- Home

- »

- Plastics, Polymers & Resins

- »

-

Ready-to-Use Pharmaceutical Packaging Market Report, 2033GVR Report cover

![Ready-to-Use Pharmaceutical Packaging Market Size, Share & Trends Report]()

Ready-to-Use Pharmaceutical Packaging Market (2026 - 2033) Size, Share & Trends Analysis Report By Container Type (Sterile Vials, Sterile Syringes, Sterile Cartridges), By Material (Glass, Plastic, Rubber, Aluminum), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-579-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ready-to-Use Pharmaceutical Packaging Market Summary

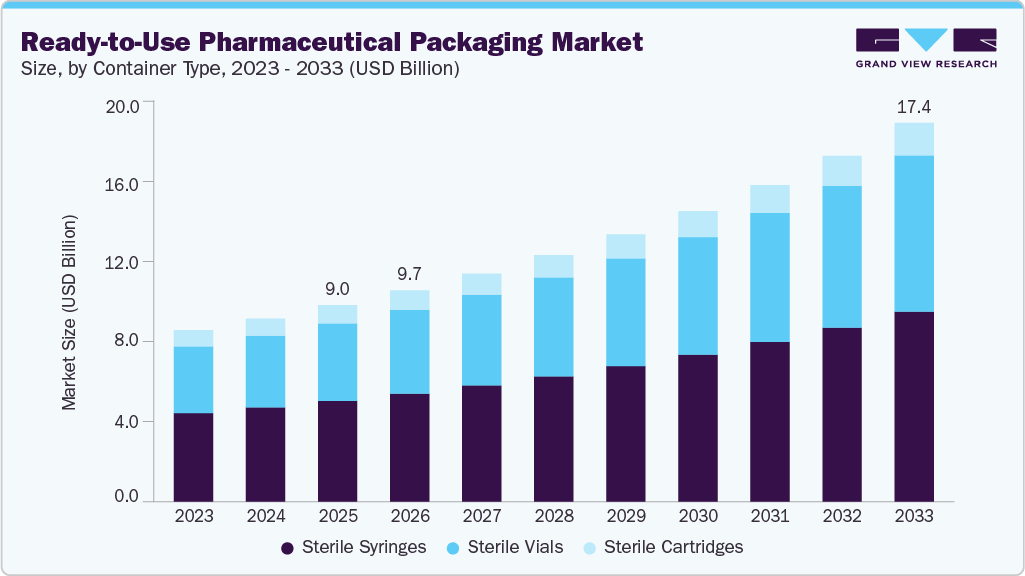

The global ready-to-use pharmaceutical packaging market size was valued at USD 9.03 billion in 2025 and is projected to reach USD 17.43 billion by 2033, growing at a CAGR of 8.7% from 2026 to 2033. Another strong driver is the growing need for faster drug delivery to market, which pushes companies to adopt RTU packaging to reduce time spent on in-house sterilization and preparation.

Key Market Trends & Insights

- Europe dominated the global ready-to-use pharmaceutical packaging market and accounted for the largest revenue share of over 38.0% in 2025.

- Based on container type, the sterile syringes segment dominated the market in terms of revenue, accounting for a market share of over 51.0% in 2025.

