOS S.P.A, TOA Inc., VITELLE LAB

b. Key factors that are driving the private label cosmetics market growth include growing consumer demand for affordable, personalized products and the rise of e-commerce channels. Additionally, increasing preference for natural ingredients and retailers’ focus on unique offerings boost market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.