- Home

- »

- Plastics, Polymers & Resins

- »

-

Recycled Polyethylene Terephthalate Market Report, 2033GVR Report cover

![Recycled Polyethylene Terephthalate Market Size, Share & Trends Report]()

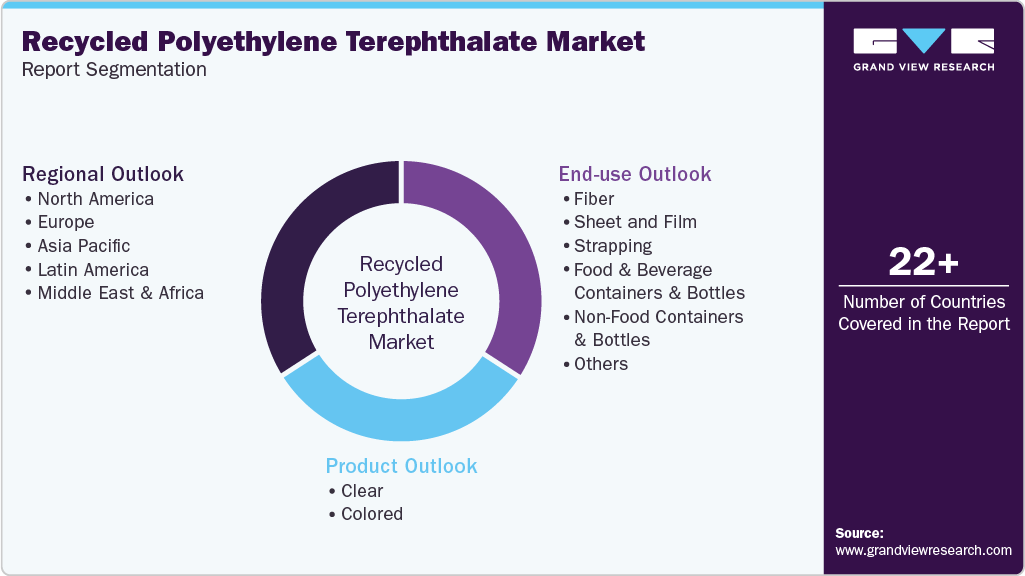

Recycled Polyethylene Terephthalate Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Clear, Colored), By End Use (Fiber, Sheet And Film, Strapping, Food & Beverage Containers And Bottles), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-938-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Recycled Polyethylene Terephthalate Market Summary

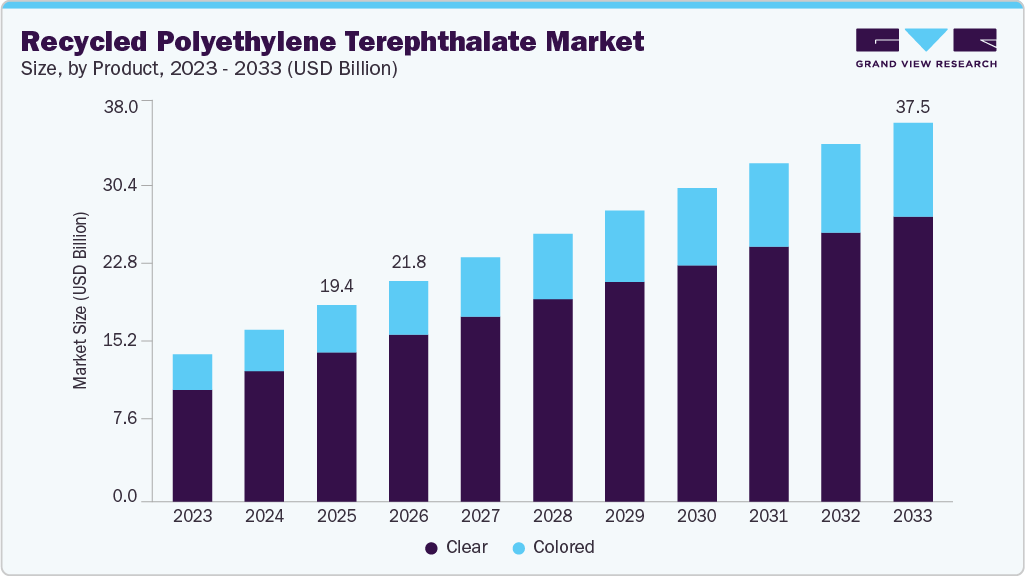

The global recycled polyethylene terephthalate market size was estimated at USD 19.38 billion in 2025 and is projected to reach USD 37.46 billion by 2033, growing at a CAGR of 8.1% from 2026 to 2033. The growth can be attributed to rising sustainability measures undertaken by food & beverage and packaging companies.

