- Home

- »

- Next Generation Technologies

- »

-

Project Management Software Market Size Report, 2030GVR Report cover

![Project Management Software Market Size, Share & Trends Report]()

Project Management Software Market (2023 - 2030) Size, Share & Trends Analysis Report By Component, By Solution, By Services, By Enterprise Size, By Deployment, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-080-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Project Management Software Market Summary

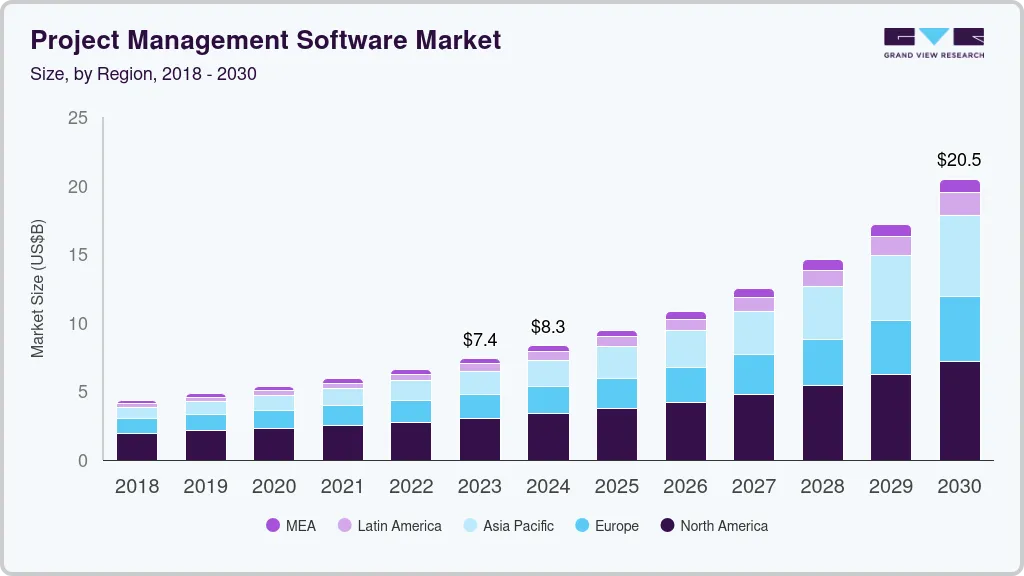

The global project management software market size was valued at USD 6.59 billion in 2022 and is projected to reach USD 20.47 billion by 2030, growing at a CAGR of 15.7% from 2023 to 2030.The rising need for business software among organizations to reduce disparities and chaos is expected to drive market growth.

Key Market Trends & Insights

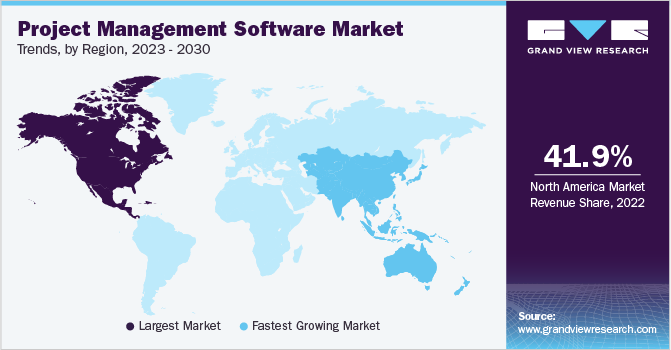

- North America held the major share of 41.97% of the target market in 2022.

- Based on component, the solution segment accounted for the largest market share of 67.20% in 2022.

- Based on solution, the activity scheduling segment accounted for the largest market share of 27.28% in 2022.

- Based on services, the support & maintenance scheduling segment accounted for the largest market share of 76.01% in 2022.

