Proximity And Displacement Sensors Market Size, Share & Trends Analysis Report By Type (Inductive, Photoelectric, Capacitive, Ultrasonic, Magnetic, LVDT), By Application , By End-use, Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-647-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

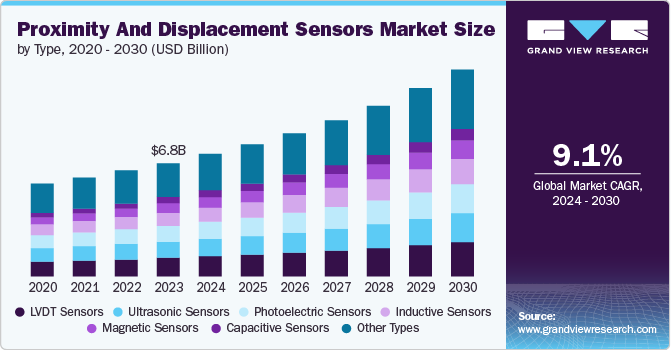

The global proximity and displacement sensors market size was valued at USD 6.82 billion in 2023 and is projected to grow at a CAGR of 9.1% from 2024 to 2030. Ongoing trend of process automation in factories, ongoing expansion of the mobile industry, and growing demand for automated processes in the industrial sector are the factors driving the market.

One of the primary drivers for market growth remain the increasing demand for factory automation and process automation. The ongoing trend of process automation in factories is a major contributor to this growth, as manufacturers seek to improve their production efficiency and recover from economic downturns. Moreover, the growth in industrial automation has also been driving the demand for proximity and displacement sensors, as companies look to automate various industrial processes to reduce costs and improve productivity.

Another significant driver of the market is the expansion of the mobile devices market. The growing popularity of contactless sensing applications, such as fingerprint recognition and gesture-based interfaces, is expected to drive the demand for proximity and displacement sensors globally. Furthermore, the increasing interest of automobile manufacturers in integrating sensor technology in automotive security and infotainment systems is also driving market growth. The declining prices of sensors, which are a result of improvement in electronic technology, economies of scale, and manufacturing in low-cost regions, are also expected to drive market growth exponentially.

The market is also driven by emerging trends and applications, including emerging concepts of smart homes and growing applications in healthcare. The proximity and displacement sensor market is poised to benefit from these emerging trends, which are expected to drive growth in various industries. Overall, the proximity and displacement sensors market is driven by a combination of factors, including factory automation, mobile devices, declining sensor prices, and emerging trends and applications. As these drivers continue to shape the market, it is expected to experience significant growth over the coming years.

Type Insights

LVDT sensors accounted for the largest market revenue share of 16.0% in 2023. The LVDT sensor excels in measuring linear displacement with high accuracy and performance, ideal for applications requiring precise positioning control. Its non-contact design eliminates wear and tear, allowing for a long operational lifespan and robust operation in extreme temperatures and vibration/shock conditions, making it a suitable choice for industrial automation applications.

Capacitive sensors are expected to register the fastest CAGR of 10.9% during the forecast period. Capacitive sensors excel in detecting subtle changes in capacitance caused by object presence, making them ideal for high-precision applications such as touchscreens, motion detection, and near-field sensing. With high resolution capabilities, particularly for short distances, they are suitable for measuring liquid levels and monitoring micromanipulation processes, offering accurate and reliable performance in a range of industries.

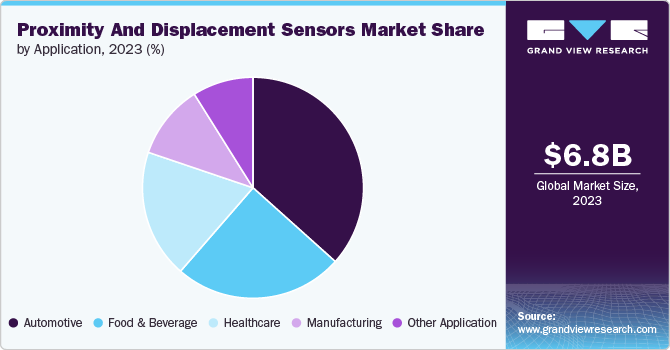

Application Insights

The automotive segment dominated the market and accounted for a share of 36.8% in 2023. The growing demand for touch-free sensing technology and the increasing adoption of sensor-based automotive security systems are driving market growth. In the automotive sector, proximity sensors are being integrated to detect proximity to objects, while the rapid development of autonomous vehicles is accelerating the use of proximity sensors, fueling market expansion and driving forward technological advancements.

The healthcare segment is projected to grow at the fastest CAGR of 9.6% over the forecast period. Sensors such as capacitive and ultrasonic technology enable contactless monitoring of vital signs, enhancing patient comfort and reducing infection risks. Proximity and displacement sensors provide precise positioning and control in robotic surgery, while also improving diagnostic accuracy with real-time data on probe placement and movement.

Regional Insights

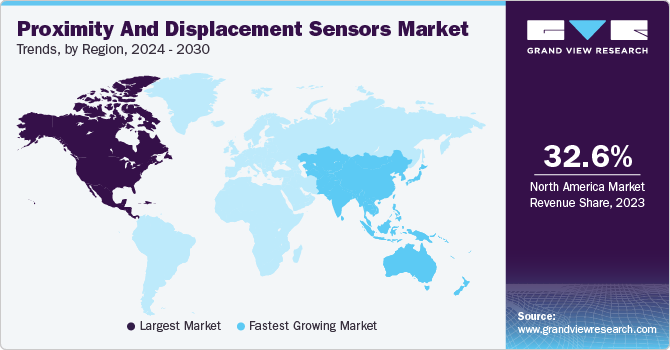

North America proximity and displacement sensors market dominated the global proximity and displacement sensors market with 32.6% of the total revenue share in 2023. This growth is driven by industrial automation growth, consumer electronics adoption, and the presence of major players. The region’s recovering economies and focus on production efficiency are also fueling demand.