Key Market Trends & Insights

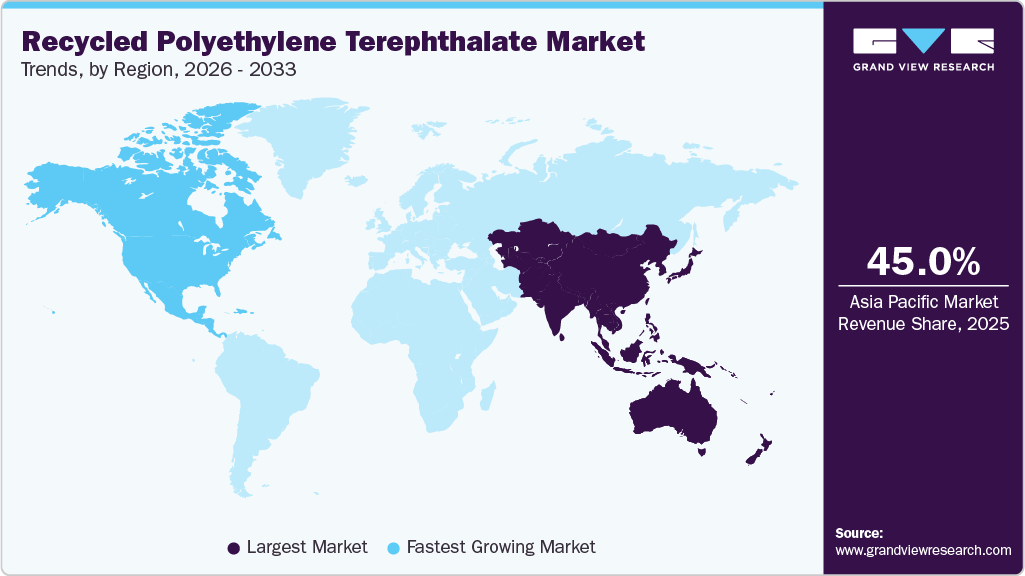

- Asia Pacific dominated the global recycled polyethylene terephthalate industry with the largest revenue share of 45.00% in 2025.

- The recycled polyethylene terephthalate industry in Mexico is expected to grow at a substantial CAGR of 9.7% from 2026 to 2033.

- By product, the colored segment is expected to grow at a considerable CAGR of 8.5% from 2026 to 2033 in terms of revenue.

- By end use, the food & beverage containers and bottles segment is expected to grow at a considerable CAGR of 8.6% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 19.38 Billion

- 2033 Projected Market Size: USD 37.46 Billion

- CAGR (2026-2033): 8.1%

- Asia Pacific: Largest market in 2025

- North America: Fastest growing market

Clear rPET products are the most sought after by both recyclers and end-use industries due to their lower costs compared to colored rPET products. Colored rPET is preferred by packaging product and bottle manufacturers as it provides them with brand identity and enables the development of products with improved aesthetics.

According to the U.S. Environmental Protection Agency, single-use plastics account for approximately 50% of the total plastic demand in the country. The plastic recycling rate in the U.S. is low, as a significant portion of the plastic waste generated is exported to other countries for recycling. After the recent ban on plastic waste imports in China, the U.S. is exporting its plastic waste to Southeast Asian countries.

Drivers, Opportunities & Restraints

Policy and corporate commitments to recycled content are the primary near-term growth engine. Mandatory recycled content targets, extended producer responsibility schemes, and public procurement rules force buy-side adoption. At the same time, large beverage and consumer goods companies lock long-term offtake and finance collection systems. Consumer pressure and ESG reporting amplify the effect by turning recycled content into a commercial requirement rather than a marketing choice.