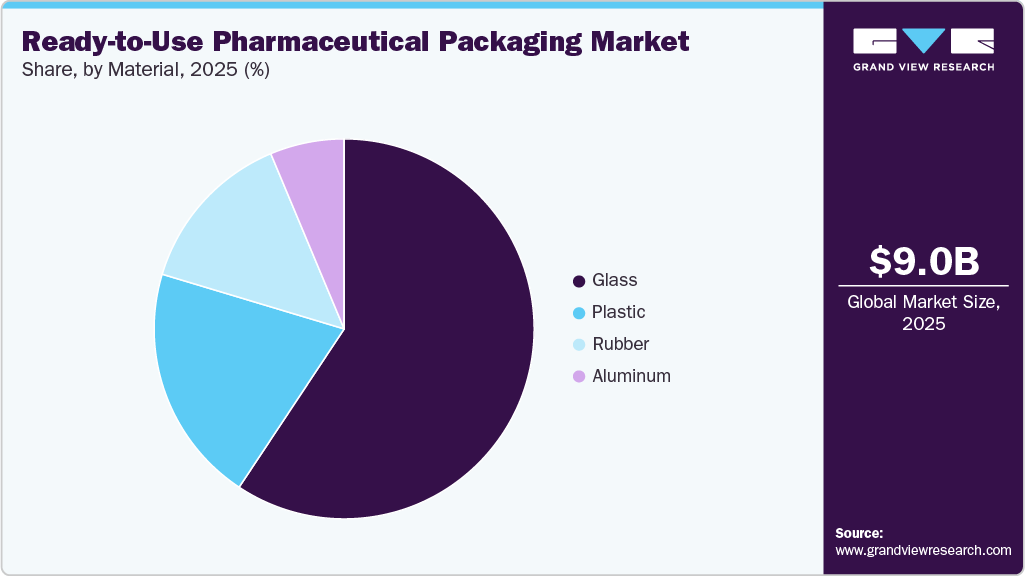

- Based on material, the glass segment dominated the market across the Material segmentation in terms of revenue, accounting for a market share of over 59.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 9.03 Billion

- 2033 Projected Market Size: USD 17.43 Billion

- CAGR (2026-2033): 8.7%

- Europe: Largest market in 2025

- Asia Pacific: Fastest growing market

This helps streamline production and meet rising global demand more efficiently. The demand for RFID-enabled labels, time-temperature indicators, and real-time monitoring solutions is accelerating as pharmaceutical companies push for higher levels of drug compliance and safety in complex supply chains. This digital convergence is not only reshaping packaging as a functional asset but also transforming it into a data-driven tool for clinical feedback, thereby aligning closely with the broader movement toward connected health ecosystems.

Drivers, Opportunities & Restraints

A key driver fueling the growth of the RTU pharmaceutical packaging industry is the rising shift of pharmaceutical production from large centralized facilities to decentralized, agile, and outsourced manufacturing environments. With contract development and manufacturing organizations (CDMOs) playing an increasingly pivotal role, pharmaceutical firms are opting for pre-sterilized, ready-to-fill packaging formats that streamline operational efficiency, reduce regulatory complexity, and minimize contamination risks. RTU systems enable faster batch release and minimize downtime, making them indispensable in high-throughput biologics and personalized medicine production pipelines.

An emerging opportunity in the RTU pharmaceutical packaging space lies in the underserved niche of advanced biologic therapies, particularly cell and gene therapies, which require high-barrier packaging with exceptional sterility assurance and compatibility. As biotech innovation surges, the demand for specialized packaging systems that support ultra-low temperature storage, precise dosing, and flexible container formats is opening new frontiers. Companies that can offer customizable RTU packaging platforms tailored to the physicochemical sensitivities of next-generation therapeutics stand to capture significant market share and long-term supplier contracts in this high-value segment.

Despite strong market momentum, a notable restraint is the significant upfront investment and technical complexity associated with validating RTU packaging systems across diverse regulatory environments. Pharmaceutical manufacturers must conduct exhaustive compatibility, extractables and leachables, and sterility validation studies to meet stringent compliance benchmarks in the US, EU, and Asia-Pacific markets.