U.S. Proximity And Displacement Sensors Market Trends

The proximity and displacement sensors market in the U.S. dominated the North America proximity and displacement sensors market with a share of 81.3% in 2023. The country’s dominance is aided by the presence of multiple technology companies, government regulations, and financial support. The industry is also driven by congested cities such as New York and Los Angeles, as well as growing demand for modern traffic control and parking solutions.

Europe Proximity And Displacement Sensors Market Trends

Europe proximity and displacement sensors market was identified as a lucrative region in 2023. The European renewable energy sector is leveraging proximity and displacement sensors to optimize energy generation in wind turbines and solar panels. Meanwhile, European smart city initiatives are adopting these sensors for intelligent traffic management, building automation, and security monitoring, expanding their applications in the region’s growing smart infrastructure landscape further.

The proximity and displacement sensors market in the UK is poised for rapid growth, fueled by the country’s prominent manufacturing sector in aerospace, automotive, and pharmaceuticals. As these industries adopt automation, demand will surge for these sensors to facilitate object detection, material handling, and precise positioning, driving innovation and efficiency in production lines.

Asia Pacific Proximity And Displacement Sensors Market Trends

Asia Pacific proximity and displacement sensors market is anticipated to witness the fastest growth of 11.8% over the forecast period. The region’s position and proximity sensors market is driven by leading manufacturers, producing cutting-edge products combining GPS, cameras, and displays for smartphones and smart home devices. The introduction of new products by regional smartphone giants is driving growth, as these sensors enable motion detection and object location capabilities, enhancing user experiences.

The proximity and displacement sensors market in China commanded a significant share in 2023, driven by the country’s thriving consumer electronics industry. The demand for these sensors in smartphones, tablets, and other devices for features like touchscreens and proximity detection is driving growth. China’s market is poised for continued expansion, fueled by industrialization, automation initiatives, and government support.

Key Proximity And Displacement Sensors Company Insights

Some key companies in proximity and displacement sensors market include Panasonic Corporation; Schneider Electric SE; Honeywell International Inc.; and Broadcom; among others. Key players dominate the market through advanced technologies and extensive distribution networks, driven by growing demand for automation in automotive, healthcare, and manufacturing, as well as the IoT and smart technologies revolution.

-

OMRON Corporation offers a diverse portfolio of products and solutions in the proximity and displacement sensors market. Its extensive range includes sensors, relays, safety devices, automation systems, and control parts, catering to various industries such as automotive, healthcare, and manufacturing.

-

KEYENCE CORPORATION creates, produces, and markets sensors and measuring tools utilized in factory automation (FA) and advanced hobby products. The company offers fiber optic sensors, photoelectric sensors, PLCs, laser scan micrometers, barcode readers, and remote-controlled model cars.

Key Proximity And Displacement Sensors Companies:

The following are the leading companies in the proximity and displacement sensors market. These companies collectively hold the largest market share and dictate industry trends.

- Panasonic Corporation

- Schneider Electric SE

- Honeywell International Inc.

- Broadcom

- Eaton

- STMicroelectronics

- OMRON Corporation

- Rockwell Automation

- Balluff GmbH

- KEYENCE CORPORATION

- ifm electronic gmbh

- Hans Turck GmbH & Co. KG

Recent Developments

-

In January 2024, Panasonic launched the LUMIX S-E100, a compact and lightweight medium-telephoto macro lens, boasting a novel Dual Phase linear motor and optical design, and an ultra-high precision manual focus sensor, for high-resolution imaging and precise autofocus capabilities.

-

In March 2024, Honeywell executed a plan to acquire all outstanding Civitanavi Systems shares by launching a voluntary tender offer, resulting in a total equity value upon completion.

Proximity And Displacement Sensors Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 7.35 billion |

|

Revenue forecast in 2030 |

USD 12.43 billion |

|

Growth rate |

CAGR of 9.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

Panasonic Corporation; Schneider Electric SE; Honeywell International Inc.; Broadcom; Eaton; STMicroelectronics; OMRON Corporation; Rockwell Automation; Balluff GmbH; KEYENCE CORPORATION; ifm electronic gmbh; Hans Turck GmbH & Co. KG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Proximity And Displacement Sensors Market Report Segmentation

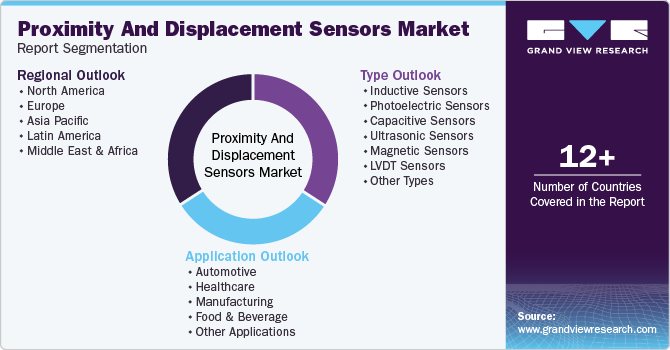

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global proximity and displacement market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Inductive Sensors

-

Photoelectric Sensors

-

Capacitive Sensors

-

Ultrasonic Sensors

-

Magnetic Sensors

-

LVDT Sensors

-

Other Types

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Healthcare

-

Manufacturing

-

Food & Beverage

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."