- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Probiotic Dietary Supplement Market, Industry Report, 2033GVR Report cover

![Probiotic Dietary Supplement Market Size, Share & Trends Report]()

Probiotic Dietary Supplement Market (2025 - 2030) Size, Share & Trends Analysis Report By Form (Chewable & Gummies, Capsules, Powders, Tablets & Softgels), By Application (Sports Fitness, General Health), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-380-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Probiotic Dietary Supplement Market Summary

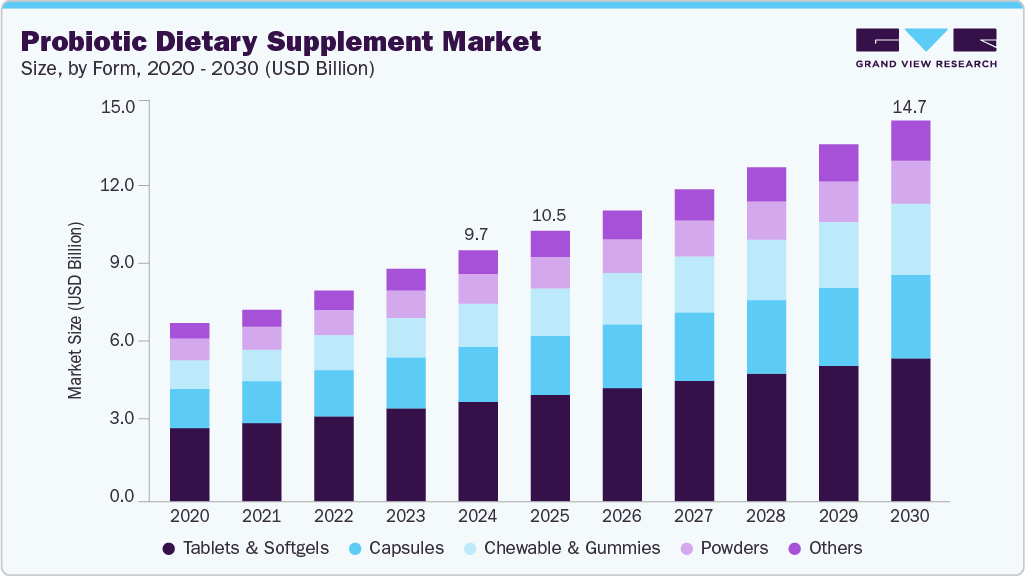

The global probiotic dietary supplement market size was estimated at USD 9.71 billion in 2024 and is projected to reach USD 14.72 billion by 2030, growing at a CAGR of 7.1% from 2025 to 2030. The market is experiencing growth, largely driven by a growing awareness among consumers of the importance of gut health and immunity.

Key Market Trends & Insights

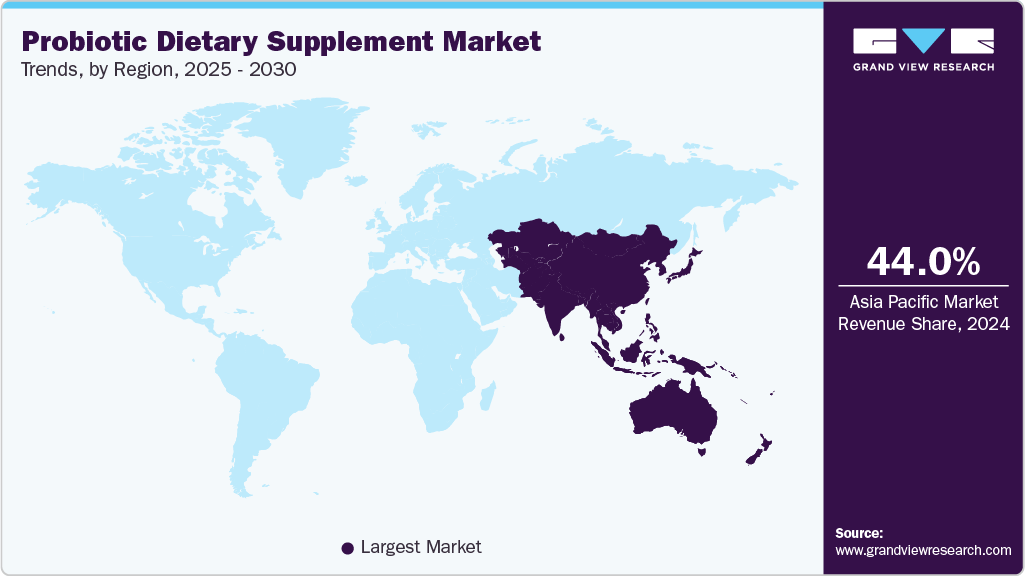

- The Asia Pacific probiotic dietary supplement market held the largest revenue share of 44.0% in 2024.

