- Home

- »

- Alcohol & Tobacco

- »

-

Ready-to-Drink Cocktails Market Size & Share Report, 2030GVR Report cover

![Ready-to-Drink Cocktails Market Size, Share & Trends Report]()

Ready-to-Drink Cocktails Market Size, Share & Trends Analysis Report By Type (Malt-based, Spirit-based, Wine-based), By Packaging, By Distribution Channel (Hypermarkets/Supermarkets, Online, Liquor Stores), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-253-5

- Number of Report Pages: 145

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Ready to Drink Cocktails Market Trends

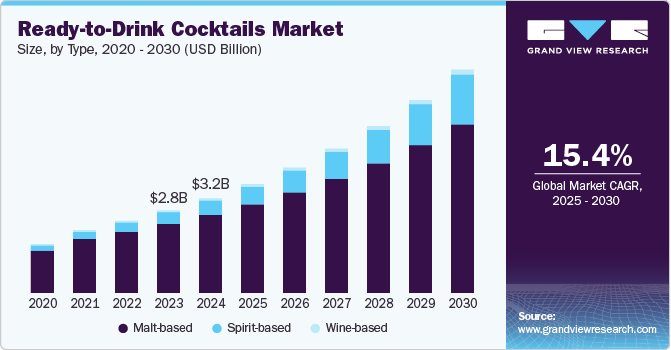

The global ready-to-drink cocktails market size was estimated at USD 3.21 billion in 2024 and is projected to grow at a CAGR of 15.4% from 2025 to 2030. The growing demand for flavored drinks with low alcohol content due to the rising health concerns is anticipated to drive the ready-to-drink (RTD) cocktails market over the forecast period. Premiumization of the product with flavors, taste, quality, and package design is further expected to drive market growth. The market has experienced a favorable effect due to the COVID-19 pandemic. While the demand for these products was already rising, the segment witnessed significant growth following the global outbreak. Factors, such as the flourishing at-home cocktail culture, increased health consciousness, convenience, and improved quality and variety of RTD cocktails have contributed to the surge in demand.

Health-conscious consumers in developed countries are increasingly opting for low-alcohol flavored beverages. These drinks typically have a lower alcohol content, ranging from 4% to 7%, and are infused with enticing flavors, such as lemon, cranberry, orange, and passionfruit. As a result, the popularity of low alcohol by volume (ABV) beverages has been steadily growing. Among them, products based on gin and tequila have witnessed significant demand from consumers. In Russia, Australia, Brazil, China, and South Africa, there has been a notable decrease in per capita alcohol consumption. This trend is attributed to changing lifestyle preferences aimed at enhancing overall well-being, as well as a growing emphasis on responsible drinking.

Consequently, there is an anticipated rise in the demand for RTD cocktails. In addition, the availability of organic, gluten-free, and keto-friendly options in the market is enticing an increasing number of consumers to embrace these products. The demand for convenient ready-to-eat (RTE) or RTD products is being propelled by consumers' increasing preference for quick and easy solutions amidst their busy lifestyles and demanding work schedules. This trend is particularly driven by the growing working population. Furthermore, the market is being influenced by a considerable segment of consumers who favor the convenience of serving homemade drinks at house parties and social gatherings.

Type Insights

The spirit-based cocktails segment dominated the market with a revenue share of 61.3% in 2024 and is projected to continue its dominance throughout the forecast period. These cocktails typically contain alcohol content of up to 5%, combined with other ingredients, such as juices, and are available in single-serve packaging with a wide range of flavors. Popular spirits like vodka, gin, tequila, whiskey, and rum are commonly used in these cocktails. With a diverse range of options including infused flavors like ginger, rose, and lavender, spirit-based cocktails have become increasingly favored among consumers, making them the preferred choice in the alcoholic beverage category.

