- Home

- »

- Advanced Interior Materials

- »

-

Recycled Refractories Market Size, Industry Report, 2030GVR Report cover

![Recycled Refractories Market Size, Share & Trends Report]()

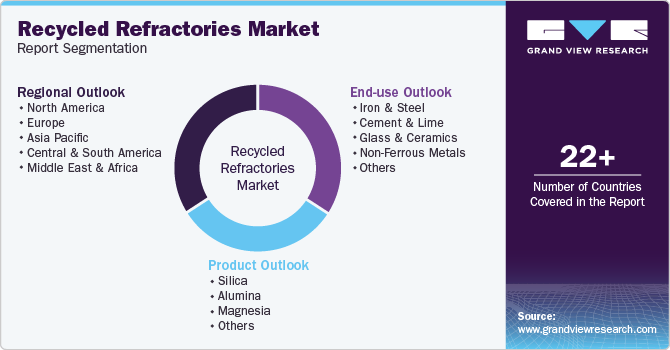

Recycled Refractories Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Silica, Alumina, Magnesia), By End-use (Iron & Steel, Cement & Lime, Glass & Ceramics, Non-Ferrous Metals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-515-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Recycled Refractories Market Summary

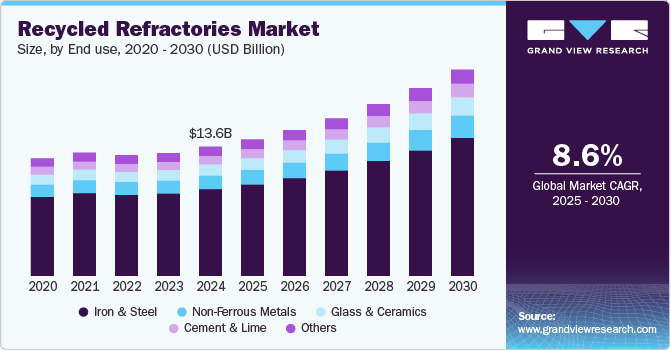

The global recycled refractories market size was estimated at USD 13,608.1 million in 2024 and is projected to reach USD 21,730.8 million by 2030, growing at a CAGR of 8.6% from 2025 to 2030. As the world becomes more conscious of the environmental impact of industrial activities, recycling has gained significant attention.

Key Market Trends & Insights

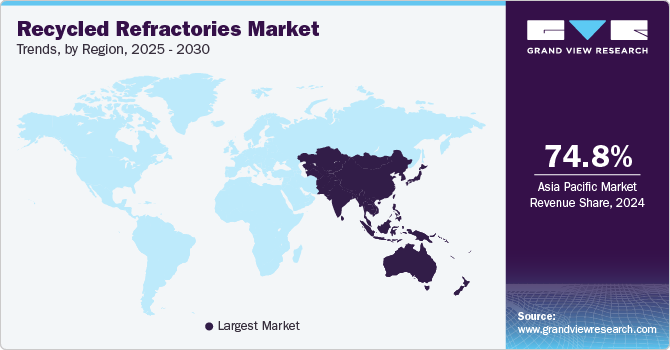

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

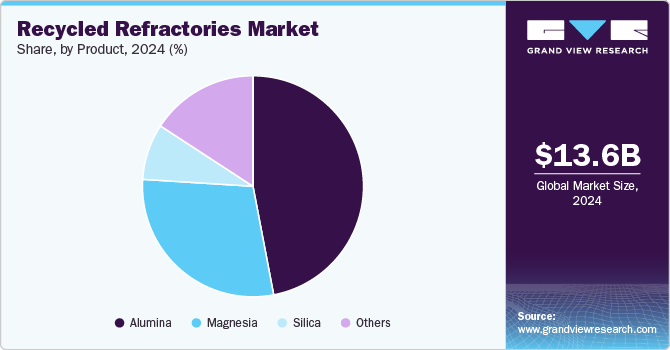

- In terms of segment, alumina accounted for a revenue of USD 6,769.9 million in 2024.

- Magnesia is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 13,608.1 Million

- 2030 Projected Market Size: USD 21,730.8 Million

- CAGR (2025-2030): 8.6%

- Asia Pacific: Largest market in 2024

Refractory materials, heat-resistant and crucial in high-temperature processes such as steel, cement, and glass production, are often subjected to extreme conditions that lead to wear and degradation. Instead of discarding these materials, industries find value in recycling and reusing them, thus reducing waste and conserving resources. This trend aligns with global goals of reducing carbon footprints and mitigating the environmental effects of manufacturing processes.

Traditional refractory materials, such as alumina, magnesia, and silica, are often expensive to mine and process. As the prices of these raw materials fluctuate, industries seek alternative sources to ensure cost-effectiveness and resource availability. Recycled refractories, derived from the leftover materials of industrial processes, offer a more affordable and sustainable option. As a result, companies are increasingly turning to recycling solutions to minimize costs while maintaining the performance of their refractories.

