- Home

- »

- Organic Chemicals

- »

-

Pyrolytic Boron Nitride Market Size & Share Report, 2030GVR Report cover

![Pyrolytic Boron Nitride Market Size, Share & Trends Report]()

Pyrolytic Boron Nitride Market (2024 - 2030) Size, Share & Trends Analysis Report By Grade (High Pure, Ultra Pure), By Application (Water Processing, OLED, Furnace Components, CSCG), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-479-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pyrolytic Boron Nitride Market Size & Trends

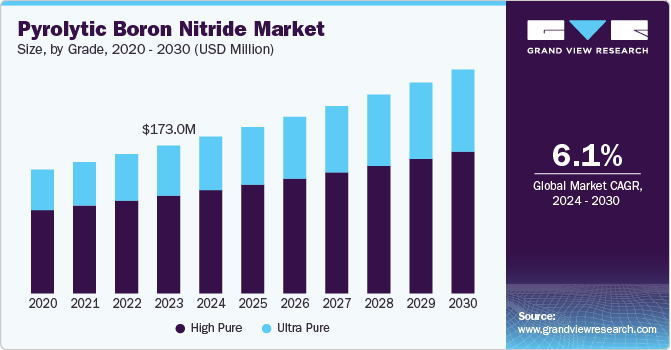

The global pyrolytic boron nitride market size was estimated at USD 173.0 million in 2023 and is forecasted to grow at a CAGR of 6.1% from 2024 to 2030. The market is primarily driven by its growing application in high-tech industries such as semiconductor manufacturing, aerospace, and electronics. PBN's excellent thermal stability, chemical resistance, and electrical insulation properties make it an essential material for use in chemical vapor deposition (CVD) processes, semiconductor wafer carriers, and crucibles used in the production of advanced materials such as gallium arsenide. In addition, with the rapid expansion of the electronics and semiconductor industries, particularly in regions such as Asia Pacific and North America, the demand for PBN is expected to grow steadily.

The rise in demand for high-purity materials in various high-temperature and corrosive environments further supports the product demand. Moreover, PBN’s unique properties, including its non-reactivity with most acids, bases, and salts at high temperatures, make it ideal for critical applications in the chemical processing industry and advanced laboratory equipment. The growing emphasis on material purity and performance, especially in precision industries such as optics and medical devices, is expected to increase the adoption of PBN, thereby driving market growth.

One of the major opportunities for growth in the pyrolytic boron nitride (PBN) market lies in the expanding use of PBN in the renewable energy sector, particularly in solar panels and advanced batteries. As the global push for clean energy intensifies, materials such as PBN, which are known for their high purity and thermal conductivity, are becoming increasingly vital for enhancing the efficiency and durability of energy storage systems and solar cell production. The ongoing advancements in photovoltaic technologies and the rising demand for high-performance materials in renewable energy infrastructure offer significant growth prospects for PBN manufacturers.

However, the complex chemical vapor deposition process required to manufacture pyrolytic boron nitride (PBN) is energy-intensive and expensive, which raises the overall cost of the final product. This can limit its widespread adoption, especially in cost-sensitive industries or in applications where less expensive alternatives such as aluminum nitride or hexagonal boron nitride can be used. The price sensitivity of certain sectors, such as general consumer electronics, can act as a deterrent to market growth.

The PBN market is characterized by the presence of several established players, with a few companies dominating the global supply due to the technical expertise required in PBN production. Major players such as Momentive Technologies and Shin-Etsu Chemical Company, Ltd. are investing heavily in research and development to improve the quality, performance, and scalability of PBN products. These companies are also focusing on expanding their product portfolios to cater to a diverse range of industries, from semiconductors to aerospace, enhancing their competitive position in the market.

Grade Insights

On the basis of the grade, the market is segmented into high pure and ultra pure. High pure accounted for the largest revenue share of 66.2% in 2023 owing to their high thermal stability, chemical inertness, and electrical insulation properties. High purity pyrolytic boron nitride (PBN) has typically a purity level of 99.9%, is widely used in semiconductor manufacturing, particularly in wafer processing and chemical vapor deposition (CVD) reactors, where materials must withstand extreme temperatures and corrosive environments. Moreover. growing demand for advanced semiconductors in consumer electronics, electric vehicles, and aerospace is significantly boosting the need for high purity PBN, which is ideal for precise applications where contamination control is critical.

In addition to semiconductors, high purity PBN is also gaining traction in the optics and aerospace industries, where it is used in the production of high-performance components that require durability in harsh conditions. The increasing emphasis on material purity and performance, especially for scientific instrumentation and high-end research, is expected to drive further demand for high purity PBN in these sectors.

Ultra high accounted revenue of USD 58.5 million in 2023 owing to its growing usage inhigh-end technologies such as optical lenses, space exploration componentsand ultra-sensitive electronics. The ultra-pure grade PBN market is driven by its use in industries where even the slightest contamination can lead to performance degradation, such as in high-vacuum environments or sensitive optical applications. Along with that, ultra-pure PBN is also favored in the production of gallium nitride (GaN) substrates, which are crucial for next-generation electronics and optoelectronics, including high-efficiency LEDs and high-power transistors.

