- Home

- »

- Medical Devices

- »

-

Rare Disease Clinical Trials Market Size Analysis Report, 2030GVR Report cover

![Rare Disease Clinical Trials Market Size, Share & Trends Report]()

Rare Disease Clinical Trials Market Size, Share & Trends Analysis Report By Therapeutic Area (Autoimmune & Inflammation, Hematologic Disorders), By Phase (Phase I, Phase II), By Sponsor, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-031-1

- Number of Report Pages: 225

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global rare disease clinical trials market size was valued at USD 11,455.0 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.7% from 2023 to 2030. This growth can be attributed to several factors, including the less number of drugs available for treating rare diseases, improvements in personalized medicine, and cell and gene therapies, which are opening up new avenues for the development of new treatments for rare diseases. Moreover, an increase in the number of funding from pharmaceutical and biotech companies and non-profit organizations for rare disease clinical trials is further supporting market growth.

The COVID-19 pandemic had a significant impact on the ability to conduct clinical trials. Due to the pandemic, various clinical trials of rare diseases were halted and delayed, and participant enrollment was postponed. This resulted in the delayed arrival of new treatments and drugs developed for the treatment of rare diseases. However, clinical trials for rare diseases resumed by the second half of 2020, and the trials are now initiated, which is expected to support the market in the post-pandemic period.

The Orphan Drug Act (ODA) of 1983 introduced significant incentives for businesses to develop treatments for rare diseases. As per this act, the sponsors of clinical trials are not required to pay the Prescription Drug User Fee Amendments (PDUFA). The ODA provides clinical research grants, an R&D tax credit for 25% of qualified clinical trial costs for orphan drugs, and market exclusivity for seven years. All these factors are likely to support the market's growth.

Biopharmaceutical researchers have developed groundbreaking treatments for several rare diseases by utilizing new technology and the expanding body of knowledge on numerous rare diseases. Orphan medications for uncommon diseases accounted for more than half (55%) of unique new drug and biological approvals in 2020. In the same year, medicines licensed to treat orphan diseases included a therapy that targets von Hippel-Landau disease, a genetic disease that affects 10,000 people in the U.S. and causes tumors and/or cysts in various sections of the body. Such research is likely to support the market.

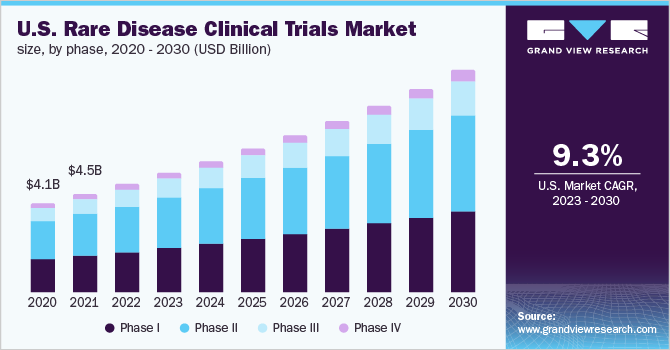

Phase Insights

In terms of phase, Phase III is anticipated to register at the fastest CAGR of 10.3% during the forecast period. The high share of Phase III trials is attributed to the fact that Phase III trials are the most expensive and involve a large number of subjects. Long-term safety studies are conducted for registration and post-marketing commitments in phase III trials.

They help compare novel drugs to standard-of-care drugs. These trials evaluate the adverse effects of individual drugs and assess which drug works better. Regulatory authorities usually require phase III clinical trial data before approving any new medication. All these factors support the segment’s growth. Moreover, a significant number of rare disease clinical trials are currently in Phase III. For instance, in November 2022, Pfizer had 12 rare disease drugs in the development phase, of which 6 were in Phase III.

Phase II held the largest share of 42.6 % in 2022. Phase II studies are performed in two parts, in the first part, the dose range exploration is done along with efficacy studies, while in further studies, the dose is finalized. In Phase II clinical trials, over 100-300 participants are recruited. As of November 2022, the phase II segment had the highest number of registered clinical studies. As of November 2022, 72,522 studies were registered on the ClinicalTrial. Gov portal. The high number of Phase II clinical trials is promoting the growth of the segment.

Therapeutic Area Insights

The oncology segment held the largest share of 33.9% in 2022. The high number of approvals for cancer rare disease drugs, increasing clinical trials for cancer treatment, and growing interest among researchers in finding effective treatments for rare cancers are some of the key factors supporting the segment’s growth. For instance, in January 2023, the USFDA approved atezolizumab (Tecentriq), an immunotherapy drug for use in patients with advanced alveolar soft part sarcoma (ASPS).

The infectious disease segment is expected to exhibit the fastest CAGR of 10.6% during the forecast period. Rare infectious diseases include Acanthamoeba keratitis, Q fever, Marburg virus, and others. Because these rare diseases are fatal, there is a growing interest among researchers in developing treatments and vaccines for them. Acanthamoeba keratitis is commonly seen among people who wear contact lenses. In the U.S., over 85% of people wear contact lenses. This increases the risk of diseases and supports the treatment demand. These factors are supporting the segment growth.

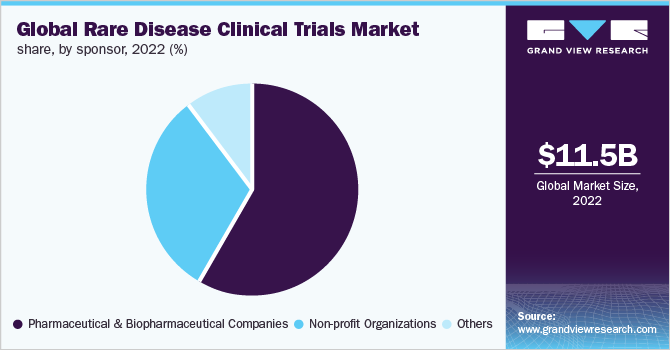

Sponsor Insights

The pharmaceutical & biopharmaceutical companies accounted for the largest revenue share of 58.5% in 2022. Pharmaceutical companies are actively involved in conducting clinical trials for rare diseases by collaborating with other companies.