Modern recycling techniques have made it possible to efficiently clean, process, and reuse refractory materials that were once discarded as waste. Innovations such as advanced separation technologies, chemical treatments, and mechanical processes have improved the quality of recycled refractories, making them more viable for reuse in industrial applications. These advancements have expanded the potential for recycling and ensured that recycled materials maintain the high performance required in demanding industries.

Regulatory pressures and sustainability goals imposed by governments and environmental organizations further propel the demand for recycled refractories. Policies to reduce industrial waste, lower emissions, and promote circular economies are becoming more stringent. In response, many companies in sectors such as steel, cement, and foundries are adopting recycling programs to comply with regulations. Recycled refractories offer a solution that helps businesses meet their environmental targets while reducing their dependency on non-renewable resources. This regulatory environment has incentivized businesses to invest in recycling technologies and adopt sustainable practices.

The global movement towards a circular economy is another vital driver behind the growth of recycled refractories. This approach emphasizes resource efficiency by maximizing material use throughout its lifecycle while minimizing waste generation. As industries increasingly recognize the importance of sustainability, there is a collective push towards adopting practices that support material reuse and recycling initiatives within manufacturing processes. In June 2024, MIRECO, a joint venture between RHI Magnesita and Horn & Co. Group, expanded its production footprint in Italy by acquiring Refrattari Trezzi, a specialist in refractory recycling. This strategic acquisition enhances MIRECO's ability to supply high-value secondary raw materials and customized services to the steel and industrial sectors, reinforcing its commitment to sustainability and the circular economy.

Drivers, Opportunities & Restraints

The growing emphasis on sustainability and environmental preservation has become a significant driver for the recycled refractory industry. The increasing pressure on industries to reduce their carbon footprints has led to greater interest in recycling and reusing materials like refractory waste. Recycled refractories, used to line furnaces, kilns, and other high-temperature equipment, offer an environmentally friendly alternative to producing new refractories. Recyclable refractories reduce the need for virgin raw materials, lowering environmental impact and reducing mining, extraction, and energy consumption costs.

The potential for growth in the recycled refractories market lies in the advancements of recycling technologies and the increasing adoption of circular economy principles. As industries expand their recycling capabilities and improve material recovery processes, new opportunities exist for recycling more refractory materials that were once considered non-reusable. This creates a broad market for recycled refractory materials that can be reintegrated into high-temperature environments, reducing the demand for new materials.

Despite the benefits, several challenges hinder the widespread adoption of recycled refractories. One of the primary constraints is the variability in the quality and composition of recycled refractories, which can affect their performance in high-temperature environments. Recycled materials might not always meet the stringent standards required for specific applications, posing risks to safety and efficiency.

End Use Insights

Recycled refractories, crucial in steel production, offer a sustainable alternative to traditional materials, aligning with the growing focus on reducing industrial waste and carbon emissions. As steelmakers strive to improve operational efficiency and reduce their environmental footprint, the demand for recycled refractories continues to rise. These materials are highly valued for maintaining high performance while offering significant savings compared to fresh refractory products, driving their increasing adoption in the steel sector.

Cement & lime is anticipated to grow significantly over the forecast period. The ongoing urbanization and infrastructure development across emerging markets contribute to the rising demand for cement. As cities expand, the need for residential, commercial, and industrial buildings grows, increasing cement consumption. Consequently, this surge in demand for cement results in higher requirements for refractory materials, which are vital for maintaining the high-temperature environments inside kilns and furnaces. The adoption of recycled refractories in cement helps meet this demand more sustainably by reducing costs and improving resource efficiency.

Product Insights

Alumina is crucial in high-temperature industrial processes, including steel, cement, glass, and non-ferrous metal production. As industries seek to lower their environmental impact, recycling Alumina not only contributes to reducing waste but also significantly cuts down on the need for virgin materials. This aligns with the growing trend of circular economy practices, where manufacturers strive to reintroduce materials back into the production cycle, fostering sustainability in high-energy-consuming industries.

Magnesia is anticipated to register the fastest CAGR over the forecast period. As magnesia-based refractories are widely used in high-temperature applications such as furnaces, kilns, and converters, the increasing demand for these industries is a key driver for the growth of recycled magnesia refractories. Manufacturers focus on recycling these refractories to reduce costs while maintaining performance, appealing to industries looking for eco-friendly and cost-efficient solutions. Additionally, the push for sustainability and resource conservation encourages using recycled magnesia, which helps reduce the environmental impact of mining new magnesia.

Regional Insights

North America’s recycled refractories market is anticipated to grow significantly over the forecast period. The region has a well-established industrial base, and with an increasing focus on sustainability and resource efficiency, the demand for recycled refractories has increased. The region’s strong industrial sector continues to drive the need for refractories, while recycling offers a cost-effective and eco-friendly solution.

