- Home

- »

- Plastics, Polymers & Resins

- »

-

Recycling Equipment Market Size And Share Report, 2030GVR Report cover

![Recycling Equipment Market Size, Share & Trends Report]()

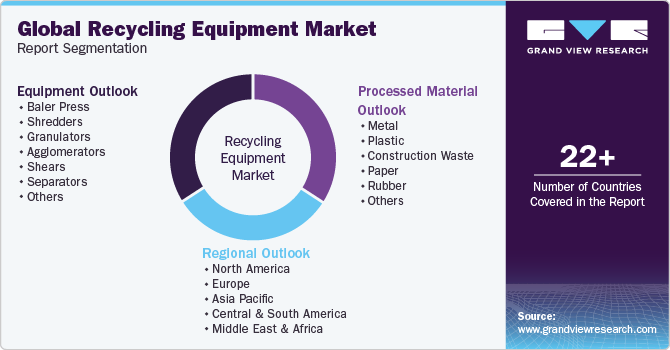

Recycling Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Equipment (Baler Press, Shredders, Granulators, Agglomerators), By Processed Material (Metal, Plastic, Construction Waste), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-708-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Recycling Equipment Market Summary

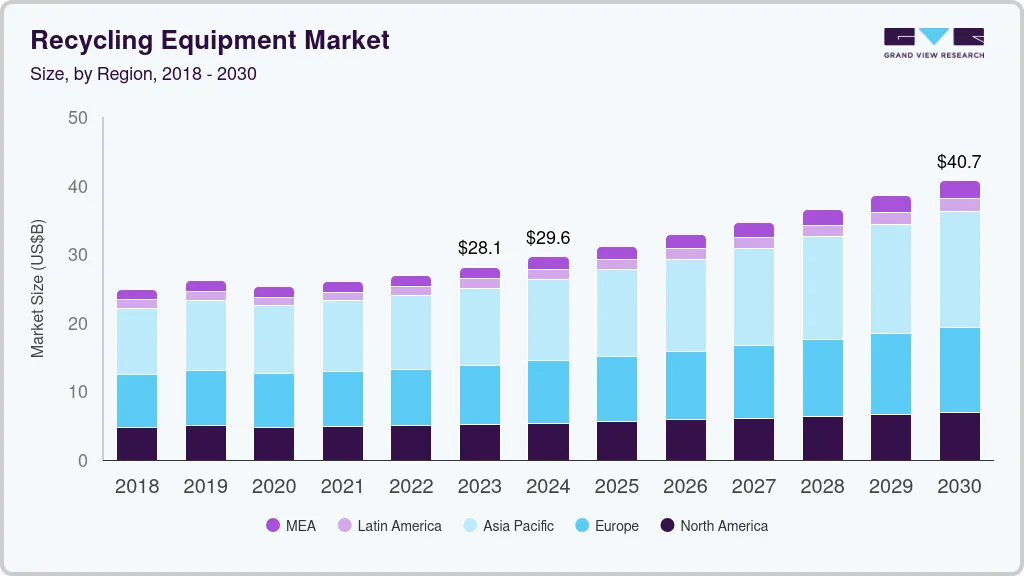

The global recycling equipment market size was estimated at USD 28,125.1 million in 2023 and is projected to reach USD 40,694.8 million by 2030, growing at a CAGR of 5.4% from 2024 to 2030. The rising awareness about the sustainable benefits of recycling and reusing waste materials is a significant market growth driver. With increased environmental awareness among businesses, consumers, and governments, there is a growing emphasis on minimizing the ecological footprint of waste disposal.

Key Market Trends & Insights

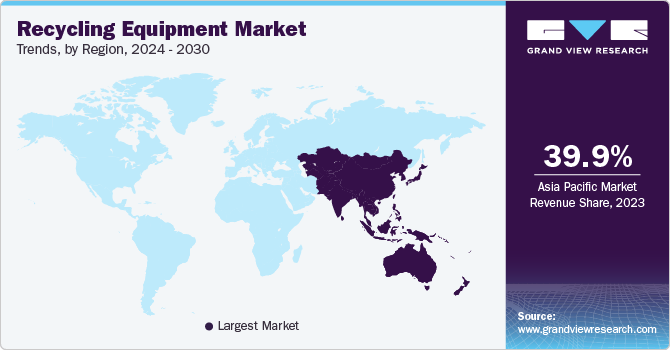

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, US is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, baler press accounted for a revenue of USD 6,951.4 million in 2023.