For instance, in January 2022, Pfizer Inc. announced a four-year research collaboration with Beam Therapeutics Inc. This collaboration aims to develop novel advanced in vivo base editing programs for a variety of rare diseases. This research was funded by Pfizer, Inc. Similar agreements in the future are expected to support the segment market.

The nonprofit organization segment is expected to grow at a CAGR of 9.9% across the forecast period. Non-profit organizations such as the National Organization for Rare Disease (NORD), The Rare Diseases Clinical Research Network (RDCRN), and other public organizations are actively involved in providing funding for rare disease clinical research to support the development of potential treatments for rare diseases. For instance, in October 2022, the USFDA awarded 19 grants for clinical research on rare diseases. USFDA also provided funding of USD 38 million to support research. Active funding by these organizations is expected to promote this market segment.

Regional Insights

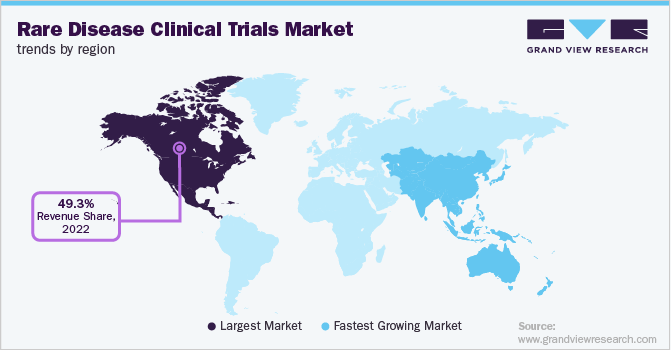

North America held the largest revenue share of 49.3 % in 2022 due to rising spending on orphan drugs for rare disease treatment, favorable reimbursement policies, and the presence of major market players that led to the development of innovative products. Also, the U.S. FDA has a fast-track approval process for drugs used to treat serious diseases. For instance, as per the Accelerated Approval Regulations, a drug used to treat a serious condition can be approved using the surrogate end-point, which streamlines the FDA drug approval process. All these factors are expected to support the market in North America.

The Asia Pacific region is expected to grow at the fastest rate of 10.6% across the forecast period. This is due to the availability of a significant number of Food and Drug Administration (FDA), Therapeutic Goods Administration (TGA), and European Medicines Agency (EMA)-approved facilities in the region. Moreover, the large patient pool and low cost of conducting clinical trials in the region further support the regional market.

The public organizations in the region are undertaking initiatives to support clinical research. For instance, in December 2022, the high count in India requested the central government to release USD 0.6 million (INR 50 Million) to conduct clinical research on Duchenne Muscular Dystrophy in the country. All the above-mentioned factors support regional market growth.

Key Companies & Market Share Insights

Market players are undertaking various strategic initiatives such as the launch of new product partnerships, collaborations, mergers and acquisitions, and geographic expansion aiming to strengthen their product portfolio, and provide a competitive advantage. For instance, in January 2023, an R&D organization, Genethon, launched a pivotal clinical trial for the treatment of Crigler-Najjar Syndrome using gene therapy. Some prominent players in the global rare disease clinical trials market include:

-

Takeda Pharmaceutical Company

-

F. Hoffmann-La Roche Ltd.

-

Pfizer, Inc.

-

AstraZeneca

-

Novartis AG

-

LabCorp

-

IQVIA

-

Charles River Laboratories Inc.

-

Icon PLC

-

Parexel International Corporation

Rare Disease Clinical Trial Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.65 billion

Revenue forecast in 2030

USD 24.25 billion

Growth rate

CAGR of 9.7% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

Segments Covered

Therapeutic area, phase, sponsor, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait

Key companies profiled

Takeda Pharmaceutical Company; F. Hoffmann-La Roche Ltd.; Pfizer, Inc.; AstraZeneca; Novartis AG; LabCorp; IQVIA, Inc.; Charles River Laboratories; Icon PLC; Parexel International Corporation

Customization scope

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rare Disease Clinical Trials Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rare disease clinical trials market report based on therapeutic area, phase, sponsor, and region:

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiovascular Disorders

-

Neurological Disorders

-

Infectious Disease

-

Genetic Disorders

-

Autoimmune And Inflammation

-

Hematologic Disorders

-

Musculoskeletal Disorders

-

Others

-

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Sponsor Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biopharmaceutical Companies

-

Non-profit Organizations

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The oncology segment held a market share of 33.9% by therapeutic area in 2022. The growing investment in the research & development of activities for cancer-based rare diseases is one of the prominent factors supporting the segment's growth.

b. Some key players operating in the rare disease clinical trials market include Parexel International Corporation, Icon PLC, Charles River Laboratories Inc., IQVIA, and a few others.

b. Increasing investments across the R&D activities for rare diseases, and the growing prevalence of rare diseases especially in pediatrics, etc are a few of the factors supporting the market growth.

b. The global rare disease clinical trials market size was estimated at USD 11.5 billion in 2022 and is expected to reach USD 12.7 billion in 2023.

b. The global rare disease clinical trials market is expected to grow at a compound annual growth rate of 9.7% from 2023 to 2030 to reach USD 24.3 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."