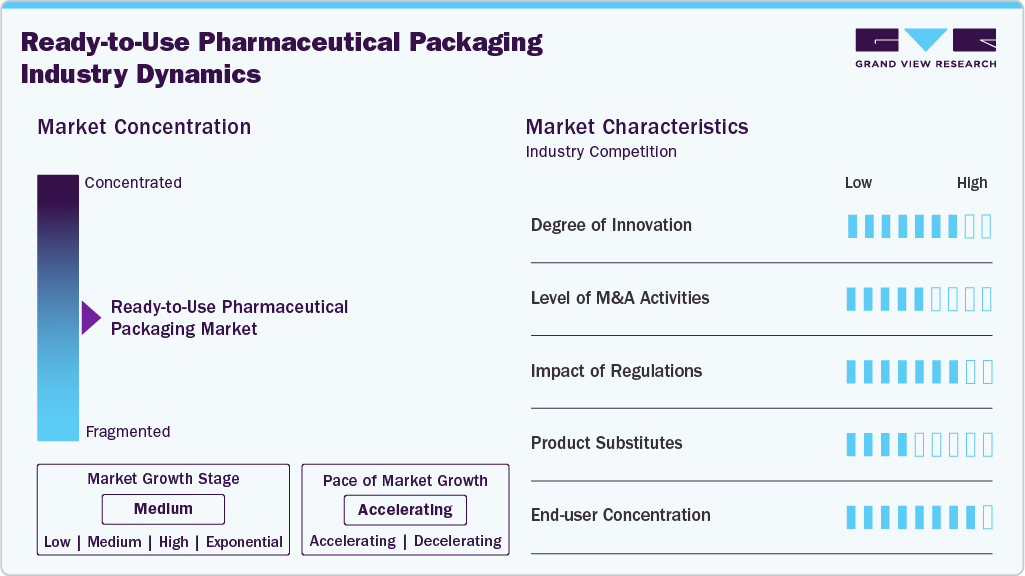

Market Concentration & Characteristics

The growth stage of the industry is medium and the pace is accelerating. The industry exhibits a significant level of concentration with key players dominating the landscape. Major companies like Schott AG, Gerresheimer AG, West Pharmaceutical Services, Stevanato Group, SGD Pharma, Nipro Corporation, AptarGroup, Berry Global, Datwyler, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Stringent global regulatory frameworks are playing a pivotal role in shaping the Ready-to-Use (RTU) pharmaceutical packaging industry, particularly through mandates around aseptic processing, container closure integrity, and extractables and leachables. Agencies such as the U.S. FDA, EMA, and Japan’s PMDA are increasingly enforcing harmonized standards like Annex 1 revisions and ISO 11040, driving pharmaceutical manufacturers to adopt pre-validated, pre-sterilized packaging components to meet compliance thresholds with minimal risk. This regulatory rigor is compelling both legacy drugmakers and CDMOs to transition from in-house sterilization to RTU platforms to ensure faster approval cycles and higher batch consistency.

The industry exhibits a high degree of end-user concentration, with a limited number of global pharmaceutical giants and biologics manufacturers accounting for a significant share of RTU packaging demand. Companies such as Pfizer, Roche, and Novartis, alongside major CDMOs, are centralizing purchasing volumes, driving economies of scale and influencing supplier innovation pipelines.

Container Type Insights

The sterile syringes segment dominated the ready-to-use pharmaceutical packaging industry across the container type segmentation in terms of revenue, accounting for a market share of over 51.0% in 2025. The sterile syringes segment dominates the ready-to-use pharmaceutical packaging market due to the rapid growth of injectable biologics, vaccines, and specialty drugs that require precise, contamination-free delivery. Strong adoption of prefilled syringes by pharmaceutical companies to reduce medication errors, improve dosing accuracy, and enhance patient convenience further supports revenue growth. Additionally, stringent regulatory requirements and increasing demand for safety-engineered, ready-to-administer formats significantly favor sterile syringe packaging over other container types.

Sterile vials are emerging as a rapidly growing segment with a projected CAGR of 9.3% over the forecast period. This outlook is due to rising demand for injectable generics, biosimilars, and hospital-administered drugs that require flexible dosing and multi-drug compatibility. Their compatibility with lyophilized formulations, ease of large-scale filling, and lower cost compared to prefilled syringes make them attractive to pharmaceutical manufacturers. Additionally, increasing adoption of ready-to-use sterile vials helps reduce aseptic processing complexity and contamination risks, supporting strong CAGR growth.

