- Home

- »

- Plastics, Polymers & Resins

- »

-

Protective Packaging Market Size & Forecast Report, 2030GVR Report cover

![Protective Packaging Market Size, Share & Trends Report]()

Protective Packaging Market Size, Share & Trends Analysis Report By Type (Flexible, Foam, Rigid), By Material (Paper & Paperboard, Plastic Foams, Plastic), By Function, By End-use (Automotive, Healthcare), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-037-8

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Protective Packaging Market Trends

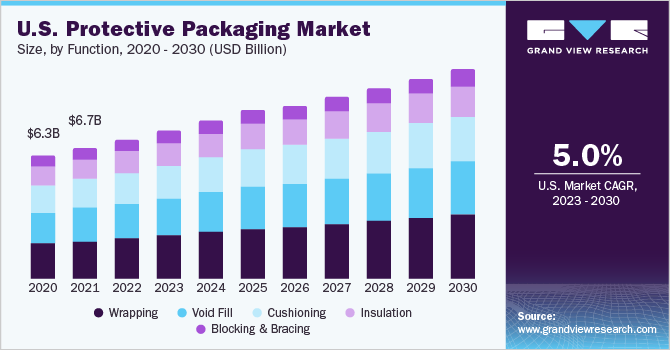

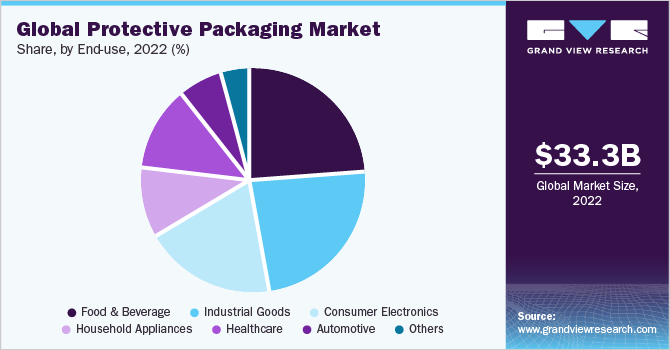

The global protective packaging market size was valued at USD 33.32 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. This market growth is attributed to the surge in online shopping and the growth of international trade in products such as electronics, medical devices, and other fragile items. Protective packaging ensures product safety throughout long transportation duration, warehousing, and product handling across regions which in turn drives its demand. The U.S. protective packaging industry is driven by the growth of e-commerce platforms in the country owing to the busy lifestyle of consumers. Several key companies are constantly developing new materials, designs, and technologies such as inflatable air cushions, protective sustainable packaging, and molded foam inserts to meet the evolving needs of e-commerce businesses. For instance, Sealed Air offers an on-demand protective foam packaging solution across the country under the name Instapak Quick RT, tailored for e-commerce businesses.

A shift in consumer preference towards convenience-oriented items such as frozen foods and ready-to-eat meals requiring protective packaging solutions drives its market growth in the country. For instance, Point Five Packaging, a U.S.-based packaging solutions manufacturer meets the increasing consumer demand in the country by offering protective packaging solutions for ready-to-eat and on-the-go snacks. Additionally, the presence of key players such as Altor Solutions; Smurfit Kappa; Sonoco Products Company; and Sealed Air in the U.S. further contributes to the demand for protective packaging in the country.

Type Insights

The flexible type accounted for the largest market share of over 65.0% in the base year 2022 in terms of revenue. Based on type, the protective packaging industry is further categorized into flexible, foam, and rigid types. The large share is attributed to the composition of flexible materials such as plastic films, aluminum foil, and paper, which offer cost-effectiveness, customization options, and reusability. These properties drive the protective packaging industry demand for flexible packaging, particularly in end-use industries such as food & beverage, pharmaceuticals, and personal care.

The foam packaging type is driven by its high-shock absorbent, lightweight, and cushioning properties, making it highly suitable for packaging sensitive and fragile products. This includes electronics, food & beverages, and other moisture-sensitive consumer goods that require reliable protection throughout various stages such as product handling, storage, and transportation.

The rigid type protective packaging is made of cardboard, metal, and plastic and is mainly used to pack heavy items such as whip cream and pickle jars to prevent any physical damage such as breakage. For instance, Pringles, a snack product manufacturer uses rigid packaging solutions made from cardboard and tin offering protection against any physical damage. In addition, this packaging type is also used for gaseous products such as aerosol spray bottles and soda cans & bottles which further drives the market growth for this segment.

Material Insights

Based on material, the protective packaging market is further segmented into paper & paperboard, plastic foams, plastic, and others. Among these, the paper & paperboard segment accounted for the largest market share in 2022 due to its selection as an alternative material to plastic, driven by plastic bans in regions such as Asia Pacific, North America, and Europe. With the growing demand for sustainability among consumers, e-commerce platforms encourage manufacturers to opt for paper protective packaging as an alternative to plastics further driving the growth for this segment.