U.S. Recycled Refractories Market Trends

The U.S. recycled refractories market is anticipated to grow steadily, driven by increasing demand from steel and cement industries. Sustainability regulations are likely to boost adoption as manufacturers seek cost-effective and eco-friendly solutions. The availability of high-quality recycled materials is projected to enhance their competitiveness against virgin refractories. Advancements in processing technologies are likely to improve efficiency and expand application areas.

Asia Pacific Recycled Refractories Market Trends

Asia Pacific recycled refractories market held the largest revenue share of 74.8% in 2024 and is growing due to the increased industrialization and urbanization in the region, especially in emerging economies like China and India, are key drivers. These countries are undergoing rapid industrial growth, leading to higher refractory demand. As production processes evolve, the need for sustainable solutions has emerged, with recycled refractories gaining traction due to their cost-effectiveness and environmental benefits.

Europe Recycled Refractories Market Trends

The European Union has long promoted environmental responsibility with comprehensive policies to reduce carbon emissions, enhance energy efficiency, and minimize waste. These policies have created a conducive environment for recycling across industries, including the refractory sector. Recycling refractories reduces the need for virgin raw materials, which not only helps conserve natural resources but also lowers the environmental impact of manufacturing. As European industries face growing pressure to meet sustainability targets, the demand for recycled refractories has risen as they help reduce energy consumption, carbon emissions, and waste generation, aligning with regulatory requirements and corporate sustainability goals.

Central & South America Recycled Refractories Market Trends

Central & South America have diverse and growing industrial sectors, with key industries such as steel, cement, and non-ferrous metals playing a prominent role in the region's economy. As these industries expand and modernize, a demand for refractories is rising, essential for high-temperature industrial applications. With the ongoing push for more sustainable practices and economic efficiency, recycled refractories are becoming an increasingly important solution, contributing to the market's growth in the region.

Middle East & Africa Recycled Refractories Market Trends

The MEA region has a robust industrial base which requires high-performance refractories for high-temperature applications. As these industries grow and modernize, the demand for refractories rises. However, the region’s increasing focus on sustainability, cost efficiency, and resource conservation makes recycled refractories more attractive, driving market growth.

Key Recycled Refractories Company Insights

Some of the key players operating in the market include Global Recycling, Deref S.p.A, Harsco Corporation, and others

-

Global Recycling is a leading company specializing in the recycling of refractory materials, and it has over 25 years of experience in the industry. Based in India, the company focuses on repurposing discarded refractories from various sectors, such as steel, cement, glass, aluminum, copper, fertilizer, petrochemicals, and ceramics, into high-quality raw materials for refractory manufacturers.

-

Deref S.p.A. is a prominent player in the European refractory recycling and Iron & Steel. Deref’s innovative ReStoRe technology (REfractory and STeel REcovery) transforms low-value spent refractory waste into high-value products for steelmaking. This process involves upgrading spent refractories sourced from periodic demolitions of refractory units, allowing them to be reused in Electric Arc Furnace and Blast Furnace cycles instead of relying on primary raw materials like lime, dolo-lime, bauxite, and metallic scrap.

Key Recycled Refractories Companies:

The following are the leading companies in the recycled refractories market. These companies collectively hold the largest market share and dictate industry trends.

- Global Recycling

- Krosaki Harima Corporation

- Deref S.p.A.

- Harsco Corporation

- HORN & CO. GROUP

- LKAB Minerals

- Mineralen Kollée

- REF Minerals

- RHI Magnesita

- Jai Balajee Trading Co.

- Refratechnik

- Valoref (Saint-Gobain)

Recycled Refractory Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.38 billion

Revenue forecast in 2030

USD 21.73 billion

Growth rate

CAGR of 8.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Russia; China; India; Japan; South Korea; Brazil; Saudi Arabia

Key companies profiled

Global Recycling; Krosaki Harima Corporation; Deref S.p.A.; Harsco Corporation; HORN & CO. GROUP; LKAB Minerals; Mineralen Kollée; REF Minerals; Refratechnik; Jai Balajee Trading Co.; RHI Magnesita; Valoref (Saint-Gobain)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recycled Refractories Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global recycled refractories market report based on product, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Silica

-

Alumina

-

Magnesia

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Iron & Steel

-

Cement & Lime

-

Glass & Ceramics

-

Non-Ferrous Metals

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Russia

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global recycled refractories market size was estimated at USD 13.61 billion in 2024 and is expected to reach USD 14.38 billion in 2025.

b. The global recycled refractories market is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2030 to reach USD 21.73 billion by 2030.

b. The iron & steel segment dominated the market with a revenue share of over 67% in 2024.

b. Some of the key vendors of the global recycled refractories market are Global Recycling; Krosaki Harima Corporation; Deref S.p.A.; Harsco Corporation; HORN & CO. GROUP; LKAB Minerals; and others.

b. The key factor that is driving the growth of the global recycled refractories market is driven by the increasing demand for sustainable manufacturing practices and the rising focus on reducing industrial waste.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.