Protective Textiles Market Size & Trends

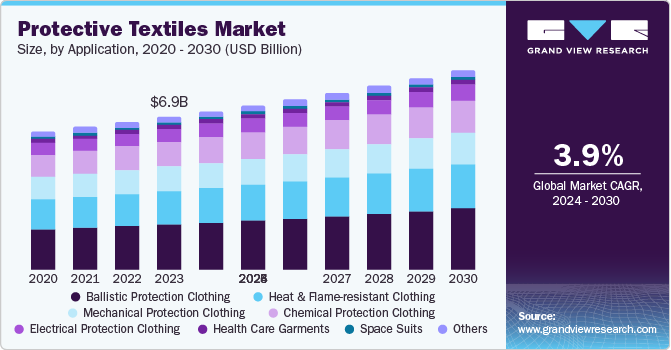

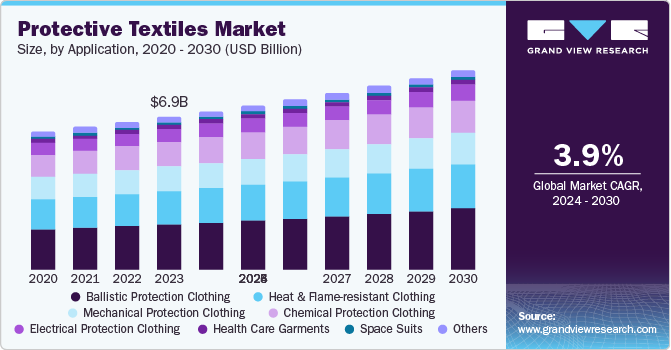

The global protective textiles market size was valued at USD 6.90 billion in 2023 and is projected to grow at a CAGR of 3.9% from 2024 to 2030. Increasing needs for health and workplace safety in medical centers and manufacturing facilities are expected to increase the demand for personal protective textiles in the coming years. The increasing awareness for the protection against flames, heat, microorganisms, and hazardous work environment is likely to support demand for personal protective textiles for clothing and other wearables. Additionally, the growing demand for performance clothing in oil fields and chemical production facilities is expected to propel market growth over the forecast period.

Stringent regulations across industries, including manufacturing, construction, healthcare, and defense, mandate the use of protective textiles to safeguard workers from hazards. Governments and regulatory bodies are enforcing stricter compliance measures, driving demand for protective textiles that meet specific safety standards. Growing awareness of workplace-related injuries and illnesses has led to increased demand for protective equipment textiles. Media reports highlighting safety incidents and their consequences contribute to public awareness and demand for protective measures.

The healthcare sector, particularly during pandemics and outbreaks, experiences increased demand for PPE, including protective textiles for gowns, masks, and gloves. Firefighters, paramedics, and law enforcement personnel rely on protective textiles for their safety while responding to emergencies. Protective textiles are used in sports equipment, such as helmets, pads, and gloves, to reduce injuries. The popularity of outdoor activities such as hiking, camping, and skiing has led to increased demand for protective clothing that can withstand harsh weather conditions.

Ongoing infrastructure projects, such as construction of roads, bridges, and industrial facilities, require protective textiles for workers involved in these activities. The development of advanced textile materials, such as high-performance fibers and protective coatings, offers enhanced protection against various hazards, including chemicals, heat, and radiation. This improvement in textile technology have led to the creation of protective textiles that are more comfortable, durable, and breathable, enhancing worker satisfaction and compliance further fueling the market growth.