- By form, the tablets & softgels segment held the largest market share of 39.7% in 2024.

- By form, the chewable & gummies segment is expected to grow at a CAGR of 8.6% from 2025 to 2030.

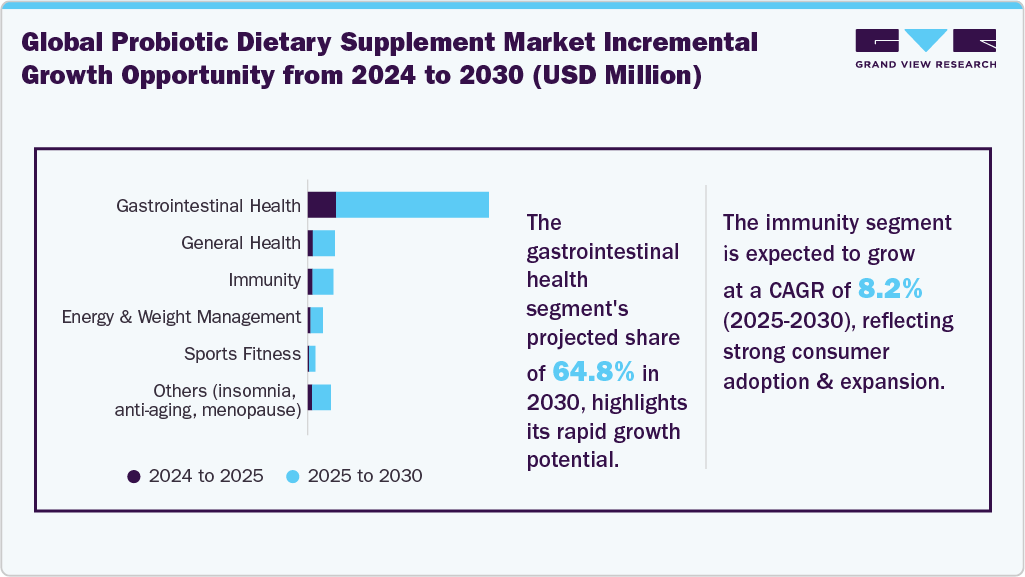

- By application, the gastrointestinal health segment dominated the market with a revenue share of 64.7% in 2024.

- By end use, the adults segment dominated the probiotic dietary supplement market with a revenue share of 55.1% in 2024.

Key Market Trends & Insights

- 2024 Market Size: USD 9.71 Billion

- 2030 Projected Market Size: USD 14.72 Billion

- CAGR (2025-2030): 7.1%

- Asia Pacific: Largest market in 2024

The incidence of digestive ailments is rapidly increasing, which is anticipated to drive the demand for probiotic products. These products combat harmful bacteria in the gut and are effective in treating conditions such as intestinal inflammation, antibiotic-associated diarrhea, and urogenital infections. Consumer education has also played a pivotal role. Increased media coverage and information dissemination have made people more aware of digestive health issues and their connection to broader health concerns. For instance, nearly three in five U.S. consumers report actively seeking out foods that support their gut microbiome, with fermented foods being among the most popular choices. This heightened awareness has translated into a greater willingness to invest in probiotic supplements.The focus on gut health has also intensified in recent years, driven by an increasing number of individuals experiencing digestive issues such as irritable bowel syndrome (IBS) and constipation. As a result, gut microflora probiotics have gained popularity as a means of addressing these concerns.

The popularity of probiotic dietary supplements has been steadily increasing due to the convenience of consuming powders and chewable tablets in a variety of appealing flavors such as apple, orange, and raspberry. These supplements contain lactic acid bacteria, specifically Streptococcus thermophilus and Lactobacillus, which help regulate the digestive system and enhance immune responses. Lactobacillus is also effective in treating a range of conditions such as diarrhea, high cholesterol, skin disorders, irritable bowel syndrome, and lung infections.