In addition, ultra-pure PBN is becoming increasingly important in advanced battery technologies, particularly in solid-state batteries, due to its superior thermal properties and chemical inertness. As demand for clean, reliable energy solutions grows, the need for ultra-pure materials that can maintain performance in extreme environments is expected to drive the ultra-pure PBN market.

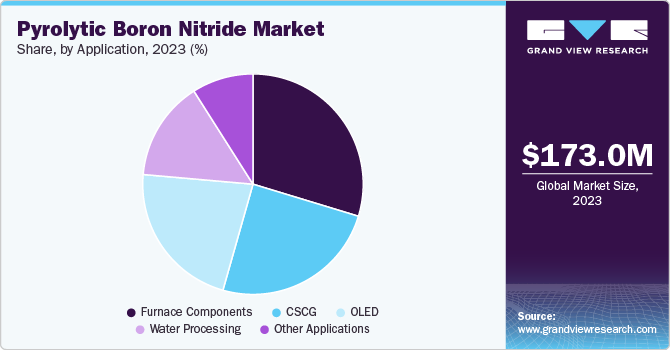

Application Insights

Based on application, the market is segmented into water processing, OLED, furnace components, CSCG, and other applications. Among these, furnace components dominated the market with a revenue share of 29.7% in 2023. PBN is widely used in the manufacturing of furnace components, where it is favored for its ability to withstand high temperatures and maintain structural integrity in extreme heat environments. Its use in components such as crucibles, heaters, and insulators is vital for industries such as metallurgy, electronics, and semiconductor production. As demand for high-temperature processing grows across various industrial sectors, PBN’s role in improving furnace efficiency and longevity is becoming more prominent.

Organic Light Emitting Diode (OLED) accounted for the fastest growing application with CAGR of 6.9% over 2024 to 2030, particularly in the fabrication of OLED displays. Its high thermal stability and electrical insulation properties make it valuable for creating precise, contamination-free environments during OLED manufacturing. As demand for high-resolution, energy-efficient OLED screens in smartphones, televisions, and wearable devices continues to rise, the use of PBN in the manufacturing process is expected to grow, providing an essential material solution for ensuring the performance and longevity of OLED devices.

Water processing application is expected to grow at 5.6% in terms of revenue over the period of 2024-2030. PBN’s chemical inertness and resistance to corrosion make it an ideal material for components that come into contact with aggressive chemicals or need to operate in harsh environments. In addition, PBN is used in water treatment systems that require durable materials capable of withstanding both high temperatures and corrosive agents without degrading over time. Its non-reactivity with most acids and alkalis, make it suitable for filtration systems, especially in industrial water treatment facilities.

PBN is a critical material in the crystal sublimation crystal growth (CSCG) method, particularly in producing materials such as silicon carbide (SiC) and gallium nitride (GaN), which are crucial for high-power electronics and LED technologies. PBN crucibles and containers are used in the sublimation and crystal growth processes, providing a stable, contamination-free environment that ensures high-quality crystal formation. As demand for advanced semiconductor materials grows, driven by the expansion of electronics and optoelectronics industries, PBN's role in crystal growth will continue to expand.

Regional Insights

North America led the Pyrolytic boron nitride (PBN) market with a revenue share of 37.8% in 2023 and is expected to grow at the substantial CAGR over the forecast period. The market is driven by the strong presence of semiconductor, aerospace, and defense industries in the region. The U.S. is the leading market in North America due to its advanced manufacturing capabilities and increasing demand for high-tech materials in sectors such as electronics, energy, and space exploration. The growth of clean energy initiatives, particularly in battery storage and solar technology, is further driving demand for PBN products, especially in applications requiring high thermal conductivity and chemical resistance.

U.S. Pyrolytic Boron Nitride Market Trends

The U.S. remains a key player in the North America PBN market due to its leading position in semiconductor manufacturing and aerospace industries. PBN’s extensive use in high-temperature furnaces, semiconductor wafer carriers, and aerospace components is being bolstered by government investment in advanced technologies, defense, and renewable energy sectors. Furthermore, U.S. companies are at the forefront of innovation in PBN applications, particularly in optoelectronics and high-performance industrial materials, contributing to the growth of the domestic PBN market.

Aisa Pacific Pyrolytic Boron Nitride Market Trends

Aisa Pacific pyrolytic boron nitride (PBN) market is the fastest growing with CAGR of 7.1% over the forecast period fueled by the rapid expansion of the electronics and semiconductor industries in countries such as China, Japan, South Korea, and Taiwan. The region’s dominance in the global electronics supply chain, along with increasing investments in renewable energy technologies, is propelling product demand. In addition, the rising focus on advanced materials for high-tech applications in industries such as optics, aerospace, and energy storage are further boosting the PBN market in the Asia Pacific. China and Japan, in particular, are leading the region in the production and consumption of PBN for high-performance industrial applications.

