- Home

- »

- Backup Power Solutions

- »

-

PV Inverter Market Size, Share And Growth Report, 2030GVR Report cover

![PV Inverter Market Size, Share & Trends Report]()

PV Inverter Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (String PV Inverter, Central PV Inverter), By End-use (Commercial & Industrial, Utilities), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-022-4

- Number of Report Pages: 93

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

PV Inverter Market Summary

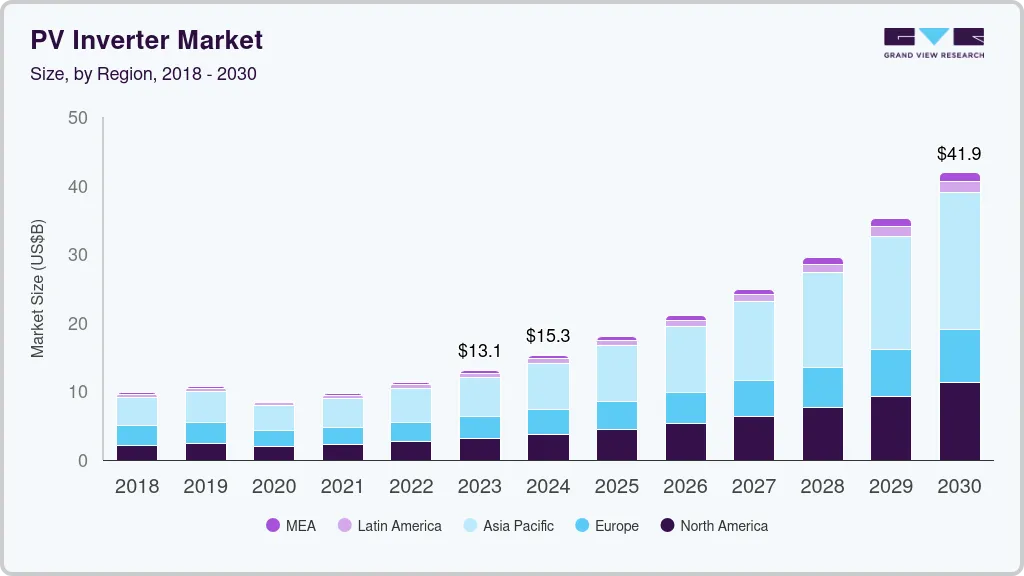

The global pv inverter market size was estimated at USD 13,088.5 million in 2023 and is projected to reach USD 41,869.7 million by 2030, growing at a CAGR of 18.1% from 2024 to 2030. The growing awareness regarding environmental issues and need to reduce carbon emissions is driving demand for clean energy solutions, which in turn is expected to drive demand for various energy equipment including PV inverters.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, Germany is expected to register the highest CAGR from 2024 to 2030.

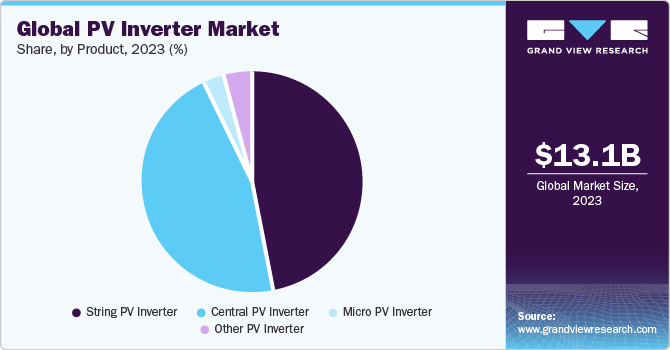

- In terms of segment, string pv inverter accounted for a revenue of USD 6,164.3 million in 2023.

- Micro PV inverter is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 13,088.5 Million

- 2030 Projected Market Size: USD 41,869.7 Million

- CAGR (2023-2030): 18.1%

- Asia Pacific: Largest market in 2023

According to the International Energy Agency (IEA), power generation from solar photovoltaic (PV) increased by 270 TWh in 2022, up by 26% in 2021. Solar PV accounted for approximately 4.5% of total global electricity generation in 2022.