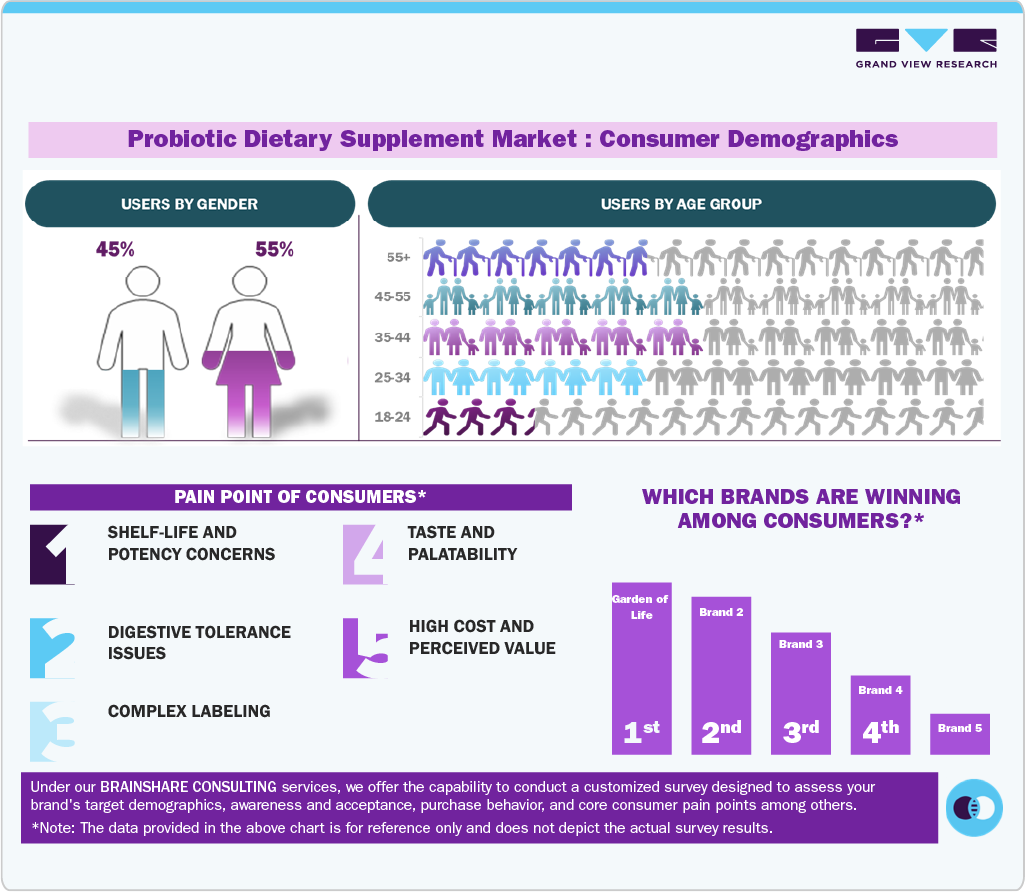

Consumer Insights

Consumers worldwide increasingly prioritize gut health, immunity, and overall wellness, driving the adoption of probiotic dietary supplements. Convenient and easy-to-consume formats, such as softgels, gummies, chewables, and powders, are preferred, particularly among adults and younger populations. Flavor, palatability, and clean-label ingredients strongly influence purchasing decisions, while scientific validation and regulatory assurances enhance consumer trust. Parents increasingly seek probiotics for infants and children, emphasizing the importance of digestive and immune support from an early age. In addition, the rise of e-commerce and digital health education makes probiotic products more accessible and visible, encouraging frequent and repeated consumption.

Form Insights

The tablets & softgels segment held the largest revenue share of 39.7% in 2024. Tablets offer convenience and superior shelf stability, making them an ideal option for individuals with busy lifestyles. Additionally, tablets can be developed to provide an accurate dosage, which is crucial for supplements that require precise dosing for optimal efficacy and safety. These forms are less susceptible to moisture and oxygen, ensuring prolonged potency of the live microorganisms they contain. This stability is crucial for maintaining the efficacy of probiotics, which are sensitive to environmental factors.