Technology and feedstock diversification create high-value commercial openings. Chemical depolymerization and improved contamination-tolerant processes enable the conversion of lower-grade streams into food-safe rPET and virgin-equivalent monomers, opening up applications in food packaging and textiles that previously required virgin PET. Companies that vertically integrate collection, advanced sorting, and chemical recycling can capture margin uplift and reduce exposure to feedstock price swings.

Feedstock inconsistency and collection economics limit the scalability and low cost of supply. Variable collection rates, high contamination in curbside streams, and the cost of intensive sorting reduce yield and increase the per-unit cost of rPET compared to commoditized virgin PET. Price volatility in virgin feedstock and insufficient regional recycling infrastructure create periods of scarcity or margin compression for rPET producers. Until collection systems and quality control improve, these structural constraints will cap faster market penetration.

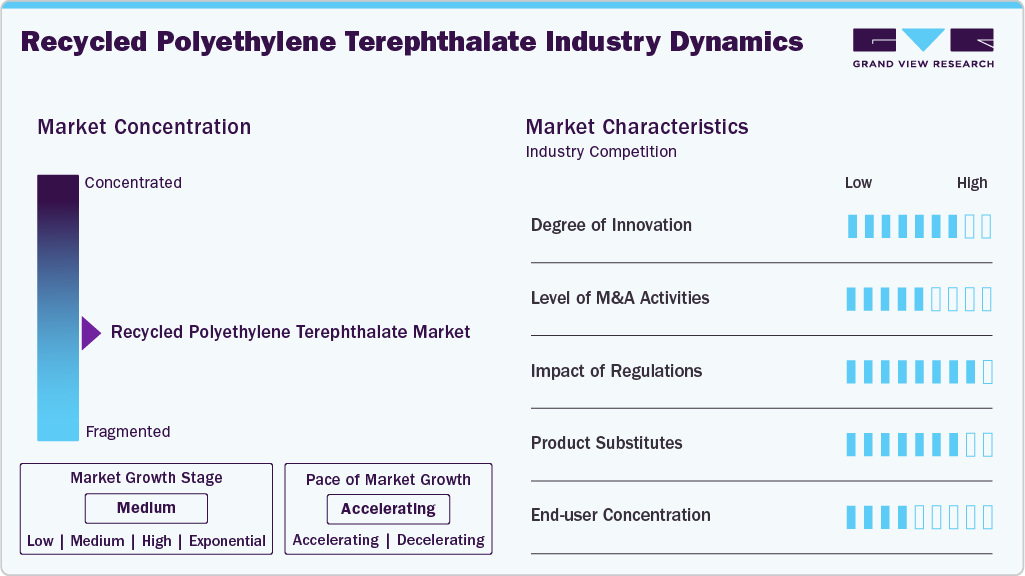

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companies such as Placon, Clear Path Recycling LLC, Verdeco Recycling, Inc., Indorama Ventures Public Ltd., and others, have played a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet the evolving demands of the industry.

The recycled PET industry is experiencing a notable increase in technological sophistication, driven by innovative recycling processes that enhance product quality and expand application potential. Chemical and enzymatic recycling methods are enabling the production of higher-purity rPET, suitable for food-grade packaging and advanced industrial uses beyond traditional fibers and containers. Open data initiatives and collaboration among research institutions and industry players are accelerating the refinement of polymer properties and expanding performance benchmarks. These innovations enhance supply reliability, enabling rPET to meet stringent regulatory and brand quality standards.

Substitute materials increasingly challenge rPET’s value proposition in select applications, especially where performance or cost advantages prevail. Bio-based polymers, copolyesters such as PETG, and other engineered plastics offer similar clarity and strength with potentially lower environmental impact profiles. Alternative recyclates, such as recycled polypropylene and polyethylene, are gaining traction in the flexible packaging segment. In high-performance applications, engineered composites and emerging materials developed through AI-driven polymer design could displace rPET where bespoke mechanical properties are required. These substitute pathways compel rPET producers to continuously improve their quality and cost competitiveness.

Product Insights

The clear segment dominated the market in terms of revenue, accounting for a market share of 75.89% in 2025, and is forecast to grow at a 7.9% CAGR from 2026 to 2033, due to its durability, lightweight nature, non-reactivity, and shatterproof properties. Moreover, low energy requirements and ease of bottle-to-bottle recycling are expected to drive the growth. Clear rPET resists the growth of fungi, mold, and bacteria.