Market Size & Forecast

- 2022 Revenue: USD 6.59 Billion

- 2030 Projected Market Size: USD 20.47 Billion

- CAGR (2023-2030): 15.7%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Project management software establishes and ensures efficient workflow within organizations. It is a digital system that helps organizations plan projects, schedule operations, and track the performance of resources. Project management software enables teams to collaborate and share virtual platforms to view ongoing project updates, follow-ups, upcoming and ongoing projects, deadlines, etc. Thus, the demand for project management software is growing significantly. Some major applications of project management software are planning, scheduling, resource allocation, document management, issue tracking, and task management. An organization may deal with multiple projects and tasks at a particular time, leading them to struggle with various priorities such as defining tasks, assigning resources, and achieving goals. Project management software assists organizations in resource management and helps them check the company’s workflow, pending tasks, and project updates. As projects progress, the project management software helps users in creating notes, track status, and communicate among multiple teams. Further, it also sends reminders to the team about incomplete tasks and upcoming deadlines. Thus, project management software reduces disparities and challenges, enhancing the overall efficiency of the organizational process.

Project management software is emerging as an effective tool across various end-use industries such as BFSI, IT & telecommunications, and engineering & construction industries that are looking to strengthen their internal communication, processes, and resource utilization. Furthermore, project management software is becoming extremely beneficial for businesses following hybrid and remote work strategies. Teams working remotely often experience excess data sharing, lack of communication, and mismanagement of shared files. Project management solutions enable streamlined communication, offer document management, and keep track of critical organizational data in one platform. Thus, the changing organizational structure and hybrid work-life scenario are expected to drive the market demand.

Some of the factors challenging the market growth are data privacy and security concerns. The project software management consists of critical information, organizational data, employee records, and resource details. These datasets can hamper the security and subsequently, the market position of organizations. Furthermore, the rising use of advanced technologies such as AI, ML, and blockchain technologies coupled with rising investments by key players in dealing with rising cyber security challenges is expected to minimize the impact of the following challenges.

Key organizations in the market are making strategic decisions, including partnerships, mergers and acquisitions, and new product launches, to provide customers with superior project management software offerings. For instance, in February 2023, Monday.com announced a strategic partnership with Appfire, an enterprise collaboration app provider. As part of the collaboration, Appfire with help monday.com customers find apps that can organize their unique business needs on a single platform, including workflows, processes, and projects.

Component Insights

The solution segment accounted for the largest market share of 67.20% in 2022. The project management solution offers tools and techniques to manage organizational projects and tasks, including scheduling, planning, resource management, task management, and document management. It allows organizations, stakeholders, and users to control costs by managing budget, quality, and resources and keeping track of their performance. Thus, it ensures the timely delivery of projects while mitigating risks and challenges.

The services segment is anticipated to grow at a CAGR of 16.5% during the forecast period. Project management software includes integration, deployment, support, and maintenance services. With organizations' rising utilization of project management software, the need for software deployment and integration services is also surging. Further, the support and maintenance services are designed to assist customers in dealing with errors and obstacles while performing different tasks.

Solution Insights

The activity scheduling segment accounted for the largest market share of 27.28% in 2022. Project management software helps companies design project plans, courses of action, budgets, schedule delivery, and project deadlines effectively. Furthermore, it also offers an easy track of project performance, and real-time project updates, and defines comparison between defined and achieved plans. Thus, the demand for project management software is rising further in the following segment.

The resource management segment is anticipated to grow at a CAGR of 16.5% during the forecast period. Project management software helps manage resources by providing real-time insights into resource performance, underperforming areas, and key performance indicators. Further, it assists organizations in allocating resources, undergoing capacity planning, and analyzing the time spent by resources on each process. Thus, the following benefits are expected to drive the segment’s growth in the market.

Services Insights

The support & maintenance scheduling segment accounted for the largest market share of 76.01% in 2022. The support & maintenance services across on-premise, cloud, and hybrid project management software help customers deal with challenges, difficulties, and errors occurred during the action. Thus, the following segment is expected to witness higher growth opportunities in the market.