The demand for natural health supplements in tablet form is expected to increase during the forecast period, driven by various factors such as high-quality excipients that aid in tablet absorption and disintegration. Although natural coating may offer better dissolution, other factors such as efficacy and quality also determine the absorption rate.

The chewable & gummies segment is expected to grow at a CAGR of 8.6% over the forecast period. The growth of this segment is primarily driven by its popularity among younger consumers. These forms offer a palatable and convenient alternative to traditional capsules and tablets, making them particularly attractive to children and adults who may have difficulty swallowing pills. Chewable tablets and gummies are gaining popularity due to their pleasant taste, diverse flavors, and ease of consumption. They are often available in fruit flavors and are designed to be consumed without water, enhancing their convenience.

Application Insights

The gastrointestinal health segment dominated the market with a revenue share of 64.7% in 2024. The rising prevalence of digestive disorders primarily drives this segment’s dominance. Increasingly common conditions such as antibiotic-associated diarrhea, inflammatory bowel disease (IBD), and irritable bowel syndrome (IBS) are prompting consumers to seek natural and effective solutions. Probiotics are crucial in maintaining a balanced gut microbiota, which is essential for optimal digestive health. By introducing beneficial bacteria into the digestive system, probiotics help restore microbial balance, improve digestion, and alleviate symptoms associated with various gastrointestinal conditions.

Consuming probiotics can boost gastrointestinal health and reduce digestive discomfort, including bloating, gas, and constipation, which can lead to lower energy levels. Thus, the growing need of consumers to improve their intestinal health is a major driving factor for the market's growth during the forecast period. The changing food habits and everyday stress might lead to a reduction in the gut microbiome, and the consumption of probiotics can be reduced. Thus, increasing the consumption of probiotics in order to manage stress and increase gut microbiome would propel the growth of the market in the upcoming years.

The immunity segment is expected to grow at the fastest CAGR over the forecast period. The primary driver behind the rapid growth of immunity-focused probiotic dietary supplements is the increased consumer awareness of immune health. Consumers are increasingly proactive in supporting their immune systems through natural and preventive measures, driving greater demand for supplements that enhance immune function.

End Use Insights

The adult segment accounted for the largest revenue share of 55.1% in 2024. This dominance is primarily driven by increasing health awareness and preventive healthcare adoption among working-age populations. Adults proactively seek dietary solutions to support digestion, immunity, and overall wellness, which drives consistent demand for probiotics. This demographic values the convenience of tablets, softgels, and capsules, which fit easily into busy lifestyles. With the rising prevalence of digestive issues, stress-related gut problems, and lifestyle-related immunity concerns among adults globally, probiotic dietary supplements have become a key element of routine health management.

The infants segment is projected to grow at the fastest CAGR over the forecast period, driven by increasing parental awareness of the benefits of building gut health and immunity in early life. Parents proactively seek probiotic supplements to support healthy digestion, strengthen immunity, and promote overall infant development. Probiotics for infants are often delivered through powders, drops, or fortified formula, making them easy to administer. Early-life supplementation can help establish a balanced gut microbiota, which is crucial in the development of the digestive system and the immune system. With rising attention on preventive health and infant nutrition, probiotics have become a preferred addition to infant diets.

Regional Insights

The North America probiotic dietary supplement market is expected to grow in the coming years, primarily driven by the population suffering from chronic diseases, such as obesity, digestive distress, stress, and cardiovascular problems. Additionally, lifestyle-related diseases resulting from poor dietary habits and high consumption of processed & ready-to-eat foods would increase the demand for probiotic dietary supplements.

Rising concerns about health and wellness have driven demand for probiotic dietary supplements in this region over the years. In recent years, there has been a steady demand for food supplements and nutritional supplements across North America. Many manufacturers of these supplements in North America are expanding their operations to increase their scale within the region.

Europe Probiotic Dietary Supplement Market Trends

The Europe probiotic dietary supplement market is anticipated to grow over the forecast period, shaped by strong public trust in evidence-based nutrition. Initiatives taken by manufacturers to develop beneficial and innovative products are also driving the growth of the probiotic dietary supplement market in Europe. In June 2024, Bayer AG introduced one a day age factor cell defense, a dietary supplement designed to support cellular aging. Enriched with omega-3 fatty acids, vitamins A and D, and niacin, this supplement aims to enhance cell resilience. Such initiatives have encouraged the participants to come up with highly beneficial and innovative products, hence boosting industry growth.