Solar PV inverters are an integral part of larger solar systems. These inverters convert direct current (DC) electricity to alternate current (AC) and hence determine efficiency of whole solar system. Solar PV inverters are available with distinct characteristics and features and consider different factors affecting solar system production. Some critical factors include shading, roof orientation, roof inclination, summer vs winter production, tilting panels, and many other factors that result in required output.

The government has implemented various new incentive schemes to promote the adoption of solar and other renewable technologies. For instance, in August 2022, the U.S. government launched the Inflation Reduction Act, which allotted USD 369 billion for promotion of renewable energy sector. Many companies have started to construct new solar PV plants and are increasing capacities of their existing plants. For instance, in February 2023, Silicon Ranch announced that it would increase energy generation capacity of its solar power plant. First Solar will supply 1.5 GW of advanced American thin-film solar modules, in addition to its prior agreements, which include installation of a total of 4 GW of solar PV panels by 2027.

Renewable power generation has been witnessing unprecedented growth globally over the past decade. It has continuously surpassed end-users’ expectations with new records being set annually, along with an increased number of companies committing to their respective energy transitions. For instance, according to the International Energy Agency (IEA), in 2022, the solar PV energy generated was approximately 1,300 terawatt-hours in the U.S., witnessing an increase of 26% from 2021.

The constant economic growth in nations such as the U.S., China, and India as well as developments in supply chain and favorable government policies supporting PV inverter production in the U.S. and India are driving demand for solar PV inverters. In addition, changing consumer preferences for a sustainable environment and ambitious targets for adoption of PV inverters by governments of countries, coupled with adequate plans and policies related to PV inverters, have led to advancements in renewable energy generation.

The renewable industry has tremendously been competitive against other sources of electricity. The International Renewable Energy Agency (IRENA) has proposed that these energy resources are anticipated to grow by a full order of magnitude over next 30 years. Two significant reasons supporting this statement include the declining price of solar components that will allow more solar and wind power to be built and economic factors concerning solar power for next few decades.

Efforts to minimize power generation costs are further propelling market expansion. Renewable energy prices have declined due to several government policies that aid clean energy adoption. For example, there has been a 5% reduction in global average weighted price of levelized cost of electricity (LCOE), dropping from USD 0.035/kWh in 2021 to USD 0.033/kWh in 2022. This decrease in the price of solar power generation can be attributed to reduced installation costs of solar modules, cells, inverters, and related equipment.

Tumbling technology costs have reduced total installation costs for rooftop photovoltaic systems, which has also caused rapid cost decreases for solar electricity, especially in technologically advanced nations such as the U.S. and Germany and other developing countries globally such as India. According to the Solar Energy Industries Association (SEIA), prices for solar PV installations have fallen 43% over the last 10 years in California, U.S.

Product Insights

Based on product, the string PV inverter segment emerged as the leading segment with the maximum revenue share of 47.10% in 2023. These inverters are highly reliable with timely maintenance and flexible enough to be housed in a protected location for their installation. Inverters are integrated with large arrays installed on field installations, industrial facilities, and buildings, taking DC power from all PV panels and converting it into AC power; becoming a single point for power distribution.

Lower initial costs and easy installation are among the primary factors responsible for segment growth. These inverters are robust, and offer high design flexibility, high efficiency, three-phase variations in design, and are well-supported (with trusted brands). These inverters also offer remote system monitoring capabilities. In September 2023, WattPower announced inauguration of a new solar inverter factory with an annual production capacity of 10 GW in Chennai, India. Company will be producing string PV inverters through this new facility.

The micro PV inverters segment is projected to witness a substantial CAGR over the forecast period. Micro PV inverters are module-level electronics and have become a popular choice for commercial and industrial sectors. These inverters have the advantage of high reliability, increased efficiency & performance through maximum power point tracker (MPPT), ease of installation, no space constraints, and are cost-effective.