The colored segment is anticipated to grow at a substantial CAGR of 8.5% through the forecast period. Major end-use areas of colored rPET are automotive trays, in-process protective packaging, electronics & electrical packaging, containers, transit trays, healthcare packaging, and other plastic trays. Colored rPET is used in the production of fabrics & clothing, as well as various packaging end-uses. Colored rPET has been gaining prominence among various food and non-food beverage manufacturers due to its ability to add a striking visual. In addition, colored packaging aids in brand differentiation and lends a unique visual appeal. Recent trends in the market have shown that milk and personal care packaging manufacturers are shifting from HDPE to colored rPET to reduce costs and move toward sustainability.

End Use Insights

Fiber dominated the market across the end-use segmentation in terms of revenue, accounting for a market share of 39.93% in 2025, and is forecast to grow at an 8.1% CAGR from 2026 to 2033. Various types of clothing, including t-shirts and jackets, utilize fiber produced from rPET. It is also used in the manufacturing of automobile seat covers, sofa & chair seat covers, and carpets. The low production cost of clothing, along with favorable government regulations, is expected to drive the demand for rPET.

Increasing investments in sports activities globally are augmenting the growth of the sports clothing & accessories market, which, in turn, is expected to drive the demand for recycled PET fibers. Jerseys for sports teams are the most common type of product manufactured using rPET fiber. The demand for jerseys has experienced substantial growth in the Asia Pacific over the past decade, driven by an increase in sports activities in the region, particularly in China and India.

The food & beverage containers and bottles segment is expected to expand at a substantial CAGR of 8.6% through the forecast period. The increasing use of food containers in emerging economies of the Asia Pacific, the Middle East, and Latin America is expected to drive demand for the product in sheet & film end-uses. These containers offer thermal insulation and aesthetic appeal to stored products. Microwave-safe containers are paving the way for the growth of the sheet & film segment. Customers in developed countries prefer microwave-compatible food containers to save time on preparation. These containers are commonly used in offices as they are heat-resistant, which saves time. The demand for sheets and films in roof flooring is increasing as they help limit leakage and save buildings from extremely high and low temperatures.

Regional Insights

The Asia Pacific recycled polyethylene terephthalate industry held the largest share, accounting for 45.00% of the revenue in 2025, and is expected to grow at a notable CAGR of 8.4% over the forecast period. The presence of several players characterizes the regional market. The market in the Asia Pacific region is characterized by the availability of a significant amount of skilled labor at low cost and the easy availability of land. The shift in the production landscape toward emerging economies, particularly China and India, is expected to positively influence the market growth over the forecast period. The region is home to several rapidly expanding industries, including construction, automotive, and electronics, which present vast potential for rPET manufacturers.

The China recycled polyethylene terephthalate industry has received impetus from domestic policy actions and industry consolidation. Post-import restrictions on plastic waste and national circular economy targets have redirected material flows toward domestic collection and mechanical and chemical recycling capacity. Local mandates and strong demand from the packaging and textile sectors create a predictable off-take for food-grade rPET, as technology improvements enhance product quality. Strategic support for industrial clusters and investments in contamination-tolerant processes are strengthening China’s position as a leading producer of high-volume rPET.

North America Recycled Polyethylene Terephthalate Market Trends

The recycled polyethylene terephthalate industry in North America has witnessed regulatory momentum and brand procurement policies driving demand for rPET across the region. State-level recycled-content mandates, deposit return programs, and advancing EPR frameworks are forcing supply chain change and raising minimum quality expectations for recyclates. Large beverage and consumer-packaged-goods companies are following science-based targets and securing long-term offtake, which underwrites new sorting and reprocessing investment. The combination of policy certainty and corporate contracting is driving a surge in capacity additions for food-grade rPET.

U.S. Recycled Polyethylene Terephthalate Market Trends

The U.S. recycled polyethylene terephthalate industry has observed a patchwork of state mandates and commercial procurement rather than a single federal policy. Several states now require minimum PCR content for plastic packaging and are implementing producer responsibility rules that increase collection funding and design requirements. Brand-level sourcing commitments from beverage companies create reliable demand corridors for domestic flake and pellet producers. These dynamics are improving feedstock economics and making investing in advanced recycling and in-region capacity more commercially viable.