The evolving e-commerce sector in the region is driving the growth of the probiotic dietary supplement market. For instance, according to IPA Europe, in 2022, 48% of online sales of probiotic dietary supplements were sourced from outside Europe. EU consumer engagement with probiotic dietary supplements online has grown between 100% and 200%. Thus, growing consumer engagement with dietary supplements would propel the growth of the probiotic dietary supplement market.

Spain probiotic dietary supplement market is expanding as manufacturers increasingly invest to meet the rising demand for probiotics, postbiotics, and other products that support health and well-being, which is a major driving factor for the market's growth during the forecast period. For instance, in June 2023, Archer Daniels Midland Company (ADM) opened a new state-of-the-art production facility in Valencia, Spain, with an investment of USD30 million. This facility would produce both probiotics and postbiotics, catering to customers in the U.S., Asia-Pacific, and Europe. Thus, the growing investment by manufacturers is a significant driving factor for the market's growth during the forecast period.

Asia Pacific Probiotic Dietary Supplement Market Trends

The Asia Pacific probiotic dietary supplement market accounted for the largest revenue share of 44.0% in 2024, and is expected to grow at the fastest CAGR over the forecast period. This growth is driven by deep-rooted cultural acceptance of fermented foods and modern consumer interest in functional nutrition. Countries such as China, Japan, and South Korea have long integrated probiotics into daily diets, and this tradition now extends to supplements targeting digestion, skin, and immunity. Despite the challenge of higher product prices, consumers are willing to pay more for better health, which is expected to support market growth.

Probiotic dietary supplement market in China held the largest revenue share of 48.4% in 2024 in the Asia Pacific market, where probiotics are strongly associated with digestive comfort and immune strength. Domestic manufacturers are expanding strain development and local production capacity, supported by a growing number of clinically validated probiotic ingredients entering the market.

Central & South America Probiotic Dietary Supplement Market Trends

The Central & South America probiotic dietary supplement market is expected to grow at a CAGR of 7.3% over the forecast period. Increasing awareness among consumers about the health benefits associated with these probiotics is a major driving factor for the market's growth during the forecast period. The growing health consciousness among consumers, aimed at improving digestive health, enhancing immunity, and managing weight, is also expected to bolster market growth in the upcoming years.

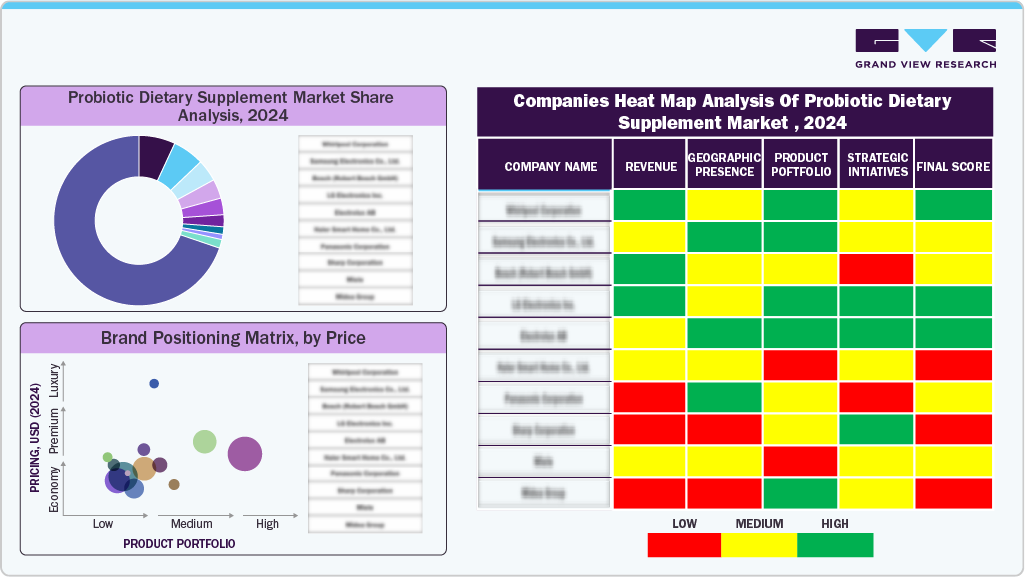

Key Probiotic Dietary Supplement Company Insights

The leading companies in the probiotic dietary supplements market are heavily investing in research and development to enhance their product offerings and create innovative formulations with superior properties to meet the growing demand.