The integration & deployment segment is anticipated to grow at a CAGR of 14.0% during the forecast period. The following segment includes the integration & deployment of project management software across various cloud, on-premise, and hybrid infrastructures. The growing demand for project software across various end-use industries such as IT & Telecom, BFSI, and engineering & construction is expected to support the growth of the following segment.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share of 64.85% in 2022. Project management software helps large organizations deal with multiple projects and tasks simultaneously, which requires utilization and management of resources, planning and scheduling tasks, task management, etc. Furthermore, project management software ensures smooth and effective communication within large organizations where teams are spread across multiple geographic locations and departments are the primary factors driving the market growth of the project management software industry solutions among large enterprises.

The SMEs segment is expected to grow at the highest CAGR of 17.3% during the forecast period. Project management software helps small and medium enterprises effectively plan, schedule, and utilize resources using the advanced features and tools offered by this software. Further, the project management software reduces the time and cost of manually tracking and maintaining operational processes by replacing them with a single technology-enabled digital platform. Thus, the following factors are expected to drive the project software management industry demand in the SME segment during the forecast period.

Deployment Insights

The cloud-based segment accounted for a market share of 56.68% in 2022. Cloud-based project management software consists primarily of subscription-based software models. It allows businesses to use project management software in a cloud-based infrastructure. This cloud-based project management software allows companies to use and extend their software licenses based on their demand. Thus, the following factors are expected to support the growth of the segment during the forecast period.

The on-premise segment is anticipated to grow at a CAGR of 14.4% during the forecast period. On-premises project management software offers an in-house hosted solution where the business can run and maintain tasks and operations within the boundaries of the organizational premise. It gives customers complete control over software use and management and ensures higher data privacy and security. Thus, the following factors are expected to support the segment growth in the project management software industry over the forecast period.

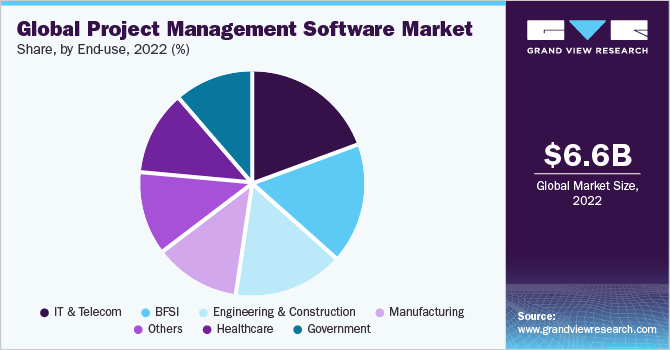

End-use Insights

The IT and telecom segment accounted for the largest market share of 19.20% in 2022. IT and Telecom are among the key industries gaining fast momentum and constantly driving the demand for project management software. IT and Telecom are among the key industries that deal with large teams, operational data, and cross-functional project development activities. The project management software helps IT and telecom industries establish smooth connections among teams, effectively evaluate project updates, and allocate resources per the requirements by monitoring real-time projects in one platform. Therefore, the demand for the project management software industry is expected to grow in the following segment.

The manufacturing segment is anticipated to grow at a CAGR of 16.8% during the forecast period. Project management software in manufacturing industries is becoming an effective tool to ensure effective planning, scheduling, task management, documenting management, and budgeting activities. It eliminates the traditional model of manually recording and maintaining worksheets, which helps reduce errors, time, and cost in running smooth manufacturing operations. Thus, the demand for project management software in manufacturing is expected to witness a lucrative growth opportunity.

Regional Insights

North America held the major share of 41.97% of the target market in 2022. In North America, the project management software industry is expected to witness positive traction owing to the rising demand for business software among major end-use industries such as IT and Telecom, BFSI, and healthcare, which is expected to drive market growth in the region. Further, the key players in the region include Microsoft Corporation; Oracle Corporation; LiquidPlanner. Inc; and Smartsheet, inc. are taking various strategic decisions to expand and enhance their regional project management software offering. These are the following factors to drive market growth in the North American region.