- Separators is the most lucrative equipment segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 28,125.1 Million

- 2030 Projected Market Size: USD 40,694.8 Million

- CAGR (2024-2030): 5.4%

- Asia Pacific: Largest market in 2023

Recycling waste materials not only reduces the energy consumption related to raw material processing but also conserves natural resources. In addition, such equipment facilitates the shift towards a circular economy model, where materials such as metal and rubber are recycled, reused, and integrated into the production cycle, thereby reducing the dependence on finite natural resources.

In the U.S., an important factor driving the market growth is the rising investment by the federal government to strengthen the recycling infrastructure. This investment translates into the upgradation and expansion of recycling infrastructure, including sorting centers, and material recovery facilities (MRFs). For instance, in September 2023, the U.S. Environmental Protection Agency (EPA) announced a significant investment of over USD 100.0 million from President Biden's Investing in America program. This investment is aimed at expanding recycling infrastructure and waste management systems throughout the country, representing the EPA's largest recycling investment in three decades. This step is a crucial initiative toward promoting sustainable waste management practices, thereby propelling the recycling equipment market. In addition to that, such investment activities are strengthening sustainable waste management practices as well as supporting the transition towards a sustainable economy.

Moreover, ongoing technological innovations in recycling equipment are propelling the market expansion. Technologically advanced recycling equipment improves the productivity and capabilities of recycling facilities across the various stages of the recycling process. For instance, artificial intelligence and robotics-based waste sorting equipment enable precise separation of recyclable materials from waste, thereby enhancing the purity and quality of recycled materials. Additionally, improvements in shredding machines optimize the volume reduction and processing of recycling materials leading to more effective recycled materials’ storage and transportation.

At the global level, the rising adoption of circular economy practices is driving the demand for recycling equipment. Circular economic practices promote the reuse and recycling of materials, thereby reducing waste and conserving natural resources. As businesses across the globe are adopting circular economy practices, they are investing in advanced recycling equipment to effectively recover, sort, and process various types of waste. This circular economy trend has been promoted by the need to reduce the reliance on finite resources, reduce the impact of waste generation on the environment, and establish of sustainable value chain.

Market Concentration & Characteristics

The market growth stage is medium and the pace of growth is accelerating. The recycling equipment market is characterized by a high degree of competition owing to the various cost-efficient technologies adopted by the market players for the manufacturing of recycling equipment compressors. Furthermore, emerging economies witnessed rapid growth in the investment in recycling infrastructure thereby driving the competition among market players.

The market is characterized by a high degree of product innovation, which results in the development of high-quality recycling equipment. For instance, in February 2024, Rotochopper, Inc. introduced a new product named Sarlac, which is a groundbreaking machine that is designed to improve the material downsizing and recycling process for businesses in various industries. Sarlac is a shear point shredding solution that can significantly enhance the efficiency of material handling, which can be a cost-effective solution for businesses seeking to optimize their operations. Such new product launches can lead to increased market penetration for a company, by entering into new segments and expanding its customer base.

The recycling equipment industry is slightly fragmented, with a few major players such as CP Group, General Kinematics, and Danieli Centro Recycling dominating and some smaller companies competing in space. Acquisitions and regional expansions are the strategies most adopted by the key players.

Regulations such as the Waste Framework Directive in Europe, the Resource Conservation and Recovery Act (RCRA) in the U.S., and the Waste Management Law enacted by Saudi Arabia in 2021 have a significant impact on the recycling equipment market. Environmental requirements such as recycling targets and landfill diversion mandates incentivize both businesses and local governments to invest in recycling infrastructure, which includes equipment for waste sorting, collection, and processing. Moreover, regulations related to waste management, quality standards recycled materials, and incentive schemes contribute to the adoption of advanced recycling equipment.

Equipment Insights

The baler press equipment segment is likely to dominate the market in 2023 owing to the increasing use of baler presses for compressing recyclable materials, such as cardboard, paper, plastic, aluminum, and non-ferrous metals, into dense bundles known as bales. Different baler presses, such as vertical balers, horizontal balers, two ram balers, and liquid extraction balers, are available in the market.

The separators equipment segment is anticipated to witness high growth over the forecast period, as it is one of the most important recycling processes to categorize scrap material. These separators are used to separate non-ferrous and ferrous metals from waste. The various types of separation equipment include magnetic separators, air separators, eddy current separators, screeners, vibratory screeners, rod decks, disc screeners, and star screeners.