Europe Pyrolytic Boron Nitride Market Trends

Europe pyrolytic boron nitride (PBN) market accounted for USD 42.7 million in 2023 driven by its adoption in the semiconductor, aerospace, and renewable energy sectors. Countries such as Germany, France, and the UK are key contributors due to their strong industrial base and focus on advanced manufacturing technologies. Europe's stringent environmental regulations are also prompting the use of high-performance, eco-friendly materials such as PBN in various industries. Moreover, the growing demand for PBN in the medical device sector, where it is used for biocompatible and heat-resistant components, is providing new growth avenues in the region.

Key Pyrolytic Boron Nitride Company Insights

Some of the key players operating in the market include Shin-Etsu Chemical Company, Ltd., Momentive Technologies, Morgan Advanced Materials, and Beijing Boyu Semiconductor Vessel Craftwork Technology Co., Ltd.:

-

Shin-Etsu Chemical Company, Ltd. is recognized for its strong presence in the PBN market, particularly in semiconductor applications. The company leverages its extensive research and development capabilities to produce high-purity and ultra-pure PBN for use in wafer carriers, crucibles, and advanced electronic components. With a broad portfolio that extends beyond PBN into other high-tech materials, Shin-Etsu serves a wide range of industries, including electronics, aerospace, and energy storage.

-

Momentive Technologies is a key player in the PBN market, particularly in North America, where it supplies high-performance ceramics to the electronics, aerospace, and industrial sectors. The company is well-known for its advanced manufacturing processes, which produce highly durable and thermally stable PBN materials used in semiconductor manufacturing and other high-temperature applications.

Innovacera Technical Ceramic Solutions, Shandong Pengcheng Special Ceramics Co., Ltd., Liling Xing Tai Long Special Ceramics Co., Limited, and Shenyang Shunli Graphite Co., Ltd. are some of the emerging participants in the market.

-

Innovacera Technical Ceramic Solutions is in the technical ceramics industry, providing PBN products and other advanced ceramics to industries such as electronics, semiconductors, and high-temperature applications. The company is increasingly focused on developing customized solutions for niche markets, which has allowed it to carve out a position in a competitive market.

-

Shandong Pengcheng Special Ceramics Co., Ltd. focuses on high-quality ceramics for the semiconductor, metallurgy, and chemical industries. The company has gained recognition for its competitive pricing and quality standards, making it a popular choice for customers looking for cost-effective PBN solutions in China and other parts of Asia.

Key Pyrolytic Boron Nitride Companies:

The following are the leading companies in the pyrolytic boron nitride market. These companies collectively hold the largest market share and dictate industry trends.

- Shin-Etsu Chemical Company, Ltd.

- Morgan Advanced Materials

- Beijing Boyu Semiconductor Vessel Craftwork Technology Co.,Ltd

- Innovacera Technical Ceramic Solutions

- Liling Xing Tai Long Special Ceramics Co., Limited

- Shandong Pengcheng Special Ceramics Co., Ltd.

- Shenyang Shunli Graphite Co., Ltd.

- Shandong Yuwang Industrial Co., Ltd.

- Momentive Technologies

- Xing Tai Long Special Ceramics Co., Ltd.

Pyrolytic Boron Nitride Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 183.5 million

Revenue forecast in 2030

USD 261.8 million

Growth rate

CAGR of 6.1% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Saudi Arabia

Key companies profiled

Shin-Etsu Chemical Company, Ltd.; Morgan Advanced Materials; Beijing Boyu Semiconductor Vessel Craftwork Technology Co.,Ltd; Innovacera Technical Ceramic Solutions; Liling Xing Tai Long Special Ceramics Co., Limited; Shandong Pengcheng Special Ceramics Co., Ltd.; Shenyang Shunli Graphite Co., Ltd.; Shandong Yuwang Industrial Co., Ltd.; Momentive Technologies; Xing Tai Long Special Ceramics Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pyrolytic Boron Nitride Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global pyrolytic boron nitride market on the basis of grade, application, and region:

-

Grade Outlook (Revenue, USD Million, 2018 - 2030)

-

High Pure

-

Ultra Pure

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Water Processing

-

OLED

-

Furnace Components

-

CSCG

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global pyrolytic boron nitride market size was estimated at USD 173.0 million in 2023 and is expected to reach USD 183.5 million in 2024.

b. The global pyrolytic boron nitride market is expected to grow at a compound annual growth rate (CAGR) of 6.1% from 2024 to 2030 to reach USD 261.8 million by 2030.

b. North America accounted for the largest revenue share of 37.8% in 2023 due to the region's strong presence of semiconductor, aerospace, and defense industries.

b. Some key players operating in the pyrolytic boron nitride (PBN) market include Shin-Etsu Chemical Company, Ltd., Morgan Advanced Materials, Beijing Boyu Semiconductor Vessel Craftwork Technology Co., Ltd, Innovacera Technical Ceramic Solutions, Liling Xing Tai Long Special Ceramics Co., Limited, Shandong Pengcheng Special Ceramics Co., Ltd., and Shenyang Shunli Graphite Co., Ltd.

b. The key factors that are driving the pyrolytic boron nitride (PBN) market growth include growing applications in high-tech industries such as semiconductor manufacturing, aerospace, and electronics

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.