Europe Recycled Polyethylene Terephthalate Market Trends

The recycled polyethylene terephthalate industry in Europe has gained momentum with the EU regulatory framework, and mandatory recycled-content targets and stringent waste export controls reshaping supply chains. Requirements under EU single-use plastics and packaging rules compel producers to incorporate fixed rPET shares, driving robust demand for high-quality flakes and pellets. Strong EPR systems fund improved collection and sorting, while harmonized standards reduce cross-border quality friction and support bottle-to-bottle recycling at scale. Brand and retailer commitments further translate regulation into long-term commercial contracts.

Key Recycled Polyethylene Terephthalate Company Insights

The recycled polyethylene terephthalate industry is highly competitive, with several key players dominating the landscape. Major companies include Placon, Clear Path Recycling LLC, Verdeco Recycling, Inc., Indorama Ventures Public Ltd., Zhejiang Anshun Pettechs Fibre Co., Ltd., PolyQuest, Evergreen Plastics, Inc., Phoenix Technologies, Libolon, and Biffa. The recycled polyethylene terephthalate industry is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Recycled Polyethylene Terephthalate Companies:

The following are the leading companies in the recycled polyethylene terephthalate market. These companies collectively hold the largest market share and dictate industry trends.

- Placon

- Clear Path Recycling LLC

- Verdeco Recycling, Inc.

- Indorama Ventures Public Ltd.

- Zhejiang Anshun Pettechs Fibre Co., Ltd.

- PolyQuest

- Evergreen Plastics, Inc.

- Phoenix Technologies

- Libolon

- Biffa

Recent Developments

-

In September 2025, Eastman and Doloop unveiled a 100% recycled PET beverage bottle at Drinktec 2025. The bottle is marketed as food-grade with no performance compromise, demonstrating advanced rPET formulations for mainstream beverage use.

-

In April 2025, Aliplast completed the acquisition of Gurit Italia’s PET recycling plant. The deal expands Aliplast’s rPET production by approximately 15,000 tons per year, enabling it to meet the growing demand for food-grade rPET in Europe.

Recycled Polyethylene Terephthalate Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 21.78 billion

Revenue forecast in 2033

USD 37.46 billion

Growth rate

CAGR of 8.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; Sweden; UK; Italy; France; Spain; Poland; China; Japan; India; South Korea; Australia; Malaysia; Singapore; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Placon; Clear Path Recycling LLC; Verdeco Recycling, Inc.; Indorama Ventures Public Ltd.; Zhejiang Anshun Pettechs Fibre Co., Ltd.; PolyQuest; Evergreen Plastics, Inc.; Phoenix Technologies; Libolon; Biffa

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recycled Polyethylene Terephthalate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global recycled polyethylene terephthalate market report based on product, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Clear

-

Colored

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Fiber

-

Sheet and Film

-

Strapping

-

Food & Beverage Containers and Bottles

-

Non-Food Containers and Bottles

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Australia

-

Singapore

-

Thailand

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global recycled polyethylene terephthalate market size was estimated at USD 19.38 billion in 2025 and is expected to reach USD 21.78 billion in 2026.

b. The global recycled polyethylene terephthalate market is expected to grow at a compound annual growth rate of 8.1% from 2026 to 2033 to reach USD 37.46 billion by 2033.

b. Clear dominated the market across all product segments in terms of revenue, accounting for a market share of 75.89% in 2025, and is forecasted to grow at a 7.9% CAGR from 2026 to 2033, due to its durability, lightweight nature, non-reactivity, and shatterproof properties.

b. Some key players operating in the recycled polyethylene terephthalate market include include Placon, Clear Path Recycling LLC, Verdeco Recycling, Inc., Indorama Ventures Public Ltd., Zhejiang Anshun Pettechs Fibre Co., Ltd., PolyQuest, Evergreen Plastics, Inc., Phoenix Technologies, Libolon, and Biffa.

b. Growing efforts by end-users to adopt a circular economy and the increasing adoption of recycled plastics in packaging, textiles, and other end-use industries are also anticipated to drive demand for recycled polyethylene terephthalate (rPET) during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.