The wine-based cocktails segment is expected to experience rapid growth, emerging as the second-fastest-growing segment with a projected CAGR of 16.2% during the forecast period. This growth is driven by consumer perceptions of wine as a healthier alternative to spirits and malts, leading to increased demand for wine-based cocktails. These cocktails typically incorporate fruit juices, such as grapefruit, oranges, passionfruit, lemon, mango, and berries, adding to their appeal. Moreover, wine-based cocktails align with evolving consumer trends toward adopting a healthier lifestyle by opting for beverages with lower ABV content. As a result, manufacturers are introducing healthier options that are gluten-free, low in carbs, made with organic/natural ingredients, and have a lower alcoholic content, catering to the growing demand for health-conscious beverages.

Packaging Insights

The bottle packaging segment held a revenue share of 21.7% in 2024, establishing its dominance in the global market. RTD cocktails were initially introduced in bottle packaging, gaining widespread popularity globally. However, due to the aluminum shortage in countries like the U.S., there has been a shift toward using glass bottles. This market trend has led to an increased demand for glass bottles in the global market for RTD cocktails.

The cans segment is poised to experience the fastest CAGR of 15.3% from 2025 to 2030. Cans have gained popularity as a preferred packaging option for ready-to-drink cocktails due to their lightweight and compact design. Consumers are increasingly seeking convenient and portable beverage choices that align with their styles and preferences.

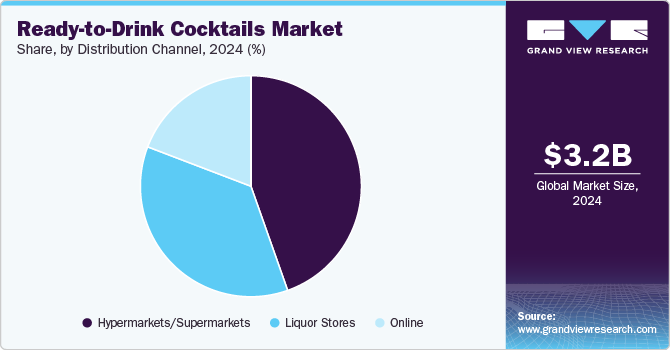

Distribution Channel Insights

In 2024, the hypermarkets/supermarkets segment dominated the market with a significant revenue share of 44.6%. This segment is expected to maintain its leading position throughout the forecast period due to the strong consumer preference for purchasing grocery products from supermarkets, convenience stores, specialty stores, and grocery stores. Consumers prefer hypermarkets/supermarkets for their extensive product choices and convenient shopping experience. Within these retail outlets, grocery stores play a vital role as distribution channels for RTD cocktails. This includes local grocery stores and well-known national chains like Kroger in the U.S., which are integral to the mainstream grocery distribution platform. These establishments ensure that ready-to-drink cocktails are readily available to consumers seeking convenience and variety in their beverage choices.

Supermarkets and hypermarkets are globally recognized distribution channels, with retail giants like Target and Walmart holding significant market shares. These establishments cater to larger order sizes compared to traditional grocery stores. On the other hand, the online segment is projected to grow at the fastest CAGR of 18.1% from 2023 to 2030. This segment includes company websites and various e-commerce platforms where RTD cocktails are made available for purchase. The increasing consumer preference for online shopping has prompted companies to actively offer their products through this channel, meeting the evolving demands of consumers who seek convenience and accessibility.

Regional Insights

The North America ready-to-drink cocktails market accounted for a share of 32.5% of the global revenue in 2024. The market growth is primarily driven by the increasing demand for vodka and whiskey-based beverages in the region. The appeal of these ready cocktails lies in their low alcohol content and affordability compared to those served at bars, making them an attractive choice for young consumers. Among the countries in North America, the United States accounted for the largest revenue share in 2022. This can be attributed to the rising consumer demand for a wide variety of flavors and the shifting preference toward convenient on-the-go products.