Material Insights

Glass dominated the ready-to-use pharmaceutical packaging market, accounting for a share of over 59.0% in 2025. The continued preference for glass containers in RTU packaging is being reinforced by the growing complexity of biologics and mRNA-based drugs, which often exhibit high reactivity with polymers. Glass offers excellent chemical resistance and stability, making it the material of choice for high-value formulations where purity cannot be compromised. Moreover, advancements in coated and strengthened glass technologies are addressing historic concerns around breakage and delamination, enabling broader adoption in high-throughput sterile packaging lines.

The plastic segment is projected to witness a substantial CAGR of 10.0% through the forecast period. Increased uptake of plastic-based RTU containers is being propelled by the rising demand for lightweight, break-resistant packaging solutions in mobile health services and field-based clinical trials. Plastics such as cyclic olefin polymers (COPs) are gaining traction for their compatibility with sensitive biologics and ease of manufacturing into complex shapes. Their growing appeal lies in enabling flexible packaging configurations while maintaining high clarity, barrier performance, and reduced cost per unit—particularly attractive for volume-driven generic injectables.

Regional Insights

Europe ready-to-use pharmaceutical packaging market accounted for the largest revenue share of over 38.0% in 2025. Europe’s strong regulatory environment serves as a significant growth pillar for RTU pharmaceutical packaging. Notably, the Falsified Medicines Directive (FMD) mandates that all medicines include a tamper-evident device and a unique identifier in the form of a two-dimensional Data Matrix code to ensure traceability and combat counterfeits. This requirement stimulates demand for RTU packaging solutions that are pre-serialized and tamper-evident. Additionally, bodies such as the European Medicines Verification Organization, involving stakeholders such as the European Federation of Pharmaceutical Industries and Associations (EFPIA), are instrumental in enforcing compliance with these traceability rules across Europe.

North America Ready-to-Use Pharmaceutical Packaging Market Trends

The RTU pharmaceutical packaging market in North America is growing primarily due to its strong and mature pharmaceutical industry, which is among the largest in the world. For instance, according to the European Federation of Pharmaceutical Industries Associations (EFPIA), North America accounts for 53.3% of global pharmaceutical sales as of 2023, far outpacing Europe, which holds 22.7%. Generic drugs account for 84% of total U.S. pharmaceutical sales, supporting the country’s strong position in supplying cost-effective medications globally.

U.S. Ready-to-Use Pharmaceutical Packaging Market Trends

The RTU pharmaceutical packaging industry in the U.S. accounts for nearly half of the global pharmaceutical market, with a high concentration of leading drug manufacturers and biotech firms such as Pfizer, AbbVie, Johnson & Johnson, Moderna, Merck & Co., Bristol-Myers Squibb, Novartis, Sanofi, GSK, and Takeda. These companies are increasingly shifting toward RTU packaging formats such as prefilled syringes, cartridges, and vials to support faster drug delivery, minimize contamination risks, and streamline fill-finish processes. The region’s established healthcare infrastructure and extensive research and development (R&D) investments also reinforce the demand for advanced packaging solutions that meet stringent quality standards.

Asia Pacific Ready-to-Use Pharmaceutical Packaging Market Trends

The ready-to-use pharmaceutical packaging market in the APAC region is primarily driven by its massive, growing, and increasingly affluent population. This demographic expansion directly translates into a higher prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer, which require long-term, often self-administered drug therapies. Ready-to-use packaging, including pre-filled syringes, blister packs, and inhalers, enhances patient compliance, safety, and convenience, factors critically important for managing these conditions outside clinical settings. For instance, the increasing diabetic population in countries such as India and China is fueling massive demand for pre-filled insulin pens and auto-injectors, making APAC the fastest-growing market for these specific packaging solutions.