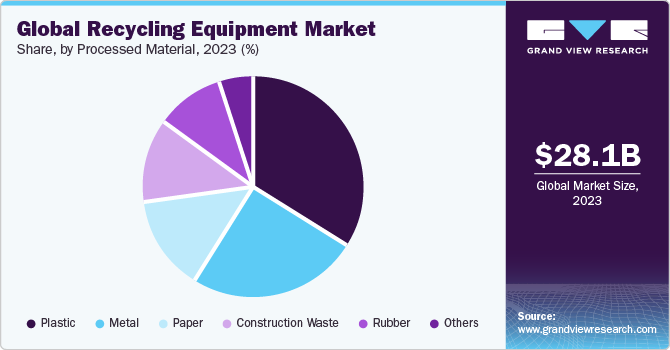

Processed Material Insights

The plastic segment is expected to dominate the market by holding a 33.6% revenue share in 2023 and is projected to grow at the fastest CAGR from 2024 to 2030. This is attributed to the rising utilization of recycled plastic in end-use industries including construction, automotive, and electrical & electronics. Additionally, various laws and guidelines forced by governments for plastic waste disposal are expected to drive the plastic recycling equipment market over the forecast period.

The rubber segment is anticipated to witness the second-fastest growth over the forecast period, as the demand for recycled rubber is rising. Recycled rubber helps preserve both energy and resources, which is used in various applications in civil engineering works such as playground surfaces, synthetic turfs, athletic tracks, speed bumps, automobile floor mats, textured paints, landscaping materials, and roofing. Thus, widespread applications of recycled rubber are expected to favor market growth over the coming years.

Regional Insights

The North America recycling equipment market is characterized by stringent environmental regulations. In addition to that, the growing environmental awareness among consumers, government, and businesses fuels demand for recycling equipment. Furthermore, continuous innovation in recycling equipment is driving the market growth.

U.S. Recycling Equipment Market Trends

The U.S. recycling equipment market accounted for more than 75.0% of the regional revenue share in 2023. This can be attributed to the strict government regulations and policies at the federal, local, and state levels, like the extended producer responsibility (EPR) initiative.

Europe Recycling Equipment Market Trends

Europe's recycling equipment market is characterized by stringent government regulations about waste management. Additionally, the shift towards the circular economy models within Europe, prioritizing material reuse, recycling, and repurposing stimulates investment in recycling equipment to strengthen sustainable resource management practices.

The recycling equipment market in Germany accounted for more than 18.0% of the regional revenue share in 2023. The demand for recycling equipment in Germany is increasing due to the Extended Producer Responsibility principle adopted by the German government. In addition to that, technological advancement and innovation in the waste management sector are driving the demand for recycling equipment.

The French recycling equipment market is expected to grow significantly over the forecast period, due to a strong emphasis on sustainable waste management among consumers and policymakers. In addition to that, a commitment to implement circular economy principles is fostering investment in recycling equipment.

Asia Pacific Recycling Equipment Market Trends

Asia Pacific led the market and accounted for 39.9% of the global revenue share in 2023, owing to growing industrialization coupled with stringent regulations about disposal processes and waste recycling. Economic development in the region along with the rising importance of waste management in India, China, and Japan are driving the regional market growth.

The recycling equipment market in China held over 40.0% of Asia Pacific, driven by the adoption of waste recycling targets by the Chinese government. Rapid industrialization and urbanization have led to an increase in metal and plastic waste. In 2021, China aimed to reuse 60% of its urban household waste by 2025. Due to such programs, the demand for sustainable waste management in China is high, which is propelling the market growth.

The Indian recycling equipment market is anticipated to grow at a CAGR of 6.3% from 2024 to 2030, due to government initiatives and regulations in the secondary metal sector. For instance, the Voluntary Vehicle Fleet Modernization Program adopted by the Indian government to reduce end-of-life vehicle numbers is driving the generation of metal scrap. To manage the generated scrap, the demand for recycling equipment is likely to increase over the forecast period.

Central & South America Recycling Equipment Market Trends

The recycling equipment market in Central & South America is expected to witness significant growth owing to the need for sustainable waste management solutions. Growing urbanization has contributed to waste generation, which created the need for efficient waste management solutions. Furthermore, growing environmental awareness among the governments is driving the adoption of recycling equipment.