U.S. Ready-to-Drink Cocktails Market Trends

The ready-to-drink cocktails market in U.S. is projected to grow at a CAGR of 15.3% from 2025 to 2030 driven by several key factors that are shaping consumer preferences and industry trends. In the U.S., the surge in RTD cocktail sales is largely driven by a cultural shift toward convenience and a fast-paced lifestyle. Consumers in the country are seeking quick, ready-made options that focus on both flavor and quality. The variety in RTD cocktail offerings, from classic favorites to innovative new blends, satisfies diverse consumer tastes, making them a go-to choice for both casual and social drinking occasions. In November 2023, Moth, a premium RTD cocktail brand from the UK, launched canned cocktails in the U.S. in four flavors: Espresso Martini, Mojito, Piña Colada, and Margarita. These products retail at a price of USD 25 for four-packs of 200 ml and are available in six Total Wine stores in Florida.

Europe Ready-to-Drink Cocktails Market Trends

The ready-to-drink cocktails market in Europe is projected to grow at a CAGR of 15.3% from 2025 to 2030. RTD cocktails are gaining popularity in Europe due to their reputation for delivering excellent taste. By combining various alcoholic bases like wine or spirits with mixers such as ginger ale, tonic, syrups, and fruit juices, product developers can create a wide array of new flavors that align with current trends and consumer preferences. These colorful and vibrant RTD drinks cater to the modern consumer's desire for novel and exciting taste experiences, appealing to those who seek variety and innovation in their beverage choices.

The ready-to-drink cocktails market in UK is projected to grow at a CAGR of 16.8% from 2025 to 2030. The market in the UK is experiencing rapid growth, driven by consumer demand for convenience in their alcoholic beverages. With a busy lifestyle becoming the norm, more people are opting for the ease of pre-mixed cocktails that can be enjoyed without the need for preparation. As a result, the RTD sector is expected to expand faster than the overall alcohol industry, thanks to its strong compound annual growth rate.

Germany ready-to-drink cocktails market is projected to grow at a CAGR of 15.5% from 2025 to 2030. The demand for RTD cocktails in Germany is growing as consumers increasingly prioritize price and value amid rising costs. This shift presents a significant opportunity for private labels to capture market share by offering affordable alternatives. However, brands can also capitalize on the premiumization trend by positioning their RTD cocktails as occasional indulgences. This approach appeals to consumers who are willing to spend more on high-quality products that provide a sense of luxury or treat. As a result, there is room for both private labels and premium brands to thrive in the evolving German RTD cocktails market.

Asia Pacific Ready-to-Drink Cocktails Market Trends

The ready-to-drink cocktails market in Asia Pacific accounted for a share of 16.6% of the global revenue in 2024. The Asia Pacific market is experiencing significant growth, driven by several key factors. Increasing consumer preference for convenience and ready-to-serve alcoholic beverages is a major driver. The region's young, urban population, who are more open to experimenting with new flavors and products, further fuels demand.

Latin America Ready-to-Drink Cocktails Market Trends

The ready-to-drink cocktails market in Latin America is projected to grow at a CAGR of 13.7% from 2025 to 2030. One of the defining trends in the market is the shift towards premium products. Consumers are increasingly seeking high-quality ingredients and craft cocktails. Brands like Rooibos & Tonic and Savanna Dry, which offer unique flavors and a distinctly local twist, have found a niche in this burgeoning market. In addition, health-conscious consumers seek lower-alcohol and lower-sugar options, prompting producers to innovate and adapt their offerings accordingly.

Middle East & Africa Ready-to-Drink Cocktails Market Trends

The ready-to-drink cocktails market in the Middle East & Africa is projected to grow at a CAGR of 12.8% from 2025 to 2030. The Middle East market presents a unique landscape due to cultural, religious, and regulatory factors in the region. While the market is not as developed as in Western countries, it has been experiencing gradual growth and evolution, particularly in more cosmopolitan areas and among expatriate communities.

Key Ready-to-Drink Cocktails Company Insights

The ready-to-drink cocktails market includes many domestic as well as international players. Key players in the global ready-to-drink cocktails market include Ranch Rider Spirits Co., House of Delola, LLC, Diageo plc, Brown-Forman, Bacardi Limited. Established players, such as Suntory Holdings Limited, have been actively investing in research and development to innovate and introduce new ready-to-drink cocktails options. These companies leverage their extensive distribution networks and brand recognition to maintain a significant market share.