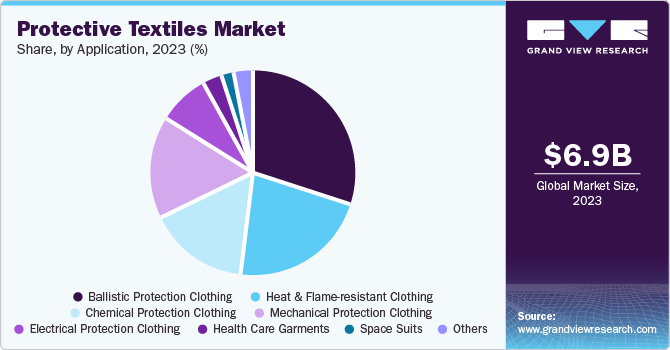

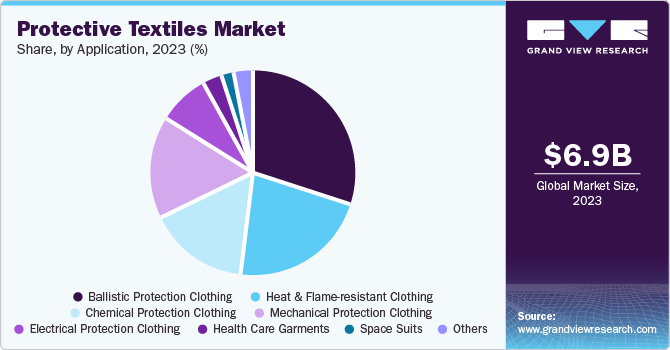

Application Insights

Ballistic protection clothing dominated the market with 29.7% share in 2023. Ballistic protection clothing, designed to shield individuals from projectiles such as bullets and shrapnel, is witnessing a surge in demand. This growth is primarily driven by the increasing prevalence of violent crimes, civil unrest, and terrorist activities globally. Law enforcement agencies, military personnel, and security personnel are increasingly investing in high-quality ballistic protection clothing to safeguard their lives. Moreover, advancements in textile technology have led to the development of lighter, more comfortable, and effective ballistic materials, further driving market growth.

Heat & flame-resistant clothing is projected to grow at CAGR of 4.2% over the forecast period. These clothing are essential for workers in industries such as manufacturing, firefighting, and oil and gas, is experiencing a steady increase in demand. The growth is driven by the rising emphasis on workplace safety and the implementation of stringent regulations to protect workers from thermal hazards. Moreover, the expansion of industries such as manufacturing and construction, particularly in developing economies, has led to a growing need for protective clothing.

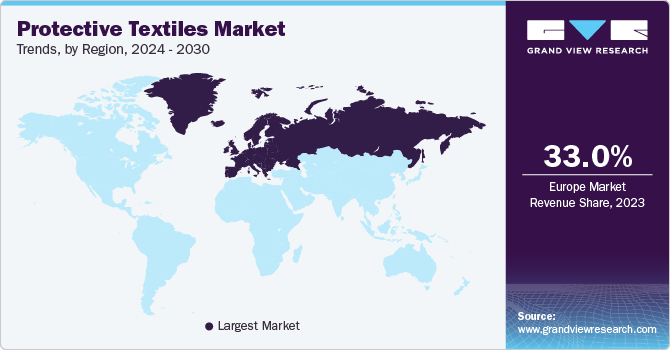

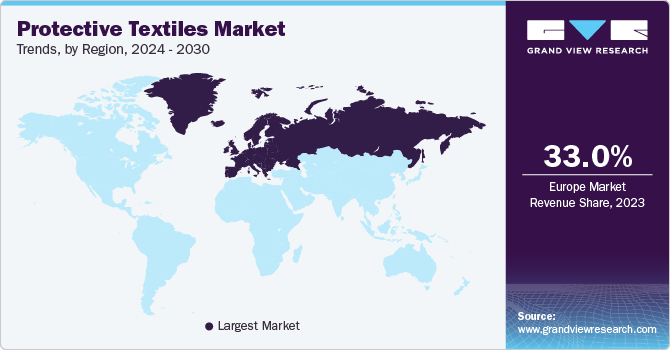

Regional Insights

North America protective textiles market was identified as a lucrative region in 2023. Strict regulatory frameworks, such as OSHA standards, ensure compliance with safety measures. Moreover, the presence of major manufacturers and suppliers of protective textiles in the region has contributed to its market dominance. The region's robust economy, coupled with increasing awareness of workplace hazards, has fueled the demand for protective textiles across various industries, including manufacturing, construction, and healthcare.

U.S. Protective Textiles Market Trends

The U.S. has emerged as a key consumer for personal protective textiles in North America in 2023 on account of the well-established industrial manufacturing sector in the country. Moreover, high investment in R&D for the defense sector has created a scope for high-performance ballistic clothing and bulletproof wearables, thus has positively influenced the market.

Europe Protective Textiles Market Trends

Europe dominated the global protective textiles market with 33.0% market share in 2023 on account of the high utilization of protective clothing in the industrial workplace coupled with stringent regulations for workplace safety in the production facilities. Moreover, the growing manufacturing industry and healthcare facilities across the region have provided growth opportunities for the market.