Regional Insights

The Asia Pacific region dominated the market with the largest market share of 44.09% in 2023. China is the largest contributor to the rapid growth of this region’s solar market and is also a major global competitor. A growing number of solar installations in developing nations has also significantly contributed to growth of market in the region. According to the Energy Information Administration (EIA), in 2021, solar and wind combined generated 12% of China’s electricity. Similarly, according to the Ministry of New and Renewable Energy, at the end of 2022, solar power installed capacity has reached around 61.97 GW.

The North America region held a significant revenue share in 2022, with the U.S. being a major contributor to market growth. The U.S. is a prominent market for different types of PV inverters. Some of the recent inverter trends in the country include the dominance of 60 kW plus capacity three-phase string inverters and 1.5 MW plus capacity central inverters. Though North America witnessed sturdy growth for string inverters, central PV inverters are expected to maintain the largest market share over the forecast period.

According to the Solar Energy Industries Association, the U.S. has witnessed a cumulative installation of 153 GWdc of solar capacity during the first six months of 2023, with expectations to reach around 375 GWdc by 2028. Notably, photovoltaic solar (PV) installations accounted for around 54.0% of total new electricity-generating capacity additions in the first three months of 2023. This surge in solar PV adoption is anticipated to be a prominent driving factor for market expansion in the region throughout the forecast period.

The U.S. emerged as the largest market in North America in 2023. It is a significant market for different types of PV inverters. Some recent inverter trends in the U.S. include an increase in the sizes of central inverters (1.5 MW plus) and three-phase string inverters (60 kW). Though the U.S. has witnessed steady growth for string inverters, central inverters are anticipated to maintain their hold of market share.

Market Dynamics

Concerns regarding excessive carbon emissions owing to usage of conventional fuels for transportation and power generation purposes have prompted countries globally to opt for cleaner and more efficient sources of power. Furthermore, under the Paris Climate Agreement, countries such as the U.S., Germany, India, Japan, and the UK have pledged to reduce their carbon footprints. The power industry has shifted its focus toward large-scale incorporation of electricity generation through renewable energy to meet demand for electricity owing to increasing awareness regarding sustainable energy sources.

Renewable energy has predominantly become a feasible alternative as civilization stands at a critical juncture where world is on the cusp of adopting clean energy at a scale never seen before. In the current scenario, it costs less to build a new solar or wind plant than to continue running a natural gas or coal plant. Now, with an increased utilization of solar energy, there is an increased manufacturing of solar equipment such as solar PV inverters, solar panels, and other solar devices. Thus, all these factors are expected to drive market growth.

Global electricity demand is anticipated to witness an increase of nearly two-thirds of current demand over the forecast period. A growing focus on projects related to distributed power & utility is anticipated to boost market growth over the next eight years. Coal is another source of generating electricity worldwide; however, considering degradation of coal reserves and its adverse environmental impact, there has been a rise in the use of natural gas and other renewable sources such as wind energy to produce electricity.

End-use Insights

Based on end-use, the market is categorized into commercial, residential & industrial, and utilities segments. The utilities segment emerged as leading segment and accounted for a revenue share of 44.33% in 2023. The most widely used PV inverter in utility sector is central & string inverter. Increased renewable energy demand, declining costs of solar power & equipment, and emerging government subsidies are primary reasons for growth of the utility sector. The presence of key players, providing consumers with industry-leading utility-scale solutions to achieve higher efficiency and reduced balance-of-system costs with their pre-integrated power stations is driving the growth of the segment.

This trend is projected to continue over the forecast period. Utility-scale solar projects require reliable, powerful, and scalable infrastructure. Central and string inverters are extensively used in the utility sector. Companies such as SMA Solar Technology AG; Delta Electronics, Inc.; Fimer Group; Hitachi Hi-Rel Power Electronics Private Limited; and other key players are engaged in manufacturing of string and central PV inverters.

The increased renewable energy demand, declining cost of solar power & equipment, and government subsidies are primary reasons for growth of utility sector. There are several key players including First Solar that provide consumers with industry-leading utility scale solutions to achieve higher efficiency and reduced balance-of-system costs with their pre-integrated power stations.