The plastic foams segment is expected to grow at a fast CAGR during the forecast period. This growth is attributed to the unique properties of plastic foam, which is available in various forms such as rolls, sheets, bags, and blocks.Plastic foam offers effective protection against scratches and abrasions, making it ideal for safeguarding delicate products such as electronics. Its cushioning properties help absorb shocks and impacts during handling and transportation, reducing the risk of damage to the packaged items.

Plastic materials such as polyethylene terephthalate (PET), polyvinyl chloride (PVC), and Expanded Polystyrene (EPS), are commonly utilized in protective packaging solutions. These materials offer several advantageous properties such as thermal insulation and lightweight characteristics. They act as a barrier, effectively safeguarding packaged goods against temperature changes. Additionally, these plastics are recyclable, contributing to sustainable packaging practices and addressing concerns regarding environmental impact which further drives its demand for the protective packaging industry.

Function Insights

The wrapping segment accounted for the largest market share in 2022. Based on function, the protective packaging industry is further segmented into void fill, wrapping, insulation, blocking & bracing, and cushioning. Protective wrappings, such as paper wrap or bubble wrap, can be used for multiple products of different sizes as they are in the form of rolls that can be easily cut into the desired length according to the product's requirements. Wrapping provides cushioning and lightweight properties, reducing the chances of physical damage to the product during storage and transportation owing to its high shock-absorbing properties.

The void-fill segment is expected to grow at a fast CAGR over the forecast period. This growth is driven by the application of void-fill techniques, which involve filling empty spaces within packages or shipping containers using materials such as paper, air pillows, and packing peanuts. The primary purpose of void fill is to prevent product movement during shipment, offering enhanced cushioning and protection against physical damage. It is mainly used in the e-commerce sector to avoid returns and damage to the products, which further drives the market growth in this segment.

End-Use Insights

The food & beverage end-use segment recorded the largest market share in 2022 due to their requirements to preserve the freshness, quality, and safety of food and beverages such as dairy products, meat products, bakery products, and frozen meals throughout the supply chain. Based on end-use, the market is further categorized into food & beverage, industrial goods, consumer electronics, household appliances, healthcare, automotive, and others.

The growing trend of manufacturing sustainable protective packaging materials by protective packaging manufacturers for the packaging of food & beverage products is anticipated to increase the demand for the product over the forecast period. For instance, EcoEnclose offers protective packaging with recycled or natural fiber molded pulp for alcoholic and non-alcoholic beverages.

The consumption of protective packaging in the industrial goods end-use segment is expected to grow over the forecast period. This growth is attributed to the specific protective packaging requirements such as foam inserts, air cushions, and edge protectors of industrial goods including lubricants and oils. These solutions offer protection against physical damage and external environmental factors such as moisture, light, and oxygen during transit and warehousing which drives the protective packaging industry demand for this end-user segment.

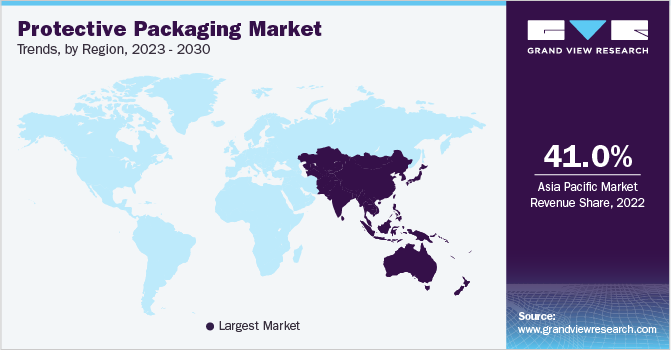

Regional Insights

Asia Pacific dominated the protective packaging market with a share of over 41.0% in 2022. The region is a prominent manufacturing hub, with countries like China, India, Japan, and South Korea hosting major electronics and industrial spares manufacturers which drives the demand for protective packaging solutions in the region. Moreover, the rise of economic platforms such as Amazon and Alibaba has necessitated the development of protective packaging solutions that can withstand the rigors of long-distance shipping, product handling, and warehousing, further driving the demand for the protective packaging industry in the region.

China accounted for the highest market share in the region in 2022 owing to the lucrative growth in the healthcare sector on account of increasing foreign investment and reforms in the industry. In addition, the China Food and Drug Administration (CFDA) implemented stringent quality and safety standards for medical and healthcare products in the country. It emphasizes the need for protective packaging to maintain product quality, prevent tampering, and protect against external environmental factors such as moisture, light, and oxygen. Adhering to these regulations is necessary for companies operating in the medical and healthcare sector, driving the demand for the protective packaging industry in the country.