Asia Pacific Protective Textiles Market Trends

Asia Pacific protective textiles market is expected to grow in coming years. The region's burgeoning industrialization, particularly in countries such as China, India, and Japan, has led to a surge in demand for protective clothing to safeguard workers in manufacturing, construction, and other industries. Moreover, the region's large population and diverse economic landscape create significant opportunities for the protective textiles industry.

The market for protective textiles in India is predicted to expand quickly in the near future due to rapid industrialization, particularly in sectors such as manufacturing and construction. Moreover, the increasing emphasis on workplace safety and the implementation of stringent regulations have led to a higher adoption of protective textiles across industries.

Key Protective Textiles Company Insights

Some of the key companies in the global protective textiles market include W. L. Gore & Associates, Inc., DuPont, Schoeller Textil AG, PBI Performance Products, Inc., TEIJIN LIMITED., and others. These players compete based on product quality, durability, and resistance characteristics. Moreover, players are focusing on the introduction of durable and lightweight textile products with enhanced high load-bearing capacity to sustain in the competitive market. Players are focusing on the agreements and contracts with personal protective clothing manufacturers to smoothen the supply chain and sustain in the competitive market. Investments in R&D to enhance the characteristics of the textiles with the involvement of various raw materials are expected to provide growth prospects to the players

- TenCate Fabrics specializes in protective fabrics designed for various industries, including firefighting, emergency response, military, and heavy industry. The company focuses on creating high-quality flame-resistant (FR) fabrics that provide safety, comfort, and confidence to professionals working in extreme conditions.

Key Protective Textiles Companies:

The following are the leading companies in the protective textiles market. These companies collectively hold the largest market share and dictate industry trends.

- W. L. Gore & Associates, Inc.

- DuPont

- TenCate Fabrics

- DyStar Group

- Kusumgar

- Madhuram Fabrics Pvt. Ltd.

- Schoeller Textil AG

- PBI Performance Products, Inc.

- TEIJIN LIMITED.

- Marina Textil S.L.

Protective Textiles Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 7.14 billion

|

|

Revenue forecast in 2030

|

USD 9.00 billion

|

|

Growth Rate

|

CAGR of 3.9% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application and Region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, and Brazil

|

|

Key companies profiled

|

W. L. Gore & Associates, Inc., DuPont, TenCate Fabrics, DyStar Group, Kusumgar, Madhuram Fabrics Pvt. Ltd., Schoeller Textil AG, PBI Performance Products, Inc., TEIJIN LIMITED. , Marina Textil S.L.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

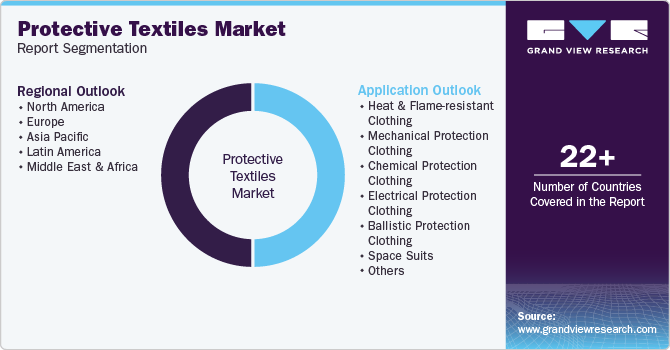

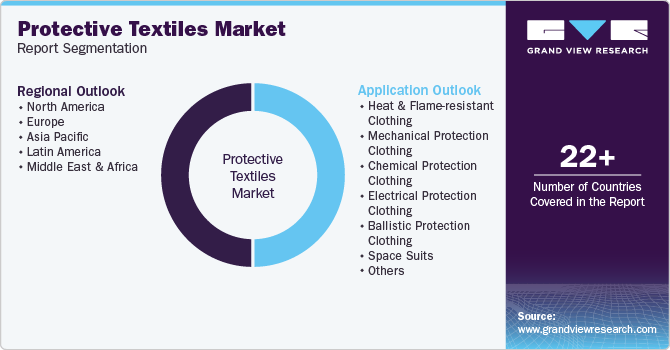

Global Protective Textiles Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global protective textiles market report based on application and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Heat & Flame-resistant Clothing

-

Mechanical Protection Clothing

-

Chemical Protection Clothing

-

Electrical Protection Clothing

-

Ballistic Protection Clothing

-

Space Suits

-

Health Care Garments

-

Others

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)