The residential segment has witnessed growth owing to increased demand for solar renewable energy among consumers for electrification purposes. Governments in various countries have taken active steps with policies and financial incentives to promote captive power generation through renewable sources such as power in residential buildings. In April 2023, SolaX Power, a renowned manufacturer of solar inverters, announced the launch of X1-Hybrid LV, a new innovative single-phase low-voltage hybrid inverter specifically designed for residential applications. This new inverter is engineered to provide high efficiency for low-voltage solar photovoltaic (PV) systems.

Commercial buildings include malls, retail stores, offices, hospitals, and schools, which are installing solar power systems for captive consumption. These sectors require a continuous supply of electricity for their uninterrupted functioning.

Key Companies & Market Share Insights

The market for PV inverters is highly competitive and moderately fragmented due to the presence of numerous market players. The dominant trend in operations of these solar companies includes vertical integration, which defends against market power and reduces competition. Technology sourcing, skilled manpower, and strong R&D are among the significant factors governing competitiveness of the PV inverters industry.

In addition, development and introduction of new products are among the key strategies for market players. For instance, in January 2023, SOFARSOLAR Co., Ltd., a global supplier of photovoltaic (PV) and energy storage solutions, announced the launch of a new inverter SOFAR 100-125KTL-G4. This new inverter features the integration of industry-leading ultra-high current, easy installation, and intelligent protection.

In July 2023, LG Energy Solution Ltd., a South Korea-based battery manufacturer, introduced new hybrid inverters tailored for residential applications in the European market. Designed to accommodate both low-voltage and high-voltage configurations, these inverters come equipped with a built-in backup function, specifically crafted to seamlessly integrate with the company's distinctive line of batteries.

Key PV Inverter Companies:

- Delta Electronics, Inc

- Eaton

- Emerson Electric Co.

- Fimer Group

- Hitachi Hi-Rel Power Electronics Private Limited

- Omron Corporation

- Power Electronics S.L.

- Siemens Energy

- SMA Solar Technology AG

- SunPower Corporation

PV Inverter Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.28 billion

Revenue forecast in 2030

USD 41.87 billion

Growth rate

CAGR of 18.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; Spain; Poland; Netherlands; China; Japan; India; South Korea; Australia; Malaysia; Indonesia; Thailand; Taiwan; Vietnam; Brazil; Argentina; Chile; Saudi Arabia; UAE; South Africa

Key companies profiled

Siemens Energy; Fimer Group; SMA Solar Technology AG; Delta Electronics, Inc; SunPower Corporation; Omron Corporation; Eaton; Emerson Electric Co.; Power Electronics S.L.; Hitachi Hi-Rel Power Electronics Private Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global PV Inverter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global PV Inverter market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

String PV inverter

-

Central PV inverter

-

Micro PV inverter

-

Other PV inverter

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial & Industrial

-

Utilities

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

Vietnam

-

Taiwan

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global PV inverter market size was estimated at USD 13.09 billion in 2023 and is expected to reach USD 15.28 billion in 2024.

b. The global PV inverter market is expected to witness a compound annual growth rate of 18.3% from 2024 to 2030 to reach USD 41.87 billion by 2030.

b. The Asia Pacific led with over 44.09% of market share in terms of revenue in 2023. This can be directly attributed to the commissioning of several grid-scale solar farms throughout the region, especially in China and India. Government subsidies and purchase incentives have played the primary role in driving installations of solar power in the region.

b. Some key players operating in the PV inverter market include Siemens, ABB, KACO Omron Corporation, Hitachi H-Rel Power Electronics Pvt. Ltd, SunPower Corporation, Eaton, Power-One, Tigo Energy, and Enphase Energy.

b. The demand for solar PV inverters is primarily driven by increased demand for solar energy and renewable power generation. Solar energy is expected to dominate new capacity additions in the renewable sector globally, by 2023; where projects larger than the capacity of 5 megawatts will hold over 60% of the global market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.