North America is anticipated to grow at a fast CAGR during the forecast period owing to the increased demand for online shopping on popular e-commerce platforms in the region such as Amazon, Shein, and Grubhub. These companies provide packaging guidelines and recommendations to sellers. These guidelines emphasize the importance of using appropriate protective packaging solutions to safeguard products from various risks encountered during shipping. By adopting protective packaging solutions, manufacturers can deliver products in excellent condition, enhancing customer satisfaction and driving market growth in the region.

European countries are implementing recycling targets for packaging solutions, including protective packaging. For instance, Germany has enacted The Green Dot Act to reduce plastic landfill caused by packaging waste in the country. This approach is driving the growth of the protective packaging industry across the region, with an emphasis on designing packaging that is reusable and recyclable. Furthermore, the increasing consumer preference for on-the-go snacks, driven by the hectic schedules of European consumers, has fueled the demand for packaged consumer goods, thereby increasing the demand for protective packaging across the region.

Central and South America drives the protective packaging market through various government regulations. For instance, in Brazil, the National Health Surveillance Agency (ANVISA) has established guidelines for protective packaging in the healthcare sector. These guidelines require the use of protective packaging materials to maintain the sterility of medical devices and pharmaceutical products until they are used. Protective packaging provides a barrier against microorganisms and protects medical products against contamination during handling and transportation, thereby contributing to the market growth in the region.

The Middle East & Africa is witnessing significant growth in the protective packaging market due to the increased demand for electronic products such as smartphones. Bubble wrap and air pillows are versatile protective packaging materials that provide cushioning and protection against impacts for smartphones. Moreover, the presence of several key players in the region, such as MEPCO; Crown; DS Smith; among others, is driving the market in the region.

Key Companies & Market Share Insights

Key Companies resort to multiple mergers and acquisitions in a bid to gain market share in a particular region. In some cases, the companies build technological collaborations to produce an advanced product with superior performance characteristics to increase revenue. For instance, in February 2023, Smurfit Kappa announced the launch of Vitop Uni taps for its bag-in-box product portfolio, which provides additional protection against tampering with the packaging till its final distribution. Some prominent players in the global protective packaging industry include:

-

Sealed Air Corporation

-

Sonoco Products Company

-

Smurfit Kappa Group Plc.

-

WestRock Company

-

Huhtamaki OYJ

-

DS Smith Plc

-

Pregis LLC

-

Pro-Pac Packaging Limited

-

Dow Chemical Company

-

Intertape Polymer Group (IPG)

-

Storopack Hans Reichenecker Gmbh

-

International Paper Company

-

EcoEnclose

-

Point Five Packaging

-

Universal Protective Packaging, Inc.

Protective Packaging Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 35.50 billion

Revenue forecast in 2030

USD 50.15 billion

Growth Rate

CAGR of 5.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Volume in million tons, revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, material, function, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; Southeast Asia; Brazil; South Africa; Saudi Arabia; United Arab Emirates

Key companies profiled

Sealed Air Corporation; Sonoco Products Company; Smurfit Kappa Group Plc.; WestRock Company; Huhtamaki OYJ; DS Smith Plc; Pregis LLC; Pro-Pac Packaging Limited; Dow Chemical Company; Intertape Polymer Group (IPG)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Protective Packaging Market Report Segmentation

This report forecasts volume & revenue growth at regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global protective packaging market report based on type, material, function, end-use, and region:

-

Type Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

Flexible Protective Packaging

-

Foam Protective Packaging

-

Rigid Protective Packaging

-

-

Material Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

Paper & Paperboard

-

Plastic Foams

-

Plastic

-

Others

-

-

Function Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

Void Fill

-

Wrapping

-

Insulation

-

Blocking & Bracing

-

Cushioning

-

-

End-Use Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Industrial Goods

-

Consumer Electronics

-

Household Appliances

-

Healthcare

-

Automotive

-

Others

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global protective packaging market was valued at USD 33.32 billion in the year 2022 and is expected to reach USD 35.50 billion in 2023.

b. The global protective packaging market is expected to grow at a compound annual growth rate of 5.1% from 2023 to 2030 to reach USD 50.15 billion by 2030.

b. Asia Pacific dominated the protective packaging market with a share of 41.88% in 2022. This is attributable to increasing consumer spending, continuous technological advancements, and improvements in manufacturing activities in the region.

b. Some key players operating in the protective packaging market include Sealed Air Corporation, Sonoco Products Company, Smurfit Kappa Group Plc., WestRock Company, Huhtamaki OYJ, DS Smith Plc, Pregis LLC, Pro-Pac Packaging Limited, Dow Chemical Company, and Intertape Polymer Group (IPG)

b. Key factors that are driving the protective packaging market growth include increasing global manufacturing output, continuous technological advancements, and consumer spending on packaged goods.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."