The recycling equipment market in Brazil is projected to grow at a CAGR of 6.0% over the forecast period, owing to the stringent government regulations and resource conservation. As Brazil signed the Paris Agreement in 2016, it has been working to meet its Nationally Determined Contribution (NDC) by reducing its carbon footprint. The recycling equipment encourages the reuse of materials thereby decreasing the necessity for energy-intensive manufacturing procedures, helping to reduce the carbon footprints.

Middle East & Africa Recycling Equipment Market Trends

The Middle East and Africa recycling equipment market’s growth is driven by the rising investment in infrastructure development used for waste management. These investments enable the implementation of more sophisticated recycling processes and facilities such as advanced sorting systems and material recovery facilities.

The recycling equipment market in Saudi Arabia is projected to grow at a CAGR of 6.1% over the forecast period. The growing awareness and stringent regulations aimed at waste reduction and environmental protection are driving the demand for recycling equipment.

Key Recycling Equipment Company Insights

The recycling equipment market consists mainly of global players, of which a few operate regionally. New product launches, mergers and acquisitions, partnerships, and collaborations are vital strategies that companies adopt for sustained growth. Furthermore, key raw material suppliers and equipment manufacturers have integrated their operations to provide raw materials and manufacture the final product to cut down on raw materials procurement and operation costs.

Major players frequently undertake geographical expansion strategies to enter established and newer markets. New product developments and approvals are also a part of the key initiatives key companies undertake to gain more substantial market penetration. Some players adopted the expansion strategy to increase their product reach and increase the availability of their products in diverse geographical areas. Moreover, the market players have undertaken marketing strategies to improve their brand recall.

Key Recycling Equipment Companies:

The following are the leading companies in the recycling equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Recycling Equipment Manufacturing

- The CP Group

- American Baler

- Kiverco

- General Kinematics

- MHM Recycling Equipment

- Marathon Equipment

- Ceco Equipment Ltd.

- Danieli Centro Recycling

- ELDAN Recycling

- Metso

- Suny Group

- Forrec Srl Recycling

- BHS Sonthofen

- LEFORT GROUP

Recent Developments

-

In October 2023, General Kinematics recently announced the completion of a 42,000-square-foot expansion of their primary manufacturing space in Illinois, which includes high bay ceilings for 80-ton cranes, additional space for capital equipment, and storage. With this new addition, the facility now spans 262,000 square feet, enabling the company to increase its manufacturing capabilities and meet the growing demand for its products.

-

In June 2021, CP Group introduced the OCC Auger Screen. This patented machine is designed to efficiently separate mid to large-sized old, corrugated cardboard (OCC) in material recovery facilities (MRF). The OCC Auger Screen employs a series of steel cantilevered tri-lobe augers that generate agitation, similar to the traditional OCC Screen, which makes it easier to separate the OCC and create a clean OCC fraction.

Recycling Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 29.60 billion

Revenue forecast in 2030

USD 40.69 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends

Segments covered

Equipment, processed material, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Japan; China; India; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Recycling Equipment Manufacturing; The CP Group; American Baler; Kiverco; General Kinematics; MHM Recycling Equipment; Marathon Equipment; Ceco Equipment Ltd.; Danieli Centro Recycling; ELDAN Recycling; Metso; Suny Group; Forrec Srl Recycling BHS Sonthofen; LEFORT GROUP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recycling Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the recycling equipment market report based on equipment, processed material, and region:

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Baler Press

-

Shredders

-

Granulators

-

Agglomerators

-

Shears

-

Separators

-

Extruders

-

Others

-

-

Processed Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal

-

Plastic

-

Construction Waste

-

Paper

-

Rubber

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global recycling equipment market size was estimated at USD 28.12 billion in 2023 and is expected to be USD 29.60 billion in 2024.

b. The global recycling equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 40.69 billion by 2030.

b. Asia Pacific region dominated the market and accounted for 39.91% share in 2023, due to owing to the increased industrial construction and infrastructure activities in emerging nations such as India and China are expected to positively impact the market.

b. Some of the key players operating in the recycling equipment market include recycling equipment manufacturing, The CP Group, American Baler, Kiverco, General Kinematics, MHM Recycling Equipment, Marathon Equipment, Ceco Equipment Ltd., Danieli Centro Recycling, ELDAN Recycling, Metso, Suny Group, Forrec Srl Recycling BHS Sonthofen, LEFORT GROUP.

b. The key factors that are driving the recycling equipment market growing requirement of recycled metals from various end-use industries, rising demand for plastic waste recycling infrastructure, and increasing generation of construction & demolition waste, metal waste, and E-waste worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.