Asia Pacific is anticipated register growth as the fastest-developing regional market at a CAGR of 19.7%. The rapid adoption of advanced technologies such as AI, ML, and IoT in various end-use industries such as IT and Telecom, manufacturing, healthcare, transportation, logistics, etc. coupled with the growing government initiatives towards digitization such as the digital India program is expected to strengthen the adoption of project management software in the Asia Pacific region. Further, project management software supports SMEs and individual business organizations in the region by offering them cost-effective and reliable tools for managing everyday business operations. Thus, the following factors are expected to drive the demand for project management software solutions in the Asia Pacific region.

Key Companies & Market Share Insights

The key players operating in the project management software market include Adobe Inc.; Atlassian Corporation Plc.; Microsoft Corporation, Oracle Corporation; Plainview, Inc.; Planisware; SAP SE; and ServiceNow to broaden their software offering companies are utilizing a variety of inorganic growth strategies, such as mergers, partnerships, and acquisitions. In July 2022, Planview offered connected work solutions, including portfolio and work management solutions, and announced a strategic partnership with Tasktop to provide value stream management. Based on the partnership Planview and Tasktop will assist organizations to speed up their time to market, enhance operational efficiency, and provide capability which will help customers connect their software delivery business while enabling them to transform their organization quickly and efficiently. Some prominent players in the global project management software market include:

-

Adobe Inc.

-

Atlassian Corporation Plc

-

Broadcom Inc.

-

Microsoft Corporation

-

Oracle Corporation

-

Plainview, Inc.

-

Planisware

-

SAP SE

-

ServiceNow

-

Zoho Corporation Pvt. Ltd.

-

Teamwork.com

-

Smartsheet, inc.

-

Asana Inc.

-

Monday.com

-

LiquidPlanner, inc.

Project Management Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.38 billion

Revenue forecast in 2030

USD 20.47 billion

Growth Rate

CAGR of 15.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Segments covered

Component, solution, services, enterprise size, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Adobe Inc.; Atlassian Corporation Plc.; Broadcom Inc.; Microsoft Corporation; Oracle Corporation; Plainview, Inc.; Planisware; SAP SE; ServiceNow; Zoho Corporation Pvt. Ltd.; Teamwork.com; Smartsheet, inc.; Asana Inc.; Monday.com; LiquidPlanner, inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Project Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global project management software market report based on component, solution, services, deployment, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Services

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Activity Scheduling

-

Project Portfolio Management

-

Resource Management

-

Issue Tracking

-

Document Management

-

Others

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Integration & Deployment

-

Support & Maintenance

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprises (SMEs)

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manufacturing

-

BFSI

-

IT & Telecom

-

Healthcare

-

Engineering & Construction

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global project management software market size was estimated at USD 6.59 billion in 2022 and is expected to reach USD 7.38 billion in 2023.

b. The global project management software market is expected to grow at a compound annual growth rate of 15.7% from 2023 to 2030 to reach USD 20.47 billion by 2030.

b. The activity scheduling segment accounted for the largest market share of 27.28% in 2022. Project management software helps companies effectively design project plans, courses of action, budgets, schedule delivery, and project deadlines. Furthermore, it also offers an easy track of project performance, real-time project updates and defines comparison between defined and achieved plans. Thus, the demand for project management software is rising further in the following segment.

b. Adobe Inc., Atlassian Corporation Plc., Broadcom Inc., Microsoft Corporation, Oracle Corporation, Plainview, Inc., Planisware, SAP SE, ServiceNow, Zoho Corporation Pvt. Ltd., Teamwork.com, Smartsheet, inc., Asana Inc., Monday.com, and LiquidPlanner, inc.

b. The rising need for business software among organizations to reduce disparities and chaos is expected to drive market growth. Project management software establishes and ensures efficient workflow within the organization. It is a digital system that helps organizations to plan projects, schedule operations, and track the performance of resources. Thus, the demand for project management software is growing significantly.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.