Key Probiotic Dietary Supplement Companies:

The following are the leading companies in the probiotic dietary supplement market. These companies collectively hold the largest market share and dictate industry trends.

- Vitakem Nutraceutical Inc.

- Lesaffre

- Herbalife International, Inc

- H&H Group

- Dr. Joseph Mercola

- ADM

- Amway

- Bayer AG

- BioGaia

- Nestlé Health Science

- NOW Foods

- Nature's Sunshine Products, Inc.

- Seed Health, Inc.

- RenewLife

- Goodhealth Products Limited

Recent Developments

-

In September 2025, Garden of Life broadened its protein offerings by introducing Sprouted Barley Protein + Probiotics powders. This innovative plant-based protein powder contains 21 grams of protein from sprouted barley and rice, providing all essential amino acids, along with 1 billion CFU of Bacillus coagulans SNZ 1969 probiotics to enhance digestive health.

-

In June 2025, Bioma Probiotics officially launched a next-generation synbiotic supplement to enhance gut health. This innovative formula combines prebiotics, probiotics, and postbiotics to nourish the gut microbiome comprehensively.

Probiotic Dietary Supplement Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.46 billion

Revenue forecast in 2030

USD 14.72 billion

Growth rate

CAGR of 7.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Form, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key company profiled

Vitakem Nutraceutical Inc.; Lesaffre; Herbalife International Inc.; H&H Group; Dr. Joseph Mercola; ADM; Amway; Bayer AG; BioGaia; Nestlé Health Science; NOW Foods; Nature's Sunshine Products Inc.; Seed Health, Inc.; RenewLife; Goodhealth Products Limited.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Probiotic Dietary Supplement Market Report Segmentation

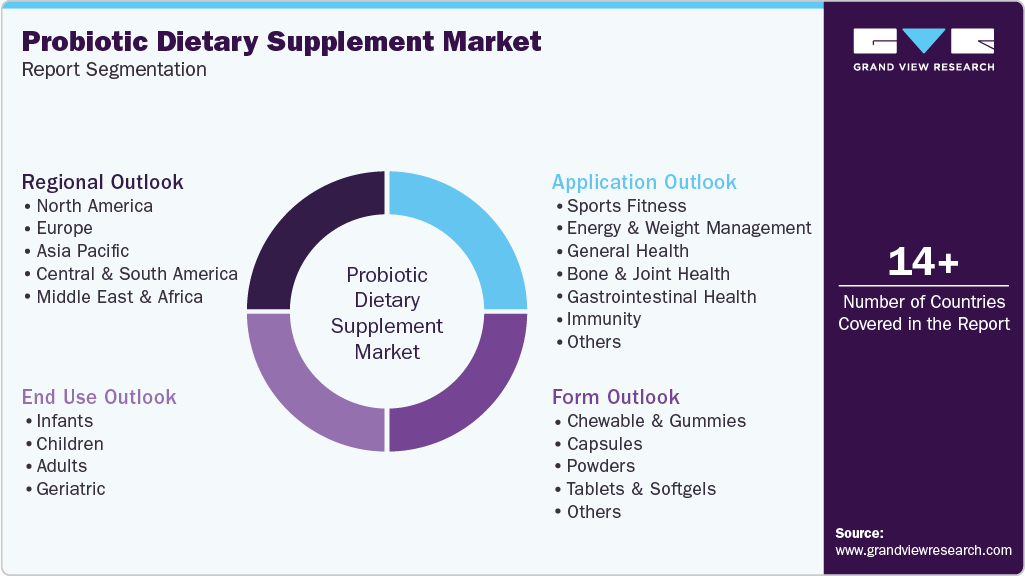

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global probiotic dietary supplement market report based form, application, end use, and region:

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Chewable & Gummies

-

Capsules

-

Powders

-

Tablets & Softgels

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Fitness

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Skin/Hair/Nails

-

Brain/Mental Health

-

Others (Insomnia, Anti-aging, Menopause)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Infants

-

Children

-

Adults

-

Geriatric

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.