Key Ready-to-Drink Cocktails Companies:

The following are the leading companies in the ready to drink (RTD) Cocktails market. These companies collectively hold the largest market share and dictate industry trends.

- Ranch Rider Spirits Co.

- House of Delola, LLC

- Diageo plc

- Brown-Forman

- Bacardi Limited

- Asahi Group Holdings, Ltd.

- Pernod Ricard

- Halewood Wines & Spirits

- Shanghai Bacchus Liquor Co., Ltd.

- Suntory Holdings Limited

- Manchester Drinks Company Ltd.

- Anheuser-Busch InBev

View a comprehensive list of companies in the Ready-to-Drink Cocktails Market

Recent Developments

-

In February 2024, Diageo announced the launch of a new range of premium ready-to-drink (RTD) bottled cocktails in the U.K. This collection, named The Cocktail Collection, features three distinct cocktails: a Johnnie Walker Old Fashioned (20.5% ABV), a Tanqueray Negroni (17.5% ABV), and a Cîroc Cosmopolitan (17.5% ABV).

-

In February 2024, Diageo introduced a new line of malt-based ready-to-drink (RTD) cocktails under the Captain Morgan brand in the U.S. The new line, named Captain Morgan Sliced, features four distinct flavors inspired by popular cocktails: Pineapple Daiquiri, Strawberry Margarita, Passionfruit Hurricane, and Mango Mai Tai.

-

In November 2023, Bacardi introduced a new range of ready-to-drink cocktails under its Eristoff vodka brand. This launch included two specific varieties: Eristoff Pink It Up! and Eristoff Passion Star! ERISTOFF Pink It Up! is a blend of vodka, lemonade, and strawberry flavors, while ERISTOFF Passion Star! combines vodka with soda and passion fruit.

Ready-to-Drink Cocktails Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.69 billion

Revenue forecast in 2030

USD 7.58 billion

Growth rate

CAGR of 15.4% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; Australia & New Zealand; Thailand; Brazil; UAE

Key companies profiled

Ranch Rider Spirits Co.; House of Delola LLC; Diageo plc; Brown-Forman; Bacardi Limited; Asahi Group Holdings Ltd.; Pernod Ricard; Halewood Wines & Spirits; Shanghai Bacchus Liquor Co., Ltd.; Suntory Holdings Limited; Manchester Drinks Company Ltd.; Anheuser-Busch InBev.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Ready-to-Drink Cocktails Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ready-to-drink cocktails market report based on type, packaging, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Malt-based

-

Spirit-based

-

Wine-based

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Online

-

Liquor Stores

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global ready-to-drink cocktails market size was estimated at USD 3.21 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of 15.5% from 2025 to 2030.

b. The global ready-to-drink cocktails market is expected to grow at a compounded growth rate of 15.5% from 2025 to 2030 to reach USD 7.58 billion by 2030.

b. The spirit-based cocktails segment dominated the market with a revenue share of 61.3% in 2024 and is projected to continue its dominance throughout the forecast period. These cocktails typically contain alcohol content of up to 5%, combined with other ingredients, such as juices, and are available in single-serve packaging with a wide range of flavors. Popular spirits like vodka, gin, tequila, whiskey, and rum are commonly used in these cocktails. With a diverse range of options, including infused flavors like ginger, rose, and lavender, spirit-based cocktails have become increasingly favored among consumers, making them the preferred choice in the alcoholic beverage category.

b. Some key players operating in the ready to drink cocktails market include The Absolut Company; House of Delola, LLC; Diageo plc; Brown-Forman; Bacardi Limited; and Asahi Group Holdings, Ltd.

b. Key factors that are driving the market growth include health-conscious consumers in developed countries are increasingly opting for low-alcohol flavored beverages.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."