Key Ready-to-Use Pharmaceutical Packaging Company Insights

Key players operating in the ready-to-use pharmaceutical packaging market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Ready-to-Use Pharmaceutical Packaging Companies:

The following are the leading companies in the ready-to-use pharmaceutical packaging market. These companies collectively hold the largest market share and dictate industry trends.

- SCHOTT Pharma

- Gerresheimer AG

- West Pharmaceutical Services, Inc.

- Stevanato Group

- SGD Pharma

- NIPRO

- AptarGroup, Inc.

- BD

- Dätwyler Holding Inc.

- APG Pharma

- DWK Life Sciences

- DAIKYO SEIKO, LTD.

Recent Developments

-

In August 2025, SCHOTT Pharma launched the SCHOTT TOPPAC polymer cartridge, the industry's first ready-to-use (RTU) polymer cartridge that complies with ISO dimensions. It offers glass-like functional performance with added break resistance, is compatible with all major fill-and-finish lines and injection devices such as pen systems, and currently comes in 1.5 ml, 3 ml, and 5 ml formats, with a 10 ml version in development.

-

In May 2025, Gerresheimer AG successfully completed a major investment of around USD 110.0 million in a state-of-the-art glass production facility at its Lohr site in Germany, marking one of the company's largest investments in moulded glass in recent years. The expansion also involved upgrading infrastructure, production buildings, machines, and installing an energy-efficient cooling system. The Lohr facility produces a wide range of glass products for the pharmaceutical and food industries and is part of Gerresheimer’s key growth strategy in moulded glass production.

-

In May 2025, SCHOTT Pharma expanded its ready-to-use (RTU) cartriQ portfolio by introducing a sterile 1.5 ml cartridge, which is the smallest format in their sterile cartridge range to date. This new cartridge is designed to optimize pharmaceutical filling processes with an innovative diamond-shaped nest design that enhances efficiency and sustainability. This expansion aligns with SCHOTT Pharma’s strategy to provide high-value solutions for pharmaceutical manufacturing and patient-friendly drug delivery.

Ready-to-Use Pharmaceutical Packaging Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 9.72 billion

Revenue forecast in 2033

USD 17.43 billion

Growth rate

CAGR of 8.7% from 2026 to 2033

Historical data

2021 - 2024

Base Year

2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Container type, material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

SCHOTT Pharma; Gerresheimer AG; West Pharmaceutical Services, Inc.; Stevanato Group; SGD Pharma; NIPRO; AptarGroup, Inc.; BD; Dätwyler Holding Inc.; APG Pharma; DWK Life Sciences; DAIKYO SEIKO, LTD.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ready-To-Use Pharmaceutical Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global ready-to-use pharmaceutical packaging market report on the basis of container type, material, and region:

-

Container Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Sterile Vials

-

Sterile Syringes

-

Sterile Cartridge

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Glass

-

Plastic

-

Rubber

-

Aluminum

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global ready-to-use pharmaceutical packaging market size was estimated at USD 9.03 billion in 2025 and is expected to reach USD 9.72 billion in 2026.

b. The global ready-to-use pharmaceutical packaging market is expected to grow at a compound annual growth rate of 8.7% from 2026 to 2033 to reach USD 17.43 billion by 2033.

b. Glass dominated the market across the material segmentation in terms of revenue, accounting for a market share of 59.32% in 2025.

b. Some key players operating in the RTU pharmaceutical packaging market include SCHOTT Pharma; Gerresheimer AG; West Pharmaceutical Services, Inc.; Stevanato Group; SGD Pharma; NIPRO; AptarGroup, Inc.; BD; Dätwyler Holding Inc.; APG Pharma; DWK Life Sciences; DAIKYO SEIKO, LTD.

b. Improved mechanical and thermal properties from adding graphene make plastics more suitable for demanding industrial applications. This is driving interest from sectors like automotive and aerospace, where performance and durability are key.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.